One of These Things is Not Like the Others

The IBB has been defying the general market indices in January because of the anticipation leading up to and through the JPM conference.

But now that the conference is on it's last day and many participants have already left for home, the IBB is selling off.

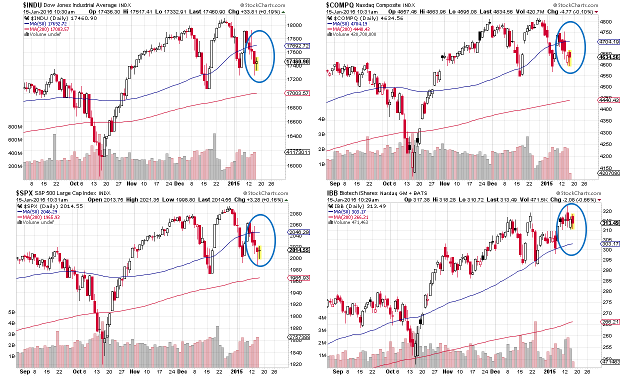

Here's the 3 month charts of the major market indices and the IBB. It reminds us of the Sesame Street song "One of these things is not like the others".

Clockwise from Top left:

Dow Jones

NASDAQ Composite

Ishares Biotechnology ETF (IBB)

S&P500

The IBB had stayed above it's 50-day moving average while the others indices have not.

Notice how the IBB has managed to stay above it's 50-day moving average level of $303.17. With the excitement of JPM over - one has to wonder how long the IBB can defy the rest of the market.

Looking Back to 2014

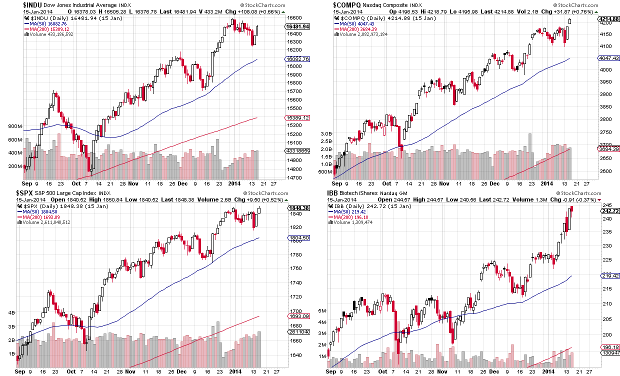

Here's how those same charts looked this time last year:

3-Month Charts

Clockwise from Top left:

Dow Jones

NASDAQ Composite

Ishares Biotechnology ETF (IBB)

S&P500

This time last year all the indices were up, but the IBB was far outpacing the other indices... But we all know what happened just a few months later - In February the IBB topped - and then there was a huge sell-off from March to April.

What's Next

A pullback in the IBB after the hype and excitement of the JPM conference wanes is to be expected. Coming up very soon on the heels of the conference is Q4 2014 earnings season.

We don't expect too many surprises for the big biotech names for year-end earnings since all of them have already presented at JPM and most have provide guidance for what to expect in their year-end results.

There are still some major data announcements - perhaps the biggest of which will be Vertex Pharmaceuticals (NASDAQ:VRTX) announcement of top-line results from their phase 2 trial of Kalydeco + VX-661 their second generation corrector molecule.

CAR-T Away Some Profits

Now may be a good time to book at least some gains on some of the biotech names that have really heated up (perhaps overheated?) ahead of the JPM.

In particular, if you've been holding the CAR-T stocks since before the ASH conference (as we recommended to subscribers in the December issue of the Red Acre Biotech Binary Event Watch), booking at least some gains now is a pretty good idea. Valuations in this space are lofty.

The clinical data may eventually justify these valuations and over the long term we are positive on these stocks, but right now these names are perhaps overheated due to the excitement of the JPM conference on the heels of some exciting data at the ASH conference.

Alternately, if you missed an entry for these stocks, keep them on your watch list as they consolidate. Buying the dips and scaling in to build a position is always a sound idea.