Abstract

To deal with potential conflicts between the triple-bottom-line expectations of investors and the performance of executives, firms can use incentives by integrating corporate social performance (CSP) targets into executive compensation. No evidence yet exists that CSP targets in executive compensation actually lead to an improvement of CSP results. Using a panel data set of 400 firms for the years 2008–2012 leading to 1846 firm-year observations, the relationships between CSP targets and CSP results and CSP improvements are analyzed. The results show that (a) the level of CSP has no effect on the use of CSP targets, (b) the use of CSP targets in general does not automatically lead to better CSP results, and (c) the use of quantitative, hard CSP targets is an effective way to improve CSP results, especially to lower CSP weaknesses.

Similar content being viewed by others

Introduction

Although every firm needs to perform financially, firms are increasingly expected to behave in socially responsible ways and consider the interests of stakeholders such as communities, employees, and environmental groups. This trend is caused by changing regulations but also by emerging investor activism (Goranova and Ryan 2014; Parker 2014). Investor activism has an effect on broader corporate outcomes and stakeholder issues, such as the firm’s environmental impact (Lee and Lounsbury 2011; Reid and Toffel 2009) and its corporate social performance (CSP) (David et al. 2007; Rehbein et al. 2004). Investors may raise both financial as well as social issues (O’Rourke 2003), reflecting their concern for the triple bottom line of economic, social, and environmental performance (Crifo and Forget 2013; Goranova and Ryan 2014).

In response to these pressures, an increasing number of firms seek to improve their CSP. One approach firms have taken is to put CSP on the agenda of the executive by introducing CSP indicators in the executive evaluation and reward process (Coombs and Gilley 2005). The recently published guidelines on integrating environmental, social, and governance (ESG) issues in executive pay by the United Nations provide a tangible tool to guide dialog on this issue and to help firms improve corporate boards’ practices (PRI 2012). Despite the importance of target setting for firms, research offers little empirical evidence regarding their use and performance effects (Arnold and Artz 2015). Practitioners (Tonello 2011) as well as researchers (Kolk and Perego 2014) debate the effectiveness of CSP incentives to improve CSP results.

Since the 1980s, agency theorists have begun to investigate the relationship between pay and managerial actions (Coughlan and Schmidt 1985; Larcker 1983). Although a limited number of studies have addressed the idea of ‘strategic’ reward systems, matching compensation systems to a firms’ strategy (Artz et al. 2012; Boyd and Salamin 2001), there is some recent evidence that CEOs respond to compensation schemes in the manner intended (Chng et al. 2012; O’Connell and O’Sullivan 2014; Pathak et al. 2014). Unfortunately, this evidence is mainly available for financial targets. In contrast, we know very little about the effectiveness of CSP targets. The available research provides only scarce insight into the use of CSP targets in executive compensation (e.g., Berrone and Gomez-Mejia 2009a; Cordeiro and Sarkis 2008), and informs us even less about the effects of these CSP targets on CSP results (Russo and Harrison 2005).

This study adds to existing knowledge, first, by using a large, longitudinal sample of S&P 500 firms to identify the use of CSP targets, specified toward qualitative, soft CSP targets and quantitative, hard CSP targets; second, by analyzing whether CSP is a predictor for the use of CSP targets or a consequence of the use of CSP targets; third, by analyzing if the use of CSP targets has an effect on CSP results.

The remainder of this paper is organized as follows. The next section provides the theoretical background and introduces the hypotheses. An introduction to CSP, executive compensation, and an overview of existing studies investigating the relationships between these topics is provided in this second section. The third section describes the method used, data, and statistics. Results are described in the fourth section, and finally discussion and conclusions are provided in the fifth section.

Theoretical Background and Hypotheses

Corporate Social Performance

Corporate social responsibility (CSR) and CSP have been present in accounting and management literature for about 45 years. The CSR and CSP concepts have been defined in many different ways (see for an overview of definitions Dahlsrud 2008), but generally imply that firms are accountable to a wide audience of stakeholders such as employees, customers, and local communities. Where CSR focuses on the behavior or strategy of a firm, CSP is the result or the outcome of this behavior (Wood 2010). Increased demand for CSP is, among others, observable through attention from investors for topics such as climate change and ethical issues (David et al. 2007) aiming to identify the long-term investment opportunities and risks for firms (Herremans et al. 1993; Luo et al. 2014; Tan, 2014). The results of such developments have led to the creation of new accounting, control, and reporting systems to respond to CSR-related information both internally and externally (Bebbington and Larrinaga 2014; Gray 2010; Henri and Journeault 2010) and to the creation of various sustainability indices. Some examples are the Dow Jones Sustainability Index (DJSI) and databases providing information on CSP and ESG issues, such as the information provided by Thomson Reuters ASSET4, Bloomberg, and the MSCI ESG STATS, formerly known as the Kinder, Lydenberg, Domini (KLD) database.

Executive Compensation

When capital suppliers of a firm become more interested in CSP, they want to make sure that the firms’ executives are focused on the firms’ CSP as well. The potential conflict of interest between principals—the suppliers of capital to the firm—and the agents—the managers of the firm delegated with the decision-making responsibilities—is the essence of agency theory (Jensen and Meckling 1979). In the many decades of scholarly research into directors’ compensation, agency theory is the most commonly used theoretical perspective (for good overviews see Gerhart et al. 2009; Larkin et al. 2012). Providing managers with financial incentives in the form of a compensation contract is a widely used approach to align the interests of the principals and the agents (Bonner and Sprinkle 2002; Deckop et al. 2006; Makri et al. 2006). Although there is substantial heterogeneity in pay practices across firms, industries, and countries (e.g., Jansen et al. 2009), most executive pay packages contain four basic components: a base salary, an annual bonus tied to accounting performance, stock options, and long-term incentive plans (Murphy 1999). Research suggests that it is essential to distinguish between different uses of performance measurement and their determinants (Van Veen-Dirks 2010). It is often questioned whether compensation plans contain sufficient incentives to take optimal actions on behalf of the principals (Jensen and Murphy 1990) and other stakeholders (Faulkender et al. 2010).

CSP and Executive Compensation

Traditionally, incentives only addressed the financial performance of the firm (Berrone and Gomez-Mejia 2009b). More recently, firms started to use CSP targets in incentive systems (Berrone and Gomez-Mejia 2009a; PRI 2012; Russo and Harrison 2005). This study is not the first research analyzing the interrelationships of executive compensation, CSP targets, and a firms’ CSP. Most of the existing studies focus on the effect of executive compensation on CSP (see Fig. 1, intermitted line), and a few studies analyze whether this effect changes when CSP targets are used (see Fig. 1, dotted line), while only one empirical study was found to actually analyze the effect of CSP targets on CSP (see Fig. 1, full line).

The existing studies show mixed results about the effect of executive compensation on CSP. A negative relationship has been found to exist between executive salaries and firms’ environmental reputation (Coombs and Gilley 2005), executive salaries and CSP (Cai et al. 2011; Stanwick and Stanwick 2001), and short-term bonuses and CSP (Deckop et al. 2006). Some studies provide more detail and analyze the disaggregated effects on CSP strengths and CSP weaknesses. CSP strengths capture the extent to which a firm can be deemed socially responsible, while CSP weaknesses capture violations of social responsibility, such as pollution, corruption, or fraud. A positive relationship has been found to exist between executive salaries and CSP (Callan and Thomas 2011), long-term incentives and CSP (Deckop et al. 2006), executive salaries and CSP weaknesses (Mahoney and Thorne 2005, 2006; McGuire et al. 2003), and bonuses, stock options, and CSP strengths (Mahoney and Thorne 2005, 2006).

In contrast to the previous studies, only looking at the effect of executive compensation on CSP, some studies aim to assess how the use of CSP targets moderates the effect of executive remuneration on CSP. Cordeiro and Sarkis (2008) focus on environmental performance and study how explicit links between CSP and executive compensation function. They conclude that executives are rewarded for CSP only in firms that explicitly link CSP targets to executive compensation, while firms that do not use CSP targets do not explicitly and directly reward executives for CSP. Although this conclusion might seem straightforward, it could also be interpreted in an alternative way. If CSP would lead to higher financial performance, as has been shown by many authors (e.g., Margolis and Walsh 2003; Margolis et al. 2007; Eccles et al. 2011), executives might still be indirectly rewarded for higher CSP. Next to that, CSP might also lead to improved reputation of a firm and its executive (e.g., Eccles et al. 2011) and might be seen as a non-financial incentive (Staw and Epstein 2000; Zajac 1998). Contrary to this, Berrone and Gomez-Mejia (2009a) conclude that firms with an explicit environmental pay policy do not reward CSP more than firms who do not have those mechanisms. In result, they theorize that these mechanisms are symbolic rather than instrumental: “firms that are unwilling to make the necessary investment to reduce or eliminate toxic emissions may instead adopt structures like explicit environmental pay policies to signal concern about the natural environment and appear to be taking the right steps to preserve it” (Berrone and Gomez-Mejia 2009a, p. 120).

Two descriptive studies (Eccles et al. 2011; Kolk and Perego 2014) provide information on the use of CSP targets in executive compensation, but these studies do not give any information on the effects of the use of CSP targets in executive compensation on a firms’ CSP. Eccles et al. (2011) described that mainly firms that have better CSP use CSP incentives. They did not, however, examine whether incentives actually contribute to a higher CSP. Kolk and Perego (2014) describe four case studies from the Netherlands, and conclude that it is not clear whether including CSP targets in executive remuneration is a sign of firms taking their social responsibility seriously or just a form of window dressing and/or yet another perverse mechanism that allows firms to keep bonus levels high (Kolk and Perego 2014). Interestingly, although all these studies analyze the use of CSP targets in executive compensation, none of them analyze the effect that the integration of these targets has on CSP.

Only one empirical study was found to actually assess the influence of CSP targets on CSP results (Russo and Harrison 2005). This study by Russo and Harrison (2005) is industry specific and only studies environmental performance. It looks at the environmental performance of firms in the electronics industry, and concludes that there is weak evidence that environmental targets can elicit desired environmental performance on the plant level. “Environmental targets could represent a new “carrot” and shift some managerial attention to environmental issues” (Russo and Harrison 2005, p. 590). They also conclude that facilities in their sample seem to behave mainly reactively and in result remuneration policies seem to follow from emissions and not the other way around.

CSP as a Predictor or a Consequence of the Use of CSP Targets?

Previous research has failed to provide a clear picture on the causal relation between CSP and CSP targets. In result, it is not clear at all whether firms that have weaker CSP are more likely to introduce CSP targets. Introducing CSP targets in executive compensation as a consequence of a high level of CSP results might be seen as a form of window dressing (Berrone and Gomez-Mejia 2009a; Kolk and Perego 2014). Although one could also offer an alternative explanation, as firms with high levels of CSP results might introduce CSP targets in executive compensation to formalize the institutionalization of their commitment to CSP. Taking an agency theory approach to the use of targets, one would expect that especially firms with weaker CSP results are likely to introduce CSP targets in the compensation of their executives; as these firms are more likely to be interested in using these targets as a managerial instrument to align the incentives of its managers with the firms’ goals. As a result, it is expected that firms with a low level of CSP results will make more use of CSP targets than firms with a high level of CSP results.

H1

Firms with a low level of CSP results will be more likely to use CSP targets in executive compensation.

If the results would show that indeed firms with weaker CSP use CSP targets more often in their executive compensation, it would still not be clear whether the use of CSP targets actually leads to higher CSP results. The single study that analyzed the effectiveness of CSP targets found environmental targets to lead to higher environmental performance in the electronics industry (Russo and Harrison 2005). Here, it is similarly expected that CSP targets lead to higher CSP results.

H2

Companies that use CSP targets in executive compensation have higher CSP results.

Quantitative, Hard CSP Targets Versus Qualitative, Soft CSP Targets

Researchers as well as practitioners have argued that it is important to distinguish quantitative, hard CSP targets and qualitative, soft CSP targets. In 2010, the European Sustainable Investment Forum stated: “concerns exist around the extent to which performance targets are set as ‘soft targets’ thereby guaranteeing a minimum level of bonus” (Eurosif 2010, p. 4). A ‘soft target’ is a target without clear-cut underlying quantification, e.g., reduction of CO2 emissions in the next year, increasing the amount of women at the top in the next year or improving the rating of the firm at the DJSI in the next year. In contrast to this, a ‘hard target’ is a target with clear-cut underlying quantification, e.g., reduction of CO2 emissions with 20 percent in the next year, increasing the amount of women at the top from 10 percent to 25 percent by 2020 or improving the rating of the firm at the DJSI from the fifth position to the fourth position in the next year. According to the organizational psychology literature and the accounting literature, soft targets are often less accurate and reliable than hard targets because they are less controllable, less objective and often influenced by the rater’s biases (Feldman 1981). On one hand, subjectivity can be useful in mitigating various problems faced in assigning rewards through formulas based on quantitative performance measures (Gibbs et al. 2004). On the other hand, subjectivity in compensation systems can lower managers’ motivation to perform on the specific target, while they will be less able to distinguish what constitutes good performance (Ittner et al. 2003). In this study, it is expected that quantitative, hard CSP targets are more effective in improving CSP results than qualitative, soft CSP targets.

H3

The use of quantitative, hard CSP targets in executive compensation leads to greater improvement in CSP results as compared to the use of qualitative, soft CSP targets.

Method

Sample

Our initial sample consists of S&P 500 listed firms for the years 2008–2012 tracked by MSCI ESG STATS (the formerly the KLD database). MSCI ESG STATS is an independent agency with a long history of tracking firms, and rating firms, on the basis of a number of CSP dimensions (Barnett and Salomon 2012). The MSCI ESG STATS database is the largest multidimensional CSP database available to the public (Deckop et al. 2006) and has been used frequently in recent academic research (e.g., Barnett and Salomon 2012; Cheng et al. 2014; Coombs and Gilley 2005). We use firm-level operational data from COMPUSTAT, an international database of fundamental and market data on firms. Annual proxy statements are used to collect information on performance measures and specify whether firms have targets for CSP linked to executive compensation. This leads to a sample of 400 firms, and for the remaining 100 firms annual proxy statements are not available for all years. To control for within-firm dynamics, a one-year time lag of the dependent variable is used in our empirical specification. This reduced our observations to a maximum amount of 1846 observations.

Measures

Corporate Social Performance

Following Deckop et al. (2006), the proxy for CSP in this study is constructed on the basis of the summated scores of six MSCI ESG STATS categories: Employee Relations, Product Quality, Community Relations, Natural Environment, Human Rights, and Diversity. MSCI ESG STATS uses data from a variety of company, government, nongovernment organization, and media sources to rate firms based on social performance criteria. The scores are obtained by differencing the scores on the strength and weakness dimension of each category. We use the disaggregated scores for weaknesses and strengths in addition to the aggregated total scores as proxy for CSP. To calculate the total CSP score for each particular category, its total CSP weakness score is subtracted from its total CSP strength score (Barnett 2007). The change in the level of CSP over a given period is defined as the difference between the MSCI ESG STATS scores between two periods over the whole period 2008–2012.

Corporate Social Performance Targets

Data on CSP targets in executive compensation are collected from annual proxy statements (form DEF 14A) filed in the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system from the U.S. Securities and Exchange Commission (SEC). Proxy statements are the only publicly available source, which officially provide information on executive performance measures (Macindoe and Eaton 2011). The mandatory section “Compensation Discussion and Analysis” has been the primary area of proxy statements to collect data. In addition, search keywords in line with MSCI ESG STATS category items are used to assure that no targets are accidentally overlooked. Table 1 shows the used target coding, which is in line with the MSCI ESG STATS categories. A distinction between the use of qualitative, soft CSP targets and quantitative, hard CSP targets is made. Each target used is labeled as a quantitative, hard target if clear-cut underlying quantification is provided (a target percentage, amount, or other quantifiable metric), or as a qualitative, soft target if no clear-cut underlying quantification is provided.

Firm Controls

Several variables are included in the hypothesis-testing model to control for the firm-specific situation: the existence of a CSP committee, firms’ size, and financial performance. There are two main approaches to mitigate agency conflicts, implementation of incentives and monitoring. The introduction of CSP targets in the executive compensation structure is one example of the first approach. The second approach focuses not on rewarding but on monitoring, for example by installing a board commission (Tosi et al. 1997). More and more executive boards create committees on CSP (Mackenzie 2007). CSP committees, defined as a board committee responsible for any of the target categories of CSP, may be asked to provide advice and recommendations to the executive board about stakeholder issues and trends, as well as company goals and strategies to achieve them (White 2006). CSP committees may, for example, advice on metrics, internal policies, and/or practices affecting CSP objectives (Cramer and Hirschland 2006). Existence of a CSP committee is expected to have an effect on the use of CSP targets as well as on CSP results and has been identified based on the proxy statements (1 = yes, 0 = no).

Firm size is assessed as the logarithm of total assets. Based on past research (e.g., Artiach et al. 2010), and we expect firm size to be associated with the use of CSP targets and CSP results. Financial performance is, similar to previous studies (Deckop et al. 2006; McGuire et al. 2003), measured as return on assets (ROA) and expected to have an effect on the use of CSP targets and CSP results. Data on total asset and ROA are collected from COMPUSTAT.

Statistical Methodology

We use an ordinary least squares (OLS) specification for both models. Previous research has identified many macroeconomic factors associated with CSP, including changes in governmental policy and systemic, macroeconomic shocks (Barnett and Salomon 2012). Therefore year effects are added to the models. Next to that, we incorporate a one-year lag of the independent variable into every specification to account for within-firm persistence in performance and for the possibility that some effects will manifest only in the next year. To correct for unobserved between-firm heterogeneity, we incorporate firm fixed effects into the models’ specification. Given the panel structure of the data with multiple observations per firm, the possibility arises that the errors (ε it) will be correlated within firms across time. Such serial correlation of residuals across multiple observations within firms could lead to invalid regression results. We therefore incorporate linear autoregressive dynamics with lags of the dependent variable as regressors to account for within-firm persistence in performance (see Greene 2003).

In summary, we control for dynamic firm-level characteristics as well as within-firm AR(1) dynamics, fixed year effects, and fixed firm effects to estimate the effect of CSP targets on CSP results.

Results

The correlations for the variables and descriptive statistics are provided, respectively, in Tables 2 and 3. To check for multicollinearity, tolerance and variance inflation indices are calculated. All values were far below 10, which is the general threshold for concern (Kennedy 2003).

Over the years, between 32 percent in 2008 and 40 percent in 2012 of the firms use CSP targets in executive compensation (see Table 3). This number is higher than the 29 percent found by Macindoe and Eaton (2011), and approximately the same as the 38 percent reported by Tonello (2011) and the 40 percent reported by Graafland and Zhang (2014). Most popular are the use of CSP targets for employee relations and diversity. The least used are CSP targets for human rights issues, product quality and community, and stakeholder engagement. The number of firms that use quantitative, hard targets is much lower than those using qualitative soft targets, and ranges over the years from 4 percent in 2008 up to 8 percent in 2012. Quantitative, hard targets are mainly used for employee relations (e.g., targets related to safety issues like the reduction of accidents in the next year from 10 to 8), diversity (e.g., increase of the number of women in top position from 5 percent to 10 percent in the next year), and environmental issues (e.g., reduction of CO2 emissions with 10 percent in the next year).

Results of the OLS regression are reported in Tables 4, 5, and 6. The first hypothesis predicts a negative relationship between the level of CSP and the use of CSP targets in executive compensation. The results in Table 4 show that the aggregated as well as the disaggregated levels of CSP have no significant effect on the use of CSP targets in executive compensation. In result H1 is rejected.

The second hypothesis predicts a positive effect of the use of CSP targets in executive remuneration on CSP results. The results in Table 5 show significant effects on an aggregated level only for firms using quantitative, hard targets (0.11, P < 0.05). On a disaggregated level, the results show that only firms using quantitative, hard targets have significantly less CSP weaknesses (−0.05, P < 0.10). In result H2 is partly accepted.

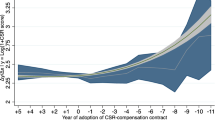

Hypothesis three predicts that the improvement in CSP will be higher for firms using quantitative, hard CSP targets in executive remuneration as compared to the use of qualitative, soft CSP targets. On an aggregated CSP level, indeed Table 6 shows a significant result for quantitative, hard targets (0.17, P < 0.05). In case a firm uses qualitative, soft targets, a negative significant result is found (−0.06, P < 0.10). On a disaggregated level, a significant result is found for CSP weaknesses showing that firms using quantitative, hard targets have significantly reduced their CSP weaknesses (−0.17, P < 0.10). In result H3 is accepted.

Discussion and Conclusions

In response to investors raising financial as well as social issues, showing their concern for the firms’ economic, social, and environmental performance firms seek to improve their CSP.

In this research, we look at the effectiveness of improving CSP through the use of CSP targets in executive compensation. Although it has been recognized by many that using CSP targets might contribute to CSP improvement of firms, there is only one study that actually assesses the effectiveness of CSP targets (Russo and Harrison 2005). Unfortunately, this research dates from 2005, focuses on one single aspect of CSP (environment), and only includes companies in the electronics industry. This current study aims to provide a contemporary and integral perspective on the relation between CSP and the use of CSP targets in executive compensation. This study results in three important findings that increase our knowledge about the use of CSP targets.

First, it was expected that especially firms with weaker CSP would use CSP targets, but the results show no significant linkage between CSP and the use of CSP targets in executive compensation. In other words, firms with weak CSP results as well as firms with strong CSP results use CSP targets. This is problematic in light of the importance of variation in terms of CSR regulation, norms, measures, pressures, and performance across industries and individual firms (e.g., Etzion 2007) and weakens our confidence in the use of explicit remuneration targets. Second, across the board a positive effect of CSP targets on the improvement of CSP cannot be detected in this study. However, when the distinction is made between the types of CSP targets, we do see that quantitative, hard CSP targets are effective in improving CSP. This third finding empirically confirms the expectation raised by Eurosif (2010) that qualitative, soft CSP targets are generally ineffective.

Based on these findings, we must face the possibility that the use of CSP targets in executive compensation and CSP improvement might not be related (or might be only weakly related) in firms, even when these firms claim an explicit linkage between these two variables. The notion of a limited effective relationship is an important one as it contributes to the ongoing quest whether CSP targets are a sign of corporate responsibility or just window dressing (Berrone and Gomez-Mejia 2009a; Kolk and Perego 2014; Tonello 2011). Research in the management area already showed that CEO performance-based compensation might result from a mix of performance-driven and symbolic forces. Westphal and Zajac (1994) and Zajac and Westphal (1995) found that a substantial proportion of the largest US firms were likely to adopt but not actually use (or to use only in a limited fashion) long-term incentive performance plans. This finding is consistent with the logic that certain governance mechanisms are a response to external pressures (Luoma and Goodstein 1999; Kolk and Perego 2014) instead of an attempt to improve performance. A similar situation might well prevail in the context of CSP links to top executive compensation. Faced with pressures for accountability and legitimacy in a world where CSR issues are increasingly important, with specific pressures for compensation linkages from activist shareholders, social investing funds, and other stakeholders, compensation committees might respond by explicitly using CSP targets in executive compensation and rest satisfied with this initiative.

The results suggest that quantitative, hard targets seem to be mainly used for managerial purposes leading to improved CSP results, while qualitative, soft CSP targets seem to be mainly used for symbolic reasons, not leading to any direct improvement of CSP. This does not imply however that soft targets have no value at all. Soft targets can have signaling power, raise awareness, and motivate people involved. The use of qualitative, soft targets might be used internally as an instrument to raise awareness and to motivate executives to exert more attention to CSP. Next to that, the targets might also be used and made known to the public to signal to the stakeholders how important CSP is for the firm. Nevertheless, it might be worthwhile for firms to make soft targets as clear, controllable, and objective as possible. In conclusion, the most important practical implication of this study is that the findings present an encouragement for the use of quantitative, hard CSP targets in executive compensation. Moreover, it provides evidence for the effectiveness of quantitative, hard targets to reduce especially CSP weaknesses.

Several limitations apply to this study of which some could be addressed in future research. Firstly, the sample only includes large US firms. As such, some caution is needed in generalizing the findings across all kinds of firms. Using a more representative sample, future research could examine whether these conclusions also hold for smaller firms or firms from other regions. Secondly, the study relies on the measures developed by MSCI ESG STATS to assess CSP. It might be questioned whether CSP results can be captured fully by the MSCI ESG STATS measures. Next to that, as an archival study we can only provide evidence on associations, not causality (see, e.g., Alewine 2010; Cho et al. 2012). Thirdly, the data on CSP targets in executive compensation are collected from one single source, proxy statements. Although cross-checks were installed to minimize the effects of the human factor in the data gathering, there is still a possibility that some unidentified discrepancies remain. Finally, we do not explore whether the use of CSP targets leads to actual higher or lower financial CEO remuneration. For future research to be able to perform more specific analyses of the effects that CSP targets have on CSP, firms would need to report the percentages of executive compensation that are linked to CSP targets and to financial targets. This study might encourage other researchers to build upon the results and remaining questions. For example, it might be interesting to investigate the contribution of executive compensation packages to the disparity between executive and ordinary employee remuneration. While social inequality has risen in recent years and is becoming a significant ethical concern. Next to that, historically compensation packages have been tied to a firm’s financial performance and frequently resulted in an emphasis on share value or return on equity. It would be interesting to research whether CSP components in executive compensation supplement or replace financial incentives.

In practice, many firms use CSP targets without any academic evidence that CSP targets actually lead to improved CSP results. This study gives novel insights by providing empirical evidence of CSP being not such a good predictor for the use of CSP targets but being a consequence of the use of quantitative, hard CSP targets. Firms are expected to be able to improve their CSP results using quantitative, hard CSP targets. Query ID="Q1" Text="No queries."

References

Alewine, H. C. (2010). A model for constructing experimental accounting research. Sustainability Accounting, Management and Policy Journal, 1(2), 256–291.

Arnold, M. C., & Artz, M. (2015). Target difficulty, target flexibility, and firm performance: Evidence from business units’ targets. Accounting, Organizations and Society, 40(1), 61–77.

Artiach, T., Lee, D., Nelson, D., & Walker, J. (2010). The determinants of corporate sustainability performance. Accounting and Finance, 50(1), 31–51.

Artz, M., Homburg, C., & Rajab, T. (2012). Performance-measurement system design and functional strategic decision influence: The role of performance-measure properties. Accounting, Organizations and Society, 37(7), 445–460.

Barnett, M. L. (2007). Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Academy of Management Review, 32(3), 794–816.

Barnett, M. L., & Salomon, R. M. (2012). Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strategic Management Journal, 33(11), 1304–1320.

Bebbington, J., & Larrinaga, C. (2014). Accounting and sustainable development: An exploration. Accounting, Organizations and Society, 39(1), 395–413.

Berrone, P., & Gomez-Meija, L. R. (2009). Environmental performance and executive compensation: An integrated agency-institutional perspective. Academy of Management Journal, 52(1), 103–126.

Berrone, P., & Gomez-Mejia, L. R. (2009). The pros and cons of rewarding social responsibility at the top. Human Resource Management, 48(6), 959–971.

Bonner, S. E., & Sprinkle, G. B. (2002). The effects of monetary incentives on effort and task performance: Theories, evidence, and a framework for research. Accounting, Organizations and Society, 27(4/5), 303–345.

Boyd, B. K., & Salamin, A. (2001). Strategic reward systems: A contingency model of pay system design. Strategic Management Journal, 22(8), 777–792.

Cai, Y., Jo, H., & Pan, C. (2011). Vice or virtue? The impact of corporate social responsibility on executive compensation. Journal of Business Ethics, 104(2), 159–173.

Callan, S. J., & Thomas, J. M. (2011). Executive compensation, corporate social responsibility, and corporate financial performance: A multi-equation framework. Corporate Social Responsibility and Environmental Management, 18(6), 332–351.

Cheng, B., Ioannou, I., & Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Management Journal, 35(1), 1–23.

Chng, D. H. M., Rodgers, M. S., Shih, E., & Song, X. B. (2012). When does incentive compensation motivate managerial behaviors? An experimental investigation of the fit between incentive compensation, executive core self evaluation, and firm performance. Strategic Management Journal, 33(12), 1343–1362.

Cho, C. H., Guidry, R. P., Hageman, A. M., & Patten, D. M. (2012). Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Accounting, Organizations and Society, 37(1), 14–25.

Coombs, J., & Gilley, K. (2005). Stakeholder management as a predictor of CEO compensation: Main effects and interactions with financial performance. Strategic Management Journal, 26(9), 827–840.

Cordeiro, J., & Sarkis, J. (2008). Does explicit contracting effectively link CEO compensation to environmental performance? Business Strategy and the Environment, 17(5), 304–317.

Coughlan, A. T., & Schmidt, R. M. (1985). Executive compensation, management turnover, and firm performance: An empirical investigation. Journal of Accounting and Economics, 7(1), 43–66.

Cramer, A., & Hirschland, M. (2006). The socially responsible board. The Corporate Board, 161, 20–24.

Crifo, P., & Forget, V. D. (2013). Think global, invest responsible: Why the private equity industry goes green. Journal of Business Ethics, 116(1), 21–48.

Dahlsrud, A. (2008). How corporate social responsibility is defined: An analysis of 37 definitions. Corporate Social Responsibility and Environmental Management, 15(1), 1–13.

David, P., Bloom, M., & Hillman, A. J. (2007). Investor activism, managerial responsiveness, and corporate social performance. Strategic Management Journal, 28(1), 91–100.

Deckop, J., Merriman, K., & Gupta, S. (2006). The effects of CEO pay structure on corporate social performance. Journal of Management, 32(3), 329–342.

Eccles, R.G., Ioannou, I., & Serafeim, G. (2011). The impact of a corporate culture of sustainability on corporate behaviour and performance. Working paper 12-035. Harvard Business School, Boston.

Etzion, D. (2007). Research on organizations and the natural environment, 1992-present: A review. Journal of Management, 33(4), 637–664.

Eurosif/EIRIS. (2010). 3rd remuneration theme report. Eurosif report. Available at http://www.eurosif.org/publication/download/remuneration/. Accessed July 2014.

Faulkender, M., Kadyrzhanova, D., Prabhala, N., & Senbet, L. (2010). Executive compensation: An overview of research on corporate practices and proposed reforms. Journal of Applied Corporate Finance, 22(1), 107–118.

Feldman, J. M. (1981). Beyond attribution theory: Cognitive processes in performance appraisal. Journal of Applied Psychology, 66(1), 127–148.

Gerhart, B., Rynes, S., & Fulmer, I. S. (2009). Pay and performance: Individuals, groups, and executives. Academy of Management Annals, 3(1), 251–315.

Gibbs, M., Merchant, K. A., Van der Stede, W. A., & Vargus, M. E. (2004). Determinants and effects of subjectivity in incentives. The Accounting Review, 79(2), 409–436.

Goranova, M., & Ryan, L. V. (2014). Shareholder activism: A multidisciplinary review. Journal of Management, 40(5), 1230–1268.

Graafland, J., & Zhang, L. (2014). Corporate social responsibility in China: Implementation and challenges. Business Ethics, 23(1), 34–49.

Gray, R. (2010). Is accounting for sustainability actually accounting for sustainability and how would we know? An exploration of narratives of organisations and the planet. Accounting, Organizations and Society, 35(1), 47–62.

Greene, W. H. (2003). Econometric analysis (5th ed.). India: Pearson Education.

Henri, J. F., & Journeault, M. (2010). Eco-control: The influence of management control systems on environmental and economic performance. Accounting, Organizations and Society, 35(1), 63–80.

Herremans, I. M., Akathaporn, P., & McInnes, M. (1993). An investigation of corporate social responsibility reputation and economic performance. Accounting, Organizations and Society, 18(7/8), 587–604.

Ittner, C. D., Larcker, D. F., & Meyer, M. W. (2003). Subjectivity and the weighting of performance measures: Evidence from a balanced scorecard. The Accounting Review, 78(3), 725–758.

Jansen, E. P., Merchant, K. A., & Van der Stede, W. A. (2009). National differences in incentive compensation practices: The differing roles of financial performance measurement in the United States and the Netherlands. Accounting, Organizations and Society, 34(1), 58–84.

Jensen, M. C., & Meckling, W. H. (1979). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Dordrecht: Springer.

Jensen, M., & Murphy, K. (1990). Performance pay and top-management incentives. Journal of Political Economy, 98(2), 225–264.

Kennedy, P. (2003). A guide to econometrics. Boston: MIT Press.

Kolk, A., & Perego, P. (2014). Sustainable bonuses: Sign of corporate responsibility or window dressing? Journal of Business Ethics, 119(1), 1–15.

Larcker, D. F. (1983). The association between performance plan adoption and corporate capital investment. Journal of Accounting and Economics, 5, 3–30.

Larkin, I., Pierce, L., & Gino, F. (2012). The psychological costs of pay-for-performance: Implications for the strategic compensation of employees. Strategic Management Journal, 33(10), 1194–1214.

Lee, M. P., & Lounsbury, M. (2011). Domesticating radical rant and rage: An exploration of the consequences of environmental shareholder resolutions on corporate environmental performance. Business and Society, 50(1), 155–188.

Luo, X., Wang, H., Raithel, S., & Zheng, Q. (2014). Corporate social performance, analyst stock recommendations, and firm future returns. Strategic Management Journal, 36(1), 123–136.

Luoma, P., & Goodstein, J. (1999). Research notes. Stakeholders and corporate boards: Institutional Influences on Board Composition and Structure. Academy of Management Journal, 42(5), 553–563.

Macindoe, M., & Eaton, D. (2011). Greening the Green, A Glass Lewis Report on Executive Compensation and Sustainability in 2010. Glass, Lewis & Co., LLC: San Francisco.

Mackenzie, C. (2007). Boards, incentives and corporate social responsibility: The case for a change of emphasis. Corporate Governance: An International Review, 15(5), 935–943.

Mahoney, L., & Thorne, L. (2005). Corporate social responsibility and long-term compensation: Evidence from Canada. Journal of Business Ethics, 57(3), 241–253.

Mahoney, L., & Thorne, L. (2006). An examination of the structure of executive compensation and corporate social responsibility: A Canadian Investigation. Journal of Business Ethics, 69(2), 149–162.

Makri, M., Lane, P. J., & Gomez-Mejia, L. R. (2006). CEO incentives, innovation, and performance in technology-intensive firms: A reconciliation of outcome and behavior-based incentive schemes. Strategic Management Journal, 27(11), 1057–1080.

Margolis, J. D., Elfenbein, H. A. & Walsh, J. P. (2007). Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Working paper. Boston, MA: Harvard Business School.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268–305.

McGuire, J., Dow, S., & Argheyd, K. (2003). CEO incentives and corporate social performance. Journal of Business Ethics, 45(4), 341–359.

Murphy, K. J. (1999). Executive compensation. Handbook of Labor Economics, 3, 2485–2563.

O’Rourke, A. (2003). A new politics of engagement: Shareholder activism for corporate social responsibility. Business Strategy and the Environment, 12(4), 227–239.

O’Connell, V., & O’Sullivan, D. (2014). The influence of lead indicator strength on the use of nonfinancial measures in performance management: Evidence from CEO compensation schemes. Strategic Management Journal, 35(6), 826–844.

Parker, L. D. (2014). Corporate social accountability through action: Contemporary insights from British industrial pioneers. Accounting, Organizations and Society, 39(8), 632–659.

Pathak, S., Hoskisson, R. E., & Johnson, R. A. (2014). Settling up in CEO compensation: The impact of divestiture intensity and contextual factors in refocusing firms. Strategic Management Journal, 35(8), 1124–1143.

PRI Principles for Responsible Investment (2012). Integrating ESG issues into executive pay. Available at: http://www.unglobalcompact.org/docs/issues_doc/lead/ESG_Executive_Pay.pdf. Accessed January 2014.

Rehbein, K., Waddock, S., & Graves, S. B. (2004). Understanding shareholder activism: Which corporations are targeted? Business and Society, 43(3), 239–267.

Reid, E. M., & Toffel, M. W. (2009). Responding to public and private politics: Corporate disclosure of climate change strategies. Strategic Management Journal, 30(11), 1157–1178.

Russo, M., & Harrison, N. (2005). Organizational design and environmental performance: Clues from the electronics industry. Academy of Management Journal, 48(4), 582–593.

Stanwick, P. A., & Stanwick, S. D. (2001). CEO compensation: Does it pay to be green? Business Strategy and the Environment, 10(3), 176–182.

Staw, B. M., & Epstein, L. D. (2000). What bandwagons bring: Effects of popular management techniques on corporate performance, reputation, and CEO pay. Administrative Science Quarterly, 45(3), 523–556.

Tan, Z. (2014). The construction of calculative expertise: The integration of corporate governance into investment analyses by sell-side financial analysts. Accounting, Organizations and Society, 39(5), 362–384.

Tonello, M. (2011). Emerging sustainability practices. In The Conference Board, Sustainability matters: Why and how corporate boards should become involved (pp. 38–51). New York: The Conference Board. Retrieved from www.conference-board.org. Accessed July 2014.

Tosi, H. L., Katz, J. P., & Gomez-Mejia, L. R. (1997). Disaggregating the agency contract: The effects of monitoring, incentive alignment, and term in office on agent decision making. Academy of Management Journal, 40(3), 584–602.

Van Veen-Dirks, P. (2010). Different uses of performance measures: The evaluation versus reward of production managers. Accounting, Organizations and Society, 35(2), 141–164.

Westphal, J. D., & Zajac, E. J. (1994). Substance and symbolism in CEO’s long-term incentive plans. Administrative Science Quarterly, 39, 367–390.

White, A. L. (2006). The stakeholder fiduciary: CSR, governance and the future of boards. San Francisco: Business for Social Responsibility. Accessed July 2014.

Wood, D. (2010). Measuring corporate social performance: A review. International Journal of Management Reviews, 12(1), 50–84.

Zajac, E. J. (1998). CEO selection, succession, compensation and firm performance: A theoretical Integration and empirical analysis. Strategische Managementtheorie, 11, 96.

Zajac, E. J., & Westphal, J. D. (1995). Accounting for the explanations of CEO compensation: Substance and symbolism. Administrative Science Quarterly, 40(2), 283–308.

Acknowledgements

I would like to thank Achraf Bouchrit, Frerich Buchholts, Mohammad Faizi Nazir, Job Harms, Oxana Krasyuk, Urmila Rautar, and Marjelle Vermeulen for helping me in collecting and analyzing the data. I am also very thankful to Jim Weber, Bryan Husted, Jill Brown, and the two anonymous reviewers for their insightful comments on previous versions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Maas, K. Do Corporate Social Performance Targets in Executive Compensation Contribute to Corporate Social Performance?. J Bus Ethics 148, 573–585 (2018). https://doi.org/10.1007/s10551-015-2975-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-015-2975-8