US firms fear retaliation to Donald Trump’s tariffs will be ‘final nail in the coffin’ for exports to China

- US Dairy Council fears for the future of its access to the huge consumer market with Beijing expected to respond to the anticipated new 25 per cent rate on Friday

- Exporters of blueberry, whiskey and wine also say that Beijing’s retaliation would put a dampener on their business, which is already reeling from previous tariffs

As the United States prepares to increase tariffs on US$200 billion of Chinese goods to 25 per cent from Friday, American companies are fearful China’s retaliation will kill off their exports to the world’s biggest consumer market.

The US government confirmed the tariff increase from 10 per cent to 25 per cent by filing a notice with the Federal Register, the official portal for public policy updates, with Beijing saying it “will have no choice but to implement countermeasures”.

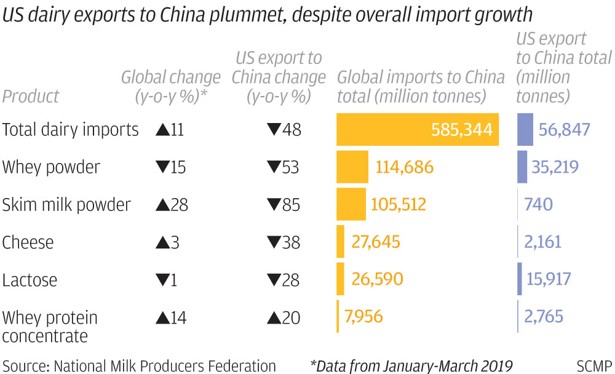

Jaime Castaneda, senior vice-president of the US Dairy Council, said much of his industry was already hit with a 25 per cent tariff by China last year, which caused total dairy exports from the US to China to plunge by 48 per cent in 2018.

Any increase on import restrictions would be “a final nail in the coffin for our exports”, Castaneda said. “If [US] President [Donald] Trump raises tariffs again, we don’t know exactly what China is going to do. We hope that they don’t retaliate. If they retaliate, of course, we hope that it’s not going to be on all dairy products.”

China is expected to retaliate almost immediately, with Beijing reported to be preparing to unleash countermeasures to the US escalation, which were first announced in a series of tweets by Trump on Sunday.

While China has less margin to levy additional tariffs on US goods due to the fact that it buys far less from America than America buys from China, it could raise the rate of existing tariffs. China could also make life more difficult for American companies by ordering Chinese buyers to cease or scale back purchases of certain goods, analysts have suggested.

At an event in Hong Kong on Thursday, a series of US companies spoke of their fear of reprisals from China and how an escalation will compound an already difficult situation.

Patricia Kontur, programme director at the Wild Blueberry Association, a trade association of growers and processors of blueberries in the state of Maine, said that China’s initial retaliation last year lifted berry tariffs from 40 per cent to 65 per cent. This had a severe impact on their exports to China and any further burden on the business could kill off the trade altogether, she said in an interview at a hospitality and food industry fair in Hong Kong.

“We have targeted China for quite a few years, but it is a tariff-heavy market, so it is very hard when you have a premium product – you have to negotiate over pricing, so we have had to find a niche in the Chinese market,” she said. “I don’t know how much more damp [business] could be.”

The escalation in tensions came as a surprise, said Kontur, who learned of the planned tariff increase when her plane landed in Hong Kong on Sunday. At the week-long event where international companies try to find buyers and partners for the Chinese market, the trade war is dominating conversation.

“There was surprise, especially because we were hearing that there was healthy good news coming from the negotiations. There is a lot of political discussion, which is usually not top of [our] mind. Usually we are talking about sales and marketing,” she said.

Kontur said that while berry growers are busy dealing with day-to-day issues such as keeping bees out of their crops, there is widespread concern across the American agricultural community, which has had a rough time in dealing with tariffs and uncertainty brought on by the trade war.

David De Gendt exports bourbon on behalf of the Boundary Oak distillery in Kentucky. At the same event, he said that Chinese delegates loved his Abraham Lincoln and General George Patton-themed liquor, with the faces of both historical American figures adorning their bottles.

“Don’t forget, it's not Trump's face on there, it is Lincoln’s, and Lincoln was legendary in terms of bipartisanship, trying to collaborate and cooperate and find solutions and ways for America to come together. So I think it is a very good symbol,” De Gendt said.

He fears that any escalation in trade tensions will affect the company’s plans to enter the Chinese market, which is a growing target for many premium consumer products.

“The raising of the tariffs looks like a bad poker game in a dive somewhere, with two players who are just not willing to back down. It kind of feels like the Celebrity Apprentice on a national level,” he added.

US wine exports to China have fallen almost in perfect correlation with Chinese tariffs. Two lots of tariffs in April and September 2018 added 25 per cent to the duty on American wines entering the booming Chinese market. This led to a 25 per cent slump in US wine exports to China, 90 per cent of which came from California.

Christopher Beros, Asia director at the California Wine Institute, said that “we know when you increase tariffs significantly, it’s an issue, it is always going to have some impact”.

However, he was philosophical about the impact of potential Chinese retaliation in response to Trump’s tariff increase, since the duties on Californian wine are already high, at 76 per cent.

“Our winery members and the importers in China all have to make their own decisions about how they deal with this. It is not good news, but life is long. And the Chinese consumer likes our products and I hope and believe that the tariffs will not be around forever,” Beros said.