Conventional wisdom has it that paying company bosses with a lot of stock and options aligns their interests with those of shareholders. But a working paper from three researchers in the US and the UK suggest equity-heavy pay packages do exactly the opposite: Depress returns for years to follow.

The trio crunched more than 15 years of data from 1,500 or so companies, expecting to find evidence to support the premise that stock-based pay improves performance. (An earlier version of the paper, which looked at a coarser measure of total pay, was mentioned in a Wall Street Journal column in 2009.)

“The whole point of the paper was to show that options really work,” says P. Raghavendra Rau, a University of Cambridge finance professor, who wrote the paper with Michael J. Cooper of the University of Utah, Huseyin Gulen of Purdue University. “It was a little surprising.”

What matters is how much the CEO is getting relative to other top executives at similar-sized companies in the same industry, Rau said. “If you find this guy getting a lot more options than that, that’s the time you have to worry.”

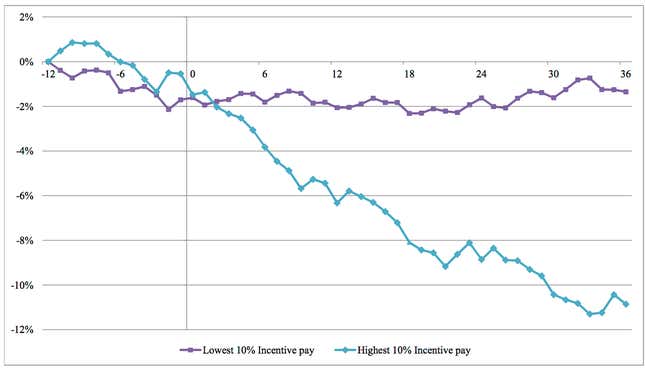

The researchers analyzed companies that roughly correspond to the S&P 1500 from 1994 through 2011. They found that those that were most generous with stock-based incentives saw stock-market returns lag those of similar-sized companies in the same industries, by about 8% over three years.

Another way to look at it: On average, these companies paid their CEOs about $21.09 million in total compensation, and sacrificed about $1.4 billion in market value each year for their trouble—a truly dismal return on investment.

Most interestingly, the effect was strongest at high-growth companies and those that had recently outperformed their peers in the market.

Even after excluding companies with new CEOs (who often get big first-year packages) or recent acquisitions (which take time to digest) from the data, the effect remained. Results didn’t change much after controlling for market value, share issuance, poor corporate governance or how much stock the CEO owned, among other factors. And the results weren’t driven by outliers with freakishly high or low pay packages, either. Using median pay figures yielded much the same results.

CEOs reading this shouldn’t fear poverty, though. Although the study found that those who were overpaid compared with their peers performed less well, those who were underpaid clocked a stock-market advantage of only about 0.1%.

So why do CEOs with big incentives stumble?

It isn’t lack of courage. You’d expect CEOs to be cautious if they’re sitting on a pile of “in-the-money” stock options (where the cost of exercising the option is below the current share price), for fear of hurting the value of their holdings. But the researchers found little difference between the performance of these CEOs and those holding only “underwater” options (where exercising the options costs more than the underlying shares are currently worth), whom one would expect to take more risks.

The real culprit is probably overconfidence, the researchers conclude. Options give a CEO an incentive not to slacken off. But they also appear to attract people willing to take too-big risks.

“Who’s the kind of guy who’s attracted by the options?” Rau said. “The guys who are really confident about delivering growth going forward. They don’t perform as well as the market thinks they’re going to.”

The researchers evaluated CEOs’ confidence in part by checking how many in-the-money options they held. A confident boss would hold on to more options in the belief that her holding would go up in value, instead of exercising them. And the most confident CEOs, it turned out, were more likely to make unwise acquisitions or over-invest in capital-intensive projects.

The lesson for boards? “You want to hire a guy who’s smart and confident and willing to work for the company,” Rau said. “But you don’t want to hire a guy who overestimates his ability to deliver for the company.”