Although I poked fun at the WSJ in my last post, the buzz about the dollar — the growing clamor to do something about its decline — is coming from a number of people. And it has me worried, because it’s part of the groundswell of demands that we begin an exit strategy from loose monetary policy now now now, even though nothing in the actual economic situation warrants such action.

Ed Andrews’s article on dissension at the Fed was deeply disturbing when you bear in mind that Fed presidents historically never air such disputes in the open. The fact that they’re doing so now is an indication that many of our central bankers are so eager to start tightening that they’re throwing the normal rules aside.

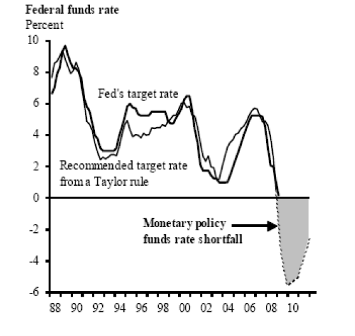

This is really bad. Bear in mind that with core inflation below the Fed’s target of 2 percent (which I think is too low, but that’s another story) and huge excess capacity in the economy, the Taylor rule says that interest rates should be negative, and since they can’t, they should stay zero for a long time.

But the hawks are on the march, thumping their chests, because, well, just because.

And the declining dollar will, I’m sure, be used as yet another justification for bizarrely premature Fed hawkishness. A repeat of 1937, here we come.

Comments are no longer being accepted.