Board Games are Back: A Social ROI Report

Modern consumers spend too much time looking at screens. I consider it meaningful that even the kings of driving product adoption, Apple, recently added a feature to help people stay conscious of how long they spend looking at a piece of glass (that's your iPhone) instead of the real world. Even CEO Tim Cook shuts off all notifications now to avoid screen addiction.

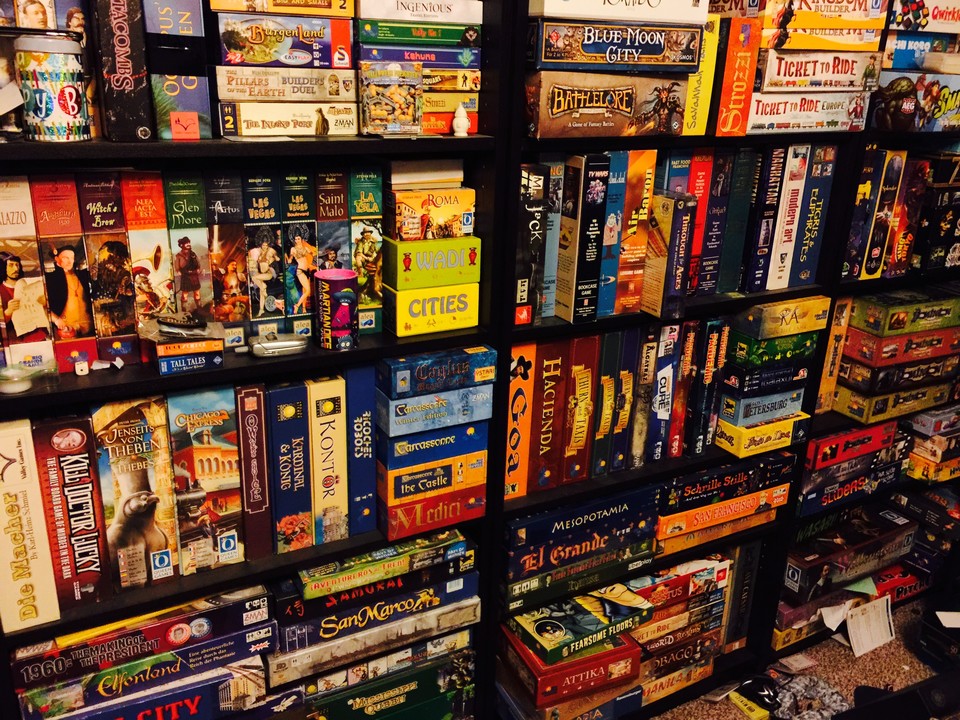

The backlash against endless screen time is powering growth in an industry for the hobby I've engaged in all my life: Board Games. As an information worker for nearly 30 years, I’m wary of going home to log into Netflix for a binge-watch or jump on the Xbox to battle it out with friends. When I’m done working hard at the screen all day, I want to see faces and talk to people. I want to interact, negotiate and make decisions that affect the people in front of me, not just all over the digital world. Board games are wonderful for a disconnected experience with IRL humans, not just virtual ones.

Thankfully, more people are taking up the hobby—a lot more. The global board game market is predicted to hit 12 billion dollars by 2023, with annual growth accelerating through multiple pathways. For example, if crowdfunding had a case study, it would be the board game market. Multi-million-dollar Kickstarter campaigns have been run by both relative upstarts like Cool Mini or Not (now called CMON because they don’t just do miniature games any longer) and old-school 80's game companies like Steve Jackson Games. Heck, Tasty Minstrel Games invented many of the Stretch Goals that are now a huge part of every crowdfunding campaign; for the uninitiated, these are bonuses that the creator provides if the campaigns hits certain funding goals. Practically every industry that crowdfunds uses them now, but they started with board games.

That’s not all: Board Game Cafes are becoming a new ‘third place’ for people to gather to unwind, major mainstream retailers like Target, Walmart and Barnes and Noble are carrying more board games every year (even soliciting ‘exclusive’ editions from publishers), and we have even seen the birth of a cottage industry for upgrading board games with nicer components and containers that more suitably fit the games so many have come to love. Companies like The Broken Token and Top Shelf Gamer are expanding this last category constantly as the flood of new board games keeps rising.

With all this growth, we see a market rich with smaller companies and some behemoths. Like all modern products, a key way in which board games are sold is through social media and content marketing. YouTube is populated with myriad tabletop game influencers who explain games, show themselves playing games, or just ‘preview’ games for their audience, often via paid endorsements from publishers. Instagram is full of gorgeously-filtered images of board games, Facebook has lively commentary and videos, and the Twitterverse endlessly debates the merits of new games, while promoting the heck out of the latest Kickstarter campaign that is blasting past 400% funding. Board Games, my gentle reader, have arrived.

So, how are the key companies doing in their quest to engage board game and even casual audiences with their wares? I took a look at some Top Board Game companies to review the earned media value they have gained on their own channels and their overall Brand Profile EMV (which is a combination of their social reach and the last 30 days of their performance), to see who is winning the share of voice war in social media board games.

To compile this data, I used Social ROI Reporter, a reporting tool for social media marketing created by my company, Soulmates.AI.

Top Game Companies Based on Brand EMV

When we look at Brand Earned Media Value, we compile the value of their social reach (Facebook Page Likes, plus Instagram and Twitter Followers), with the total value of the content on all of these platforms that these brands have produced in the last 30 days. These values all come from the a.network Earned Media Value Index, which is the gold standard for judging social media actions and endorsements. The Q1 2019 report is now available as a free download.

- CMON Games - $275,284 - Leading the pack is the Kickstarter darling, CMON. With nearly 18 million dollars committed to its line of zombie-themed board games, Zombicide, CMON understands that they need social engagement and they aren't afraid to pay for some promotion to get the word out. As a result, they're leading the pack with a mix of organic and paid growth.

- WizKids Games - $274,004 - WizKids is also a big content creator with a huge social reach, the source of a lot of their value. While they are getting into more board games with a cross-section of themes and audiences, this company was at the height of their popularity with their signature miniatures game, Mage Knight Rebellion, which is now more simply presented in a more traditional board game, Mage Knight. That past social reach is a lot of their value, rather than deep engagement from content they've produced recently.

- Steve Jackson Games - $153,705 - SJG has been around for decades and their recent products have been focused on drumming up nostalgia with their older buyers who recall their 80's heyday with games like automobile combat game Car Wars and the simple but now monolithic war-game, Ogre. This heritage is augmented by their more recent but now venerable game, Munchkin, which has a rabid fanbase that buys their themed editions regularly.

- Tasty Minstrel Games - $151,341 - As I said, Tasty Minstrel practically invented Kickstarter for board games, as one of the first publishers to use the platform to fund its new titles. They have built a massive following and partner with a cross-section of influencers to promote their products, leaving their own channels quiet at times. So, most of their value is in the potential to reach a huge audience.

- iELLO Games (USA) - $97,303 - The US-based operation of iELLO has a solid cross-section of followers and quality content on their profiles, making for a solid spot in the list. The parent company in France has some of their own profiles, but this is just for the US version. iELLO has a lot of wonderful games but the US market probably first took notice of them with King of Tokyo, a dice game designed by Richard Garfield, the man behind Magic: The Gathering.

- Asmodee North America - $83,692 - This is a tough one to report on since they have bought a ton of smaller brands in recent days. Fantasy Flight Games, Plaid Hat, Catan and more fall under their publisher shingle, but they keep separate brand profiles on the social channels. Consolidating all of those profiles may not make sense, but for Asmodee's true EMV, we'd need to combine the work from many channels online. The Asmodee parent company is the behemoth referenced above; this massive organization could actually give us the tabletop gaming world's first unicorn (billion-dollar company). Even their digital division is becoming a force to be reckoned with.

- Alderac Entertainment Group - $83,590 - Alderac has a solid foundation of social reach and some good EMV that came to them on the strength of strong content (no paid element) so all the full value of what we're reporting comes with no asterisk, no additional costs. Alderac has been around for a long time, famous for their exceptional card game Legend of the Five Rings (now an Asmodee title), which was one of the finest post-Magic: The Gathering collectible card games, and for bringing micro-game wonder Love Letter from Japan. This last game has now been sold to Asmodee, but Alderac is still bringing out other great games like Space Base and Mystic Vale.

- Renegade Game Studios - $78,207 - Renegade has a good presence, but a lot of their work is also with influencers so the brand's direct EMV isn't on the top end. They have worked with a lot of YouTubers to push their signature titles, like the partnership with Garphill Games for the North Sea Trilogy, the fine title Lanterns and franchise-builder Clank!. Yet, if you add in all the praise and support they get from other companies, it would challenge the industry leaders in EMV.

- Blue Orange Games - $62,880 - Blue Orange is still building their audience and sorting out regular content. They're getting things going on Facebook and Instagram looks like a great opportunity for them, especially since their games are beautiful. Their award-winning Kingdomino from a couple of years back has given then the chance to grow from mostly family games into the strategy games market. They recently published Blue Lagoon from the original game design Rock Star, Reiner Knizia, and the opportunity to build on its success is ahead of them.

Individual Social Network Performance

CMON is the monster here, generating over $27K in EMV in the last month on their Facebook page alone. We do detect that some of their content includes paid promotion, so their ROI report would need to factor into the mix.

Their nearest competition is Steve Jackson Games with 1.6K, including some small paid promotion. Renegade Game Studio and BlueOrange made over $800 in EMV during the last month, but with some paid component to their work. Alderac Entertainment Group has over $700 in EMV for the month - which appears to be entirely organic - but it’s coming from an awful lot of posts since their Average EMV Per Post is only $7.

Our Instagram reporting is hinder somewhat because not all game companies seem to have upgraded their accounts to Business Pages, which is now an Instagram requirement to get proper metrics. That said, we can still see that CMON is again dominating with $6.2K in EMV, with all other takers behind them.

iELLO follows them well behind with $1.3K in the last 30 days and then it’s just in the hundreds for the rest of the pack. Not as much brand activity on board games for Instagram; they must be paying creators instead.

That said, huge average EMV for BlueOrange Games from a single post suggests that more frequent posting might benefit the brand.

Twitter is on fire with board game companies, particularly CMON and Steve Jackson Games, who are neck-and-neck for category leadership if you remove the paid promotion from CMON. Alderac is healthy here, not far behind with over $800 in EMV, with Renegade behind them and then a pack in the sub-$300 area.

In the end, most of the Tweets aren’t worth a great deal; the highest average is $47 and some are as low as $2. Twitter may only be worth it if the brands are reposting from other platforms.

YouTube

While the Social ROI Reporter web app tracks YouTube as well, most of the brands in our study seem to rely primarily on Social Media Creators to deliver their messages on YouTube. Only CMON really cultivates content of their own on a branded channel.

Is this a missed opportunity for these brands or does it make more sense for them to simply partner with the expert creators out there who keep a steady stream of content coming out about all the latest games, strategies for success, and even just straight game-play videos for people who would like to see others play a board game. As a former podcaster in the board game industry, I say more power to the community of creators that have risen up and helped spread the word about board games with the world. This is truly the way to gain valuable earned media anyway, through authentic content that provides true value to your audience.

Would you like to get more insight into the social media success of your brand against the competition? For more information on SRR, please click here to get details on how you can get quick access to the more precise industry values for social media and influencer marketing.

Consultant-Retail Lease Negociations-Restaurant & Hotel Specialist- Swiss Canadian Trade

4yVery interesting article ! Thank you for sending it to me.

Founder and CEO Mind Twisters Inc. United States and Canada

4yAt Mind Games our focus has always been to bring families and friends together to enjoy the true essence of socializing by challenging our minds and enrich our customer lives. A turn key Business model have been established since 90's with expansion plan at shopping centres where opportunity presents itself. For more information please inquire at info@mindgames.ca or call 416.977.7478

President/Owner, Grand Prix International, Inc. (GPI)

4yThis is a great article Eric, and I concur 100% with your reporting! As a manufacturer of many games in the industry, we can certainly attest to the growth. And we're seeing lots of creativity applied to components and packaging.

Making Impact for Parks & Helping People Relax

5yMy favorite game involves paper, pencils, and a group of friends. The name of the game is fish bowl, salad bowl, or bowl of fun, depending on who you ask. Jessica Volbrecht Foti Panagio @Mark Cann can you give your review from our recent game? ;)

Naturfagsunderviser med popcornhjerne

5yGood old pen and paper rpg's can still catch the interest of many teenagers following the same trend :-D