The initial public offering of Prince Pipes and Fittings will open for subscription on December 18. The bidding for anchor investors' reserved portion will open for a day on December 17.

All potential bidders, other than anchor investors, shall participate in the offer mandatorily through the Applications Supported by Blocked Amount (ASBA) process (including UPI ID in case of retail individual bidders, if applicable) by providing details of their respective bank accounts in which the corresponding bid amount will be blocked by the SCSBs.

Equity shares will be listed on BSE and the National Stock Exchange. BSE shall be the designated stock exchange. JM Financial and Edelweiss Financial Services are the book running lead managers to the issue while Link Intime India is the registrar to the issue.

Here are 10 key things to know before subscribing the public issue:

Company profile

Prince pipe is recognised as one of the leading polymer pipes and fittings manufacturers in India in terms of number of distributors. It markets products under two brand names: Prince Piping Systems; and Trubore. It is positioned as an end-to end polymer piping systems solution provider due to its comprehensive product range.

As of October 31, 2019, it had a product range of 7,167 SKUs. Its products are used for varied applications in plumbing, irrigation and soil, waste and rain water (SWR) management.

The total installed capacity of its six existing plants is 2,41,211 tonnes per annum as of October 2019.

Prince Pipe plans to expand the installed capacity at Jobner (Rajasthan) plant from 6,221 tonnes per annum to 17,021 tonnes per annum by December 2019 and to 20,909 tonnes per annum by March 2020. It also plans to set up a new manufacturing plant in Sangareddy (Telangana), with a total estimated installed capacity of 51,943 tonnes per annum in FY21.

It uses five contract manufacturers, of which two are in Aurangabad (Maharashtra), one is in Guntur (Andhra Pradesh), one is in Balasore (Odisha) and one is in Hajipur (Bihar).

Public Issue

The issue consists of fresh issue of Rs 250 crore and offer for sale of Rs 250 crore.

The offer for sale comprises selling of Rs 20 crore shares by Jayant Shamji Chheda, Rs 140 crore shares by Tarla Jayant Chheda, Rs 50 crore shares by Parag Jayant Chheda and Rs 40 crore shares by Vipul Jayant Chheda, which all are promoters.

Bids can be made for a minimum of 84 equity shares and in multiples of 84 shares thereafter. The issue will close on December 20.

The 50 percent of the public issue, or Rs 250 crore shares, are reserved for qualified institutional buyers while 15 percent (Rs 75 crore) is reserved for non-institutional investors and 35 percent (Rs 175 crore shares) for retail bidders.

Pre-IPO placement

The company had undertaken a private placement of 5,96,500 compulsorily convertible preference shares, which have been converted into 59,65,000 equity shares for cash consideration aggregating to Rs 106.18 crore (pre-IPO placement). Hence, the size of the fresh issue of up to Rs 356.18 crore has been reduced by Rs 106.18 crore and accordingly the fresh issue is up to Rs 250 crore, the company said in its DRHP.

South Asia Growth Fund II Holdings LLC picked up 6.18 percent (representing 59,26,820 equity shares) stake in the company in pre-IPO placement.

Price band

Prince Pipes, in consultation with merchant bankers, has fixed IPO price band at Rs 177-178 per share, a premium of Rs 167-168 per share over face value of Rs 10 per share.

Issue size and objectives of the issue

The company aims to raise Rs 500 crore through public issue.

The company will not receive any proceeds from the offer for sale and promoter selling shareholders intend to use those proceeds towards repayment of the outstanding bonds issued by Express Infra Projects LLP.

One of our promoter group entities, Express Infra Projects LLP, has issued bonds aggregating up to Rs 200 crore, of which Rs 191.5 crore was outstanding as at October 2019. For securing these bonds, promoters had pledged certain equity shares aggregating 35 percent of the equity share capital of company, with IDBI Trusteeship Services, acting as a trustee on behalf of the bondholders.

The company intends to utilise net proceeds from fresh issue and pre-IPO placement for repayment of certain outstanding loans, financing the project cost towards establishment of a new manufacturing facility, either set up directly or indirectly, up gradation of equipment at manufacturing facilities; and general corporate purposes.

Competitive Strengths

> Strong brands in the pipes and fittings segment with over 30 years’ experience and multiple industry awards and accolades;

> Comprehensive product portfolio across polymers serving diverse end-use applications;

> Strategically located manufacturing facilities with a core focus on quality;

> Large and growing distribution network;

> Technical collaboration with a reputed international player for almost the last five years, which has helped company to improve the quality of products and manufacturing efficiency;

> Company has strong management team;

Strategies

> Company will continue to actively manage product mix at each of its plants to improve profit margins;

> Company believe its increased installed capacity for manufacturing DWC pipes will enable it to increase sales of DWC pipes;

> It plans to increase sales of prince piping systems products by reaching out to more retailers and expanding distribution network both in new areas as well as in areas where it already has a strong presence;

> Company plans to set up a new manufacturing plant in Telangana and expand capacity at plant in Rajasthan;

> Company plans to expand the Trubore brand (popular in south India, primarily in Tamil Nadu), which acquired in 2012, to new geographies like North, East and West India;

> Prince Pipes plans to increase awareness of its brands through major marketing initiatives

Financials

Company reported a profit of Rs 83.35 crore in financial year 2018-19, a growth of 14.6 percent over previous year and revenue grew by 19 percent to Rs 1,571.8 crore in same period. But revenue declined 0.71 percent and profit fell 1.9 percent in FY18 compared to FY17.

Its profit stood at Rs 26.67 crore on revenue of Rs 380 crore for three months period ended June 2019.

Top 20 distributors account 15-20 percent of company's sales and retail segment account 20 percent to total revenue and the rest is accounted by institutions.

Jayant Shamji Chheda, Parag Jayant Chheda and Vipul Jayant Chheda have provided personal guarantees amounting to Rs 612.97 crore as at October 31, 2019 to lenders in relation to the outstanding loans availed by company.

Promoters and Group Companies

Promoters of company are Jayant Shamji Chheda, Tarla Jayant Chheda, Parag Jayant Chheda, Vipul Jayant Chheda and Heena Parag Chheda.

Parag Jayant Chheda and Vipul Jayant Chheda are two sons of Jayant Shamji Chheda while Heena Parag Chheda, the Vice President – Finance of company, is wife of Parag Jayant Chheda.

Promoters held 90.06 percent stake in the company at the time of filing red herring prospectus.

Prince Pipes' group companies are Ace Polyplast Private Limited; Pinnacle Realty Projects Private Limited; and Accord Infra Projects Private Limited, wherein promoters' family owns 100 percent stake each.

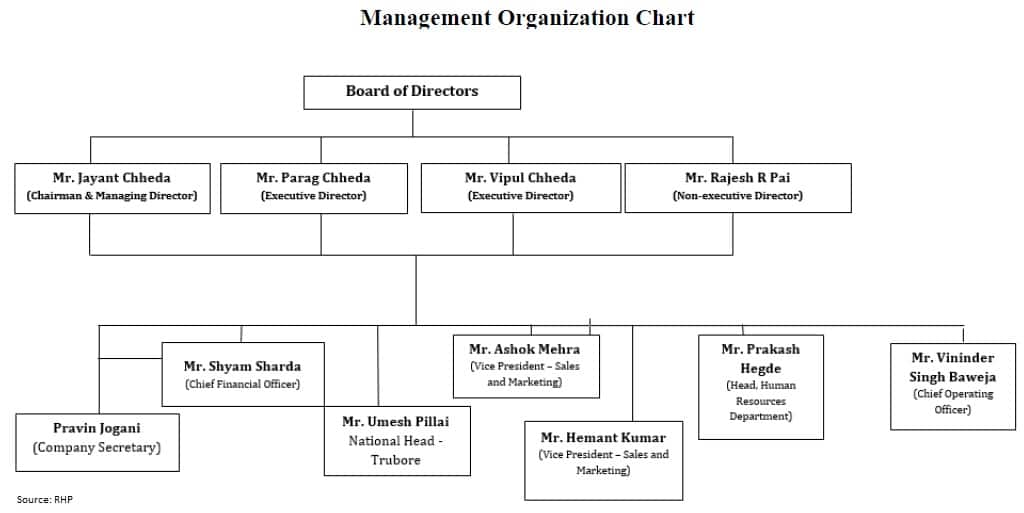

Management

Jayant Shamji Chheda, the Chairman and Managing Director of the company, has more than three decades of experience in the pipes segment.

Parag Jayant Chheda and Vipul Jayant Chheda are executive directors of the company.

Rajesh R Pai is the non-executive director while Ramesh Chandak, Mohinder Pal Bansal, Dilip Deshpande and Uma Mandavgane independent directors on the board.

Shyam Kishanchand Sharda, the Chief Financial Officer, is a Chartered Accountant and has approximately two decades’ experience in accounting, finance, and taxation. Pravin Jogani is the Company Secretary and Compliance Officer.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!