- India

- International

Explained: What the Jio deal means for Reliance and Facebook

Facebook’s purchase of nearly 10% stake in Jio marks its entry in India, improves Reliance’s balance sheet, allows each company to gain from the other’s reach.

Reliance Industries Chairman Mukesh Ambani and wife Neeta Ambani in Mumbai. (AP Photo)

Reliance Industries Chairman Mukesh Ambani and wife Neeta Ambani in Mumbai. (AP Photo)

Facebook’s purchase of a nearly 10% stake in Reliance Industries’ digital business unit Jio Platforms brings one of the world’s largest Internet companies on the table with India’s largest telecom player. The $5.7-billion deal, which values Reliance’s digital operations at around $66 billion, pushes the Indian conglomerate ahead in its plans of de-leveraging its balance sheet while accelerating the launch of its new commerce business.

Further, it not only marks Facebook’s long-pending formal entry into India’s telecom sector but also catapults it to a place among the biggest foreign investors in India’s technology space.

Read news in Tamil, Malayalam, Bangla

What does the deal mean for Reliance Industries?

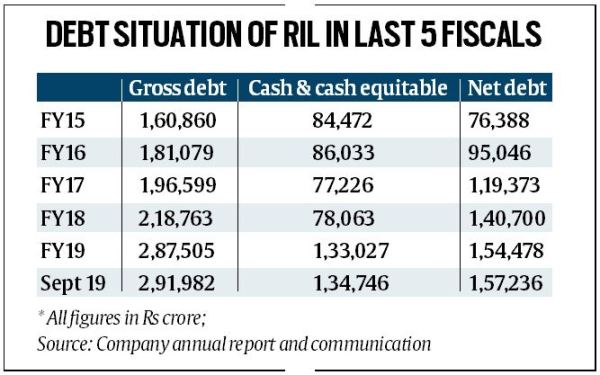

Back in August 2019, while addressing the company’s shareholders at the annual general meeting, Reliance Industries Chairman Mukesh Ambani had said the group had prepared a roadmap for becoming a zero net-debt company within 18 months. The Facebook deal significantly contributes to that plan by paring about Rs 43,574 crore from its outstanding debt as of September 2019 of Rs 2.92 lakh crore. The other primary contributors to the debt-reduction plan will be a potential $15 billion (around Rs 1.05 lakh crore) deal with Saudi Aramco for a 20% stake in Reliance Industries’ refining and petrochemicals business and Rs 7,000 crore from a 49% sale in its fuel retail joint-venture to British firm BP. However, experts believe the Aramco deal to be under threat on account of the oil prices crash caused by the COVID-19 outbreak.

Also read | After Facebook’s Jio investment booster, RIL in talks with other investors to pare debt

Besides the balance sheet de-leveraging, the timing of the deal with Facebook is significant for another reason: online platforms selling essential goods have suddenly witnessed an upsurge in demand. For example, before the outbreak, just 1% of the Rs 80,000-crore grocery market in India was represented by online players. After the lockdown, online platforms started to account for 50% of the grocery demand in the country by some estimates before it corrected. “We’re one of the few industries that has got more than enough business but not enough resources,” said Hari Menon, CEO of India’s largest online grocer Bigbasket.

Source: Company annual report and communication

Source: Company annual report and communication

Experts have said the arrangement among Reliance Retail, Jio Platforms and Facebook-owned WhatsApp to offer consumers the ability to access the nearest kiranas, or grocery stores, which can provide products and services to their homes by transacting with JioMart using WhatsApp, has come at a very opportune time. WhatsApp boasts 400 million users in India. Further, using WhatsApp’s base also allows Reliance Retail to promote its services to users of Jio’s rival telecom players.

Also read | Reliance-Facebook deal opens up WhatsApp’s entire user base for Mukesh Ambani

What does the deal mean for Facebook?

Facebook has been trying for years to get its finger in the Internet pie. In 2015, it had experimented with Free Basics, which provided free access to basic Internet services as a partnership with service providers. However, criticised for being a walled garden, it soon pulled out of the idea after differential pricing was disallowed by the telecom sector regulator.

It had even looked at the possibility of beaming free Internet from the air using a solar-powered drone called Aquila, and enabled low cost high-speed Wi-Fi in some remote parts of India with an initiative called Express Wi-Fi. But data was expensive in those times, and free access to the Internet was envisioned as the easiest way to bring the next billion users online. Then, Reliance Jio happened. It launched with data rates so low that they became the industry standard in one of the largest online markets in the world. Jio alone helped bring 388 million users online, well over a third of what Facebook had planned.

The partnership with Reliance could also help Facebook navigate the regulatory environment in India, where it has had several skirmishes with the authorities, including for its major initiatives such as WhatsApp Pay.

The first major non-distress deal during the pandemic is part of the debt-reduction plan of India's biggest corporate entity - and could lead to the accelerated launch of Reliance's e-commerce plans on the JioMart platform, For Facebook, the partnership could help it navigate the regulatory environment, including for initiatives such as WhatsApp Pay.

What does it mean for India’s Internet ecosystem?

The deal also marks Facebook’s entry among elite investors in India’s technology space, joining the likes of SoftBank, Amazon and Google that have together poured in billions of dollars in Indian tech startups and their own ventures over the years. Prior to Jio Platforms, Facebook had invested around $20-25 million in social commerce platform Meesho in 2019, and participated in a $110 million funding round for edu-tech company Unacademy earlier this year.

The deal with Reliance also gives Facebook access to the latter’s bouquet of digital apps. These include in-house apps such as Jio Money, Jio TV, etc in addition to the young startups acquired by Reliance or its subsidiaries across categories such as logistics, e-commerce and artificial intelligence.

📣 Express Explained is now on Telegram. Click here to join our channel (@ieexplained) and stay updated with the latest

What does it mean for Reliance’s data localisation principles?

In January last year, speaking at the Vibrant Gujarat Summit, Ambani had stressed that India’s data “must be controlled and owned by Indian people – and not by corporates, especially global corporations”. “For India to succeed in this data-driven revolution, we will have to migrate the control and ownership of Indian data back to India – in other words, Indian wealth back to every Indian,” he had said. While some have raised the red flag over Facebook’s track-record on data privacy issues, executives of both companies said Wednesday that data sharing was not a part of the deal. “There will be areas that we will collaborate in but there will be areas where we will potentially not agree with each other,” a Jio official said. Facebook, on the other hand, maintained its stance in favour of an open ecosystem for data to flow across boundaries.

More Explained

EXPRESS OPINION

Apr 24: Latest News

- 01

- 02

- 03

- 04

- 05