Zynga’s acquisition of fellow games firm NaturalMotion in January this year represents one of the most lucrative exits in a while for the British games industry.

Zynga agreed to pay $527m (£317m) for the Oxford-based company, which made its name with mobile hits CSR Racing, My Horse and Clumsy Ninja, as well as the Euphoria physics engine used for Grand Theft Auto V and other console games.

So what happens now? NaturalMotion CEO Torsten Reil and Zynga CEO Don Mattrick talked separately to The Guardian about why they decided their companies made a good match, and what opportunities lie ahead in mobile gaming.

“We really weren’t looking to sell the company. It was kind of surprising to me that we did!” says Reil. “But I got to know Don a few months back, and we realised that we have the same vision of the industry: to provide something new to players, to really wow people and prove that quality really matters.”

The ‘w’ word is certainly the message coming out of both companies. “Their products have a tremendous wow factor,” says Mattrick. “CSR and Clumsy Ninja have set a high bar in terms of production values, and they’ve learned that once you give people something delightful, they engage with it.”

Mattrick himself is relatively new to Zynga, having joined the company in July 2013 to replace its founder Mark Pincus as CEO, from a previous job heading Microsoft’s entertainment and devices division.

The NaturalMotion deal is one of his first big moves as he tries to turn around a long-term slump for Zynga, which has struggled with the transition from being the largest social games publisher on Facebook by some distance, to an exploding mobile games industry where games like Candy Crush Saga and Clash of Clans are the biggest earners.

Mattrick says Zynga has “doubled down on execution” since he joined, with a particular emphasis on revamping some of the company’s most successful franchises – Words With Friends, FarmVille and Zynga Poker – for new mobile versions to be released in 2014.

“The transition to mobile is well underway,” he says. “And we’ve been able to find a great strategic fit with the team at NaturalMotion. We have faith that they will continue their string of mobile hits, after shipping CSR in 2012 and Clumsy Ninja in 2013 in the categories of racing and people, and also will do other amazing things.”

For his part, Reil says NaturalMotion has much to learn from Zynga, particularly about “how to engage with users over the longer term – it’s less a matter of scale, and more a matter of deep expertise, which has been quite an eye-opener for us”.

Mutual praise aside, Zynga’s decision to pay $527m for NaturalMotion also looks like an admission that its mobile strategy needs an injection of creativity and energy. That long-term slump? Zynga’s own stats show it clearly.

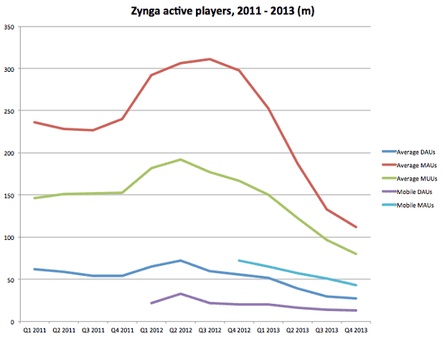

Analysis of the company’s financial reports since the start of 2011 show a clear peak in the summer of 2012, when Zynga’s games were attracting 306m monthly active users (MAUs) and 72m daily active users (DAUs), with 4.1m people a month buying virtual items within those games (monthly unique payers – MUPs).

A year later, and the company was reporting 187m MAUs, 39m DAUs and 1.9m MUPs, and by the end of 2013, those figures had declined further to 112m MAUs, 27m DAUs and 1.3m MUPs. In short, Zynga lost 63% of its monthly AND daily active users in 18 months, not to mention 68% of its paying customers.

All the way along, Zynga’s executive team were telling analysts and journalists that the company was firmly focused on winning in mobile, yet its mobile stats have shown a similar decline.

In the second quarter of 2012, Zynga had 33m mobile DAUs, but that fell steadily to 13m by Q4 2013. Meanwhile, mobile MAUs fell from 72m in the final quarter of 2012 to 43m in the final quarter of 2013.

Zynga’s decision to spend $210m on the developer of mobile hit Draw Something in March 2012 just as that game peaked may look like a big mistake with hindsight, but the company’s mobile problems have run deeper than that, as a succession of new games failed to strike it big on iOS and Android.

Turning this around is what tempted Mattrick to leave Microsoft, and make an even bigger acquisitive bet on NaturalMotion while doubling down on Zynga’s three most popular existing franchises.

“We’re going to see amazing growth in terms of smartphones and tablets in this next decade: people estimate that today there are around 1.3bn devices split between those two categories, that will quickly grow past 2bn in the next few years,” he says.

“That’s pretty dramatic growth just counting the number of devices, but the capabilities of those devices is also moving at the fastest pace we’ve ever seen in technology.”

Mattrick is happy to praise Supercell and King for their success with Clash of Clans and Candy Crush Saga, suggesting that Zynga still has ambitions of producing mobile games capable of competing on quality as well as revenues.

“They got to an excellent gameplay loop, and that’s incredibly valuable. What I would love is for us to be able to have gameplay loops that are equally excellent, in potentially different genres of product experience, where higher production values complement that in a way that pulls people in,” he says.

“That’s the opportunity for us: we’re trying to build a company that’s the at-scale top-20 leader in Western markets. We’re a larger company than King or Supercell in terms of absolute headcount – we have approximately 2,000 people – so we are trying to place more bets in more categories.”

High headcounts aren’t hugely in fashion in mobile gaming right now. King made $1.9bn in 2013 and ended the year with 665 staff, while Supercell made $892m that year with just 132 employees. That’s a per-employee take of $2.8m and $6.8m respectively, compared to Zynga’s $373k – based on $759.6m of revenues in 2013, when it ended the year with 2,034 staff.

Mattrick’s bet is that Zynga can make its headcount an advantage rather than a sign of corporate bloat, while refocusing on popular franchises like Words With Friends, Zynga Poker and FarmVille.

“They have tens of millions of people interactive with them each and every day. This past quarter, Words With Friends posted its best result in five years of running as a franchise. These products are alive and well, and we see 2014 as a growth year,” he says, pointing to Zynga’s $1.2bn of cash and a lack of debt as signs it can continue its comeback.

“Yes, a lot of people are sceptical about whether Zynga could navigate the transition [from Facebook to mobile]. The reality is that the company fared a lot better than people perceived. Zynga was $30m of cashflow positive in 2013. People say ‘oh, this company missed a beat and isn’t faring that well’. Well, the company did miss a beat, but it has tremendous staying power, and tremendous assets as a team.”

Hiring Reil – albeit at a significant cost – was a smart move. He’s one of the more strategic thinkers in the free-to-play mobile gaming market, with NaturalMotion’s rise down to careful analysis of industry trends, and then impressive execution of games that took advantage.

He sees more opportunity ahead within Zynga. “The product has to be the strategy: everything has got to be about the product and creating something really amazing for consumers. On mobile, quality is winning out. Compared to retail, there is nothing you can do to push the product down to consumers,” he says.

“A couple of years ago, there was definitely a feeling that people were quite happy with reasonably basic [social/mobile] games. And in many ways, those games added a lot of value, but all the time there is definitely a strong trend towards immersion. The trick now is to combine that with the Starbucks-line gameplay, where you can dive in to games and play them while waiting for your macchiato to arrive. It’s about combining short-buzz gameplay with quality.”

NaturalMotion seemed to be doing a pretty good job of this under its own steam: Clumsy Ninja raced to 10m downloads within a week of its release in November 2013, for example. Meanwhile, CSR Racing was famously making $12m a month in August 2012: a figure that shocked the industry then, but looks middling now compared to the current biggest app-store earners – a sign of how fast the mobile games market has grown.

Why sell to Zynga, rather than try to overtake it? “While it’s true that the revenues possible with a hit on mobile are pretty incredible, even though small companies can achieve that, the expertise that’s required to create a hit is pretty deep now. On the one hand, it’s quite technical in terms of the creativity required,” says Reil.

“But it’s also quite technical in the insight you need to have on how to structure those games, how to retain players over time and make sure monetisation works. That expertise is non-trivial: the trend over the last 12 months has been that it’s harder for an inexperienced small team to achieve that.”

His point: even NaturalMotion, which was having hits and making money, sees Zynga as a company that has a deeper well of expertise on the latter disciplines.

“It’s really hard to go really deep and understand what connects really deeply and retains really well. That’s the big thing everyone is learning now. The big disruptions are coming from some new companies, but also – which I find more likely – from existing companies redisrupting the market,” he says.

“If you’re in the business and understand the free-to-play side, that gives you a really good foundation to redisrupt. That foundation helps you to break through with amazing products on top of that. It’s much harder than it was a couple of years ago to come from nowhere with no experience in free-to-play.”

That’s a point made with different wording by Mattrick, who suggests that “as the industry progresses, natural barriers to leadership will emerge”, adding that “it will become more challenging to make the same level of aggregate investment as companies who started early in this.”

NaturalMotion also has a background in the console games industry, albeit more as a middleware supplier rather than a publisher. Meanwhile, Mattrick’s years working on Xbox give him an insight into that industry too.

Are we going to see next-generation console and social/mobile games continue to exist as largely-separate but parallel strands of the overall games industry? Or is there scope for companies like Zynga, King and Supercell to take their hits to console, if they want to?

Mattrick politely swerves the question, perhaps sensing it may end in a conversation comparing console and mobile gaming’s qualities. He does suggest that “free to play will post the fastest growth rate” in the coming years though. “I think people will be surprised at how large the profit pools are in the industry, in aggregate,” he says.

“It’s not dissimilar to feature film and TV. Both the feature film industry has grown – box office has grown – and television has grown. You could make the statement that traditional console games are much closer to feature films, and what we do in the mobile space is much closer to TV,” continues Mattrick.

“For a feature film, you drive to the cinema, sit in your seat and watch the film. Our space is more like picking up a TV remote: you turn it on, see an experience, and decide if it’s interesting or not in 30 seconds or less. If it is interesting, you’ll continue to watch and engage. There’s a place for both.”

A common view from critics of free-to-play mobile games is that they’re not “good” games compared to console. If anything, though, that 30-second dynamic suggests a high bar for quality and accessibility. Which brings us back to what NaturalMotion may bring to Zynga.

“I think this is what’s going to continue to make people practise their craft and get better at what we do,” says Mattrick. “That’s how you accelerate learning: you really pay attention to excellence and great execution. We’re doing that in Zynga, and I know the team at NaturalMotion are focused on it too.”

Comments (…)

Sign in or create your Guardian account to join the discussion