Aircraft Actuator Market by Component (Electronic, Electrical, & Mechanical), Application (Power Generation, Power Distribution, Flight Control, Landing & Braking, Fuel, Avionics, & Health Monitoring), Aircraft Type and Geography - Global Forecast to 2022

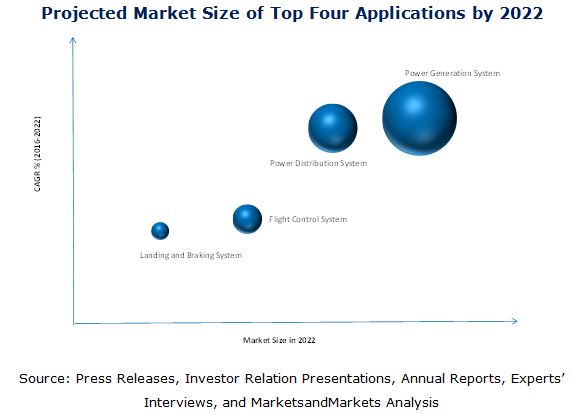

The aircraft actuator market was valued at USD 10.30 Billion in 2015 and USD 20.13 Billion by 2022 and is expected to grow at a CAGR of 9.5% between 2016 and 2022. The base year used for this study is 2015 and the forecast period is from 2016 to 2022. This report provides a detailed analysis of the aircraft actuator market based on component, aircraft type, and application. It has been estimated that the power generation application would hold a large share of the aircraft actuator market. However, the market for health monitoring systems is expected to grow at the highest CAGR between 2016 and 2022. The global aerospace industry is set for extraordinary growth over the next generation, driven by the demand in emerging markets. Continued economic growth, increasing urbanization, a growing middle class population, rising international students, tourists, and migrants; flourishing trade among nations, liberalization, and bilateral air service agreements are just some of the factors that are set to increase the global connectivity. The growth of the aerospace industry will directly impact and drive the aircraft actuator market.

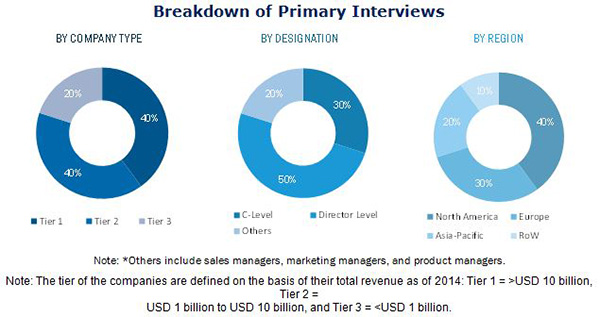

The research methodology used to estimate and forecast the aircraft actuator market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global aircraft actuator market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors, and executives. The market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

This study answers several questions for the target audiences, primarily which market segments to focus on, in next two to five years for prioritizing the efforts and investments.

The actuators and electronic components ecosystem includes raw material suppliers, OEMs (component manufacturers), system integrators, airplane manufacturers, and end users as important elements.

The target audience:

- Raw material suppliers

- Actuator, electronic, and electrical & mechanical component designers, manufacturers, and suppliers

- Aircraft system integrators, suppliers, and service providers

- Aircraft manufacturers

- Application software providers

- Government bodies such as regulating authorities and policy makers

- Aviation-related associations, organizations, forums, and alliances

- Research institutes and organizations

- Market research and consulting firms

Report Scope:

In this report, the aircraft actuator market has been segmented into the following categories:

Market, by Component:

- Actuator

- Electronic Component

- Electrical and Mechanical Component

Market, by Aircraft Type

- Narrow Body

- Wide Body

- Very Large Body

Market, by Application:

- Flight Control System

- Health Monitoring System

- Power Distribution System

- Power Generation System

- Avionics System

- Landing and Braking System

- Fuel Management System

- Others

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Component Analysis

Further breakdown of the sub-type of component segment, by application

Further breakdown of the sub-type of component segment, by aircraft type

Aircraft Type Analysis

Further breakdown of the aircraft type segment, by components sub-type

Application Analysis

Further breakdown of the application segment, by components sub-type

Company Information

Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

The aircraft actuator market was valued at USD 10.30 Billion in 2015 and is expected to grow at a CAGR of 9.5% between 2016 and 2022. The actuators and electronic components market growth can be directly linked with the growth of the commercial aviation industry. The most significant factor driving the aircraft actuator market is the increasing demand for commercial aircraft globally. Major factors responsible for this growth are growing urban population, rise in the per capita income, emerging economies, hectic lifestyles and the need for time saving, and increased demand from developing countries. The growing trend of more electric aircraft (MEA) is the other factor driving the growth of the aircraft actuator market. Developments in fault-tolerant architecture, electro-hydrostatic actuators, primary and secondary flight control systems, power generation and conversion systems, and high-density electric motors are strengthening the concept of MEA.

The demand to increase the safety associated with air travel has boosted the demand for health monitoring systems. Health monitoring system followed by power generation system and power distribution system are the fastest-growing application sectors of the aircraft actuator market. The increasing trend to adopt the MEA concept has resulted in an increasing number of electronic components replacing the traditional mechanical or hydraulic components. This has resulted in increased power requirement by various electronic components, further increasing the demand for power generation systems and power distribution systems.

Electrical and mechanical components held the largest share of the overall component market in 2015; this market is expected to grow at highest CAGR during the forecast period. This is mainly because electrical and mechanical components are part of all big and small applications in a commercial aircraft.

Narrow body aircraft had the largest market for commercial aviation. The rapid growth in the aviation sector in emerging economies has created a huge market for low-cost aviation carriers and narrow body aircraft are widely preferred for domestic as well as international routes.

Factors such as rapid technological upgrades and stringent regulatory framework are challenges for the aircraft actuator market. The equipment that is built by manufacturers tends to have long life cycles that outlast the life spans of semiconductors and other components that are critical to those systems. This is forcing OEMs to change their design of equipment which involves lots of R&D, cost, and time. Moreover, regulatory compliance is also a major factor behind the current wave of innovation. With rapid technological advancements going on in the sector and new technologies and products replacing the old ones every five to seven years, it is becoming a challenge for the component and system manufacturers to adhere to the regulatory environment.

UTC Aerospace Systems (U.S.) and Honeywell Aerospace, Inc. (U.S.) are two major players in the aircraft actuator market. The companies heavily invest in research and development activities and introduce new products to stay ahead in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Global Actuators and Electronic Components Market for Commercial Aviation

4.2 Actuators and Electronic Components Market for Commercial Aviation, By Application

4.3 Actuators and Electronic Components Market for Commercial Aviation, By Component and Aircraft Type

4.4 Aircraft Deliveries in 2015

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Actuators and Electronic Components Market for Commercial Aviation, By Component

5.2.2 Actuators and Electronic Components Market for Commercial Aviation, By Application

5.2.3 Actuators and Electronic Components Market for Commercial Aviation, By Aircraft Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Trend of More Electric Aircraft

5.3.1.2 Increased Demand for Commercial Aircraft Globally

5.3.2 Restraints

5.3.2.1 Rapid Technological Upgrades

5.3.3 Opportunities

5.3.3.1 Growing Air Traffic in Emerging Economies

5.3.3.2 Shifting Focus From Defense to Commercial Aviation

5.3.4 Challenges

5.3.4.1 Stringent Regulatory Framework

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Competitive Rivalry

7 Market, By Component (Page No. - 50)

7.1 Introduction

7.2 Actuators

7.2.1 Hydraulic Actuators

7.2.2 Electric Actuators

7.2.3 Pneumatic Actuators

7.2.4 Mechanical Actuators

7.2.5 Other Actuators

7.3 Electronic Components

7.3.1 Field Programmable Gate Arrays (FPGA)

7.3.2 Integrated Circuits (ICS)

7.3.3 Transistors

7.3.3.1 Metal-Oxide Semiconductor Field-Effect Transistors (MOSFETS)

7.3.3.2 Insulated-Gate Bipolar Transistors (IGBTS)

7.3.3.3 Bipolar Junction Transistors (BJTS)

7.3.4 Thyristors

7.3.5 Diodes

7.3.6 Converters

7.3.6.1 AC-DC Converter

7.3.6.2 DC-AC Converter

7.3.6.3 DC-DC Converter

7.3.6.4 Bi-Directional DC-DC Converter

7.3.7 Others

7.4 Electrical and Mechanical Components

7.4.1 Motors

7.4.1.1 AC Motors

7.4.1.1.1 Induction Motors

7.4.1.1.2 Synchronous Motors

7.4.1.2 DC Motors

7.4.1.2.1 Brushed DC Motors

7.4.1.2.2 Brushless Permanent Magnet Motors

7.4.2 Valves

7.4.3 Generators

7.4.4 Auxiliary Power Units (APUS)

7.4.5 Others

8 Market, By Aircraft Type (Page No. - 68)

8.1 Introduction

8.2 Narrow Body

8.3 Wide Body

8.4 Very Large Body

9 Market, By Application (Page No. - 76)

9.1 Introduction

9.2 Flight Control System

9.3 Health Monitoring System

9.4 Power Distribution System

9.4.1 Centralized Electrical Power Distribution System (CEPDS)

9.4.2 Semi -Distributed Electrical Power Distribution System (SDEPDS)

9.4.3 Advanced Electrical Power Distribution System (AEPDS)

9.4.4 Fault-Tolerant Electrical Power Distribution System (FTEPDS)

9.5 Power Generation System

9.6 Avionics System

9.7 Landing and Braking System

9.8 Fuel Management System

9.9 Others

10 Geographic Analysis (Page No. - 90)

10.1 Introduction

10.2 Americas

10.3 Europe

10.4 Asia-Pacific

10.5 RoW

11 Competitive Landscape (Page No. - 97)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Agreements and Contracts

11.3.2 Acquisitions, Collaborations, and Joint Ventures

11.3.3 New Product Launches

11.3.4 Expansions

12 Company Profiles (Page No. - 104)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 System Manufacturers

12.2.1 Honeywell Aerospace

12.2.2 Rockwell Collins, Inc.

12.2.3 Safran SA

12.2.4 UTC Aerospace Systems

12.2.5 Woodward, Inc.

12.3 Component Manufacturers

12.3.1 Infineon Technologies AG

12.3.2 Microsemi Corp.

12.3.3 Vishay Intertechnology, Inc.

12.4 Commercial Aircraft Manufacturers

12.4.1 Airbus Group SE

12.4.2 The Boeing Company

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 135)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (55 Tables)

Table 1 Orders and Deliveries From Boeing Family Aircraft in 2015

Table 2 Orders and Deliveries From Airbus Family Aircraft in 2015

Table 3 Porter’s Five Forces Analysis With Its Weightage Impact

Table 4 Actuators and Electronic Components Market Size for Commercial Aviation, By Component, 2013–2022 (USD Million)

Table 5 Actuator Mapping for Narrow Body Aircraft

Table 6 Actuators Mapping for Wide-Body Aircraft

Table 7 Actuators Mapping for Wide-Body Aircraft

Table 8 Actuator Configuration in A Conventional Commercial Aircraft for Flight Control Surfaces and Landing Gear

Table 9 Actuators and Electronic Components Market Size for Commercial Aviation, By Actuator Type, 2013–2022 (USD Million)

Table 10 Actuators and Electronic Components Market Size for Commercial Aviation for Actuators, By Application, 2013–2022 (USD Million)

Table 11 Actuators and Electronic Components Market Size for Commercial Aviation for Actuators, By Aircraft Type, 2013–2022 (USD Million)

Table 12 Actuators and Electronic Components Market Size for Commercial Aviation, By Electronic Component Type, 2013–2022 (USD Million)

Table 13 Actuators and Electronic Components Market Size for Commercial Aviation for Electronic Components, By Application, 2013–2022 (USD Million)

Table 14 Actuators and Electronic Components Market Size for Commercial Aviation for Electronic Components, By Aircraft Type, 2013–2022 (USD Million)

Table 15 Actuators and Electronic Components Market Size for Commercial Aviation, By Transistor Type, 2013–2022 (USD Million)

Table 16 Actuators and Electronic Components Market Size for Commercial Aviation, By Converter Type, 2013–2022 (USD Million)

Table 17 Actuators and Electronic Components Market Size for Commercial Aviation, By Electrical and Mechanical Component Type, 2013–2022 (USD Million)

Table 18 Actuators and Electronic Components Market Size for Commercial Aviation for Electrical and Mechanical Components, By Application, 2013–2022 (USD Million)

Table 19 Actuators and Electronic Components Market Size for Commercial Aviation for Electrical and Mechanical Components, By Aircraft Type, 2013–2022 (USD Million)

Table 20 Actuators and Electronic Components Market Size for Commercial Aviation, By Aircraft Type, 2013–2022 (USD Million)

Table 21 Actuators and Electronic Components Market Size for Commercial Aviation for Narrow Body Aircraft, By Component, 2013–2022 (USD Million)

Table 22 Actuators and Electronic Components Market Size for Commercial Aviation for Narrow Body Aircraft, By Application, 2013–2022 (USD Million)

Table 23 Actuators and Electronic Components Market Size for Commercial Aviation for Wide Body Aircraft, By Component, 2013–2022 (USD Million)

Table 24 Actuators and Electronic Components Market Size for Commercial Aviation for Wide Body Aircraft, By Application, 2013–2022 (USD Million)

Table 25 Actuators and Electronic Components Market Size for Commercial Aviation for Very Large Body Aircraft, By Component, 2013–2022 (USD Million)

Table 26 Actuators and Electronic Components Market Size for Commercial Aviation for Very Large Body Aircraft, By Application, 2013–2022 (USD Million)

Table 27 Actuators and Electronic Components Market Size for Commercial Aviation, By Application, 2013–2022 (USD Million)

Table 28 Actuators and Electronic Components Market Size for Commercial Aviation for Flight Control Systems, By Component, 2013–2022 (USD Million)

Table 29 Actuators and Electronic Components Market Size for Commercial Aviation for Flight Control Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 30 Actuators and Electronic Components Market Size for Commercial Aviation for Health Monitoring Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 31 Actuators and Electronic Components Market Size for Commercial Aviation for Power Distribution Systems, By Component, 2013–2022 (USD Million)

Table 32 Actuators and Electronic Components Market Size for Commercial Aviation for Power Distribution Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 33 Actuators and Electronic Components Market Size for Commercial Aviation for Power Generation Systems, By Component, 2013–2022 (USD Million)

Table 34 Actuators and Electronic Components Market Size for Commercial Aviation for Power Generation Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 35 Actuators and Electronic Components Market Size for Commercial Aviation for Avionics Systems, By Component, 2013–2022 (USD Million)

Table 36 Actuators and Electronic Components Market Size for Commercial Aviation for Avionics System, By Aircraft Type, 2013–2022 (USD Million)

Table 37 Actuators and Electronic Components Market Size for Commercial Aviation for Landing and Braking Systems, By Component, 2013–2022 (USD Million)

Table 38 Actuators and Electronic Components Market Size for Commercial Aviation for Landing and Braking Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 39 Actuators and Electronic Components Market Size for Commercial Aviation for Fuel Management Systems, By Component, 2013–2022 (USD Million)

Table 40 Actuators and Electronic Components Market Size for Commercial Aviation for Fuel Management Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 41 Actuators and Electronic Components Market Size for Commercial Aviation for Other Systems, By Component, 2013–2022 (USD Million)

Table 42 Actuators and Electronic Components Market Size for Commercial Aviation for Other Systems, By Aircraft Type, 2013–2022 (USD Million)

Table 43 Global Outlook for Commercial Aviation, 2016–2035

Table 44 North America: Outlook for Commercial Aviation, 2016–2035

Table 45 South America: Outlook for Commercial Aviation, 2016–2035

Table 46 Europe: Region Outlook for Commercial Aviation, 2016–2035

Table 47 Asia-Pacific: Outlook for Commercial Aviation, 2016–2035

Table 48 Middle East: Outlook for Commercial Aviation, 2016–2035

Table 49 Africa: Outlook for Commercial Aviation, 2016–2035

Table 50 Russia and Others: Outlook for Commercial Aviation, 2016–2035

Table 51 Market Ranking of the Top Five Players in the Actuators and Electronic Components Market for Commercial Aviation, 2015

Table 52 Five of the Most Recent Agreements and Contracts in the Actuators and Electronic Components Market for Commercial Aviation

Table 53 Five of the Most Recent Acquisitions, Collaborations, and Joint Ventures in the Actuators and Electronic Components Market for Commercial Aviation

Table 54 Five of the Most Recent New Product Launches in the Actuators and Electronic Components Market for Commercial Aviation

Table 55 Three of the Most Recent Expansions in the Actuators and Electronic Components Market for Commercial Aviation

List of Figures (48 Figures)

Figure 1 Actuators and Electronic Components Market for Commercial Aviation: Research Design

Figure 2 Process Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions for the Research Study

Figure 6 Narrow Body Aircraft Expected to Have A Large Market During the Forecast Period

Figure 7 Concept of More Electric Aircraft to Generate More Demand for Electrical and Mechanical Components in the Commercial Aviation Sector

Figure 8 Health Monitoring Systems Expected to Be the Fastest-Growing Application in the Market During the Forecast Period

Figure 9 Increasing Demand of Commercial Aircraft With Growing Air Traffic to Increase the Demand for Actuators and Electronic Components

Figure 10 Top Three Applications of Actuators and Electronic Components for Commercial Aviation

Figure 11 Electrical and Mechanical Components and Narrow Body Aircraft Held More Than Two-Third of the Market Share

Figure 12 Major Parameters Impacting the Dynamics of the Actuators and Electronic Components Market for Commercial Aviation

Figure 13 Value Chain Analysis: Major Value is Added During the Original Equipment Manufacturing and System Integration Phases

Figure 14 Porter’s Five Forces Analysis

Figure 15 High Competitve Rivalry Due to the Presense of A Large Number of Established Players

Figure 16 Presense of Several Established Playes to Have the Highest Impact on New Entrants

Figure 17 Legislative Regulations is the Key Factor Impacting the Market for Substitutes

Figure 18 Bargainnig Power of Suppliers is Highly Impacted By Supplier Concentration

Figure 19 Buyer Concentration in the Industry is Key Factor Supporting Buyers’ Bargaining Power

Figure 20 Large Number of Players Led to High Degree of Competition in the Market

Figure 21 Electrical and Mechanical Components to Be the Largest and the Fastest-Growing Component Type During the Forecast Period

Figure 22 Electric Actuators to Be the Fastest-Growing Actuator Type for Commercial Aviation During the Forecast Period

Figure 23 Market for Converters to Be the Largest and Fastest-Growing During the Forecast Period

Figure 24 Generator to Be the Largest and the Fastest-Growing Market for Electrical and Mechanical Components During the Forecast Period

Figure 25 Estimated New Airplane Deliveries From 2016 to 2035

Figure 26 Narrow Body Aircraft Estimated to Hold A Major Share of the Overall Actuators and Electronic Components Market During the Forecast Period

Figure 27 Power Generation Application to Hold A Major Share of the Overall Market During the Forecast Period

Figure 28 Electronic Components Market Size for Commercial Aviation for Health Monitoring Systems, 2013–2022 (USD Million)

Figure 29 Aircraft Deliveries Snapshot (2016–2035)

Figure 30 Companies Adopted Agreements and Contracts as the Key Growth Strategy Between January 2014 and February 2016

Figure 31 Actuators and Electronic Components Market for Commercial Aviation: Market Evaluation Framework

Figure 32 Battle for Market Share

Figure 33 Geographic Revenue Mix of 5 Actuating System and Electronic Control System Manufacturers in the Commercial Aviation Industry

Figure 34 Honeywell Aerospace: Company Snapshot

Figure 35 Honeywell Aerospace: SWOT Analysis

Figure 36 Rockwell Collins, Inc.: Company Snapshot

Figure 37 Rockwell Collins, Inc.: SWOT Analysis

Figure 38 Safran SA: Company Snapshot

Figure 39 Safran SA: SWOT Analysis

Figure 40 UTC Aerospace Systems: Company Snapshot

Figure 41 UTC Aerospace Systems: SWOT Analysis

Figure 42 Woodward, Inc.: Company Snapshot

Figure 43 Woodward, Inc.: SWOT Analysis

Figure 44 Infineon Technologies AG: Company Snapshot

Figure 45 Microsemi Corp.: Company Snapshot

Figure 46 Vishay Intertechnology, Inc.: Company Snapshot

Figure 47 Airbus Group SE: Company Snapshot

Figure 48 The Boeing Company: Company Snapshot

Growth opportunities and latent adjacency in Aircraft Actuator Market

I'm currently looking for information related to aircraft industry and more specifically on Nacelles to work on my thesis. How would the trends in electric aircrafts and demand for commercial aircraft affect this market?

Have you included any case studies about the use of aircraft actuators used for various aircraft types such as narrow body, wide body, and large body? How have you defined these types?