Little progress has been made towards achieving gender diversity in the financial services industry, a damning report has found.

A research note carried out for the Financial Conduct Authority and published by the regulator yesterday (November 18) warned diversity had remained "consistently low" at industry level at a female quota of approximately 17 per cent of FCA approved individuals.

The report also analysed 94 financial institutions focusing exclusively on senior managers and found the share of females had grown "relatively rapidly" in that group since 2005 (by 9 per cent) - but only from a low base of 9 per cent.

The report, written by Karen Croxson, Daniel Mittendorf, Cherryl Ng and Helena Robertson, found the industry average had remained "remarkably unchanged" since 2005 despite several regime shifts and increased public scrutiny.

The report stated: "There is an increasingly broad-based consensus about the need for gender diversity in financial services globally.

"The last few years have seen an increasing focus on bold targets and high-profile initiatives to improve gender diversity, with concerns that male dominated firms are inherently more risk-taking and firms need to represent the society of consumers they serve."

In 2016 the HM Treasury launched the Women in Finance Charter in a bid to address the underrepresentation of women in finance, with more than 330 firms pledging to it implement its recommendations.

But today's report said: "Despite the scrutiny and public commitments to evolve, financial services have seen little if any improvement in gender diversity.

"In addition, there is evidence to suggest that women in senior positions at UK financial firms tend to represent support functions, rather than profit-generating ones."

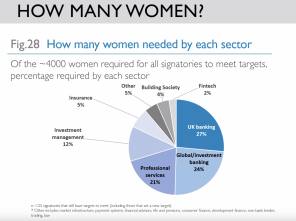

The report found large investment managers had a more gender diverse senior management, in comparison with institutional brokerage firms, which made up the least gender diverse sector in the sample.

The report concluded: "We find that, whilst there have been gains in gender diversity in some areas, improvement has often come from a very low base and many firms and sub-sectors continue to lag on representation of senior women.

"The evidence also suggests that non-executives are more likely to be women than other senior managers."

Anna Sofat, chief executive at Addidi Wealth, said the FCA was right to focus on gender diversity and the progress, or lack thereof, in the industry.

Ms Sofat said: "This sits at the heart of the culture within our industry. Culture was a major contributor to the 2008 credit crisis and whilst there was a clear understanding that things have to change, little has actually been done to bring about fundamental change.

"In Addidi’s experience, the key change has to be the focus on 'hunter and farmer' mentality which is prevalent when recruiting financial advisers, the focus is always on the sale and transaction in our industry whilst much of the value is actually delivered by client care over many years, an area where women advisers typically excel at.

"It's time the industry reviewed its remuneration and reward structures as well as focus on delivering long term value to clients and shareholders alike."

rachel.mortimer@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.