5 Graphs That Show How Crazy It Is to Compare California to Greece

At a campaign stop yesterday in Iowa, Mitt Romney tossed out a laugh line that seemed to neatly sum up the core of conservative fears about our future as a country. "Entrepreneurs and business people around the world and here at home think that at some point America is going to become like Greece or like Spain or Italy," he said, before adding, "or like California -- just kidding about that one, in some ways."

Every good joke is supposed to have a little kernel of truth to it. And we all know that, in their most feverish nightmares, conservatives imagine the U.S. transforming into a giant version of the Golden State, with its big spending government, constant budget battles, aggressive regulators, and powerful unions. And the next step from there: the Mediterranean! (Cue the threatening Flamenco).

But is California really our very own economically nutty slice of Europe? Does it deserve to be lumped in with the black seep of the global economy? In short, no, not even close. If anything, Greece, Spain, and Italy would love to be in as good shape as California right now.

I'm not an expert in state finances, so I called up Standard & Poor's analyst Gabriel Petek for a tutorial. Last year, Petek published a report waiving off comparisons between California and Greece. Today, he says, the comparison is just as "superficial."

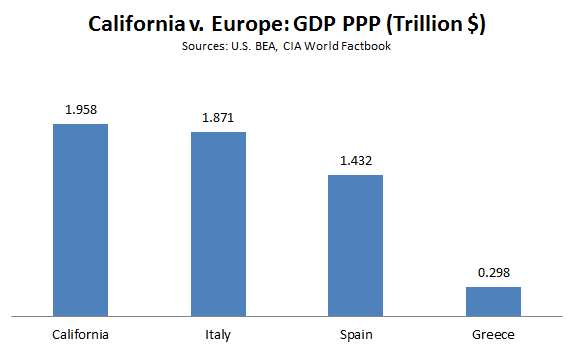

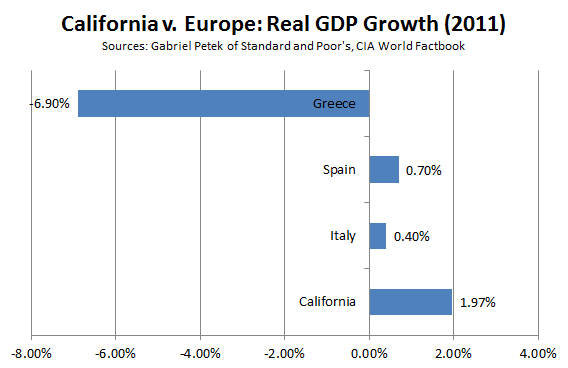

If California were a country, it's $1.958 trillion economy would be the world's tenth largest, at least when measured by purchasing power parity. And like its similarly sized (or, in the case of Greece, comparatively diminutive) counterparts in Europe, it has the disadvantage of not printing its own money. In that sense, U.S. states like California and members of the European Union had something important in common: When catastrophe hit in 2008, neither could devalue their currency and try to revive their economies via exports. Europe's debtors had to run deficits to try and stay afloat, and are now paying for it with painful austerity measures. California, meanwhile, reaped the benefits of federal stimulus spending. And by last year, it managed nearly 2 percent growth, according Setek, far outdistancing Italy, Spain, or painfully contracting Greece.

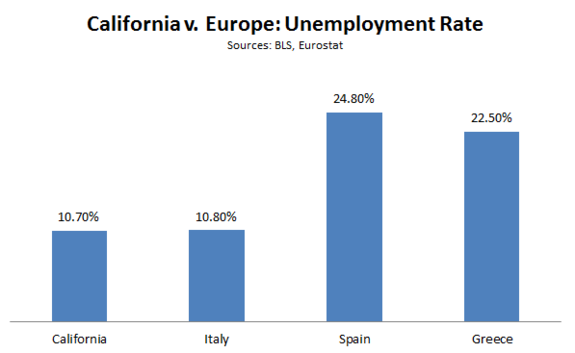

California's 10.7 percent unemployment is in fact about on-par with Italy's. But it's far superior to the desolate labor markets in Spain and Greece. Moreover, it's been improving. During the 12 months ending in June, California added 279,000 workers to its payrolls -- 48,000 more than its closest competitor, Texas. In May, it was responsible for more than half of all new jobs in the country.

But what about California's famed budget messes? Indeed, compared to other U.S. states, it isn't exactly a paragon of fiscal prudence. Cali's rather addled state legislators have been notoriously incapable of balancing a budget on time or reigning in spending, even as ballot initiatives have capped their ability to tax.

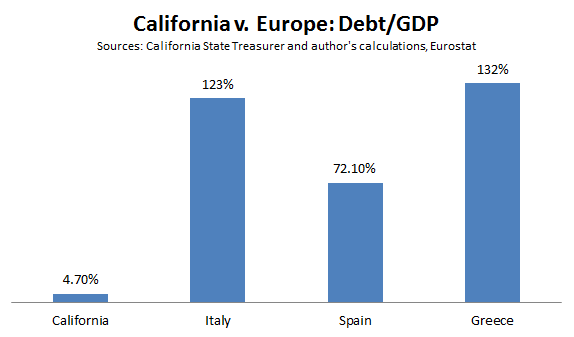

But that's compared to other U.S. states. Like other parts of the union, California is, in the end, constitutionally required to balance its budget. It does issue bonds to pay for infrastructure projects, which has left it with about $90 billion of outstanding debts, equivalent to a little less than 5 percent of its GDP. Suffice to say, that's a pittance compared to the giant European debt loads that are striking fear into the hearts of bond investors.

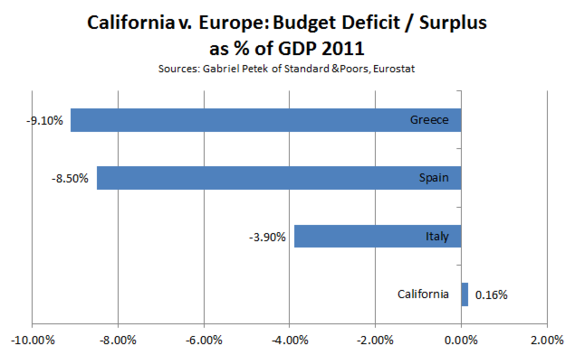

Of course, just because states balance their budgets on paper doesn't mean it will work out that way in the real world. Sometimes tax revenues come in a bit lower than expected. Sometimes they finish out a bit higher. California has run some relatively small budget deficits in the past, which it's had to cover with the next year's tax dollars. In 2011, though, Petek calculates that California's general fund actually finished with a slight surplus. Again, Europe: Not so lucky.

Even though it occupies a special place of disdain for the GOP faithful, California is a pretty dynamic economy by global standards. It's the home of Hollywood and Silicon Valley. And while the state might play a larger economic role than in other corners of the country, it's still relatively light compared to Europe's more bloated government sectors. State spending is last year was roughly 6 percent of its economy, while federal dollars usually make up around 18 percent. In Italy and Greece, Government is about half the economy. In Spain, it's around 43 percent.

So lumping California in with Greece, Italy, and Spain is, in the end, pretty silly. But why am I dwelling on it then? Again, every good joke is supposed to have a kernel of truth. And among a certain set of conservatives, there seems to be a feeling that states are just one extra medicaid payment away from getting savaged by the world's bond markets. California has its economic problems. But they're not that bad. Just ask Europe.