Abstract

We examine how heterogeneity in organizational structure affects private firm earnings quality in the European Union. Organizational structure refers to whether the firm is organized as a single legal entity (standalone) or as a business group. Private firms can be organized either way, while public firms are de facto groups. Even though private firms are not affected by market forces, we show that private business groups face greater stakeholder pressure for earnings quality than do standalone firms, while standalone firms have stronger tax minimization incentives. Due to these differences in nonmarket forces, private business groups have higher earnings quality than standalone firms. This heterogeneity among private firms is an important unexplored factor in the study of private firms, affecting the comparison between public and private firm earnings quality. We find that overall, public firms have higher earnings quality than private firms but this relation reverses when we control for nonmarket forces by examining business groups only.

Similar content being viewed by others

Notes

The terms earnings quality, financial reporting quality, accounting quality, and accruals quality have been used interchangably in the literature.

Public standalone firms can exist in theory, but we do not observe any in our sample. Moreover, on Compustat, all the U.S. firms provide consolidated financial statements; i.e., they are business groups.

In untabulated robustness tests, to test for the effect of tax incentives, Burgstahler et al. (2006) re-run separate analyses either using observations from consolidated financial statement data or observations from unconsolidated (or parent-only) accounts, because the alignment of tax and financial accounting is commonly based on the parent-only accounts. Even though they find a much larger and more significant tax effect, using the subsample of unconsolidated accounts, they do not find evidence of a differential tax effect between public and private firms for either of the two subsamples, which might be due to the substantial decrease in sample size.

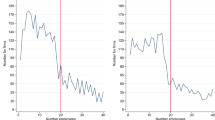

The two-sample Kolmogorov–Smirnov test confirms that the distributions are significantly different from each other.

For example, as Watrin et al. (2014, 59) point out, “Corporate income tax is levied at the single-entity level, which means that every parent and subsidiary is obliged to prepare separate tax statements and to pay taxes. The tax laws of member states frequently allow for group taxation within the territory in question, and some allow for losses that occurred in other member states to be deducted. However, income is generally not taxed based on a consolidated European or international income statement. Even under group taxation, taxable income is assessed at the single-entity level and then consolidated for the group. Thus, even in the case of group taxation, the single financial statement is the basis for taxable income in countries with high book-tax conformity.”

We have data for fiscal years 2004–2014 and use 2004 to construct lags. This yields a 10-year unbalanced panel.

See http://ec.europa.eu/eurostat/web/national-accounts/statistics-illustrated for national statistics in Europe.

For a summary of the size thresholds and source references, see Appendix C of Bernard et al. (2018).

We calculate cash flow from operations using the balance-sheet approach, because U.S. style cash flow statements are generally not available for our sample of private and public European companies.

The difference in operating cycles is not due to industry effects, since, as pointed out above, the industry compositions of all three groups are similar.

Results are similar if we use Hope et al.’s (2013) research design (untabulated).

In Table 5, for each individual country, the mean difference and t-statistic are computed from a firm-year level regression of the stakeholder metric against a dummy variable for business group versus standalone, with industry and year fixed effects and clustering standard errors at the firm level. The aggregate statistics are computed from the mean of the 11 country differences.

As a robustness test, we also use the Dechow and Dichev (2002) and Kothari et al. (2005) earnings management proxies, with similar results to those reported in the paper. Results are qualitatively and quantitalively similar using accounts payable scaled by assets instead of Inv_Int as an independent variable.

To avoid counfounding effects in this model, we do not include leverage (LEV) as control, as this is also a proxy for stakeholders demand. Nonetheless, we run a sensitivity test (untabulated), and results hold above and beyond the inclusion of such control.

The coefficients of the control variables at the country level are consistent with those in Table 9, Panel A (except, of course, for LEGAL, which is not in the country-level regressions, since it is a constant at the country level).

When we estimate equation (9) with only leverage or inventory intensity as the sole independent variable, neither is significant. This shows that it is not the other independent variable that is causing leverage and inventory intensity to be insignificant. By contrast, Table 5 showed that business groups and standalone firms differed in their stakeholder pressure, as proxied by inventory intensity and leverage. The different results for inventory intensity and leverage in Table 5 versus Table 11, Panel A, are due to the fact that the different tests flip the independent and dependent variables and consequently have different statistical properties (different coefficients and different error terms) and different interpretations. Despite the fact that standalone firms and business groups have different inventory intensity and leverage ex-post (Table 5), inventory intensity, and leverage are not important determinants of the choice to become a business group ex-ante (Table 11, Panel A).

We also replicate the analysis on a country basis (untabulated), and results are quantitatively and qualitatively similar to the ones reported in Table 9, Panel B, using standard OLS.

We also use a different specification by including the percentage owned by the three largest shareholders.

References

Armstrong, C. S., Jagolinzer, A. D., & Larcker, D. F. (2010). Chief Executive Officer Equity Incentives and Accounting Irregularities. Journal of Accounting Research, 48(2), 225–271.

Asker, J., Farre-Mensa, J., & Ljungqvist, A. (2015). Corporate Investment and Stock Market Listing: A Puzzle? Review of Financial Studies, 28(2), 342–390.

Ball, R., Kothari, S. P., & Robin, A. (2000). The Effect of International Institutional Factors on Properties of Accounting Earnings. Journal of Accounting and Economics, 29(1), 1–51.

Ball, R., Robin, A., & Wu, J. S. (2003). Incentives Versus Standards: Properties of Accounting Income in Four East Asian Countries. Journal of Accounting and Economics, 36(1), 235–270.

Ball, R., & Shivakumar, L. (2005). Earnings Quality in U.K. Private Firms: Comparative Loss Recognition Timeliness. Journal of Accounting and Economics, 39(1), 83–128.

Barth, M. E., Landsman, W. R., & Lang, M. (2008). International Accounting Standards and Accounting Quality. Journal of Accounting Research, 46(3), 467–498.

Beatty, A. L., Ke, B., & Petroni, K. R. (2002). Earnings Management to Avoid Earnings Declines across Publicly and Privately Held Banks. The Accounting Review, 77(3), 547–570.

Belenzon, S., Berkovitz, T., & Rios, L. A. (2013). Capital Markets and Firm Organization: How Financial Development Shapes European Corporate Groups. Management Science, 59(6), 1326–1343.

Berle, A. A., & Means, G. G. C. (1991). The Modern Corporation and Private Property. Piscataway: Transaction Publishers.

Bernard, D., Burgstahler, D., & Kaya, D. (2016). Disclosure Incentives and Data Availability for Private Firms: Implications for Comparisons of Public and Private Firm Financial Reporting Quality. SSRN, working paper.

Bernard, D., Burgstahler, D., & Kaya, D. (2018). Size Management by European Private Firms to Minimize Proprietary Costs of Disclosure. Journal of Accounting and Economics, 66(1), 94–122.

Bigus, J., Georgiou, N., & Schorn, P. (2016). Legal Form and Earnings Properties. The European Accounting Review, 25(3), 515–548.

Burgstahler, D., & Dichev, I. (1997). Earnings Management to Avoid Earnings Decreases and Losses. Journal of Accounting and Economics, 24(1), 99–126.

Burgstahler, D., Hail, L., & Leuz, C. (2006). The Importance of Reporting Incentives: Earnings Management in European Private and Public Firms. The Accounting Review, 81(5), 983–1016.

Campbell, L., Linxiao, L., & Martin, K. (2015). Accrual Earnings Management Prior to Delisting. Journal of Accounting and Finance (2158-3625), 15(3), 53–63.

Carey, P., & Simnett, R. (2006). Audit Partner Tenure and Audit Quality. The Accounting Review, 81(3), 653–676.

Chandler, A. D. (1977). The Visible Hand: The Managerial Revolution in American Business. Cambridge: Harvard University Press.

Christensen, H. B., Hail, L., & Leuz, C. (2013). Mandatory Ifrs Reporting and Changes in Enforcement. Journal of Accounting and Economics, 56(2, Supplement 1), 147–177.

Coppens, L., & Peek, E. (2005). An Analysis of Earnings Management by European Private Firms. Journal of International Accounting, Auditing and Taxation, 14(1), 1–17.

DeAngelo, H., DeAngelo, L., & Stulz, R. M. (2006). Dividend Policy and the Earned/Contributed Capital Mix: A Test of the Life-Cycle Theory. Journal of Financial Economics, 81(2), 227–254.

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding Earnings Quality: A Review of the Proxies, Their Determinants and Their Consequences. Journal of Accounting and Economics, 50(2–3), 344–401.

Dechow, P. M., & Dichev, I. D. (2002). The Quality of Accruals and Earnings: The Role of Accrual Estimation Errors. The Accounting Review, 77(s-1), 35–59.

Dechow, P. M., Richardson, S. A., & Tuna, I. (2003). Why Are Earnings Kinky? An Examination of the Earnings Management Explanation. Review of Accounting Studies, 8(2), 355–384.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting Earnings Management. Accounting Review, 70(2), 193-225..

DeFond, M. L., & Park, C. W. (2001). The Reversal of Abnormal Accruals and the Market Valuation of Earnings Surprises. The Accounting Review, 76(3), 375–404.

Faccio, M., Lang, L. H. P., & Young, L. (2010). Pyramiding vs. Leverage in Corporate Groups: International Evidence. Journal of International Business Studies, 41(1), 88–104.

Franks, J., Mayer, C., Volpin, P., & Wagner, H. F. (2012). The Life Cycle of Family Ownership: International Evidence. Review of Financial Studies, 25(6), 1675–1712.

Givoly, D., Hayn, C. K., & Katz, S. P. (2010). Does Public Ownership of Equity Improve Earnings Quality? The Accounting Review, 85(1), 195–225.

Goncharov, I., Werner, J. R., & Zimmermann, J. (2009). Legislative Demands and Economic Realities: Company and Group Accounts Compared. The International Journal of Accounting, 44(4), 334–362.

Goncharov, I., & Zimmermann, J. (2006). Earnings Management When Incentives Compete: The Role of Tax Accounting in Russia. Journal of International Accounting Research, 5(1), 41–65.

Gopalan, R., & Jayaraman, S. (2012). Private Control Benefits and Earnings Management: Evidence from Insider Controlled Firms. Journal of Accounting Research, 50(1), 117–157.

Gopalan, R., Nanda, V., & Seru, A. (2014). Internal Capital Market and Dividend Policies: Evidence from Business Groups. The Review of Financial Studies, 27(4), 1102–1142.

Graham, J. R., Harvey, C. R., & Rajgopal, S. (2005). The Economic Implications of Corporate Financial Reporting. Journal of Accounting and Economics, 40(1–3), 3–73.

Hanlon, M., & Heitzman, S. (2010). A Review of Tax Research. Journal of Accounting and Economics, 50(2–3), 127–178.

Heckman, J. J., Ichimura, H., & Todd, P. E. (1997). Matching as an Econometric Evaluation Estimator: Evidence from Evaluating a Job Training Programme. The Review of Economic Studies, 64(4), 605–654.

Herrmann, D., & Inoue, T. (1996). Income Smoothing and Incentives by Operating Condition: An Empirical Test Using Depreciation Changes in Japan. Journal of International Accounting, Auditing and Taxation, 5(2), 161–177.

Hope, O.-K., Langli, J. C., & Thomas, W. B. (2012). Agency Conflicts and Auditing in Private Firms. Accounting, Organizations and Society, 37(7), 500–517.

Hope, O.-K., Thomas, W. B., & Vyas, D. (2013). Financial Reporting Quality of U.S. Private and Public Firms. The Accounting Review, 88(5), 1715–1742.

Hope, O.-K., Thomas, W. B., & Vyas, D. (2017). Stakeholder Demand for Accounting Quality and Economic Usefulness of Accounting in U.S. Private Firms. Journal of Accounting and Public Policy, 36(1), 1–13.

Hope, O.-K., & Vyas, D. (2017). Private Company Finance and Financial Reporting. Accounting and Business Research, 47(5), 506–537.

Keating, A. S., & Zimmerman, J. L. (2000). Depreciation-Policy Changes: Tax, Earnings Management, and Investment Opportunity Incentives. Journal of Accounting and Economics, 28(3), 359–389.

Kim, J.-B., & Yi, C. H. (2006). Ownership Structure, Business Group Affiliation, Listing Status, and Earnings Management: Evidence from Korea. Contemporary Accounting Research, 23(2), 427–464.

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance Matched Discretionary Accrual Measures. Journal of Accounting and Economics, 39(1), 163–197.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1998). Law and Finance. Journal of Political Economy, 106(6), 1113–1155.

Leuz, C. (2006). Cross Listing, Bonding and Firms’ Reporting Incentives: A Discussion of Lang, Raedy and Wilson (2006). Journal of Accounting and Economics, 42(1–2), 285–299.

Leuz, C. (2010). Different Approaches to Corporate Reporting Regulation: How Jurisdictions Differ and Why. Accounting and Business Research, 40(3), 229–256.

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings Management and Investor Protection: An International Comparison. Journal of Financial Economics, 69(3), 505–527.

Leuz, C., & Wüstemann, J. (2003). The Role of Accounting in the German Financial System. CFS Working Paper, No. 2003/16.

Lisowsky, P., & Minnis, M. (2018). The Silent Majority: Private U.S. Firms and Financial Reporting Choices. Chicago Booth Research Paper, No. 14–01.

Liu, S., & Skerratt, L. (2018). Earnings Quality across Different Reporting Regimes: Listed, Large Private, Medium-Sized, Small and Micro Companies in the U.K. Journal of Applied Accounting Research, 19(1), 2–19.

Minnis, M. (2011). The Value of Financial Statement Verification in Debt Financing: Evidence from Private U.S. Firms. Journal of Accounting Research, 49(2), 457–506.

Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management Ownership and Market Valuation: An Empirical Analysis. Journal of Financial Economics, 20, 293–315.

Nagar, V., Petroni, K., & Wolfenzon, D. (2011). Governance Problems in Closely Held Corporations. The Journal of Financial and Quantitative Analysis, 46(4), 943–966.

Pagano, M., Panetta, F., & Zingales, L. (1998). Why Do Companies Go Public? An Empirical Analysis. The Journal of Finance, 53(1), 27–64.

Peek, E., Cuijpers, R., & Buijink, W. (2010). Creditors’ and Shareholders’ Reporting Demands in Public Versus Private Firms: Evidence from Europe. Contemporary Accounting Research, 27(1), 49–91.

Pierk, J. (2016). Are Private Firms Really More Tax Aggressive Than Public Firms? WU International Taxation Research Paper Series, 2016–02.

Rosenbaum, P. R., & Rubin, D. B. (1983). The Central Role of the Propensity Score in Observational Studies for Causal Effects. Biometrika, 70(1), 41–55.

Smith, J., & Todd, P. (2005). Does Matching Overcome Lalonde's Critique of Nonexperimental Estimators? Journal of Econometrics, 125(1–2), 305–353.

Teoh, S. H., Wong, T. J., & Rao, G. R. (1998). Are Accruals During Initial Public Offerings Opportunistic? Review of Accounting Studies, 3(1), 175–208.

Watrin, C., Ebert, N., & Thomsen, M. (2014). Book-Tax Conformity and Earnings Management: Insights from European One- and Two-Book Systems. The Journal of the American Taxation Association, 36(2), 55–89.

Windbichler, C. (2000). Corporate Group Law for Europe: Comments on the Forum Europaeum's Principles and Proposals for a European Corporate Group Law. European Business Organization Law Review, 1(2), 265–285.

Wysocki, P. D. (2004). Discussion of Ultimate Ownership, Income Management, and Legal and Extra-Legal Institutions. Journal of Accounting Research, 42(2), 463–474.

Acknowledgements

We thank seminar participants at Bocconi University, NYU – Stern School of Business, University of Padova, Temple University Accounting Conference, 2017 IAS – AAA Midyear conference in Tampa, 2018 EAA conference in Milan, 2018 Berlin Annual Accounting Conference, and 2018 AAA conference in Washington DC for their constructive feedback. Prior versions of the paper were circulated under the title: “Earnings quality of private and public firms: business groups versus standalone firms.” We are grateful to Donal Byard, Claudia Curi, Lucie Courteau, April Klein, Christian Leuz (our EAA discussant), Garen Markarian, Maurizio Murgia, Annalisa Prencipe, Peter Pope, Ron Shalev, and Hong Xie (our AAA discussant) for helpful comments and suggestions. We are also especially thankful to Claudia Marangoni for her superb research support. Errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Variable definitions

Appendix: Variable definitions

Organizational Structure | |

|---|---|

Business Group | A collection of parent and subsidiary firms that function as a single economic entity |

Parent | Firm-entity controlling other firms (i.e., controlling subsidiaries). |

Subsidiary | Firm belonging to a group controlled by a given parent firm. We define subsidiaries as firms directly owned by the parent (Level 1) at a stake higher than 50%. |

Standalone | Firm that does not belong to a group and is not controlled by any other firm (i.e., no other firm owns more than 20%) and is not controlling any other firm itself (i.e., does not own subsidiaries). |

Dependent Variables (Earnings Quality Proxy) | |

|DeFond| | unsigned abnormal working capital accruals, computed as per DeFond and Park (2001). |

DeFond_Sign | signed abnormal working capital accruals, computed as per DeFond and Park (2001). |

|Jones_Mod| | unsigned discretionary accruals estimated using the modified Jones Model (Dechow et al. 1995). |

Jones_Mod_Sign | signed discretionary accruals estimated using the modified Jones Model (Dechow et al. 1995). |

EM1 | is the number of “small profits” divided by the number of “small losses.” A firm-year observation is classified as small profit (small loss) if positive (negative) net income falls within the range of 1% of lagged total assets, as per Burgstahler et al. (2006). |

EM2 | is the median ratio of the absolute value of total accruals to the absolute value of cash flow from operations. Total accruals are calculated as follows: (Δtotal current assets - Δcash) - (Δtotal current liabilities - Δshort-term debt) - depreciation expense. Cash flow from operations is equal to operating income minus total accruals, as per Burgstahler et al. (2006). |

EM3 | is the ratio of the cross-sectional standard deviations of operating income and cash flow from operations (multiplied by −1), as per Burgstahler et al. (2006). |

EM4 | is the Spearman correlation between the change in total accruals and the change in cash flow from operations (multiplied by −1), as per Burgstahler et al. (2006). |

EM aggr | is the average percentage rank across all four individual scores, EM1 to EM4. EM scores are constructed such that higher values imply higher levels of earnings management, as per Burgstahler et al. (2006). |

Test Variables | |

LISTED | dummy variable equal to 1 if the firm is publicly listed and 0 otherwise. |

LEGAL | is the mean of three institutional variables from La Porta et al. (1998), as per Burgstahler et al. (2006): efficiency of the judicial system, rule of law, and corruption index. |

STAND_ALONE | dummy variable equal to 1, if the firm is a standalone, and zero if it is a private business group. |

MTR | dummy variable taking the value of 1, if firm effective tax rate is above the country statutory tax rate and 0 otherwise (i.e. firm effective tax rate – country average tax rate > 0: dummy equal 1). |

Own_Conc Footnote 25 | share percentage owned by the single largest shareholder. |

Inv_Int | ratio of total inventory divided by total assets. |

LEV | debt-to-equity ratio. |

Controls | |

AGE | is the number of years since incorporation. |

LEV | debt-to-equity ratio. |

OP_CYCLE | represents the operating cycle (in days) calculated as (yearly average accounts receivable) / (total revenue / 360) + (yearly average inventory) / (cost of goods sold / 360). Cost of goods sold is equal to total revenue minus operating income. |

SIZE | is the book value of total assets at the end of the fiscal year (natural log). |

ROA | stands for yearly return on assets and equals net income divided by lagged total assets. |

GROWTH | is the annual percentage change in revenue. |

EXPORT | is the ratio of foreign sales over total sales. |

QUICK_RATIO | is computed as the sum of cash and cash equivalents and current receivables, scaled by current liabilities. |

Rights and permissions

About this article

Cite this article

Bonacchi, M., Marra, A. & Zarowin, P. Organizational structure and earnings quality of private and public firms. Rev Account Stud 24, 1066–1113 (2019). https://doi.org/10.1007/s11142-019-09495-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-019-09495-y