While some commercial banks are skittish about the future of home equity loans, other lenders are taking their place.

Credit unions and nonbanks sense an opportunity to enhance relationships with their current customers. In particular, credit unions have been building open-end home equity lines of credit along with other businesses in an effort to diversify.

"We're seeing credit unions gain market share, not just in HELOCs, but in business lending [and] auto lending, so it's pretty much across the board," said Curt Long, the chief economist for the National Association of Federal Credit Unions.

-

Low borrowing costs and rising home values are just two of several reasons owning a home is far less burdensome than it was a decade ago.

February 12 -

Remember those homeowners who walked away from their underwater mortgages even though they could still afford their loans? They're back, this time as prospective borrowers.

February 5 -

It's easier than ever for consumers to take out personal loans to pay down high-cost debt or fund big-ticket purchases, and two new studies show that they are taking full advantage of their options.

January 29

During 2014 home equity balances at credit unions grew by 7.2%, and in 2015 they grew by 6.1%. But bank home equity balances declined by 3.2% in 2014, and they fell another 5.3% to in 2015, according to data provided by NAFCU.

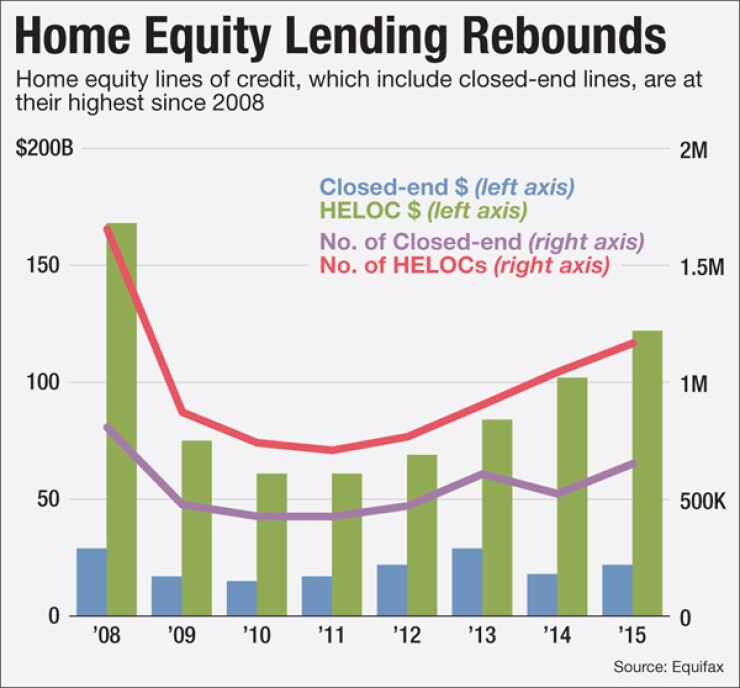

This comes at a time when total home equity lending is seeing the most activity in the post-bust period.

Data from Equifax shows that the total credit limit of new home equity lines originated between January and October of 2015 was $121.6 billion, a 19.7% increase from the corresponding time a year earlier.

The total number of new lines originated was 1.17 million, an increase of 11.8%. It was the best 10-month period for HELOCs since 2008.

There were also $21.9 billion of closed-end home equity loans originated between January and October, up 20.1% from the same period one year before and the second highest since 2008. The total number of these loans was 652,200, up 24.7% over 2014; that was also the most since 2008.

At loanDepot in Irvine, Calif., closed-end home equity lending is seen as a complement to its first-lien-mortgage and personal-loan businesses. If anything, home equity is often viewed as a good alternative to personal loans for some customers, Chief Financial Officer Bryan Sullivan said.

"When we started to really look into the personal-loan business," Sullivan said, "we noticed that a lot of the people that were taking out personal loans were also homeowners. So we sat around saying, Why would somebody take out a cost-to-capital that is higher than taking out a home equity loan?"

Banks typically are going after borrowers with credit scores of 750 or higher, but loanDepot sees an opportunity in the 700 to 760 credit score segment, he said.

Personal loans have a quicker underwriting process, and loanDepot will go lower on the credit score (to 660). But with the home equity loan, a borrower can get more money and lower rates; loanDepot will approve up to $250,000 (as long as the combined loan-to-value ratio does not exceed 95%) for a home equity loan and just $35,000 for a personal loan. The amortization period is much longer: 15 to 30 years for the home equity loan compared with just five for the personal loan.

Where loanDepot sees opportunity, banks anticipate fewer prospects for a revival as first mortgage rates stay stubbornly low.

Wells Fargo's home equity portfolio has been shrinking for a long time and unlikely to change anytime soon, Chief Financial Officer John Shrewsberry said during the company's fourth-quarter conference call.

The home equity portfolio at Bank Mutual of Milwaukee consists of adjustable-rate closed and open loans, and it has been in "gradual runoff" for the past three or four years, Chief Executive David Baumgarten said.

The consensus among observers was that home equity will grow in 2016 as first-mortgage borrowers take a second rather than refinance a low-interest-rate first mortgage. Bank Mutual believes its first-mortgage lending in 2016 will actually grow compared with 2015.

"Right now we haven't seen rates really rise, and we are not as convinced that rates are going to rise in 2016 as some of the other people are suggesting," Baumgarten said.

Pentagon Federal Credit Union offers both types of home equity products. Its marketing focus for home equity is based on the time of the year, said Debbie Ames Naylor, president of mortgage banking. In the first quarter, PenFed takes more of a bill-consolidation approach. People tend to start looking into home improvement in March, while some may look to use their equity to help pay their taxes in April.

The credit union offers adjustable-rate products, and it believes that looking at the combined loan-to-value ratio is important to ensure performance.

"We make sure we're lending responsibly so we're not creating a scenario where someone's being granted a line that they wouldn't have the capacity to repay when rates rise," Ames Naylor said. "You don't want to put the consumer into a bad position, but you want to be able to meet their needs."

It is this competition with credit cards and other types of personal loans that drove loanDepot's decision to enter the market, Sullivan said.

"The beauty of the platform is that we're agnostic as to how the consumer comes into us, whether that is online, on the phone or through our distributed retail locations, and we're agnostic as to the underlying product that they take," he said. "We're really just trying to help the consumer with whatever their current need and situation is."