What a Difference a Decade Makes

The fund industry has changed a lot since 2008.

On Twitter, my boss marveled at how thrifty index-fund buyers have become. Indexers have always watched their pennies; such is their nature. However, in recent years their penchant for paying the least has developed into a demand. Over the past decade, revealed Jeff Ptak, the cheapest 10% of S&P 500 funds received more than 100% of that sector's net inflows. Every one of the remaining nine deciles suffered net outflows.

That surprised both of us. We knew that investors had become more cost-conscious, such that the 366 index mutual funds that carry expense ratios exceeding 1% were headed for extinction. What we had not understood was how discerning fund consumers had become. In fact, when poring over the numbers, Ptak learned that being among the low-cost 10% wasn't enough. Only the cheapest 5% of S&P 500 funds enjoyed net sales. The next 5% had outflows, too.

In that spirit, I will offer what I think have been the three most notable trends in the U.S. fund industry over the past decade. (While this material is U.S.-only, it may nonetheless be relevant for overseas markets, which often follow American patterns.) With this exercise, I have combined mutual funds and exchange-traded funds, as the two fund types are largely interchangeable and serve similar customers.

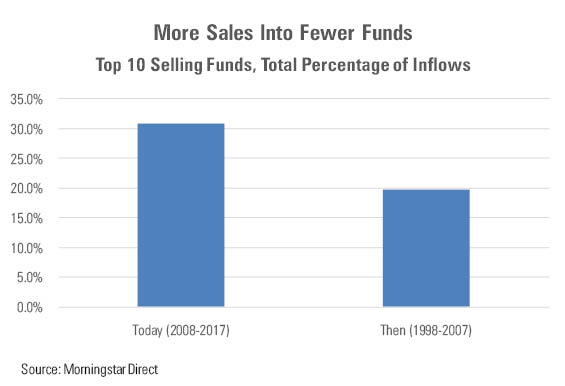

The Biggest Funds Have Prospered Most Today's most-popular funds receive a higher percentage of inflows than did their predecessors.

Entering 2008, the 10 best-selling funds over the previous decade (that is, from January 1998 through December 2007) had received just under 20% of total industry net inflows. ("Industry," once again, is defined as mutual funds plus ETFs.) For the trailing 10 years ended December 2017, that figure jumped to almost 31%. In short, the industry is consolidating. The big sales winners are getting more, and the other funds are receiving less.

The consolidation appears even larger when looking at the raw dollar amounts, because sales have increased over the years. In 2008,

(The scale can be difficult to grasp. It is not that the fund reached $107 billion, a huge number in itself. It is instead that the fund added $107 billion, besides what it held entering that time period, and besides the asset growth generated from its performance. In effect, that $100-plus billion was but the cake's icing.)

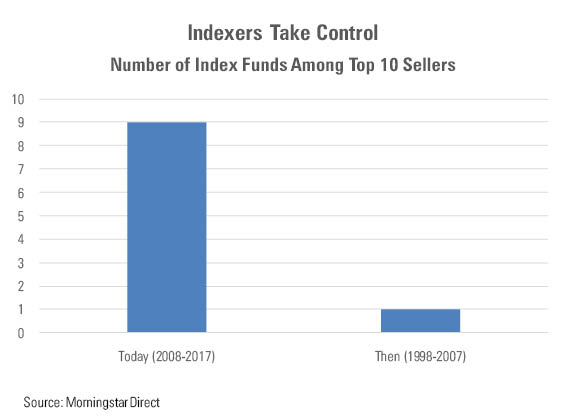

The Reason Is Indexing You probably have guessed why more money is going into fewer funds: indexing. There are many ways to invest actively--enough to support several thousand funds that can credibly claim to be different (and better) than others. In contrast, there are far fewer paths for indexing. To be sure, new indexes can always be devised. But most do not survive, because they cannot create a name for themselves and cannot acquire the substantial asset base indexers need to turn a profit.

That indexing goes hand-in-hand with industry concentration may be witnessed by the numbers. In 2008, three of the 10 largest-selling funds were indexed, with the other seven being actively managed. Today, that three has ballooned to nine. Among the 10 funds that brought in the most assets in the decade through December 2017, only

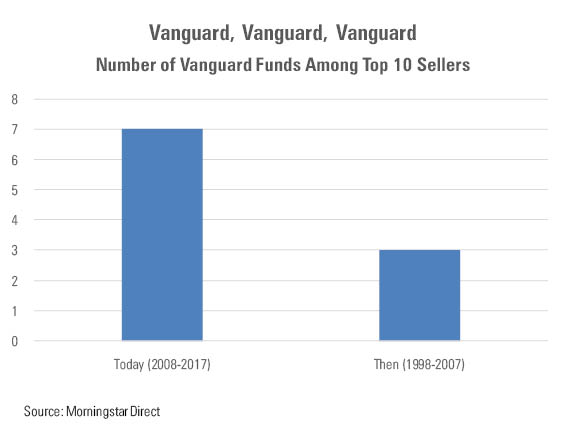

The Mightiest of Kings The sales success of the largest funds, and the dominance of indexing, intersect in Valley Forge, Pennsylvania. Vanguard is not only larger than any U.S. fund company has ever been (although it is not the largest overall money manager; that title is held by BlackRock), but it also boasts a larger market share than any U.S. fund company has ever held. The fund-industry's pie has never been heftier, and Vanguard's slice is the widest ever cut.

Ten years ago, Vanguard had only one fund among the top 10 sellers:

Better or Worse? The natural question is whether these changes have been beneficial. I believe so. Twenty-five years ago, the fund industry touched bottom. It had ballooned from its modest beginnings, which possessed the advantages of simplicity and relatively low cost, into something huge, costly, and overcomplicated. New fund categories came and went. Fund marketers pitched high-concept funds that attracted billions of dollars if marketed at the right time, despite having no track records.

Today's trends run in the opposite direction. While it is still huge--in that most funds proceed rather than fold--the fund industry is effectively shrinking. The biggest funds have become more meaningful, in the sense of determining the aggregate performance of shareholders. Meanwhile, the smaller funds matter less. As for cost and complexity, index funds have addressed those issues. They are far cheaper and more to the point than the funds that they replaced.

There remains the legitimate concern that index funds in general, and Vanguard specifically, have become dangerously large. In past columns, I have downplayed those worries by pointing out that active managers still control more assets than not and by questioning just how much damage a passive investment strategy that has gradual inflows and outflows can inflict on the financial markets. Those arguments continue to be valid. However, each year strengthens the prevailing trends--meaning that, at some point, the anxieties may be valid. Sometimes, there can be too much of even a good thing.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)