Quick Take: Mobile-Payment Fraud Rises in China, Report Finds

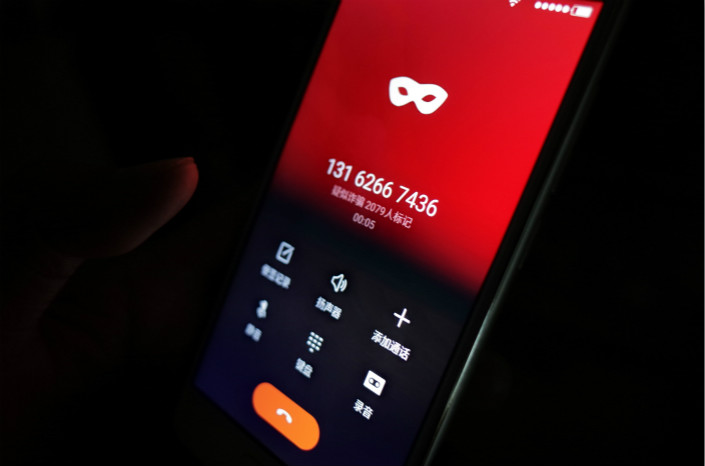

Mobile payments in China have increasingly made cash obsolete, but the convenience of the new technology has raised growing security concerns.

A China UnionPay survey of 105,000 people found that 60% had been exposed to some kind of mobile-payment security threat, including information leaks, fraud or malicious attacks.

QR codes — which are scanned using a mobile phone — have become the most popular payment technology in China, but fraud via this method is on the rise, the survey found. Nearly 30% of users reporting mobile-payment fraud said QR codes were involved, up from 15% last year.

For example, a common method of cheating users with QR codes involves using a fraudulent social media account, routing the scanned code to the thief’s payment account rather than to a retail establishment’s account.

Respondents reported risks were the highest during the opening of new accounts. To streamline the payment process, mobile platforms tend to use shortcuts — such as a mobile phone number — for user verification. But this can leave customers open to attacks, according to China UnionPay.

Older users were more vulnerable to fraud, the report found, with 59% of respondents above the age of 50 saying they had been cheated at least once. The investigation found that older people tend to be easily attracted to discounts, and may scan a given QR code more readily than younger users.

Women reported experiencing mobile-payment fraud 10% more often than men, but men reported a higher average financial loss.

Contact reporter Mo Yelin (yelinmo@caixin.com)

- 1In Depth: Why China’s Project Whitelists Can’t Cure Real Estate Slump

- 2Cover Story: China’s Balancing Act to Keep Its Social Security System Afloat

- 3China’s Youth Struggle to Find Work Despite Drop in Jobless Rate

- 4Exclusive: CATL Founder Upbeat About Ford Battery Plant Tie-Up, EVs Future in China

- 5China’s Macro Leverage Ratio Rises to 294.8% Despite Slower Borrowing

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas