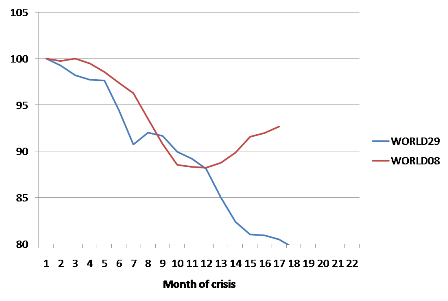

World industrial production in the Great Depression and now:

Data for the Depression courtesy of Eichengreen and O’Rourke. Data for the Great Recession (starting April 2008) from Netherlands Bureau for Cyclical Economic Analysis.

Basically, we started out with a year that matched the Great Depression, but have since pulled back a bit from the edge of the abyss.

Comments are no longer being accepted.