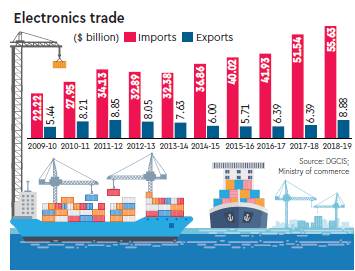

India’s electronics imports touched a record $55.6 billion in FY19, against $51.5 billion a year before, and remained the largest driver of its trade deficit after oil, showed the latest official data. However, what offered policymakers some comfort was that electronics exports jumped as much as 39% to a record $8.9 billion last fiscal, against 12.3% in the previous year.

Analysts say two aspects stand out. First, the damaging impact of the October 2014 shutdown of Nokia’s manufacturing plant in Tamil Nadu on exports is largely offset now. Second, the nature of imports in the mobile phone segment is changing, and purchases of components from overseas for local assembly/manufacturing are rising at a faster pace than those of completely-built units (CBUs).

Also read: Agricultural growth down from 4.2% during UPA regime to 2.5% under Modi, says Congress

In fact, telecom instrument imports dropped almost 15% up to February in FY19, against an almost 17% rise in the entire FY18. Telecom instruments made up for a third of overall electronics imports, followed by electronic components (28%), computer hardware and peripherals (16%), electronic instruments (14%) and consumer electronics (9%).

Between April and February 2019 (up to which latest segment-wise data are available), exports of telecom instruments (including mobile phones) jumped a massive 129% year-on-year to $2.4 billion — the highest since FY14, just before the Nokia plant closure — and emerged as the largest segment within the electronics exports category, although such exports are still far below potential. In fact, from $3.06 billion in FY14, telecom instrument exports crashed to just $1.07 billion in FY15, mainly due to the Nokia plant closure, show the DGCIS data.

As for the overall electronics imports, although the pace of rise slowed to 8% last fiscal from 23% in the previous year, in absolute term, the net imports (after excluding exports) inched up to $46.8 billion in FY19 from $45.2 billion a year before, proportionately inflating overall goods trade deficit that touched $176.4 billion last fiscal, compared with $162.1 billion in FY18.

Pankaj Mohindroo, chairman of the India Cellular & Electronics Association, said: “The profile of imports, especially in the mobile phone industry, is showing a healthy change and is as per plan.” The FY20 targets (mobile phone manufacturing of Rs 1.5 lakh crore and component manufacturing of Rs 50,000 crore) have been crossed, and that, too, a year in advance, he added. “CBU import, which was over 75%, is now below 10%. Sub-assembly import went up with the CBU import coming down, but even that has fallen substantially after PCBA (Printed Circuit Board Assembly) population has started aggressively last year,” he said. Now imports of core components have started and that will only grow, he explained. “We have to focus on large-scale exports and move towards the (export) value of $110 billion by 2025 only in mobile phones alone as per the National Policy on Electronics.”

According to a ICEA-McKinsey report, the latest resurgence in mobile manufacturing was built on the back of strong domestic demand, with the introduction of the Phased Manufacturing Programme encouraging import substitution, the report said.

Between 2014 and 2017, the Indian smartphone market grew over 37% in value per annum, from $9 billion to $22 billion. In volume term, sales of smartphones rose from 70 million units in 2014 to 150 million units in 2017. “The strong growth seen between 2014 and 2017 is starting to slow down, however, with the projected growth rate (in volumes) of 14% per annum (between 2018 and 2021) being roughly half the previous growth rate,” the report said.