As stocks skid, worries mount for 401(k) investors who can't 'stand the pain'

Adam Shell

Adam ShellIn a span of two phone calls, Daniel Milan found out last week just how nervous some of his Detroit-area investors were about the stock market’s recent rough ride.

“Two clients called and said they wanted to get out of the market completely,” says Milan, a managing partner and investment adviser at Cornerstone Financial Services in Birmingham, Michigan.

Both investors said they couldn't “stand the pain” of seeing the Dow Jones industrial average fall more than 500 points in a single day and watching their account balances shrink. They told him they would rather “cut their losses.”

The get-me-out instinct from these individuals captures the rising nervousness on Main Street as stock prices start sinking on a regular basis following the blue-chip average's record high on Oct. 3.

"It gets them a little wary," says JJ Kinahan, chief market strategist at discount brokerage TD Ameritrade. Still, despite lots of selling, there's been "very little panic," he notes.

The stock market’s latest drop, which has knocked Apple – the most valuable stock in the U.S. – down more than 20 percent from its recent high and pushed the Dow down nearly 7 percent below its peak – is causing investors to question the staying power of a bull market that turns 10 years old in March. At its peak, the broad market's bull gain totaled 333 percent.

Risks pile up

Weighing on the mood of investors is a list of challenges and negative headlines that seem to mount on a daily basis. There are fears about the global economy slowing over the U.S.-China trade fight and concerns about the steep price drop in Apple and other popular technology stocks. Rising borrowing costs are also a sticking point, as they make financing purchases of big-ticket items such as homes and SUVs pricier. Adding to the angst are concerns that the momentum for deregulation under President Donald Trump could slow now that Democrats hold the majority in the House of Representatives.

“There are plenty of challenges that could disrupt the market and shake confidence,” says Chris Larkin, senior vice president of trading at discount brokerage ETrade.

The Dow's nearly 400-point drop Monday did little to boost confidence.

More Money:Jeep Wrangler drivers report 'death wobble' on highways

More Money:Budgets, family drama and stuff: How do you manage holiday gift-giving?

More Money:David's Bridal files for Chapter 11 bankruptcy protection, aims to stay in business

Signs of anxiety on rise

Signs of investors nervousness are beginning to emerge.

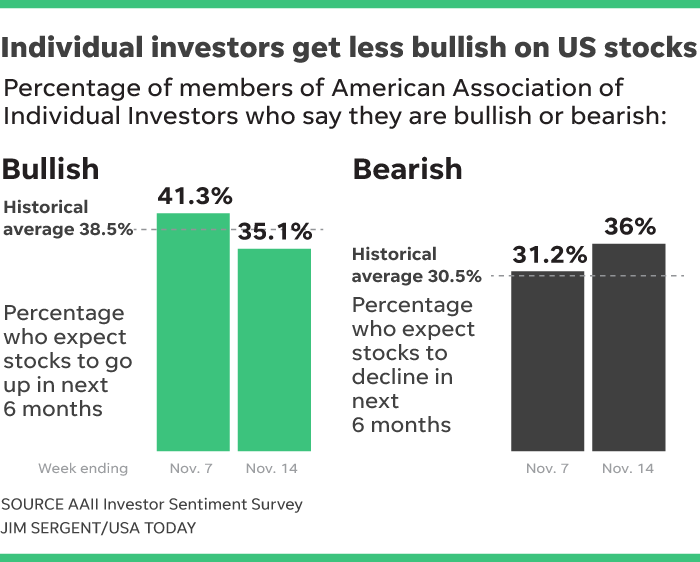

* Shrinking number of bulls: In one sign of rising cautiousness, the number of individual investors that say they are bulls, or think stocks will be up in the next six months, fell from 41.3 to 35.1 percent (below the long-term average of 38.5 percent) in the week ending Nov. 14, according to a survey from the American Association of Individual Investors. And bears swelled to an above-average 36 percent, which means bears now outnumber bulls.

More Money:David's Bridal files for Chapter 11 bankruptcy protection, aims to stay in business

More Money:Nissan's Carlos Ghosn fired, arrested over alleged income misconduct

More Money:These 8 retailers can't afford a disappointing 2018 holiday shopping season

* Buyers turn more defensive: Investors are no longer blindly buying on the dip, Wall Street speak for buying stocks when they are cheaper after a big market drop. Instead, TD Ameritrade says it has started to see retail investors become "more selective" about their trading.

Apple investors, for example, have gone on a buyers' strike of sorts.

"They have backed off," Kinahan says. "Buying has slowed down. What it tells me is investors are seeing the opportunity is lower for the market than before."

Investors, Kinahan adds, have also been reading more of the firm's educational materials on its website. They're also showing more interest lately in so-called defensive stocks, such as companies that sell everyday goods to consumers, including names such as Coca-Cola and Procter & Gamble.

"In times of uncertainty, investors want to own established stocks that pay them a dividend that they can stay in for awhile until things settle down," he says.

* Investors express angst: Investors are making their fears known to pollsters. When asked by E-Trade after the midterm elections how long they thought the current bull market would last, 22 percent said "the end is near," and another 34 percent said the end would be within two years.

Similarly, a quick post-election survey by Charles Schwab of 150 of its clients found that while 63 percent "feel bullish" about the market, 37 percent "feel bearish" and think the market is due for a significant decline.

A poll of more than 100 financial advisers by fund company Ariel Investments also captured the more negative mindset of investors. Fifteen percent of advisers' clients said they "want to reduce exposure to stocks," and another 5 percent said they "want to cut their exposure to equities altogether." More than half (55 percent) of financial advisers said their clients today are "less willing to take on risk and more concerned with avoiding loss."

* Money starts to move out of stocks: While investors haven't exited the stock market in a stampede, more money has come out of U.S. stock mutual funds and exchange traded funds than has flowed in, Investment Company Institute data show.

In the three weeks ending Oct. 17, for example, a period that saw the market flirt with a 10 percent drop, or correction, outflows of more than $22 billion hit funds and ETFs that invest in domestic stocks. But after two weeks of calm, when money flowed back into U.S. stock funds and ETFs, outflows resumed again, with nearly $4 billion exiting, ICI data show.

Money also returned to bond funds, seen as a safer play for investors. In the latest week of data, there were net inflows of $777 million into fixed-income funds. That followed four weeks of massive outflows totaling nearly $38 billion, an exodus that was due to people losing money on their bond funds when prices fell and the yield on the 10-year Treasury hit a multiyear high.

What's an investor to do?

There are always risks facing the stock market, and investors need to keep their fears in perspective, Milan says. He has been reminding his jittery clients that the Dow is still up more than 1 percent for the year and that business conditions, such as economic growth and corporate earnings, remain solid.

He's also been stressing that the lower stock prices have created a good opportunity to buy with any cash sitting on the sidelines.

What Milan is not recommending is for clients to flee the market completely.

"What we try not to let happen is let them run scared and move all their cash to a money market account," Milan says.