Now more than ever, pharma companies are being asked to develop evidence to support the clinical and economic value of their products, as well as justify their pricing strategies and utilization. Do they have a solid value story? Is the price they are charging for their product “reasonable” considering the size and unmet need of the patient population? If the answer to these questions isn’t a resounding yes, pharma companies risk finding themselves under fire from many different avenues. This could potentially come from a variety of stakeholders with divergent interests and goals—physician groups, insurance companies, and even patient advocacy groups!

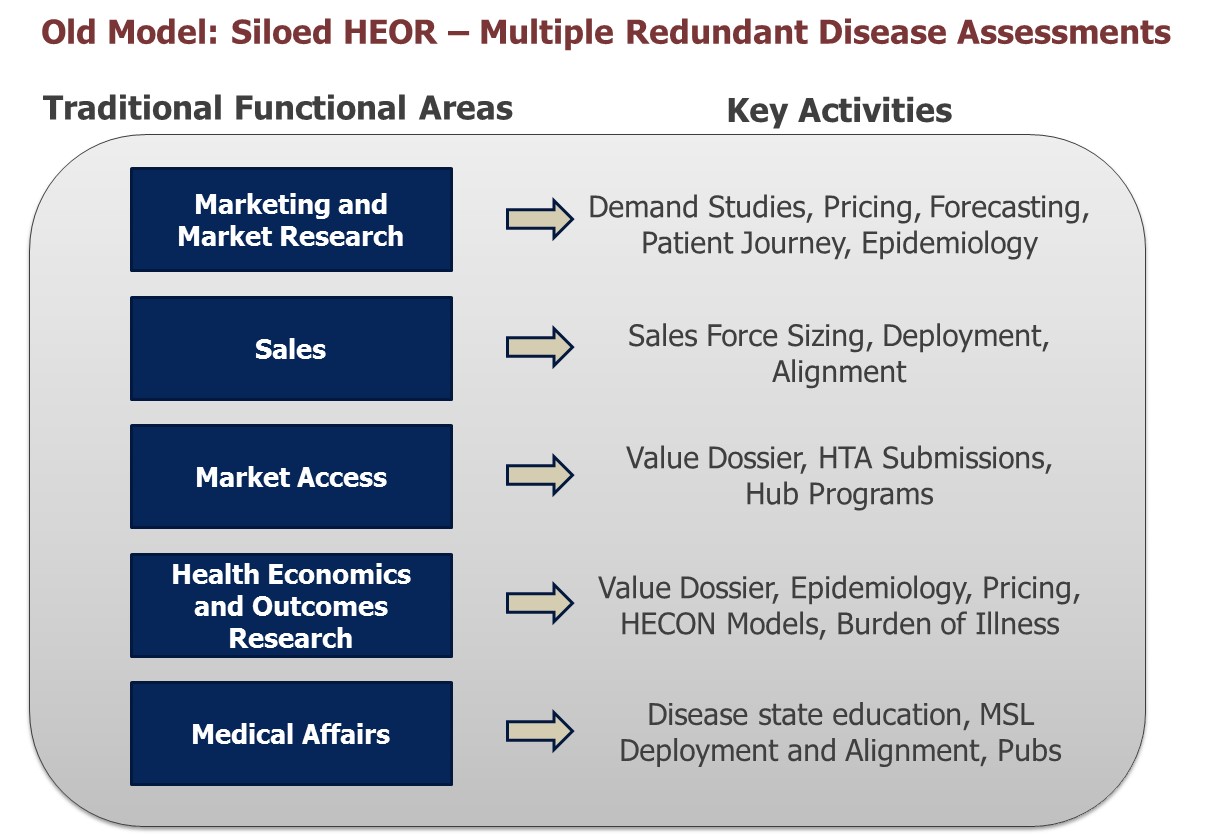

The result: Organizations must do their homework and come to market fully prepared to prove their product’s value. Not only must the company’s strategic plans reflect the product’s clinical and economic value proposition, but so must their tactical and operational plans. A chief stumbling block has been how and when to develop and deploy the “value story.” Traditional models have had teams working in silos developing their own, uncoordinated, value propositions. At best these models duplicate spend on data collection (e.g., multiple purchases of claims data) and analysis and at worst produce divergent opinions confusing the corporate strategy.

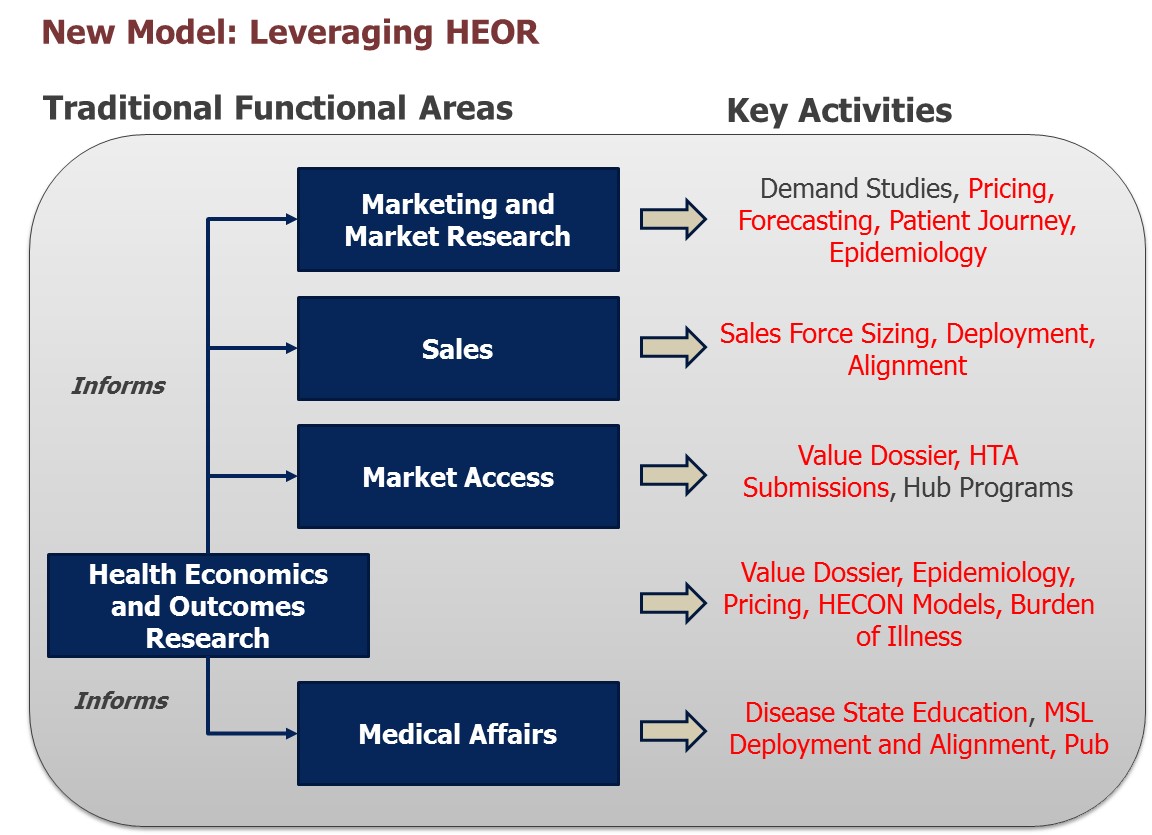

New realities recognize the need to leverage HEOR more efficiently to inform various functional needs.

Here are some lessons we’ve learned when it comes to the access and adoption challenges that organizations face and what they can do—with internal departments working collaboratively—to anticipate those challenges and effectively address them.

Lesson #1: Don’t Sugar Coat Reality—Plan for It

Does your product have a dominant clinical value story? If yes, what’s the best way to demonstrate and communicate the story? What evidence is most compelling? We’ve also found that increasingly, to grant favorable coverage, payers are demanding that products be tested versus the standard-of-care (SOC), not just placebo. Patients may embrace a product that’s tested versus a placebo, but reimbursement authorities and physician groups might not. Research the marketplace early, identify the needs of stakeholders, and plan early! Don’t wait till your Phase III trials and then wonder why getting traction with payers is problematic!

If your product is not the clear “clinical winner,” what else can you leverage to demonstrate value? Cost savings? Cost offsets? Over what time period? Make sure you’ve done your math through transparent and comprehensive budget impact models and cost effectiveness analysis. In recent years, HEOR models have received a bad rap. We’ve personally heard a large MCO call industry-developed HEOR models “just marketing”—and that was at a panel discussion on market access at a major industry conference! Make sure your models are vetted with your big accounts, that they accept your calculations and estimates, and can customize the model to run their own cost structures and “what if” scenarios.

Know your product’s true value and come to the starting line prepared with the evidence you will most certainly need: Why your product should be considered, for what patient cohorts and their size and what value it will provide patients, physicians or the healthcare system as a whole by addressing unmet needs.

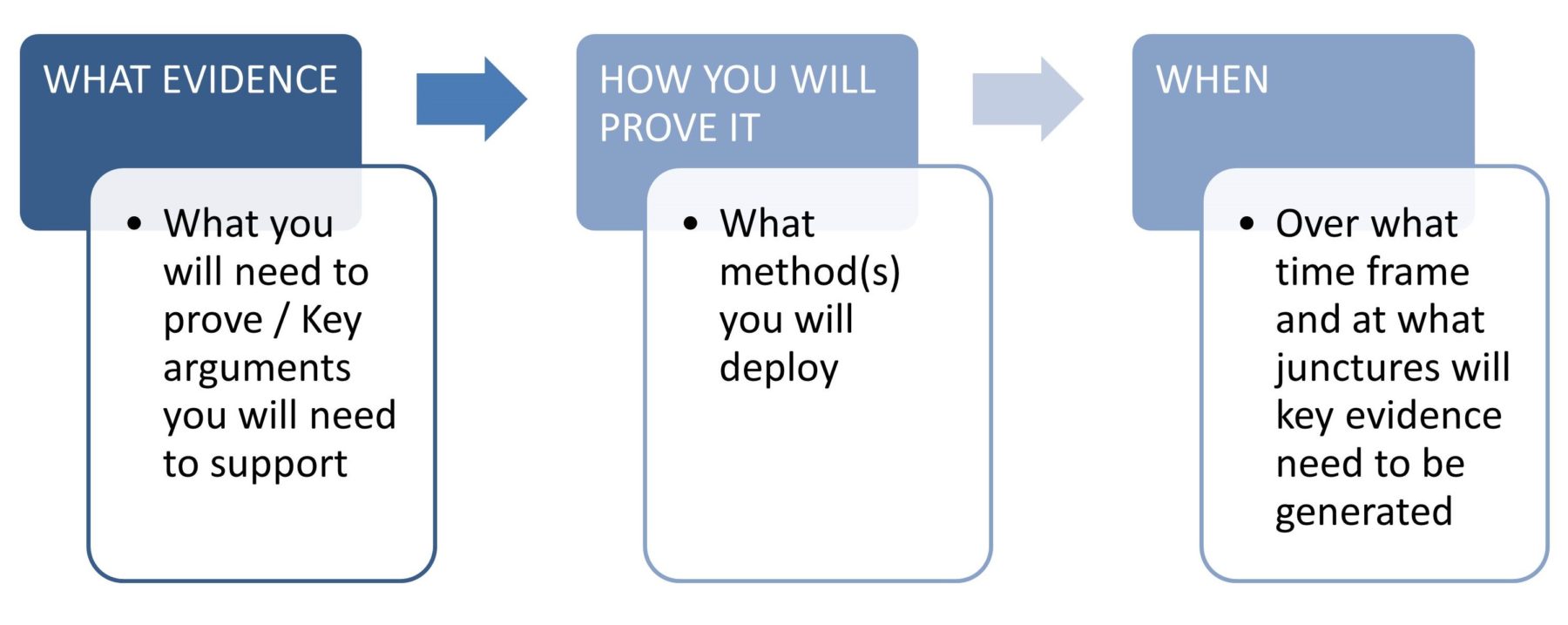

What this means upfront is identifying:

This brings to mind a recent example on how to use multi-disciplinary approaches to address a client’s challenges:

A client’s product, let’s call it Product A, has been losing share to its direct competitor (call that B). Market access is not the issue; both products are on hospital formularies. However, there’s a perception that B is faster at achieving its intended result and is significantly cheaper. The fact that Product B could result in Serious Adverse Events (SAEs) and is being used off-label doesn’t seem to hinder its growing share! What can the client do to turn the tide?

Here are some tools you can use to creatively generate the evidence needed to improve their product’s utilization:

- First, using advanced data analytics look at hospital records. Objectively speaking, did the product work faster? In this case, the answer was no! The time to therapeutic effect and time to patient discharge was basically the same across both products.

- Second, conduct a large chart audit to assess patient outcomes. Again, the outcomes were no different across the two products!

- Third, assess physician perceptions. Were physicians aware that outcomes were the same? Were they aware that Product B carried safety risks? Would physicians prescribe Product B knowing these drawbacks? The answer to all the questions was overwhelmingly clear: Armed with the facts, physicians would alter their preferences and prescribing behavior!

- Lastly, a patient preference study showed that if patients knew about the risks associated with Product B they would most certainly refuse Product B and demand Product A by name!

The client’s path was clear: Educate the market (both physicians and patients) on the outcomes of each product as well as the risks. This can come through multiple channels: DTC marketing, clinical publications, articles in trade journals—a multi-pronged approach to help reverse the downward trend in utilization.

Lesson #2: Identify a Precise Need in the Marketplace

Products we’ve seen succeed either have a very obvious clinically driven value proposition (e.g., breakthrough or fast-tracked drugs, first in class DMTs) or effectively address a gap. These products likely offer a well thought-through story that clearly pinpoints the relevant target patients and articulates its value-add.

Here is a hypothetical example to explain what type of a narrative is compelling to both physicians and payers while addressing a clear market gap:

“Product X, an oral product is indicated for diabetes patients who have failed multiple types of therapies (e.g., met, sulf, TZD’s, DDP1i) and don’t want to use injectables. It is an effective treatment, lowering A1C to insulin-like levels while delaying the use of expensive injectables.”

Intuitively, why is such a narrative compelling? Because it addresses a gap in the marketplace. Plus, it gives treaters and economic decision makers the information they are looking for: Where the product fits in the treatment algorithm and who the target patient population is. To sweeten the deal, it refers to cost savings which are relevant to payers, as well as a “feel good” factor for physicians: “You’ll be helping your patients avoid injectables and still get effectively treated.”

Increasingly, sales reps face restrictions in meeting with MDs and payers. If and when they have the opportunity to meet, they have very limited time at their disposal. Getting your value proposition down to a poignant 30-second narrative or a six to eight slide loop, whatever your goal may be, that identifies and speaks to this precise need(s), is paramount. You won’t get a second chance. So, do your research, gather your stakeholders’ input, and build it to meet the market’s needs (stated and unstated). Tip: Don’t forgot to pilot test it with key accounts ahead of the actual rollout!

Lesson #3: Encourage Internal Collaboration—In Fact Require It

The only way we’ve seen compelling narratives come together is when we get the scientists, strategists, planners, market researchers and HEOR experts to share findings and work together! It’s not just structural realignment like we discuss above, but true collaboration in which key parties come together to share learnings and do the hard work it takes to hammer out strategies and tactics that will position the product for success. Doing so increases efficiency. The alternative can be detrimental to a company, costing the company both time and money.

A key strategic decision that often gets short-changed due to the lack of internal transparency is strategic pricing—one of the most important decisions a company will make! An example immediately comes to mind.

A biotech company that was gearing up for a new product launch, and trying to figure out its optimal launch price, was unfortunately still working in silos. The forecast team, using a number of pricing assumptions, was estimating revenue for multiple scenarios. The market researchers were figuring out the market’s willingness to bear a price: Quantifying the sensitivity of physician prescribing rates and patient acceptance to different levels of patient co-pays. No one was sharing learnings with the Strategic Planning team who was researching analogs. The HEOR team meanwhile, firewalled from Commercial, was developing Budget Impact Models to figure out the economically justifiable price point. Is it any surprise that there was inefficiency and confusion as they all came together at the 11th hour to figure out the optimal price?

Increasingly, we’re finding that those that succeed in today’s marketplace come to the table prepared with multi-pronged approaches, leveraging various disciplines/departments, to tell a coherent story. So how can an aspiring company that wants to be a learning, collaborative organization work together to develop wining insights?

Here’s another case that comes to mind:

Consider the situation in which a pharmaceutical company is looking to develop a customer targeting strategy. The standard approach for years has been to simply decile physicians and to target those with high or growing sales. This simple methodology may have worked in the past, but companies are increasingly looking for more nuanced, effective and efficient ways of driving growth.

Fortunately, there are now ways companies can develop better targeting strategies that leverage customer characteristics to predict future sales, using data and skillsets found across various internal departments. Data assets from the commercial team (customer-level historical prescription volume, sales force calls and affiliation linkages) can be enriched with those from the HEOR team (anonymized patient-level claims data), while blending skillsets housed in the Market Research team (market expertise and rigorous research methods). This integration provides the opportunity to build, for example, statistical models that identify those customer factors and marketing actions that have the biggest impact on future sales and improve SF effectiveness. The findings are immediately actionable for the rep and can be revised over time/as market changes occur.

This is a single illustration of how outcomes research offerings, both data sources and methods, can be leveraged to support commercial operations. Many other situations could similarly benefit from this cross-functional synergy (e.g., claims data used to profile accounts/physicians, quantitative primary market research and secondary data sources used to segment physicians and data from all functional areas to feed promotion response models). Integrating data assets and abilities in this way enables companies to make better use resources and more informed decisions.

So, here’s the bottom line, as we see it: It’s a tough marketplace, and companies need to be armed with strong, data-driven arguments to “make their case.” This requires collaboration. If not, they risk share and maybe even their reputation. In some cases, basic information such as disease education, a primer on burden of illness, and quality of life impact might be adequate. But more often than not, stakeholders want to see a 360o view, combining elements from various disciplines: Market research, HEOR, and data analytics.

They want to ensure that regardless of methodology, the product’s value is consistent. They want to triangulate across various analyses to determine if the numbers check out: Be they epidemiology, likely new product uptake or costs. They want to see an integrated and holistic value story to fully convince them before they give a new product even a trial run. And even after adoption, the need for internal collaboration and coherence continues, as payers continue to test and re-test the product, in what is now the challenge of the new frontier: Continued evidence building in the real world.