Facebook is adding a feature to its Facebook Messenger app that will enable people to send payments directly to their friends on the social network.

The new feature will be launched in the coming months, initially for US users only. It will be available within the Android and iOS Messenger apps as well as through the messaging section of Facebook’s website.

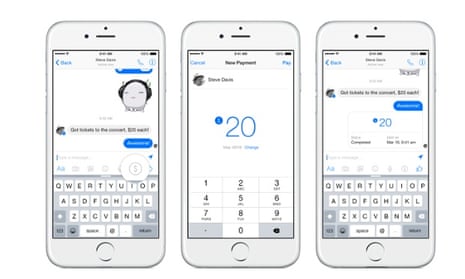

People will have to register their debit card to send or receive payments through Messenger. Once set up, they’ll be able to tap a dollar icon within a conversation with a friend, and enter the desired amount of money to send.

In its blogpost announcing the new payments feature, Facebook stressed the security features around it, beyond the ability for users to create a dedicated PIN or to use Apple’s Touch ID fingerprint-security feature on iOS devices.

“We use secure systems that encrypt the connection between you and Facebook as well as your card information when you ask us to store it for you. We use layers of software and hardware protection that meet the highest industry standards.

These payment systems are kept in a secured environment that is separate from other parts of the Facebook network and that receive additional monitoring and control. A team of anti-fraud specialists monitor for suspicious purchase activity to help keep accounts safe.”

Facebook’s interest in payments and messaging has been no secret for some time now. In June 2014 it hired David Marcus, then president of eBay’s payments subsidiary PayPal, to be the social network’s vice president of messaging products.

In a status update announcing the move, Marcus described the “compelling vision about mobile messaging” from Facebook CEO Mark Zuckerberg as the key factor in his decision to join the company, promising that he would be “getting my hands dirty again attempting to build something new and meaningful at scale”.

Questioned about the hire during Facebook’s next earnings call with analysts, Zuckerberg said of Messenger that “over time there will be some overlap between that and payments … the payments piece will be a part of what will help drive the overall success and help people share with each other and interact with businesses”.

Facebook Messenger reached 500 million monthly active users in November 2014, with rapid growth fuelled by the social network’s decision to remove the messaging feature from its main apps. Peer-to-peer payments do not appear to be currently on the agenda for Facebook’s other messaging app, WhatsApp, which has 700 million active users.

Other messaging apps are exploring this area, though. Snapchat unveiled a feature called Snapcash in November 2014 in partnership with mobile payments firm Square, for example.

It was very similar to Facebook Messenger’s new feature, with users registering a debit card then typing a dollar sign, an amount and tapping a pay button to send money to a friend.

In China, messaging app WeChat’s users have been able to register their bank accounts since 2013. During the Chinese New Year holiday in February, its users sent more than 1bn virtual “red envelopes” of cash gifts to friends using the app.

Japanese social app Line is also rolling out its Line Pay service for in-app payments, initially from users to retailers and businesses, but eventually to one another, too. Korean rival Kakao has also been experimenting with mobile payments.

In the UK, meanwhile, Barclays recently became the first British bank to allow people to make social-media-enabled payments to each other – and to small businesses – by linking their Twitter accounts to its Pingit mobile payments app.

Comments (…)

Sign in or create your Guardian account to join the discussion