In 2007, 10,000 people around the globe were asked about portable digital devices. It was part of a study conducted by the global media company Universal McCann. One of the hottest topics at the time was the first iPhone, which was announced but hadn’t yet been released. Once researchers tallied the results, they reached an interesting conclusion: Products like the iPhone are desired by consumers in countries such as Mexico or India, but not in affluent countries. The study stated: “There is no real need for a convergent product in the US, Germany and Japan,” places where, one researcher later theorized, users would not be motivated to replace their existing digital cameras, cellphones, and MP3 players with one device that did everything.

There’s a growing feeling that something is not working with market research, where billions are spent every year but results are mixed at best. Some of the problems relate to the basic challenge of using research to predict what consumers will want (especially with respect to products that are radically different). But marketers face one additional key problem: Study participants typically indicate preferences without first checking other information sources—yet this is very different from the way people shop for many products today.

In the Universal McCann study, for example, people were asked how much they agree with the statement, “I like the idea of having one portable device to fulfill all my needs.” Indeed, there was a significant difference between the percentage of people who completely agreed with this statement in Mexico (79%) and in the United States (31%). So, in theory, people in the United States were much less excited about a phone that’s also a camera and a music player.

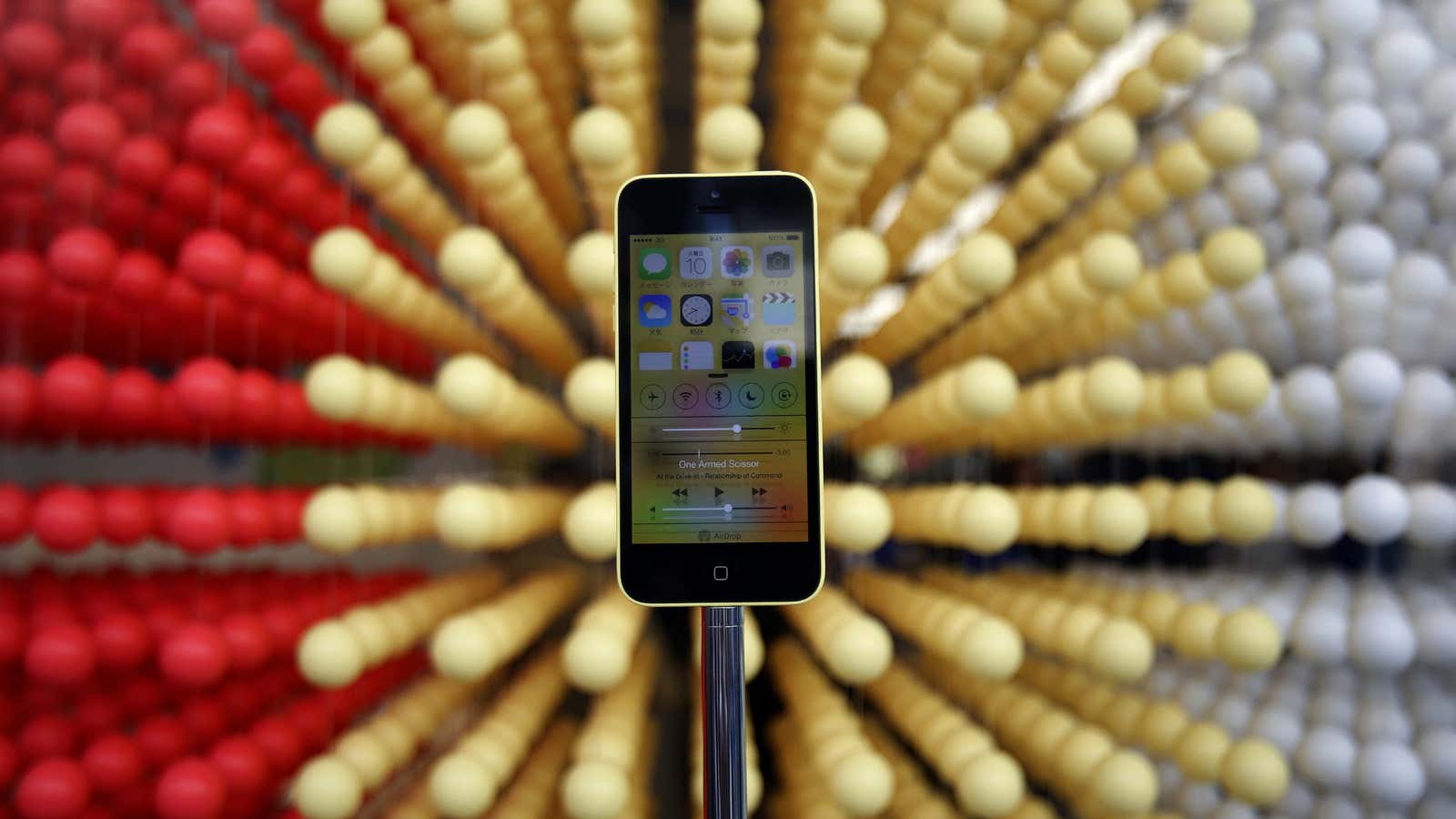

But it was a different story when people got closer to making a decision. They heard about the iPhone in the media, where it was declared a revolutionary device, and read blogs and reviews from real users. As iPhones started rolling into the marketplace, the idea of “having one portable device to fulfill all my needs” was replaced by actual reports from users.

It’s easy to blame the market research firm for this, but this is not our point. We are trying to explain the inherent difficulties in assessing consumers’ reaction in this new era. First, more decisions today are impacted by what we call O sources of information—“Other” information sources, such as user reviews, friend and expert opinions, price comparison tools, and emerging technologies or sources—whereas market research measures P sources—“Prior” preferences, beliefs and experiences. But let’s go beyond that: As we discussed, consumers have limited insight into their real preferences. This is especially true with respect to products that are radically different. Universal McCann correctly reported what it found. What market researchers often underestimate, though, is the degree to which consumers have difficulty imagining or anticipating a new and very different reality. What makes the task of a market research firm even trickier is that just as consumers’ expectations may be wrong (as was the case with the iPhone), there are many cases where industry expectations about what consumers will buy are wrong.

Not to mention that O-sourced information is often much more dynamic, so even if a researcher were trying to somehow account for the present effect of O, that may become largely irrelevant and out of date by the time actual purchase decisions are made. Also, beyond the unpredictability of O’s influence, decisions made under the influence of O are much “noisier” than hypothetical decisions made by an individual consumer on her own when completing a questionnaire. While a limited set of studied features might be reasonably representative of the factors that an individual consumer will consider, a larger set of reviewers and information sources introduces various unpredictable factors (for example, “coolness,” popularity, highlighting of seemingly insignificant features) that will be difficult to capture in traditional measurement.

The noise and hard-to-anticipate information sources similarly limit the usefulness of other common research techniques such as brand equity measures or pricing studies. While predicting individual decisions that are made in isolation is not a simple task, predicting the joint evaluations of many consumers and the influences of other information sources is likely to be an order of magnitude more difficult.

Indeed, trying to predict where things are going has become more challenging. While traditional consumer research can still tell a marketer if their next toothpaste will do better with purple or black stripes, it is not of great help for more radical, unfamiliar changes. There is no effective way to use market research to predict consumer reaction to major changes. When assessing new concepts, consumers tend to be locked into what they are used to and believe today, which makes them less receptive to very different concepts and more receptive to small improvements over the current state. Similarly, experts who try to predict the success or failure of radically new products are unlikely to be much more accurate than consumers. (Among other things, experts have famously made bad predictions regarding the success of the telephone, the Internet and television.) What marketers are often left with is trying to quickly figure out where things are going and what consumers and competitors appear to follow. And then try to offer a better solution. Instead of predicting vague consumer preferences (which may change anyway when it’s time to buy), these days one of the few things a marketer can do is follow O and play along to make the best of a situation they no longer control.

The current environment does not mean the end of market research, just a shift in focus with some silver linings. We expect that future market research will focus more on tracking and responding to consumers’ decisions as they occur, and less on long-term preference forecasting. Instead of measuring individual consumers’ preferences, expectations, satisfaction and loyalty, marketers should systematically track the readily available public information on review sites, user forums and other social media.

From ABSOLUTE VALUE by Itamar Simonson and Emanuel Rosen © 2014 Itamar Simonson and Emanuel Rosen. Reprinted courtesy of Harper Business, an imprint of HarperCollins Publishers. This piece was originally published by the Stanford Graduate School of Business and has been reprinted with permission. Follow the school on Twitter at @StanfordBiz.