For more details on our Mean More® Score, please download our thought paper.

Almost three out of every four adults in the U.S. own smartphones, a number that’s more than doubled in just four years. Whether for work or play, the devices have become part of everyday life for a soaring number of Americans.

But a smartphone can’t do much without a service plan from a mobile carrier. There’s a wide range of options available to consumers, with differences in data and usage limits, geographic coverage, price and contract length. Mobile carriers create campaigns calling attention to these components, tying them to the convenience and security a smartphone or tablet computer can provide its user.

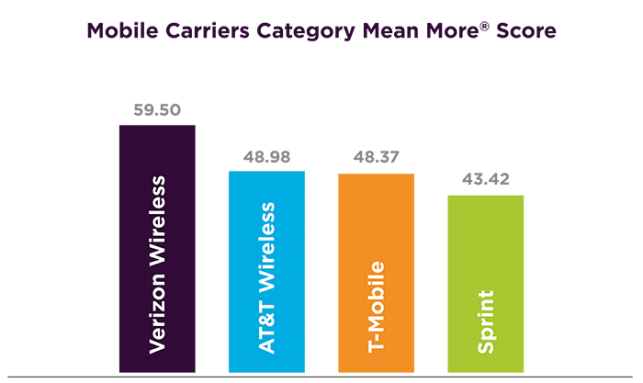

So, which mobile carrier leads the industry with consumers? Meyocks’ proprietary Mean More® Score is one tool that captures the strength of a brand. It’s based on a methodology of quantifying consumer disappointment with having to use the second choice in a given category – a unique way to capture loyalty to a brand. When it comes to mobile carriers, Verizon Wireless® users would be the most disappointed in having to opt for a different mobile provider.

Trademarks are the property of their respective owners.

Verizon’s 2016 Mean More Score of 59.50 put it almost 11 points ahead of AT&T Wireless®. Trailing Verizon and AT&T Wireless are T-Mobile® and Sprint®.

According to market share data for wireless carriers from Statista.com, Verizon Wireless and AT&T Wireless have the highest total wireless subscriptions among national carriers. As of the third quarter of 2016, 35% of U.S. wireless users subscribed to Verizon service, with just over 32% using AT&T Wireless. Sprint and T-Mobile round out the top four in total users, though fall around 20% lower than the two leaders in the category.

The latest Mean More Scores come two years after we last asked consumers for their thoughts on mobile carriers. In 2014, Verizon Wireless was also the category leader with a Mean More® Score of 58. Over the past two years, however, the Mean More Score gap has widened between Verizon and AT&T. Meanwhile, Sprint’s score shows considerable erosion in customer commitment, according to our Mean More Score metrics.

Network coverage is a key feature for consumers when it comes to choosing a mobile carrier. Even given Verizon’s usually higher price tag than its competitors, its Mean More Score could indicate consumers value network coverage over price competitiveness in making mobile carrier purchase decisions.

Why do Mean More Scores Matter?

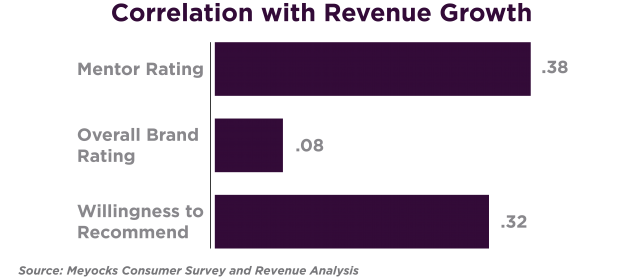

A Meyocks analysis of a number of consumer categories shows that Mean More Scores have a higher correlation with revenue growth than standard brand measurements like “Overall Brand Rating” and “Willingness to Recommend.”

Would you like to learn more about Mean More Scores and what they can mean for your product category? Let’s talk.