Within 24 months of launching in 2015, diabetes device firm Beta Bionics grabbed the attention of industry giants like Eli Lilly and Novo Nordisk. But when Boston University professor Ed Damiano set out to raise a new tranche of funding for the startup last year, his hopes were low.

Diabetes device makers were struggling to raise money in a field that was being increasingly dominated by two players: Acton-based Insulet Corp. (Nasdaq: PODD) and Medtronic plc, which had just signed an exclusive supply deal with UnitedHealthcare. Johnson & Johnson had shut down one of its diabetes subsidiaries. Shares of smaller firms like San Diego-based company Tandem Diabetes Care (Nasdaq: TNDM) dropped below $1.

Damiano was also running his company in some ways he expected potential investors would balk at. He had set up Beta Bionics as a benefit corporation — a classification introduced in Massachusetts in 2012 that allows executives to take social and environmental factors into account when making decisions, instead of just shareholders.

Further, he made it clear that the startup was not for sale, eliminating one of the few ways in which investors could get a return on their money.

"Parents of kids with Type 1 diabetes, the custodian of the mission (to treat it) needs to be us. Selling to big medtech or pharma would be the kiss of death," he said.

Nevertheless, Beta Bionics closed a $63 million Series B2 round last month, doubling the money it had raised since January. Comparatively, Insulet raised $11 million in its Series B round, while the average size of a medtech venture capital round was $29.3 million in 2018.

In the last couple of years, new figures on the $38 billion potential market for diabetes devices have reportedly drawn in giants like Apple (Nasdaq: AAPL) and FitBit (NYSE: FIT).

The field has been pegged as one that could benefit from technological advances, including new sensors and artificial intelligence tools. The approval of Tandem's first-of-its-kind pump by the FDA earlier this year, for example, sent the once beleaguered company's stock shooting up to $51.50 per share.

"The whole climate for diabetes medtech, specifically, has really changed since we started the process (of raising the Series B rounds)," Damiano said. “All these people who didn’t invest felt like they had missed the boat. At least, that’s what I think was going on in their minds."

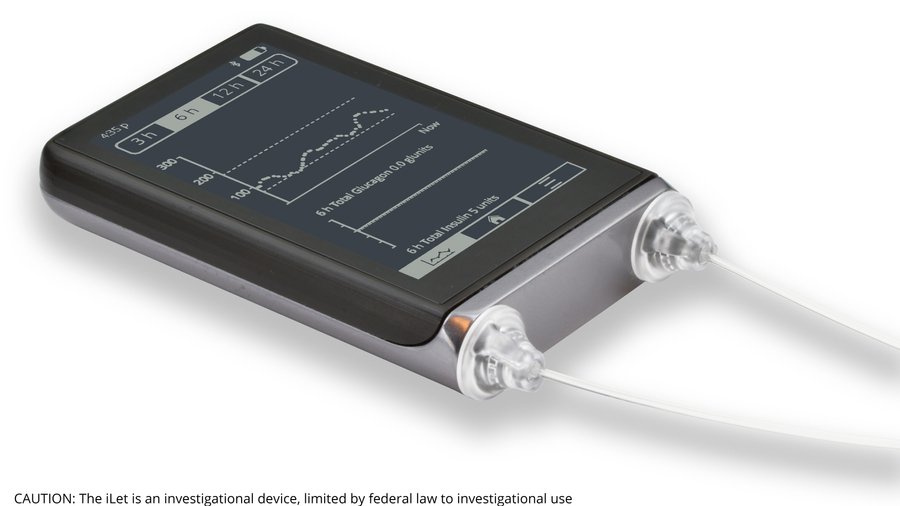

Damiano began developing the system roughly 17 years ago, after his son was diagnosed with Type 1 diabetes, the rarer form of the disease in which the body's immune system attacks the cells that produce insulin, leaving patients dependent on injections. Beta Bionics's pump, called iLet, independently monitors a person's blood sugar levels every five minutes and uses algorithms to administer insulin. But the device also releases a new glucose-stabilizing drug developed by Danish firm Zealand Pharma A/S to prevent overcorrecting and lowering the blood sugar level too much, which could place people at risk for hypoglycemia and seizures.

Since the device is dispersing a new drug, Beta Bionics will need to perform more stringent testing than most medical device companies, Damiano said.

The $126 million in freshly raised funds will help push Beta Bionics through two late-stage clinical trials in 2020. The 35-person company is also moving to a new headquarters in Concord.

All growth aside, Damiano has still had to lower his expectations for one goal: getting the device to market in time to accompany his now 20-year-old son to college.

"I've had to reset my goal, so I'm working on getting the device to him before he finishes college," Damiano said.

![Alnylam 300 Third Street Cambridge[1]](https://media.bizj.us/view/img/10648704/alnylam-300-third-street-cambridge1*120xx3463-2597-116-0.png)

9: AbbVie (13 percent growth)

2018 Mass. employees: 1,020

2017 Mass. employees: 900

Company’s main product/service focus: Global research-based specialty biopharmaceutical company

Top local executive: Richard Gonzalez, Chairman, CEO

Company's total 2017 revenue

| Rank | Prior Rank | Firm/Prior rank (*unranked in 2017)/ |

|---|---|---|

1 | 1 | Thermo Fisher Scientific Inc. |

2 | 2 | DePuy Synthes Cos, part of Johnson & Johnson Family of Companies |

3 | 3 | Boston Scientific Corp. |