In his autobiography Rogue Trader, Nick Leeson said the ethos at Barings was simple: ‘We were all driven to make profits, profits, and more profits ... I was the rising star.’

Leeson did make Barings vast sums. In 1993, he made £10m - 10% of the bank’s profits for that year. But in 1995, the discovery of a secret file - Error Account 88888 - showed that Leeson had gambled away £827m in Barings’s name.

The City’s oldest merchant bank was finished.

As stock markets took fright from the biggest financial scandal in years, Watford born Leeson fled the firm’s Singapore office leaving a note saying ‘I’m sorry’. He then went on the run.

In his absence, a mixed picture emerged of the 28-year-old whose golden touch in the currency market earned him £200,000 a year. Some colleagues said he was ‘brilliant’ and the ‘most confident trader in town’. Others said he was a ‘high-flyer who liked to dabble in dare-devil trades.’

With a global manhunt underway, Leeson surprised everyone by turning up at Frankfurt airport several days later. He then began a nine month battle to avoid extradition to Singapore, which failed.

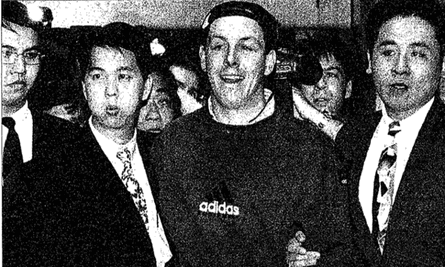

Almost a year after fleeing Singapore, Leeson landed at Changi airport escorted by security. Wearing gym gear and a baseball cap turned back to front, he looked relaxed. He was charged with forgery and fraud in relation to the collapse of Barings.

At his trial at Singapore District Court, Leeson, who had been held at Tanah Merah maximum security prison, admitted charges of forgery and cheating. Presumably in an attempt to play the sympathy card, his lawyer told the court that Leeson had said his wife had suffered a miscarriage and that Leeson was financially ruined. Unmoved, the judge sentenced Leeson to 6 ½ years in prison.

The risk of a longer prison sentence put Leeson off appealing, instead he served four years in a Singapore jail. During his spell in prison he was diagnosed with colon cancer for which he received treatment. In 1999, Leeson was freed and enjoyed champagne and smoked salmon on the flight back to London with British journalists.

Such was the interest in Leeson’s remarkable story the Sunday Mirror reported that he had made £200,000 from a book deal and a newspaper serialisation. He also received a share of the £7m profit from the film Rogue Trader, which stared Ewan McGregor and Anna Friel.

As for Barings, it become part of ING, the Dutch bank paying £1.00 for it in 1995. Many of Leeson’s former colleagues lost their jobs.

Barings’s investors also lost out. Their misery was compounded on hearing that the bank’s directors would still be getting large bonuses.

A few months later, the chancellor, Kenneth Clarke, having already said that the banking regulatory system would be ‘thoroughly’ reviewed, presented an eagerly awaited Bank of England report to the Commons. The report, as expected, said that Barings’s fall ‘came from unauthorised and concealed trading positions,’ and ‘serious problems of controls and management failings within the Barings group.’

Comments (…)

Sign in or create your Guardian account to join the discussion