Demand Energy is a startup venturing inside the enterprise with a system that manages energy storage, inverters, software, big data analytics and sometimes solar. It's intelligent energy storage and it has a clear payback for the customer, according to the firm's case studies.

There's an enormous distinction in energy storage when it's deployed behind the meter at the enterprise (or residence) versus the wind-farm-sited or substation-sited big-battery storage model. Behind the meter, the battery is combined with software and the system allows control (transactive control, in some deregulated markets) of distributed energy assets and loads.

Storage at the utility level is a different animal. No one disputes the potential of energy storage to change the nature and resiliency of the grid. But utilities remain baffled about how to extract value out of these batteries, hemmed in by dated regulatory structures and without adequate language or modeling tools to evaluate energy storage at this scale.

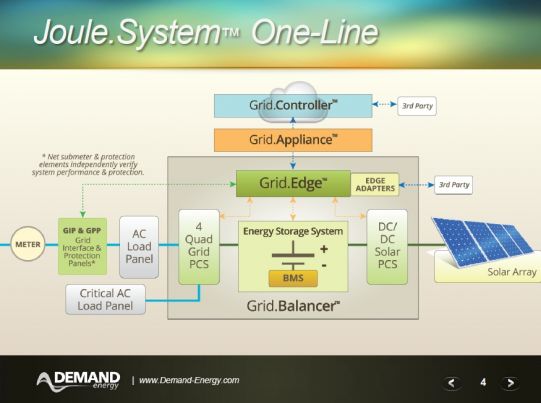

Doug Staker, VP of Business Development at Demand Energy, spoke of what his firm does as "energy cost management." The startup's system "dissociates solar production from the load of the building" and "can store solar when it's best used and then feed energy to the building when its economic value is highest."

The system also allows for demand charge management and the ability to offset generation across periods of peak demand, or minimize the impact of EV charging infrastructure, according to Staker. He spoke of the system integrating with utility demand response programs and engaging in permanent load shifting.

Of course the system also provides backup power.

In an interview with GTM's Stephen Lacey, Staker said, "Utilities are too slow. Commercial property managers and companies want storage on site." When the power fails, there are issues with elevator systems, voltage response problems when the grid sags, or having elevators trip. He called it "a real operational issue."

Staker noted that Hurricane Sandy changed people's perceptions about grid reliability and disaster readiness. Staker spoke of New York City building owners willing to pay to provide crucial services in the event of a power failure. Builder owners want to be able to pump water up to gravity feed tanks and run a service elevator for a few hours. Systems like those of Demand Energy can integrate storage and PV to provide backup power during emergencies.

There is also the potential for the node to serve as a virtual power plant (VPP) or microgrid.

New York City High-Rise

The owners of Manhattan's 58-story Barclay Tower installed a 225-kilowatt/2-megawatt-hour system in the building's basement after positive trial results with demand response and building grid stability.

The system charges the batteries from midnight to 5 a.m. The building comes to life at 7 a.m. and over the next sixteen hours, the storage system trims a series of demand spikes. "The building load is erratic and the idea is to do demand shifting," said Staker. According to Demand Energy, the Barclay Tower saw $50,000 in avoided cost, benefits from demand response, and 4-year payback, while managing cost volatility in New York's electricity rate structures.

Glenwood, the building owner, is ready to install storage in three more buildings in its portfolio, according to the VP.

System Dashboard for the 348-kilowatt Barclay Asset

A Bit About the Batteries

Demand Energy deploys valve regulated lead acid batteries from C&D in its energy storage systems. These are 2-kilowatt batteries capable of 2500 cycles at 50 percent depth of discharge, according to the firm.

Staker said that lithium-ion batteries require more management, whereas fire codes, building codes, and recyclers are comfortable with lead acid technology. Staker said, "The key driver here is economics -- the economic life. Will we be using this same technology five years from now? Probably not. It may be more advanced lead acid. Some are better power, some are more time-shifted. You’ve got to have a chemistry that you can get deployed and that has a lifecycle cost. We can make [this technology] work with economics."

Staker said that the company developed its own battery management and it's an important piece of the mix.

Notably, the battery technology of Firefly lives on at Demand Energy. Firefly was a Caterpillar spin-out that went bankrupt before it was able to commercialize its advanced anode technology. Demand Energy hired one of Firefly's engineering directors and is looking at a new, more manufacturable conductive anode design.

Firms like Demand Energy are adding intelligence and analytics to the consumer side of energy, which can optimize energy usage and capture value at the enterprise.

Stem is pursuing a similar cloud-based optimization solution that brings informational awareness to a building. Solar City is installing home energy storage in tandem with rooftop solar. Silent Power works with Hanwha to combine storage with solar. AU Optronics, looking to capitalize on the German energy storage incentive program, offers an energy storage system with lithium-ion batteries, inverter, charger, BMS, and EMS. GTM's Jeff St. John has written about energy storage pioneer AES' integration software and a related move to standardization and plug-and-play batteries from software vendor 1Energy.

Dave Curry, the Chairman of Demand Energy, called energy storage "a trillion-dollar market." But he also called it "an industry that does not exist" in a company video. Still, it's this combination of distributed generation, energy storage, analytics and cost savings which has the potential, in FERC Chairman Jon Wellinghoff's words, to "unleash the information [and] unleash the power" of the grid.

***

For more on how intelligent efficiency is reshaping the energy efficiency market, download a free white paper from GTM Research.

Stephen Lacey contributed to this article.