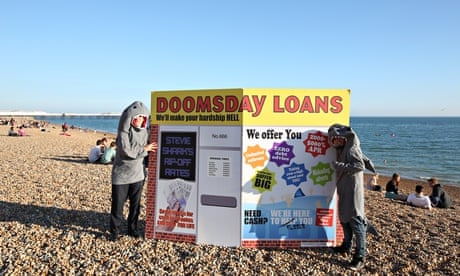

Payday lenders stand to lose more than two-fifths of their revenues, with smaller firms forced out of business under a further clampdown proposed by the financial watchdog.

People taking out payday loans will never have to repay more than twice the sum they borrowed under the Financial Conduct Authority plans, which it estimates would cost the £1bn payday loan industry £420m in lost revenues.

A borrower could be expected to save £193 a year in charges, the regulator said.

But money-saving experts warned that customers would still face hefty interest charges under the measures.

The regulator's plan comes a day after newly appointed Wonga chairman Andy Haste announced that he was axing the payday lender's cuddly grandparent puppets that appear in adverts during children's TV programmes, as part of an attempt to clean up its act. Haste said he expected the FCA cap would mean Wonga would become a "smaller and less profitable business" in the short term.

The Church of England has condemned Wonga as "morally wrong" and pledged to compete the industry out of existence by boosting credit unions. But Martin Wheatley, chief executive of the FCA, said it was not the regulator's intention to drive payday lenders out of business. "We recognise that payday lending has a role in society," he told BBC Radio 4's Today programme.

The regulator estimates that 1.6 million people took out 10m loans worth £2.5bn last year. More than half of borrowers had to pay extra charges because they did not repay their loan on time. "Unfortunately that has been a big part of the business model, where the profitability comes from, frankly, people who can't afford the loan, and that is why the additional cap acts as a backstop to stop people ratcheting up loans many, many times the original amount," Wheatley said.

Under the FCA proposal someone who borrowed £100 from a payday lender and paid it back within the agreed 30 days would pay a maximum of £24 in charges. Fees for late payment would be capped at £15, with a total price cap of 100% of the original loan to stop default charges spiralling out of control.

The FCA said it had tested other price caps, but double the original loan was easy for consumers to understand.

The regulator will publish its final rules in early November following a consultation period, with the aim of having a price cap in force from January 2015.

Stella Creasy, the Labour MP who has led the campaign against payday lenders, said British consumers would be less well protected than those in the US or Japan.

"Anyone who thinks today's announcement is the end of legal loan sharking in Britain is in for a nasty shock," she said. "Without further revision, this total cost cap of 100% of the borrowed amount will leave British consumers less well protected than their counterparts in Japan and most of Canada and the United States. Not everyone who takes out a payday loan gets into financial difficulties, but enough do due to the terms and structure of the loans. It is clear the business model is not fair. If the level of the cap does not remove the incentive to do this it is meaningless. That's why the FCA should, and could, go much further in providing the protection consumers in Britain need from the vicious cycle of debt these loans all too often create."

The Labour party has called for the cap to be introduced in October to prevent people from overstretching themselves over Christmas.

Debt charities also warned that a cap on loans would not be enough to protect borrowers from irresponsible lending.

"A payday loan cap is not the final piece of the puzzle; consumers need more choice and access to advice," said Citizens Advice chief executive Gillian Guy. "Not only is the cleanup of the existing market essential, banks need to step up to the plate to offer a responsible micro-loan. Payday loans are often used to cover the cost of daily essentials like gas and electricity bills or rent. The cap has removed some of the gamble of taking out a payday loan, but it is still an expensive form of borrowing."

The StepChange debt charity called on the FCA to require lenders to share information to prevent consumers taking out multiple loans.

The FCA had previously shied away from a cap on payday lenders because it feared it would drive people desperate for short-term cash into the arms of illegal loan sharks.

Wheatley acknowledged this was a risk: "The actual number of people who consider loan sharks or use them is very very low … it might increase, but frankly that is an illegal segment of the market and we would work very closely with other authorities to ensure that market doesn't grow."

Comments (…)

Sign in or create your Guardian account to join the discussion