Signage and promotion may have suggested that smart lighting and the IoT were the headliners at LightFair 2017, but compelling lighting products with features such as tunable white and improved enabling technologies including new LEDs were the real stars, writes MAURY WRIGHT.

Another LightFair International (LFI) is in the books and what's abundantly clear is that lighting designers and specifiers still aren't buying into the near-term deployment of networked lighting - at least not in the Internet of Things (IoT) vision with cloud analytics and management platforms. Simpler and more affordable connected solid-state lighting (SSL) systems were probably more significant to the specifier community at the May event. Moreover, the primary focus of the specifier community seems firmly directed at better lighting and we will describe how demonstrations in the area of LEDs and other enabling technologies to compelling end products might push that quality of light agenda forward.

Interested in articles & announcements on LEDs & SSL design?

Now don't misunderstand. The loudest hype at LFI was IoT focused. We have really reported the same thing for the last several years after LFI, and in conjunction with other events such as Strategies in Light. Indeed, Strategies in Light remains the venue at which many companies detail their IoT initiatives. And at LFI, companies large and small showed connected lighting being managed via the cloud and analytics running in the cloud enabling new applications in retail, asset tracking/management, office space utilization, and more. Two years ago, it was probably only the major players such as Current (GE Lighting), Philips Lighting, Acuity Brands, and a few others demonstrating technology and applications beyond autonomous and programmatic lighting control. Now even much smaller companies have similar demos, enabled in many cases by partners such as Enlighted or Igor.

We continue to believe in the IoT vision. But the somewhat-still-staid lighting industry is going to take some time getting there. Moreover, there are obstacles, such as a lack of ubiquitous network standards, that must be overcome. So we will discuss the connected demonstrations that impressed at LFI, but first let's get to quality of light and also how LED evolution is enabling higher-performance and lower-cost general lighting products that will further broaden LED penetration.

such as an epoxy molded compound substrate, the Osram Duris P 9 LED

delivers 2-5W performance for outdoor applications.

Packaged LEDs and other enablers

Of course, luminaire performance, system cost, and light quality all start with the LED light source, and as you would expect, there were some fascinating new packaged LED products at LFI. Osram Opto Semiconductors, for instance, showed its Duris P 9 (Fig. 1) high-power LED targeting outdoor lighting for the first time. The brand Duris and the adjective high-power remain a seeming mismatch because Duris was brought into existence as a low- and mid-power LED brand at Osram. But Duris, it seems, refers more to the LED architecture and packaging. The P 9, and its sibling the P 10 that won an LEDs Magazine Sapphire Award earlier in the year, are based on high-power chips that use epoxy molded compound (EMC) substrates rather than ceramic, and that share some other elements typically found in mid-power devices. The result is high-power performance at a lower price point that can accelerate LED penetration into outdoor lighting.

Osram describes the P 9 as a 2-5W device and the LED is offered in a 3.7×3.7-mm package. Driven at 1.05A, the LED can deliver efficacy of 164 lm/W at a 5000K CCT and CRI of 70 - values that might be typical in some outdoor lighting applications. The 473-lm performance along with a typical forward voltage of 2.75V yield the excellent efficacy. The LED is offered at CCTs as low as 3000K, and Osram said the target applications include high-bay lighting in addition to street and parking-area lighting. One of our LFI videos includes more information on the LED including the LED chip architecture.

There were, of course, packaged LED demonstrations across the sector. Lumileds, for instance, showed its High Density COB (chip on board) LEDs that were announced recently, which double the output of its third-generation Core COB range announced earlier in the year. At the extreme end of the discrete high-power sector, Cree showed the second-generation Extreme High Power XHP70.2 LED that it says offers 58% more lumen density than competing products.

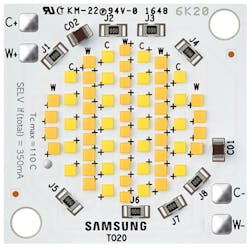

At Samsung's exhibit, the message was products across the sectors that deliver efficacy levels at the top of the industry. For instance, we recently covered a mid-power announcement where the LM301B 3.0×3.0-mm LED delivers 220 lm/W. But in our video interview with Samsung on the show floor, Brian Wilcox, senior director of LED sales, said Samsung now offers top efficacy in high-power and COB products despite being better known for mid-power LEDs.

features such as white-point tuning.

CSP LEDs

The LED sector in which we were most interested at LFI was chip-scale package (CSP) LEDs. We have been following what is presumably the next major advancement for LEDs for several years, although the general lighting market has been slow to adopt CSP LEDs in part because of the difficulty in assembling products based on the LEDs.

Samsung's Wilcox said its CSP LEDs have hit efficacy levels of 180 lm/W - matching high-power LED performance. And the Samsung CSP LEDs are being used across power ranges just as we reported about Seoul Semiconductor CSP LEDs last year. Moreover, Samsung demonstrated a number of Level 2 light engines based on CSP LEDs that can make it easier for lighting manufacturers to adopt the technology (Fig. 2). Wilcox also said Samsung had developed a new optical approach to deliver light solely from the top side of a CSP LED, whereas the company's earlier products had been five-sided emitters.

Seoul is the one LFI exhibitor that had proof positive of CSPs pervading general lighting applications. Acuity Brands allowed Seoul to exhibit two such street lights that are based on Level 2 modules provided by Seoul with CSP LEDs on board. The Lithonia Kax luminaire uses multiple arrays of four of Seoul's smallest CSP LEDs that end up grouped under a total internal reflection (TIR) optic. The Autobahn luminaire uses multiple larger individual CSP LEDs, with each under a TIR lens.

SSL drivers

Moving to LED driver design, Seoul also made news in that area at LFI, announcing the NanoDriver and MicroDriver products. The NanoDriver (Fig. 3) is what is sometimes called a hybrid module that integrates one or more ICs along with discrete electronic components. Still, the NanoDriver is only slightly larger than a typical IC and can be assembled on a printed-circuit board (PCB) or light engine using surface-mount device (SMD) technology just as SMD ICs are handled.

The NanoDriver essentially uses the latest generation of Seoul's Acrich or AC-LED technology, although Seoul is not using the Acrich brand with the new products. When combined with a handful of discrete external components, the NanoDriver can power multiple segments of LEDs connected in series, although the configuration of the LED strings is necessarily different from the simple series strings used with constant-current DC drivers.

The value proposition of NanoDriver is size and therefore PCB real estate, along with low cost. The design supports phase-controlled dimming and can also be used in 0-10V systems. The MicroDriver, meanwhile, is a NanoDriver and required external components encapsulated in a plastic package. Seoul said it can be integrated in the small format of a sconce fixture. Learn more about the Seoul LFI announcements in a video shot at LFI.

In modular driver news, Thomas Research Products (a Hubbell business) demonstrated its LBU10-P Emergency LED driver that's intended to complement a standard driver in a luminaire. Emergency lighting is a regulatory requisite in commercial buildings. One way to address the requirement is by adding emergency power capability to a percentage (perhaps 25% or 33%) of the overall luminaire population in a building.

The Thomas product includes a nickel-cadmium battery and intelligent charger that simply ensures the driver remains capable of supplying emergency power at all times. When a luminaire equipped with the product loses power, an automatic transfer switch in the Thomas driver swaps the load to battery power and can deliver constant illumination for 90 minutes.

in an extremely compact form, enabling usage in smaller light engines and luminaires.

Other enabling technologies

Enabling innovations, in fact, showed up in myriad forms at LFI. Consider materials. Dow Corning demonstrated three new silicone formulations. Silicone has become more popular for optics in SSL applications despite the fact that the material is more expensive than polycarbonate or acrylic. Silicone enables larger optics such as TIR lenses for COB LEDs and has been used to realize specialized optics for automotive and other applications.

At LFI, Dow announced the new MS-4002, MS-4022, and MS-4007 moldable optical silicone formulations. The new products yield a surface that more closely resembles a plastic surface - smoother and less tacky than prior silicones. Still, the material can be molded with special mechanical features such as undercuts that are impossible to mold in rigid plastics.

Khatod is one commercial optics manufacturer that is using silicone to produce LED lenses and optics of various shapes and sizes. At LFI, the company demonstrated its SIR50 (silicone internal reflection) lenses that can be used with COB LEDs with a light-emitting surface (LES) between 6 and 9 mm in diameter. The lenses target applications such as MR16 lamps and can deliver narrow, medium, and wide beam patterns.

using the single Remedi luminaire from Hubbell.

Tunable lighting products

Now let's turn to end lighting products, and perhaps the most compelling products on the show floor were tunable products - both color and white-point tunable. The Symmetry product from Visa Lighting was especially compelling in round form with the LED sources completely hidden. And as we described in an earlier news article, the broad white-point tuning range from 1650K to 8000K CCT caught our eye. That range delivers even more flexibility for human-centric lighting (HCL) or lighting for health and wellbeing. We also covered Acuity and Philips Lighting products in that earlier article. The Acuity technology remains very impressive, and would deserve more coverage here except for the fact that we covered it extensively last year.

There were far too many tunable products for us to detail here, but we will describe a few of the others that stood out. USAI Lighting demonstrated a technology that it calls ColorID_Complete, intended to allow people to choose from more than 170 color formulas to suit their needs and whims. The technology works with the company's Infinite, Color+, and Color Select systems. The Infinite system, for example, is used to paint walls using lighting products such as the BeveLED WRGB Infinite Color+ luminaire.

Hubbell has also rolled out a tunable technology platform that it calls SpectraSync. Initially, the company will support Dim to Warm (2200K to 3000K), Scheduled White (programmable variable intensity and white from 2700K to 6500K), and Tunable White (user-configurable variable intensity and white from 2700K to 6500K) modes. Hubbell said it will later add Dynamic Spectrum with color-tunable features. The SpectraSync technology will initially be available in Prescolite downlights, Litecontrol pendants, and Columbia troffers.

control of tunable lighting products.

Lighting for health

There's a fine line between tunable products designed for mainstream architectural spaces and others designed for healthcare applications. Hubbell makes both. And a product we saw, and were impressed with, last year at LFI was again demonstrated this year with a promise of near-term commercial availability. The Remedi luminaire (Fig. 4) is designed to be wall mounted above the patient bed in a hospital room. The fixture has three optical chambers and settings for examination (direct light that's bright and cool), reading (more pleasing direct light), and warm ambient indirect light for relaxation. The product is a great example of application-specific design.

The tunable concept also impacts the controls space. In many instances, lighting manufacturers are using simple dual 0-10V dimmers to enable separate setting of intensity and chromaticity in tunable products. But accurate and optimal deployment of tunable products will require more sophistication - read digital control, a graphical user interface (GUI), and programmatic capabilities. Lutron contributed a feature article describing the problem in 2016 and then an opinion column calling for digital controls more recently.

At LFI, Lutron announced that its Quantum 3.3 lighting control and energy management system now has integrated support for tunable-white lighting. The platform enables scheduled programmatic control and override in individual spaces with a smart device GUI (Fig. 5) or wall-mounted control. Lutron said the product is ready for designers to specify now and will ship commercially in September.

Striking luminaires

Of course, not every enticing lighting product that debuted at LFI was tunable. In fact, tunable products will continue to represent a minority of products installed, as our colleagues at Strategies Unlimited reported earlier this year at Strategies in Light.

Tempo Industries, for example, rolled out a new modular, or what it call configurable, cove lighting system - the primeFX (Fig. 6). Typically, cove lighting adds ambience to a space but does not deliver much light that is suitable for visual tasks. Tempo said its new system changes the role of cove lighting and asserts that the primeFX fixtures can deliver 85% of the light out of the cove to deliver the first level of light needed in an architectural space.

minimize the need for other light sources in a space and reduce

glare relative to troffers and downlights.

The system is based on linear luminaires, ranging in length from 2 to 6 ft, that can be serially connected to fit almost any architecture. The optic design directs all the light upward and outward above the cove to deliver indirect light from the ceiling. The company said the system delivers superior lighting relative to troffers or downlights with less glare.

Compelling luminaires also showed up in tiny form factors. Consider the Acuity Gotham MYO (Fig. 7). The company referred to the design as having "minimalistic form," yet the luminaire can deliver up to 1500 lm from each of two heads. Each head can be tilted 40° and rotated independently and the two heads can be equipped with different beam patterns and baffles. The result is a single luminaire that Acuity says can deliver ambient, task, and accent layers of light in a space.

Simplifying networks and control

Now let's move on to networked lighting as we promised up front. There was a refreshing trend at LFI - a renewed focus on simpler approaches to networked lighting with easy commissioning and lower upfront costs. The examples we will discuss range from the most simplistic scenarios to mid-range networks that can be scaled upward to full IoT features and benefits.

The fact is, lighting manufacturers have little choice today as to whether to offer connectivity. Regulatory policy in places such as California virtually demands some level of networks and controls. So companies such as Forest Lighting are adopting simple wireless links. Forest (a subsidiary of China's MLS) entered the US market a couple of years back focused on lamps, especially LED-based replacements for T8 florescent tubes. The company has since broadened its portfolio to include troffers, retrofit kits for troffers, and flat-panel ceiling fixtures.

At LFI, Forest was demonstrating its luminaire products with optional support for wireless connectivity based on EnOcean Alliance technology. EnOcean wireless is a lightweight protocol, and switches used with the system are self-powered by the kinetic energy harvested from depression of the switch (see a feature article for EnOcean background). Forest already supported 0-10V dimming and offered optional integrated occupancy sensors, but can now supply systems with wireless dimming and on/off control. The premium for connectivity is low and commissioning an EnOcean system is simple.

deliver accent, task, and ambient light layers from one fixture.

Auto-commissioning

Still, it's the mid-level systems that stood out and that are designed to support applications from a room to a mid-size commercial space. Consider Eaton's WaveLinx system (Fig. 8) announced this spring and fully demonstrated at LFI. The system is based on simple wireless area controllers that can link via a mesh network to as many as 200 sensors, switches, wall controls, switched outlets, and luminaires. The network is based on ZigBee and more complex installations can use multiple wireless controllers with each connected to the building IT network. All control is handled through an app on one or more smartphones or tablets.

The key to the simplicity is auto-commissioning. Eaton said it studied the most stringent energy codes in the world and preloaded an autonomous lighting control scenario into the wireless controllers. An installer need do nothing more than associate a luminaire with a controller, and that luminaire will be set to meet the aforementioned energy code. But the app also provides options for changing the lighting scenario and organizing zones and sensor inputs. View our LFI video shot in the Eaton booth and you can get more details on the system.

Leading up to LFI, Osram made a similar smart lighting announcement with its Simplux system that was then demonstrated at LFI. Simplux can link as many as 100 nodes using ZigBee and targets commercial spaces of 10,000 ft2 or less. But a software update to a Simplux controller will enable such a system to connect to Osram's Encelium light management system with full IoT capability.

Ironically, Cree's lighting business moved in the opposite direction at LFI. Cree was among the first companies to adopt a simple approach to networking a room or small group of rooms with SmartCast wireless technology that was announced back in 2014. At LFI this year, Cree extended the scope of the SmartCast brand to cover larger wireless installations and also its Power over Ethernet (PoE) offering. Moreover, Cree has developed cloud-based analytics capability and offers commissioning and control via smart devices. Plus, the system includes open application programming interfaces (APIs), encouraging third-party software developers; Cree will also support lighting products from other vendors with SmartCast.

luminaires, sensors, and controls in the Eaton WaveLinx system.

The Full IoT Monty

And Cree was just one of many exhibitors to show cloud-based IoT platforms joining the likes of the largest players in lighting such as Osram, Philips Lighting, Current, and Acuity that have spent years in IoT development. Acuity, for example, used LFI to announce a new IoT brand called Atrius that is an umbrella for all of the company's IoT hardware and software.

The question is how many lighting companies can afford to develop cloud-based analytics and light management systems and what will specifiers pay for such capabilities. And it appears there is not much buying happening as of now.

Cree said it developed its IoT play in house. Others are rapidly moving forward through partnerships. For example, Eaton's LumaWatt IoT system that supports indoor and outdoor applications is based on technology from partner Enlighted. Hubbell Controls Solutions used LFI as a platform to launch its NX Distributed Intelligence platform that will include NX control modules, NX sensors, NX radio modules, and more. The Hubbell controls business will sell the products to other lighting manufacturers, but the NX technology is also the basis for the coming Hubbell Lighting IoT play that was demonstrated at LFI.

Hubbell is partnered with Igor on the IoT technology. We did a video interview with Igor back at Strategies in Light. Igor has developed a number of hardware modules, including PoE modules, that luminaire makers can add to their products. But Igor's business model is based on the company's IoT platform that it can license through a company such as Hubbell to major IoT lighting installations.

Partners and matchmaking

LFI was brimming with would-be partners looking to link up. In prior years, we discussed Samsung's intention of moving into smart lighting as a module supplier. The company is already delivering a multichannel LED driver that can be wirelessly connected and can support tunable lighting. And the company says it is ready to roll out a large family of modules including wireless controllers, sensors, and switches. Moreover, the company is promising cloud support and apps for smart devices.

Tridonic used LFI to commercially launch the net4more platform that has been talked about for more than a year. We covered that company's plans in a recent interview with the CEO. And a recent feature article written by the company includes an explanation of why the IoT move by lighting manufacturers should be based on Internet Protocol (IP) networks.

Lutron, meanwhile, is a traditional controls company that sometimes also seems to want to be a lighting company and is fond of proprietary systems. At LFI this year, the company was pushing its Vive wireless lighting control module that luminaire makers can add to their systems so that they work as part of a Vive installation based on the company's proprietary Clear Connect wireless network.

Not all of the enabling technology vendors are focused on delivering the cloud software and full lighting management platforms, but rather many are just seeking to enable the smart luminaire. For example, ams believes that the key to the IoT of the future is integration of sensors in luminaires along with intelligent control. You can watch one of our LFI videos for more details.

Still, the problem remains that networks and sensors are often removed in lighting specification projects to slash costs. In a Strategies in Light keynote earlier this year, Enlighted CEO Joe Costello lamented that the specification process could set back the move toward intelligent buildings by a decade or more. So at LFI, Enlighted launched an organization called the IoT Ready Alliance that will seek to have luminaire makers include an interface in every product they sell that could later be tapped to add IoT capabilities in installed products. The path to an IoT future is surely a bumpy one, but many people continue to believe that it's the only path to prosperity for lighting manufacturers.

*Updated August 7, 2017 10:32am for clarification of Tempo luminaires.