This high-flying UK tech stock is still a long-term buy

It's ending the decade as it started it, highly profitable, but this quality company is much bigger now.

18th April 2019 15:28

by Richard Beddard from interactive investor

Share on

It's ending the decade as it started it, highly profitable, but this quality company is much bigger now.

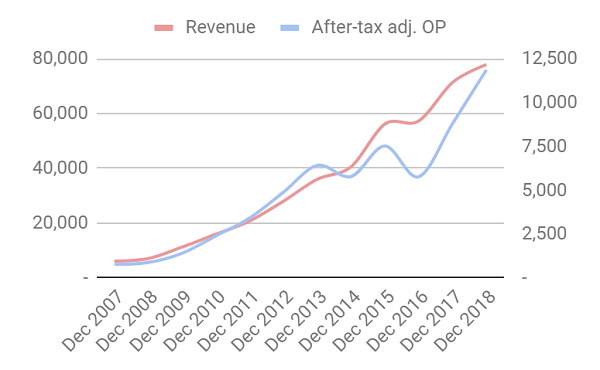

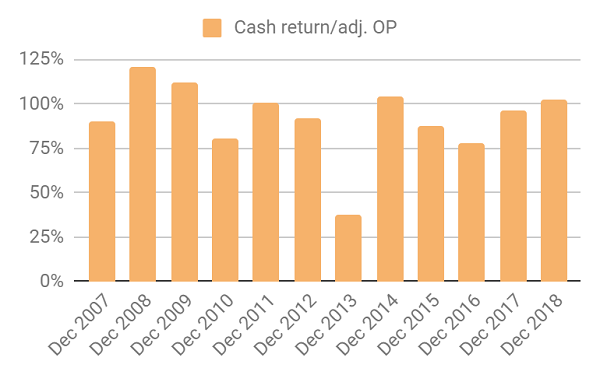

It will not always be as good as this... In the year to December 2018, Judges Scientific (LSE:JDG) earned record revenue (9% higher than the previous year), record adjusted profit (35% higher), record cash generation (it converted 103% of adjusted profit into cash), and record order intake.

Ending the decade as it started it

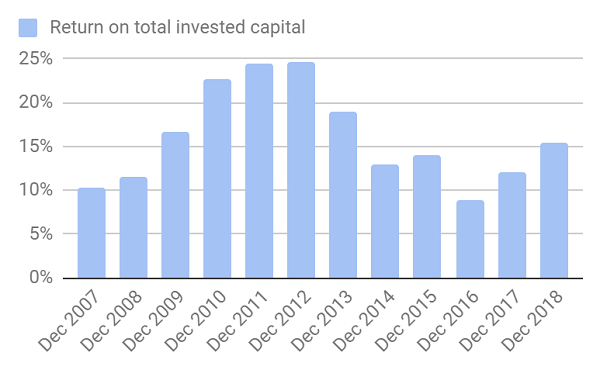

Revenue growth was helped by the first full year contribution from Oxford Cryosystems, Judges' last acquisition in July 2017, and as it increased its holdings in two other businesses. But the 15 other businesses it has acquired since 2002 and owned for more than two years grew revenue by 5.5%. Return on total invested capital was 20%, the most profitable the company has been since the glorious first few years of the decade.

Demand depends on how much universities, its main customers, and industry spend on equipment, which depends on the state of far flung economies and their public purses.

Fluctuating demand combined with high fixed costs means profit at Judges' subsidiaries can fluctuate dramatically from year to year.

Since 85% of revenue is earned from exports, profit is also sensitive to exchange rates. In 2018 all of these factors were benign, and one of its subsidiaries, probably Scientifica, that had experienced production problems in 2016 and 2018 returned to profitability.

Despite the vicissitudes of its businesses, the group as a whole has remained resoundingly profitable. Return on total invested capital, a measure that captures the full cost of acquisitions and therefore measures its skill as an acquirer, has averaged 16% since 2007, hitting a low of 9% in 2016.

Source: interactive investor

Average cash conversion is just shy of 90%.

Buying the same company many times

The company says it is piggybacking on two long-term trends, the global expansion of higher education, particularly in developing countries, and the ever-increasing optimisation of technology.

It is riding these trends using cheap debt to buy smallish exporters in private markets at bargain prices.

These are niche businesses earning strong cash flows, which Judges uses to repay the debt and invest in research and development to ensure the businesses go on earning the mothership cash. Once the company can afford it, it buys another business. Since 2002 it has bought 16 in total.

Beyond the short-term causes of volatility, and assuming the long-term drivers persist, as the company believes for decades, two things can go wrong:

The acquisitions could dry up, or Judges could start making bad ones that do not provide the cashflow required to keep the cycle going.

Pricier acquisitions

A year without any new deals is unusual, but probably not an indication that deals are drying up. Sometimes it cannot find the right businesses at the right price, and it is not in control of when founders want to retire and sell-up.

But Judges is getting bigger, so it needs bigger acquisitions or it needs to make lots of smaller ones to maintain growth.

There is more competition for larger companies, from listed rivals and private equity, which means the price of acquisitions is higher and so is the possibility of failure.

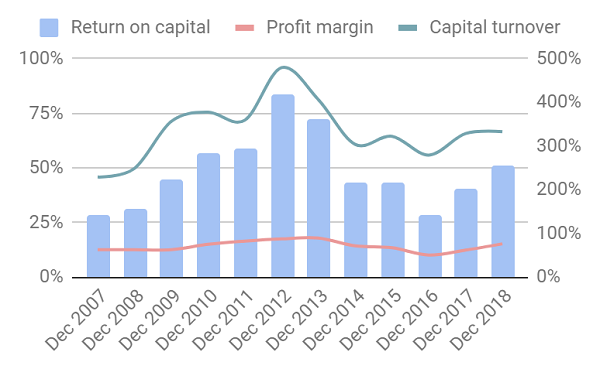

Lots of smaller acquisitions will also take more head-office time and energy. The big dips in ROTIC correspond with its biggest acquisitions: GDS, Scientifica, and Armfield. Judges struck these deals at five or six times EBIT (profit), higher valuations than normal, and the experience may have been chastening.

Set against the possibility Judges Scientific's acquisition strategy is becoming more costly, are a number of factors we know for sure.

There is no shortage of small scientific instrument manufacturers, Most of Judges' acquisitions have been in just two counties: Sussex and Hampshire and it reckons there are 2000 privately held scientific instrument companies in the UK.

Much larger acquisitive companies operating in different niches, like Halma (LSE:HLMA) and Diploma (LSE:DPLM), are still sustaining growth.

Judges believes it can increase profitability, perhaps by improving the operational performance of its businesses.

Improved operating performance

While the easy money from acquisitions may have been made when Judges was a smaller company, chief operating officer Mark Lavelle, recruited little more than a year ago and with 15 prior years experience at Halma, increasingly seems like a pivotal figure.

In this year's annual report Lavelle is credited with having improved the operating results of Judges existing businesses and perhaps the company's confidence his impact will: "provide a strong and growing enhancement to organic profitability" is an acknowledgement that in future organic growth may be an even more significant component of growth than it has been.

Judges says it has achieved compound annual organic revenue growth of 9.2 % over the last 11 years. In total, turbocharged by acquisitions, Judges has grown 26% a year CAGR. Notably, a potential source of organic growth, Research and Development, increased from £3.5m to £4.6m, nearly 6% of revenue in 2018.

Source: interactive investor

David Cicurel, the company's founder, chief executive, and dealmaker, is 70, and the possibility he might retire raises the question of whether the company he built could do without him.

Because Judges buys businesses that have sustainable cash flows, it does not need to acquire to remain a decent business. Growth would merely slow to the organic rate of growth until it worked out how to replace Cicurel.

One of the attractions of the company is the businesses largely operate themselves, under financial controls, which are the purview of experienced finance director Brad Ormsby and with operational support from Mark Lavelle.

Neither is there any reason to believe the relationships Cicurel has built would dissolve if he left the business. Lloyds loans it money on favourable terms because of Judges' demonstrable ability to repay debt quickly.

Sellers and their agents appreciate the fact that the company honours the initial terms struck with a seller and does not try to bargain the price down during due diligence.

Scoring Judges Scientific

As usual, I have scored Judges Scientific to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Average return on total invested capital of 16% and average cash conversion of 90% indicate Judges Scientific has gathered a high-quality posse of businesses.

Source: interactive investor

Score: 2

Resilient: What could go wrong?

Acquisitions may become less profitable, but I think they will probably still be worth doing for a long time to come. The company could stop acquiring now, and it would be a pretty attractive business on its own merits. It earns stunning returns on operating capital:

Source: interactive investor

Score: 2

Adaptable: How will it make more money?

Judges will do more acquisitions and provide subsidiaries with more support without trampling on the freedoms that have served it so well.

Score: 2

Equitable: Will we all benefit?

Mark Lavelle, chief operating officer, was the highest paid board member in 2018, earning £236,000 including bonuses.

The total cost of the board, three executives and four non-executives, was £728,000, which along with the IKEA furniture in the boardroom is a good sign head office costs are low.

In a good year, the executives earned a cash bonus of 25%, which in comparison to other companies is very modest and evidence Judges Scientific is still channelling resources where it will earn shareholders a good return, into businesses old and new.

Shareholders stand to gain most from this far-sighted approach, not least Judges' biggest shareholder, David Cicurel. But employees participate in Judges Scientific's share schemes and the managers of its subsidiaries are trusted to handle day-to-day business so they have "responsibility for their own destinies".

The company keeps private investors well informed, for example in this excellent presentation of the business and its results and in these descriptions with short videos of each business.

Score: 2

Cheap: Is the firm's valuation modest?

A share price of £30.70 values Judges Scientific at about 17 times adjusted profit in 2018, hardly an outrageous valuation for a collection of high quality businesses.

Score: 0.4.

A total score of 8.4 out of 10 means I think the the shares are a good long-term investment, for shareholders who can ride out the inevitable bumps in the road.

Richard owns shares in Judges Scientific.