The COVID-19 pandemic caused by the new coronavirus poses both health and economic consequences for Tennessee. A rigorous public health response is necessary to halt its rapid spread and reduce both short- and long-term economic costs. (1) (2) However, economic indicators already point to the beginning of a recession. (3) (4) This brief explains the challenges recessions create for state budgets, the tools Tennessee tapped last time, and where some of those tools stand today

Key Takeaways

- Tennessee’s budget must balance even during economic downturns, which create higher-than-usual demand for programs and services while reducing the revenues that fund them.

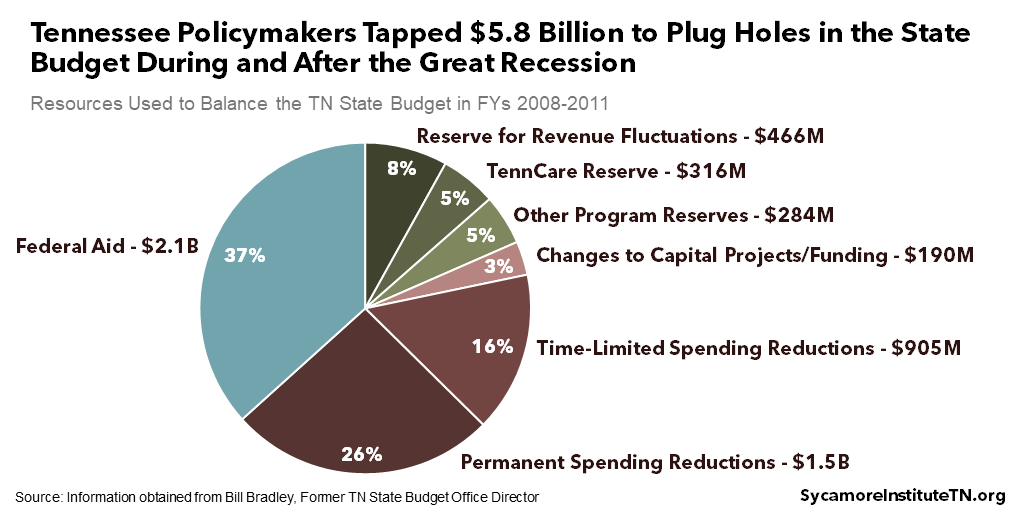

- During and after the Great Recession, Tennessee ultimately used about $5.8 billion in federal aid, state reserves, and spending cuts to balance its FY 2008 to FY 2011 budgets.

- In recent weeks, Congress passed several laws to send financial aid to states. Based on several partial estimates, Tennessee’s state and local governments may get at least $3.6 billion.

- Tennessee projects its $875 million rainy day fund will hit $1.45 billion in FY 2021. If revenues fall short, Gov. Lee can use that money to maintain programs within limits already set by lawmakers.

- The state also has $1.9 billion in TennCare and other program reserves, some of which could be made available to respond to a recession — if existing obligations permit.

- Policymakers could also turn to more difficult decisions like permanent spending cuts, raising new revenue, or diverting state tax dollars from their intended purposes.

Tennessee’s budget is “counter-cyclical,” meaning economic downturns create higher-than-usual demand for programs and services while reducing the revenues that fund them. For example, the pandemic has caused a rapid spike in unemployment claims (Figure 1). (3) (4) These Tennesseans may also turn to other public safety net programs like TennCare and SNAP. During this particular crisis, the state is also spending more on public health efforts to track and respond to the spread of the new coronavirus that causes the COVID-19 disease.

Figure 1

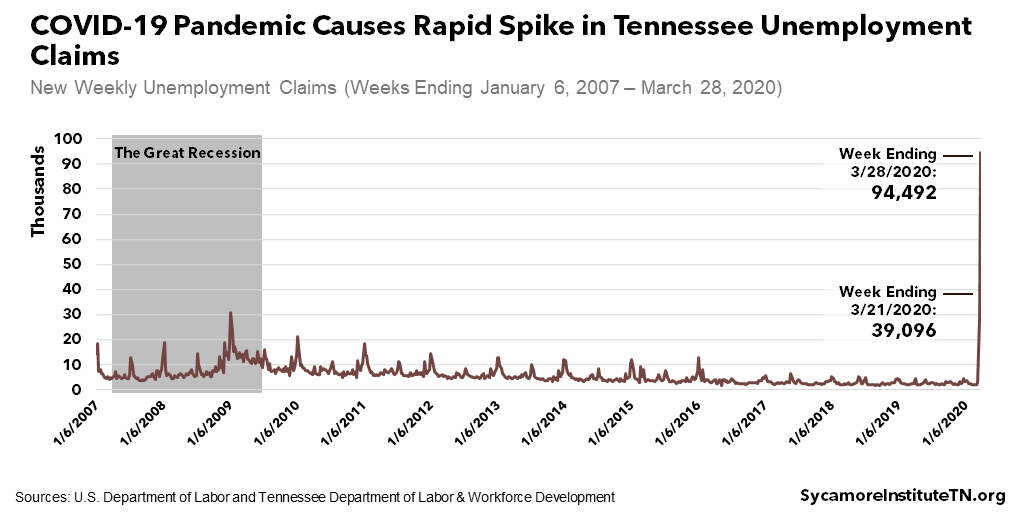

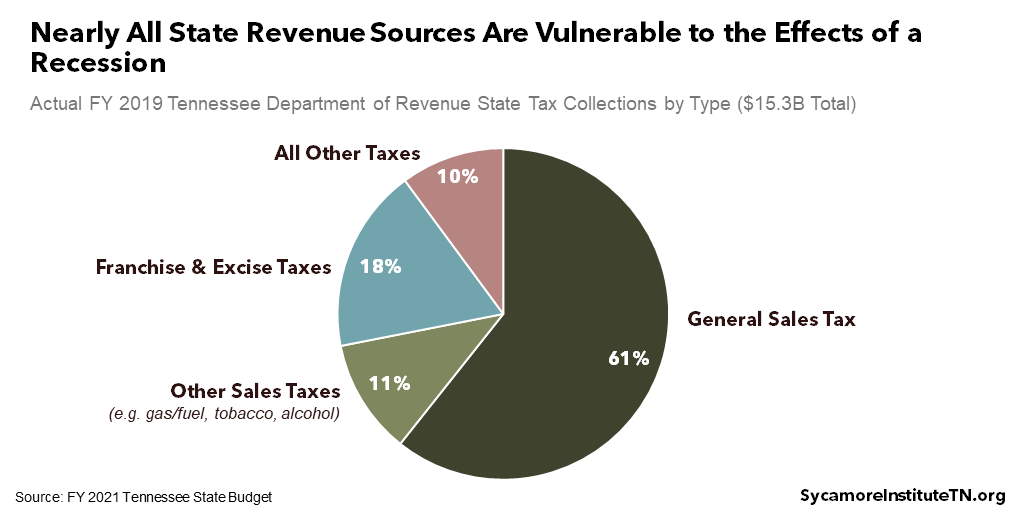

Nearly every state revenue source is vulnerable to the effects of a recession (Figure 2). Many businesses have come to a stand-still, which will slow franchise and excise tax revenues. At the same time, the drop in consumer spending and travel will reduce sales tax collections. In January before the pandemic’s impact became clear, state economists expected taxable sales to grow 5.8% over the next two years. Figure 3 shows how that projection turns negative when adjusted to mirror the two most recent recessions. (6) (7)

Economic downturns do not give state policymakers a free pass on the Tennessee constitution’s balanced budget requirement. Even as revenues fall and spending in some areas increases, the state must still spend no more in a given fiscal year than it takes in or has on hand.

Under normal circumstances, the budget’s recurring expenses are covered by recurring revenues. Recurring expenses and revenues are those reasonably expected to occur every year, while non-recurring funds are typically expected only one-time. These delineations help policymakers keep the budget balanced in both the short- and long-term.

In economic downturns, however, policymakers often use non-recurring funds to cover some recurring costs. The budget may, for example, rely on reserve balances or time-limited spending cuts with the expectation that recurring revenues will catch back up when the economy improves.

Figure 2

Figure 3

The Great Recession

Policymakers ultimately tapped about $5.8 billion in resources to balance Tennessee’s budget

during and after the Great Recession. Occurring between FY 2008 and FY 2011, that total includes

(Figure 4) (8):

Non-Recurring Federal Aid

- 2.1 billion in non-recurring federal funding, the majority of it for TennCare.

Spending Changes

- $1.5 billion from permanent, recurring program spending reductions, the brunt of which reduced state college and university funding and eliminated certain TennCare services.

- $905 million from time-limited, non-recurring program spending reductions (commonly called reversions or unspent program funds that revert back to the General Fund).

- $190 million from changes to capital spending, such as cancelling or delaying some projects and funding others with bonds.

Non-Recurring Reserves

- $466 million from the Reserve for Revenue Fluctuations, Tennessee’s official rainy day fund.

- $316 million from the TennCare reserve.

- $284 million from other program reserves.

Figure 4

What Could Happen This Time?

Policymakers will likely have to tap many of the same tools again to the extent that the new coronavirus sends the economy into a prolonged downturn. The federal government recently approved trillions of dollars in aid for Tennessee and other states. Meanwhile, the combined balance of the Reserve for Revenue Fluctuations and the TennCare reserve is projected to hit $1.8 billion at the end of FY 2021 (more below). There are also $1.5 billion in other program reserves across state government, some of which could be made available to respond to a recession after careful analysis of existing obligations and – in some cases – legislative approval.

Federal Aid to States

Tennessee is already set to get billions from the federal government. In recent weeks, Congress passed multiple relief packages with significant resources to help states deal with the COVID-19 pandemic and its economic fallout. The Families First Coronavirus Response Act was signed into law on March 18th, and the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27th. A combination of partial estimates suggest state and local governments in Tennessee may get at least $3.6 billion. Highlights from provisions that may affect the state budget include (9):

- Coronavirus Relief Fund — Tennessee will receive an estimated $2.6 billion from a $150 billion Coronavirus Relief Fund. No more than 45% of Tennessee’s allocation will be awarded to local governments with at least 500,000 residents based on their share of the state’s total population, and the remainder will go to the state. (10) In Tennessee, Shelby and Davidson Counties and the city of Memphis all have population estimates over 500,000. (11) However, criteria for local governments with overlapping populations is not yet available. Currently, two separate estimates anticipate local government in Tennessee will be allocated $285 million. (24) (25)

- TennCare Funding — Each state will get a 6.2 percentage point increase to its federal Medicaid match rate, retroactive to January 1, 2020 through the quarter in which the national emergency declaration ends. (12) One estimate predicts the increase could offset over $600 million in state spending on TennCare in 2020. (13)

- Disaster Relief — State and local governments nationwide will share $45 billion from a Disaster Relief Fund to provide medical response, personal protective equipment, and other efforts to protect citizens. (10) Tennessee’s share is not yet clear.

- Education — States, school districts, and institutions of higher education across the U.S. will share $31 billion from an Education Stabilization Fund to help with things like planning for long-term school closures, buying technology to support online learning, and providing emergency financial aid to students. (10) The state is expected to receive an estimated $260 million for K-12 – the majority of which must be allocated to local school districts. (14) Public and private colleges in Tennessee will receive an estimated $250 million, and an estimated $64 million will be disbursed directly to the governor to flexibly support both K-12 and higher education. (15) (14)

- Child Care – States will share $3.5 billion to address child care needs through the Child Care and Development Block Grant. Tennessee will receive an estimated $79 million. (16)

Tennessee’s Rainy Day Funds

Rainy day funds serve as a tool to help smooth out the ups and downs of the economic cycle. They allow states to set money aside when revenues are strong and/or demands are relatively low. States can then tap those reserves when revenues are weak and/or demand increases.

The Reserve for Revenue Fluctuations and the TennCare reserve together represent an important part of Tennessee’s ability to respond to a downturn. The statutory purpose of the Reserve for Revenue Fluctuations is specifically for unexpected changes in revenue collections or spending needs. (17) The TennCare reserve is a separate fund that holds excess dollars for TennCare. In dire situations, the legislature can make the TennCare reserve available to shore up both TennCare and the larger General Fund.

Historically, the state has used the Revenue Fluctuations Reserve as a last resort. (8) In fact, the law expresses legislative intent that spending should be cut before using the Reserve. (17) In the past, the state has initially turned to limiting spending growth for only the things that are mandatory or essential and spending reductions in other areas. The FY 2021 budget passed by the legislature on March 19th, for example, limited funding increases for COVID-19 response and higher costs from inflation, formulas, or client growths, but it did not make significant new spending reductions.

When revenues fall short, the governor can tap the Revenue Fluctuations Reserve without legislative approval to fund programs within levels already appropriated by the legislature. There is no limit on how much of the Reserve the governor can use for this purpose. The law does require notification of and hearings in the Senate and House Finance, Ways, and Means Committees, but it does not require a vote from lawmakers. To spend more on any line-item than the General Assembly has already approved, the amounts that could be used from Reserve are limited in law, and the governor would need lawmakers to pass a supplemental appropriation. (17)

How Large Are Tennessee’s Rainy Day Funds?

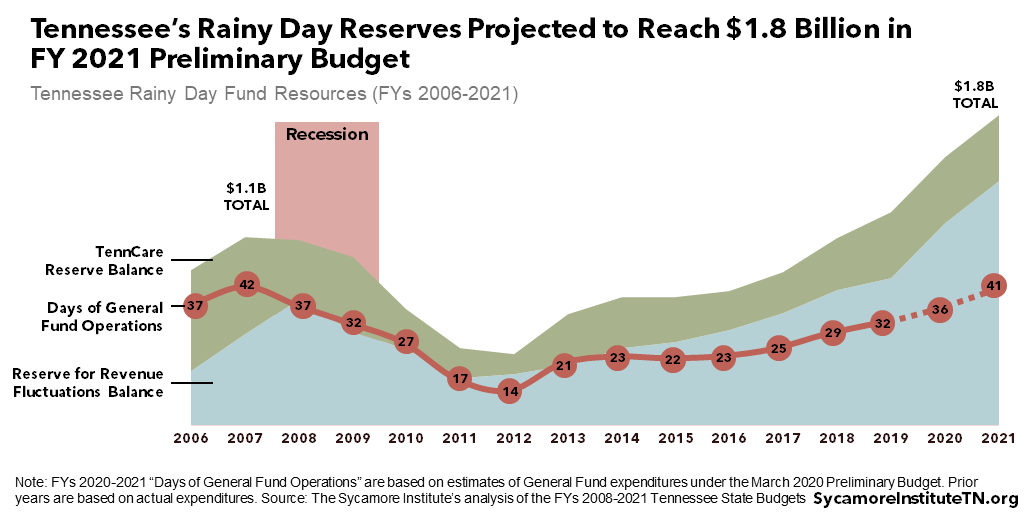

The preliminary budget allocated a combined balance of $1.84 billion in the Reserve for Revenue Fluctuations and the TennCare reserve by the end of FY 2021 (Figure 5) (18). Within this total are $1.45 billion for the Reserve for Revenue Fluctuations and $390 million for the TennCare reserve. The significant boosts lawmakers approved in March reflect the anticipated economic effects of the COVID-19 pandemic.

Figure 5

Achieving these balances depends on the state’s ability to deposit $325 million and $250 million at the end of FYs 2020 and 2021, respectively. If revenue collections drop significantly, the state may be unable to make these deposits, especially in FY 2021. Without them, the Reserve would stay at its current size of $875 million. The combined balance of $1.27 billion is about 31% lower than what is budgeted in the appropriations act.

There are many ways to measure how well a state’s rainy day reserves will withstand an economic downturn, but none are perfect. For example, nearly all assume very little change in how a state spends its dollars. In reality, states often face higher costs in some areas, cut back in others, and get extra resources from the federal government. Even so, each metric can help illuminate the spending power of these reserves. We discuss three of those metrics here.

- Credit rating agencies often look at reserves as a percent of revenues. For example, at least one credit rating agency only gives its best rating when dedicated rainy day reserves exceed 8% of annual revenues. The current Reserve for Revenue Fluctuation Balance represents about 6% of estimated FY 2020 revenues, and the two reserves combined equal about 8%. The FY 2021 budgeted amounts for the Revenue Fluctuations Reserve and the combined reserves would be about 9% and roughly 12% of estimated FY 2021 revenues, respectively. (18) (5)

- The private sector usually measures reserves in terms of the amount of time funds would cover expenses in the absence of any other revenues. It is a metric commonly used to understand financial security. The current combined balance would cover about 29 days of FY 2020 state-funded operations. The FY 2021 levels approved in the preliminary budget would cover about 41 days (Figure 5). This is just one day (or 1%) less cushion than before the Great Recession that began in December 2007 — a considerable improvement over recent years. In reality, of course, state revenues would never completely disappear.

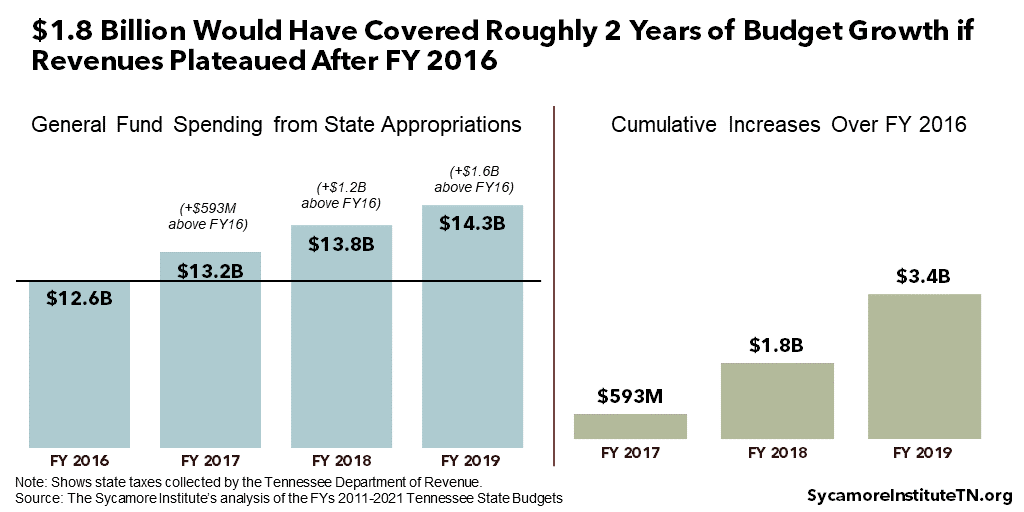

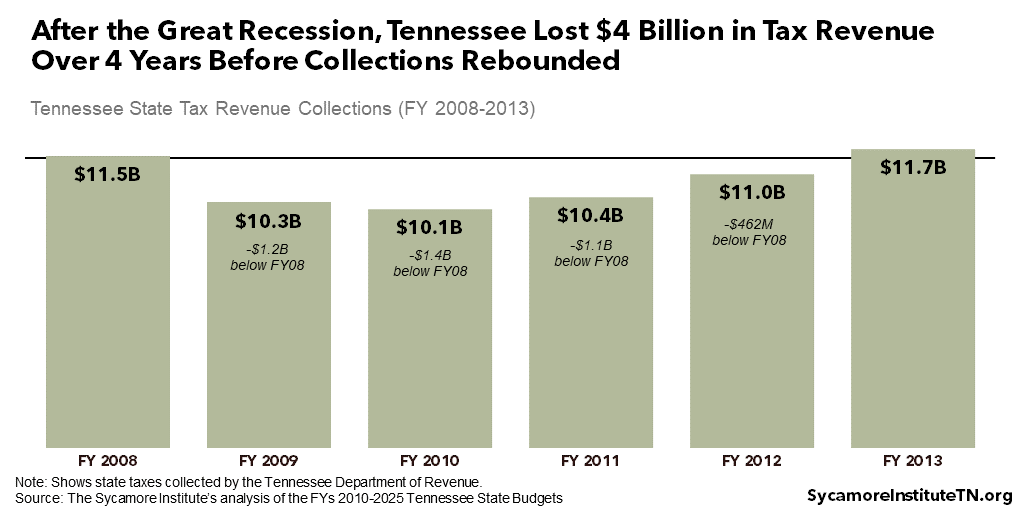

- Policymakers have recently framed reserves in terms of how much normal budget growth they could cover. If revenues had stopped growing in FY 2016, for example, $1.84 billion would have covered cost increases above the FY 2016 level for two years — $593 million in FY 2017 and $1.2 billion in FY 2018 (Figure 6). (19) The most recent recession, however, suggests revenues may be more likely to decline than plateau. State tax collections dropped nearly 12% between FY 2009 and FY 2011. Not counting any lost growth, the state lost ultimately $4 billion in base tax revenue over four years before collections rebounded to their pre-recession levels (Figure 7). (19)

Figure 6

Figure 7

Other Program Reserves

In addition to its rainy day funds, Tennessee had about $1.5 billion in other program reserves at the end of FY 2019. (20) This money is reserved for specific programs, and not all of it can be redirected to plug holes elsewhere in the budget. “Statutory” reserves are required by permanent law and most are funded by a program’s dedicated revenue sources (e.g. a fee or license). “Non-statutory” reserves are created by the appropriations act for certain programs (e.g. major maintenance balances and the TennCare reserve), with funding derived from general state revenue sources.

The administration already has access to some of these funds, but the General Assembly would have to change current law to use others. The commissioner of the Department of Finance and Administration already has the authority to use the $1.1 billion in non-statutory reserves (and the $390 million in TennCare reserve) — depending on any existing obligations as discussed below. (21) Lawmakers would have to change both permanent law and the appropriations act to tap into about $379 million of statutory reserves. (22) To date, lawmakers have not authorized the taking of the statutory reserves for FY 2020 or FY 2021 but could do so later if necessary.

Before using these funds, the Department of Finance and Administration (F&A) and affected agencies would need to ensure the state meets existing obligations. Much of this money may be obligated through contracts or for activities already complete or underway. When policymakers tapped $316 million from the TennCare reserve and $284 million from other program reserves in 2008, F&A and other state agencies jointly analyzed program commitments before determining how much to take from each reserve. In the appropriations act, the General Assembly also required reports to the Senate and House Finance, Ways and Means committees on the amounts to be taken from statutory reserves. (8)

Historically, program reserves — especially the TennCare reserve — have been tapped to balance the budget before turning to the Reserve for Revenue Fluctuations. Faced with the uncertain duration of any given recession, Tennessee policymakers have in the past prioritized holding the Reserve for Revenue Fluctuations for last use in order to preserve cash on hand. (8)

Other Tools

Policymakers also have two other options: cut recurring spending or raise new revenue. Either one could prove difficult. While recurring spending grew by about $4 billion since the Great Recession, Tennessee also cut about $2 billion in recurring costs over that period — which could make identifying new cost reductions more challenging. Meanwhile, public policy and political appetite limit Tennessee’s ability to raise new revenues. The state already has America’s highest average state-local sales tax rate, the 7th highest corporate tax collections per capita, and a constitutional ban on personal income taxes. (23)

In the early 2000s, the state took several extraordinary actions to deal with a large structural deficit that proved unpopular and have not been repeated. For example, policymakers diverted a portion of state taxes shared with local governments to balance the state’s own budget. Legislation also passed to divert Highway Fund dollars to balance the General Fund. (8)

Parting Words

At this point, it’s impossible to know exactly how much money Tennessee will need to fill any holes in the state budget caused by the COVID-19 pandemic and its economic effects. That will become clearer as time goes on. For now, state policymakers may want to brush up on the tools available and prepare themselves for the potentially difficult choices ahead.

*This report was updated on April 8, 2020 to reflect more recent information on the allocation of the federal Coronavirus Relief Fund.

References

Click to Open/Close

- Greenstone, Michael and Nigam, Visham. Does Social Distancing Matter? University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2020-26. [Online] March 30, 2020. Available at SSRN: https://ssrn.com/abstract=3561244.

- Correia, Sergio, Luck, Stephen and Emil, Verner. Pandemics Depress the Economy, Public Health Interventions Do Not: Evidence from the 1918 Flu. [Online] March 30, 2020. Available at SSRN: https://ssrn.com/abstract=3561560.

- U.S. Department of Labor. Unemployment Insurance Weekly Claims Data. [Online] [Cited: April 2, 2020.] Accessed from https://oui.doleta.gov/unemploy/claims.asp.

- Tennessee Department of Labor and Workforce Development. Tennessee New Unemployment Claims Filed for the Week Ending March 28, 2020. [Online] April 2, 2020. https://www.tn.gov/workforce/covid-19/news/2020/4/2/regional-unemployment-claim-numbers.html.

- State of Tennessee. FY 2021 Tennessee State Budget. [Online] January 30, 2020. https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fa-budget-publication-2020-2021.html.

- UT Center for Business and Economic Research. “Selected U.S. and Tennessee Economic Indicators, Seasonally Adjusted: TN Taxable Sales (Mil$)”. Accessed from the annual Economic Reports to the Governor of Tennessee for 2009-2020. [Online] 2009-2020. Available from from https://haslam.utk.edu/boyd-center/publications?subject=1137.

- FRED. Personal Consumption Expenditures (Implicit Price Deflator). Federal Reserve Bank of St. Louis. [Online] March 26, 2020. https://fred.stlouisfed.org/series/DPCERD3Q086SBEA.

- Bradley, Bill. Information provided. Nashville, TN, March 2020.

- U.S. Senate Appropriations Committee. $340 Billion Surge in Emergency Funding to Combat Coronavirus Outbreak. [Online] March 30, 2020. https://www.appropriations.senate.gov/imo/media/doc/Coronavirus%20Supplemental%20Appropriations%20Summary_FINAL.pdf.

- National Conference of State Legislatures. COVID-19 Stimulus Bill: What It Means for States. [Online] March 25, 2020. https://www.ncsl.org/ncsl-in-dc/publications-and-resources/coronavirus-stimulus-bill-states.aspx.

- U.S. Census Bureau. July 1, 2019 Population Estimates. [Online] [Cited: April 2, 2020.] Available from https://www.census.gov/quickfacts/fact/table/memphiscitytennessee,shelbycountytennessee,davidsoncountytennessee,knoxcountytennessee,hamiltoncountytennessee/PST045219.

- Centers for Medicare and Medicaid Services. Families First Coronavirus Reponse Act – Increased FMAP FAQs. [Online] March 2020. https://www.medicaid.gov/state-resource-center/downloads/covid-19-section-6008-faqs.pdf.

- Sullivan, Jennifer. Medicaid Funding Boost for States Can’t Wait . Center on Budget and Policy Priorities. [Online] March 13, 2020. https://www.cbpp.org/blog/medicaid-funding-boost-for-states-cant-wait.

- Skinner, Rebecca and Nyhof, Emma. Estimated State Grants Under a Proposed Education Stabilization Fund for a Governor’s Emergency Education Relief Fund and an Elementary and Secondary School Emergency Relief Fund, Assuming an Appropriations Level of $30.750 Billion. Congressional Research Service. [Online] March 25, 2020. https://www.sycamoreinstitutetn.org/wp-content/uploads/2020/04/Estimated-ESF-gov-and-elem-and-sec-state-grants.pdf

- Education, American Council on. “CARES Act”– Higher Education Relief Fund: Simulated Distribution of Amounts Provided Under Section 18004(a)(1) . [Online] March 25, 2020. Accessed from https://www.nasfaa.org/news-item/21362/American_Council_on_Education_Simulates_Distribution_of_CARES_Act_Emergency_Funds.

- Schmit, Stephanie. $3.5 Billion for Child Care in Coronavirus Package is Not Enough: How States Will Fare. CLASP. [Online] March 26, 2020. https://www.clasp.org/sites/default/files/publications/2020/03/2020_3.5billionchildcarecoronaviruspackage.pdf.

- State of Tennessee. TN Code § 9-4-211. [Online] https://law.justia.com/codes/tennessee/2018/title-9/chapter-4/part-2/section-9-4-211/.

- Tennessee Department of Finance and Administration. FY 2021 Administration Budget Amendment Overview. [Online] March 17, 2020. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/21AdminAmendOverviewRevisedEstimates.pdf.

- State of Tennessee. Tennessee State Budgets for FYs 2006-2020. [Online] Available via https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html.

- —. FY 2021 State Budget – ppA114-A115 – General and Education Fund Balance Sheets. [Online] January 2020.

- —. Section 36 of the Annual Appropriations Act. [Online] Example in the FY 2021 Appropriations Act: http://www.capitol.tn.gov/Bills/111/Amend/HA0694.pdf.

- Tennessee, State of. TN Code § 4-3-1016. [Online] https://law.justia.com/codes/tennessee/2018/title-4/chapter-3/part-10/section-4-3-1016/.

- Cammenga, Janelle. Facts and Figures 2020: How Does Your State Compare? Tax Foundation. [Online] February 13, 2020. https://taxfoundation.org/publications/facts-and-figures/.

- Congressional Research Service. The Coronavirus Relief Fund (CARES Act, Title V): Background on State and Local Allocations. April 1, 2020. https://crsreports.congress.gov/product/pdf/R/R46298.

- Center on Budget and Policy Priorities. How Will States and Localities Divide the Fiscal Relief in the Coronavirus Relief Fund? March 27, 2020. https://www.cbpp.org/research/state-budget-and-tax/how-will-states-and-localities-divide-the-fiscal-relief-in-the