Increasing Demand for Gold for Industrial Applications

Investors are well-aware of the numerous industrial applications for silver, and it often factors into analysis of the white metal’s demand. But gold also has industrial applications. And while investment and jewelry primarily drive the demand for gold, its use in industrial applications continues to expand, representing a growing market for the precious metal.

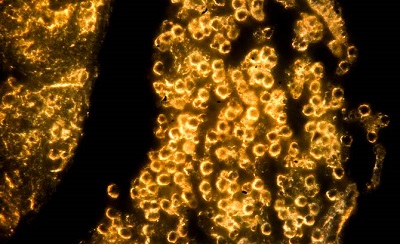

Gold nanoparticles are increasingly used in medical applications and electronics, and according to recently released market analysis by research firm Radiant Insights, the demand for gold nanoparticles is expected to grow to $4.99 billion by 2020.

High-tech applications in the electronics and computer industries drive gold’s industrial demand. The metal’s conductivity and corrosion resistance make it an ideal material for manufacturing high-specification components. Radiant Insights expects growth in this sector to continue:

With constant innovation and increasing demand for smaller, versatile and smarter devices the global electronics industry is expected to be one of the fastest growing gold nanoparticle markets. There has been a surge in demand for this technology, especially gold nanoparticle inks for storage devices, hard disks and microchips among others. These inks have also found applications in thin film transistors and photovoltaic, photo-sensors and detectors.”

The fastest growing application for industrial gold is in the medical field. Gold nanoparticles are used in drug delivery systems and nanomedicines. Global nanoparticle demand in biotechnology, drug development and drug delivery will likely grow to $90 billion by 2020, according to Radiant Insights analysis.

The World Gold council also predicts continued growth in gold’s medical applications:

A range of healthcare and catalytic applications for gold is currently being developed as the field of nanotechnology expands. While this demand is still small in tonnage terms, the growing number of patents being published relating to gold nanotechnology suggests many new applications will be developed in the coming years.”

According to the Radiant insights report, “global gold nanoparticles market volume is expected to reach 12.7 tons by 2020.” That’s a pretty amazing figure considering we are talking about tiny particles of gold between 1 and 100 nanometers in size.

According to the World Gold Council, total industrial demand for gold in 2014 came in at 346.5 metric tons. That represents about 9% of total gold demand. The electronics sector accounts for the vast majority of industrial demand at 277.6 tons. That compares with a demand of 2462.9 tons for jewelry, and 1,004.4 tons for gold coins and bars.

The World Gold Council projects other high-tech applications for gold will continue to develop in the coming years:

Gold is used across a variety of high-technology industries, in complex and difficult environments, including the space industry and in fuel cells. Gold’s catalytic properties are also beginning to create demand both within the automotive sector, as the metal has now been proven to be a commercially viable alternative to other materials in catalytic converters, and within the chemical industry.”

Combined with an anticipated drop in gold production, the increase in industrial demand over the next five years will likely put a further squeeze on tightening supplies.

Increasing industrial demand is just one of many reasons now is the time to consider buying gold. For more information and in-depth analysis on the gold market, get Peter Schiff’s report Why Buy Gold Now? You can download it for free HERE.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

“…the demand for gold nanoparticles is expected to grow to $4.99 billion by 2020.” Shall we assume that number is based on the dollar price of gold today? But if “the increase in industrial demand over the next five years will likely put a further squeeze on tightening supplies,” then shall we assume that number is inaccurate? Maybe it’s unfair to expect the report to be clear about their assumptions, but I think we can all agree that measuring dollars in gold rather than gold in dollars is probably the better way to go, long term, and that, short term, change is happening.

With elementary school students, the assistive technology options may be simpler than ones given to

high school students. Instead of talking to eachother; people

are texting instant messages back and forth over a cellular frequency.

Governments and organizations therefore now have one more

reason to destroy waste, and that is to gain electrical power.