Grid-scale energy storage could play an important role in helping unstable island grids integrate more intermittent wind and solar power. On islands where electricity is generated from expensive, imported fossil fuels, storage plus green power also makes good economic sense.

But creating the right technical, economic and regulatory frameworks to marry these two resources together isn’t easy.

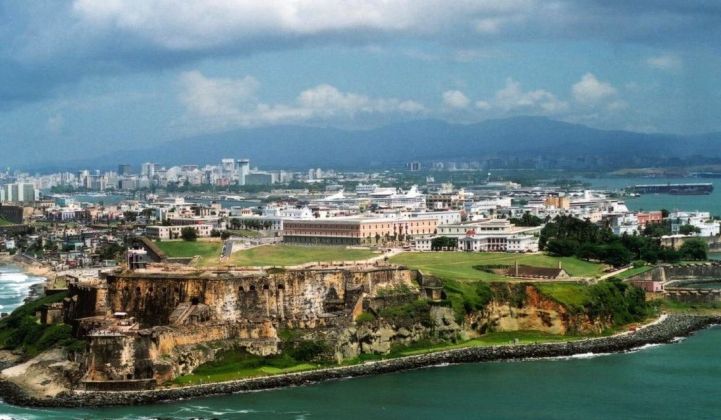

Just take Puerto Rico, where some long-awaited rules for pairing energy storage and renewable energy have finally been passed, after a year of wrangling that has kept new projects on the island in limbo until now.

Earlier this month, the Puerto Rico Electric Power Authority (PREPA) and the island’s main utility, the Autoridad de Energía Eléctrica (AEE), released a set of minimum technical requirements (MTRs) that govern new power projects. These MTRs apply to new solar or wind farm projects that are seeking to interconnect to the island territory’s grid, to which PREPA and AEE are hoping to add 600 megawatts of green power next year, to bring its share from about 1 percent today to 6 percent by the end of 2014.

Under the new MTRs, all new green power projects must include some minimum energy storage capabilities aimed at helping to stabilize the island’s grid. First, each project must have enough energy storage to provide 45 percent of the plant’s maximum generation capacity over the course of one minute, for use in smoothing out the “ramp rate” of power coming on and off with changes in sunlight or wind speeds. That’s a lot like the minimum ramp rate requirements that Hawaii’s grid requires for large-scale wind power projects, which has also made that island an early test market for storage-backed green power projects.

Second, each new Puerto Rico project must have enough storage to meet 30 percent of its rated capacity for approximately 10 minutes or less, to be called on for frequency regulation, or for keeping the grid’s power constant at 60 hertz. While other grid operators allow energy storage to play a role in frequency regulation, it’s unusual to match that requirement to individual projects, making Puerto Rico’s MTR an interesting example of how to merge several forms of grid balancing into a single regulation.

For developers targeting Puerto Rico, the decision finally opens up a path forward for projects that have been awaiting clear guidelines for more than a year, said Jim McDowall, business development manager at French battery giant Saft, in an interview. Since August 2012, PREPA has known that it needed to ask solar and wind power projects to provide some forms of balancing to keep the island’s unstable grid under control, he said.

But how to set those guidelines was a trickier issue. Specifically, project developers wanted a “safe harbor” framework that would set guidelines for how much storage needed to be included as part of a project’s nameplate capacity.

“Then all you have to do is keep the storage system operational, and you’re good to go,” said McDowall.

But some regulators wanted compliance to be based on tracking each project's continuing ability to meet grid stabilization requirements in real time, as well as for projects to face curtailment or penalties for failing to do so, he said. That, in turn, was seen as a non-starter for parties putting together financing for projects, who saw the threat of non-compliance in the future as an overwhelming risk to future profitability.

The new rules, created through negotiations between renewable energy and storage advocates and regulators, could now serve as a template for similar projects across regions that face challenges in keeping older, centrally controlled grids running amidst increasing amounts of intermittent wind and solar power, he noted.

“I think there’s going to be a domino effect around the Caribbean, when these systems start going in and they’re shown to be financeable,” said McDowall.

While he wouldn’t name any specific projects, McDowall did say that Saft has its first contract for adding storage to a renewable power project, and is soon to land its second on the island.

Other big companies involved in storage, power electronics or systems integration for storage-backed green power projects in Puerto Rico include Schneider Electric and ABB, he said. One of the key challenges coming in 2014 will be designing systems that can automatically manage the specific set of ramp-control and frequency regulation functions that the island’s new MTRs call for.

Xtreme Power, the Texas-based startup that’s built the control systems for nearly 100 megawatts of grid-scale energy storage systems around the country, is also taking orders now for 2014 delivery of systems that are compliant with Puerto Rico’s new MTRs, said Ryan O’Keefe, Xtreme Power’s vice president of business development, in an email.

AES Energy Storage, which has the largest individual fleet of commercial-scale grid energy storage projects in the United States, also has its eyes on Puerto Rico. In fact, its storage operating system software, which manages the interplay of storage and grid-scale energy markets, has long included a module designed to meet the island’s specific needs.