Philip Hammond sparked a political row on Wednesday with a tax grab on self-employed workers that breached a Conservative manifesto pledge not to raise national insurance rates.

An increase in class four national insurance rates for the self-employed, to narrow the gap with salaried employees, who tend to be taxed more heavily, was one of the most conspicuous measures in a cautious budget that also saw the chancellor upgrade his economic forecasts.

In what will be the final spring budget – there is another due in the autumn – Hammond caved in to pressure from his own backbenches over the strains on social care, and pledged to set aside £2bn over the next three years to help councils cope.

He also announced a series of measures to prepare the economy for Brexit, including a new system of vocational education to create “parity of esteem” with academic courses.

The chancellor said he would increase class four national insurance contributions (NICs) by one percentage point to 10% in April 2018, rising again to 11% in 2019.

A Labour spokesman condemned what he called a “sole traders tax” – though the Treasury pointed out that the changes would only hit those whose profits exceeded £8,000, and many of those were due to benefit from a separate change due to take effect in April, which will see class two NICs, also paid by the self-employed, abolished.

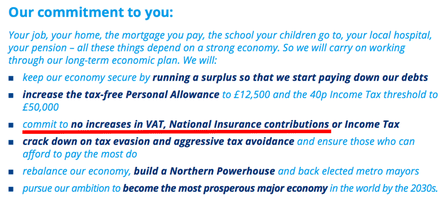

The Conservatives’ 2015 manifesto promised four times that the party would “not increase the rates of VAT, income tax or national insurance in the next parliament”. One of their key attacks on Labour was that Ed Miliband would raise NICs, in what David Cameron and George Osborne called a “jobs tax”.

In 2015, Osborne, then chancellor, tweeted: “Conservative pledge on tax: no increases in national insurance – nor an increase in its ceiling above the higher rate threshold.”

Hammond’s spokesperson insisted the policy did not break any promises, because “tax lock” legislation introduced by Osborne in September 2015 had not mentioned specific classes of national insurance. “The manifesto is not the place you should be looking for it; you should be looking for it in the legislation,” the spokesperson said.

The policy change comes alongside a cut in the tax-free threshold for dividends, which the Treasury believes encourages high-paid individuals to set themselves up as companies artificially. Between them, these two measures will raise £1.5bn a year by 2019-20.

Hammond said stronger than expected tax receipts had contributed to a better outlook for borrowing, but insisted it would be the wrong response to use up any of the extra headroom he created by loosening tax-and-spending rules last autumn.

Revealing that the Office for Budget Responsibility (OBR) had revised its growth forecast for this year from the 1.4% predicted in November to 2.0%, Hammond described the state of the British economy as one that “continues to confound the commentators”.

“As we start our negotiations to exit the European Union, this budget takes forward our plan to prepare Britain for a brighter future. It provides a strong and stable platform for those negotiations,” he said.

As well as money for social care, Hammond also promised £100m for triage services for the NHS and offered relief to companies hit by business rates increases, following a backlash from within his own party. There was also money for free schools, which would be able to offer selective education.

The NICs change, which Treasury sources said would affect highly paid professionals such as GPs, QCs and partners at law firms, was met with anger within the sector, and by MPs who said taxi drivers and delivery workers were among those affected.

Simon McVicker, of the trade body Ipse, which represents freelancers and independent professionals, said: “When you look at the additional support offered for business rates it appears as if the chancellor is supporting SMEs [small and medium-sized businesses] by hitting entrepreneurs and the smallest of businesses.”

The Labour leader, Jeremy Corbyn, said: “We have long argued for a clampdown on bogus self-employment, but today the chancellor seemed to put the burden on the self-employed worker instead. There has to be a something for something deal. So I hope the chancellor will bring forward extra social security in return. One policy that Labour backs is extending statutory maternity pay to self-employed women, which is likely to cost just £10m a year.”

Chris Leslie, a former shadow chancellor, asked in the Commons: “On the point about the increase in national insurance contributions for the self-employed, don’t you think that the chancellor needs to explain why he’s breaking a manifesto promise made in the 2015 general election manifesto on that?”

But the Resolution Foundation thinktank said it was a good move because overall more than half of self-employed workers would be better off by 2019-20 as a result of the two NI measures, and this would target the best off. Hammond said it would remedy an unfairness in the tax system between employees and the self-employed.

The threshold at which people have to start paying tax on dividend income will be cut from £5,000 to £2,000 from April 2018. This will mean a tax rise for many shareholders, including those who take their earnings through dividends and savers who have invested in shares.

It partially reverses changes Osborne made in a previous budget and is due to raise almost £900m a year by 2019.

Hammond’s injection into adult social care followed calls from MPs across the political spectrum and local councils to urgently plug a massive spending gap in the support for some of the most vulnerable elderly and disabled people in the country.

But campaigners said the chancellor did not go far enough, saying that £2bn over three years would not meet the huge growth in demand.

The Liberal Democrats’ Norman Lamb, who has organised a cross-party group to push for better social care, called it “wholly inadequate”. He added: “The result will be an increase in the number of people going without the care they need, which will put more pressure on the NHS, more people ending up unnecessarily in hospital – it gives sticking plasters a bad name.”

The shadow health secretary, Jonathan Ashworth, said Labour had been calling for £2bn now, rather than over three years. He also said that £100m for triage services did not come close to plugging the shortfall in capital spending. “This government has ignored the £5bn maintenance backlog and cut capital by £1.2bn last autumn,” he said.

On growth, the OBR, set up to provide independent forecasts for the government, now predicts that after this year, economic growth will slow to 1.6% in 2018, before picking up to 1.7% in 2019, 1.9% in 2020 and 2% in 2021.

On the public finances, the OBR forecasts borrowing will be £51.7bn in 2016-17, down significantly from £68.2bn forecast in November. Borrowing will be £58.3bn in the financial year 2017-18 and will fall to £40.8bn in 2018-19, £21.4bn in 2019-20 and then £20.6bn in 2020-21.

Here’s a snapshot of economic data announced by the Chancellor #Budget2017 pic.twitter.com/m3Lq5e1VtQ

— HM Treasury (@hmtreasury) March 8, 2017

Hammond sought to underscore government policies to “help ordinary working families” such as support with childcare costs and the “national living wage”.

But he disappointed anti-poverty campaigners who had urged him to do more for those on the lowest incomes by scaling back welfare cuts and abandoning a freeze on the pay of public sector workers.

Corbyn said the budget represented “utter complacency” about the state of the economy and the crisis facing public services. He talked about thousands of people turning up at food banks and sleeping rough, arguing that for millions the economy did not work for them.

Comments (…)

Sign in or create your Guardian account to join the discussion