One in four U.S. employees expect to work beyond age 70, while one-third report they anticipate retiring later than previously planned, according to Willis Towers Watson research released this week. The data suggest many employers may want to re-examine their financial benefit programs, as well as how those benefits are being communicated.

“The most powerful message to employers is the disproportionate concentration in a lack of retirement readiness among a portion of workforce that also self-identified as less healthy, more stressed and less engaged,” says Shane Bartling, senior retirement consultant at Willis Towers Watson.

The Global Benefits Attitudes Survey shows employees who expect to work longer are less healthy, more stressed and more likely to feel stuck in their jobs than those who expect to retire earlier. According to the survey, 40% of employees expecting to retire after age 70 have high or above average stress levels, compared with 30% of those expecting to retire at 65. For those planning to retire after age 70, less than half (47%) say they are in very good health, while nearly two-thirds (63%) of those retiring at age 65 state they are in very good health. Additionally, 40% of employees planning to work past 70 feel they are stuck in their jobs, compared with just a quarter of those who expect to retire at 65 (28%) or before 65 (27%).

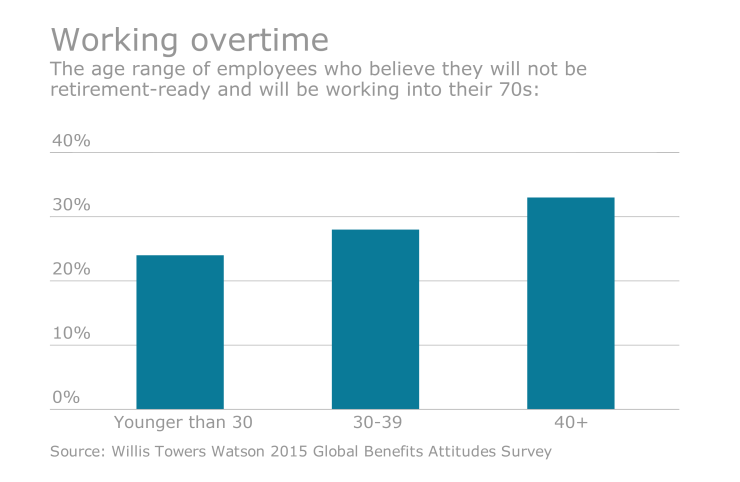

Twenty-three percent of employees believe they’ll have to work past age 70 to live comfortably in retirement; another 5% don’t think they’ll ever be able to retire. Additionally, while the average employee expects to retire at 65, they admit there is a 50% chance of working to age 70.

Employers have to remain focused on what’s under their control, knowing there’s only a limited amount of dollars to allocate toward pay and benefits to stay competitive, he says. The survey notes 62% of respondents say they would be willing to pay more out of their paychecks for more generous retirement benefits.

A major factor employers can influence is how effectively employees use those retirement dollars, Bartling says. “Are they making wise decisions in allocating? Can you provide assistance in how they spend or how they save and the types of choices they make in terms of allocating those resources?”

“The bottom line for employers is to evaluate the business impact, in both the short- and long-term, of having gaps in your retirement readiness in your workforce.”

A lot of employers aren’t doing enough, he adds. The focus has been more on a gentle approach and putting more of a burden on the employee to educate themselves.

“Although their financial situation has improved over the past few years, many workers remain worried about their long-term financial stability,” says Steven Nyce, a senior economist at Willis Towers Watson. “In fact, the only way for many employees to achieve retirement security and overcome inadequate savings is to work longer. Interestingly, employees are increasingly looking to their employers for help with retirement.”

“The bottom line for employers is to evaluate the business impact, in both the short- and long-term, of having gaps in your retirement readiness in your workforce,” Bartling advises. “Focus on the at-risk portion of your workforce, understand what’s going to resonate with them and provide the types of decision support and smarter defaults, and financial well-being support that’s going to address those gaps because it’s translating into meaningful business costs.”