After making numerous acquisitions from 2011-2014, Oracle's (ORCL) M&A pace slowed down last year. Between its $663M deal to buy Textura (announced today) and Oracle's prior 2016 deals to buy Crosswise (cross-device tracking services), Ravello Systems (software for managing/running server virtual machines in cloud environments), and AddThis (website sharing/personalization tools that produce marketing data), the pace appears to be rising again.

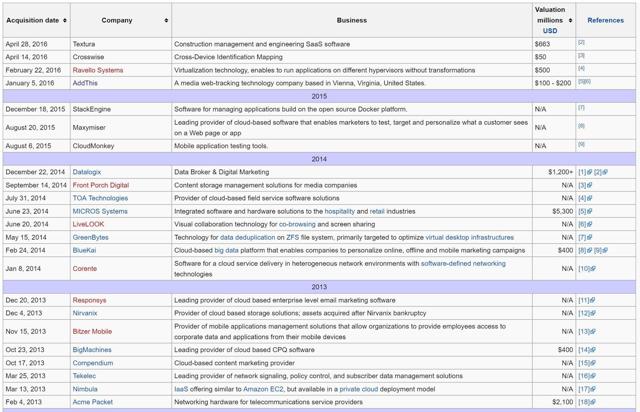

Recent Oracle acquisitions. Source: Wikipedia.

Oracle is paying 4.9x estimated 2017 sales to buy Textura (TXTR), a top provider of cloud software for managing construction projects and once a Citron Research short recommendation - Citron accused Textura of overstating the fees its charges for software use, among other things. Oracle plans to use Textura's software and its existing Primavera enterprise project-management software line to create a new Engineering and Construction Global Business Unit.

The deal highlights Oracle's willingness to enter vertical markets to grow its cloud sales, as traditional license revenue continues falling rapidly. Another such example is Oracle's 2014 purchase of cloud field service software firm TOA Technologies.