Singaporeans now have the option to invest in a low-cost and evidence-based investing approach, with a choice between 5 portfolios tailored to your risk appetite and future objectives.

I was introduced to MoneyOwl last year, and you can see my thoughts on them here. To sum it up, what makes them different is that they’re:

1. A strong team with history and a reputation for ethical business

As a joint venture between NTUC Enterprise and Providend, both of which enjoyed stellar reputations for ethical business and doing good, this means the team servicing your investment portfolio is much stronger than most ordinary financial startups that have emerged in the last few years.

2. Unlike other robo-platforms, they do not strip out qualitative human advisory.

Why is this important? Because while the AI and technology offered by other robo-advisors can claim to match you to investment portfolios based on your profile, that depends a lot on how accurately you can answer the profiling questions. But when it comes to personal finance, we all know there are little nuances that technology can never fully capture (because AI can’t judge or evaluate) whereas humans can. For instance, you might think your investing preference is more towards growth and opt for a portfolio that reflects that, only to panic and question the volatility of your portfolio…and realise a few years later that your risk appetite was much lower than you thought after all. A human advisor is more likely to be able to work out these nuances with you instead, and this is why so many investment managers are still in business.

MoneyOwl’s key differentiator is also in being a bionic advisor, where they’re the first in Singapore to combine technology with the best of human advisory. To remove conflict from the picture, all their advisers are paid zero commissions on the insurance and investment products that they recommend to you. Unlike other financial advisors, there’s no incentive for them to recommend products with the highest commissions for them, simply because they don’t get any.

3. Low-cost, evidence-based investing solutions.

Now that they’ve launched their investment services, how does it stack up against all the numerous options out there?

MoneyOwl has partnered with Dimensional Fund Advisors to offer 5 curated, passive investment portfolios. You’ll be assessed and matched to one of five portfolios based on your ability, willingness and need to take the risk. For those of you unfamiliar with DFA,

Who (or what) is Dimensional Fund Advisors?

Those of you who’ve read a ton of investment books like I have (check out my list of recommended reads here) would probably be familiar with how most authors argue that low-cost, diversified funds would be the best way to beat the most active money market managers. Vanguard funds are often name-dropped.

Unfortunately, these low-cost Vanguard funds aren’t available directly to Singapore investors, but as my friend Kyith pointed out, there was a next-best alternative: the Lion Global’s Infinity Series – a wrapper fund that lets you invest in Vanguard sub-funds following the S&P 500 index, MSCI Europe Index and MSCI World Index. The expense ratio is slightly higher than Vanguard’s at 1+%, but it was already much better compared to most unit trusts that are sold to Singaporean investors.

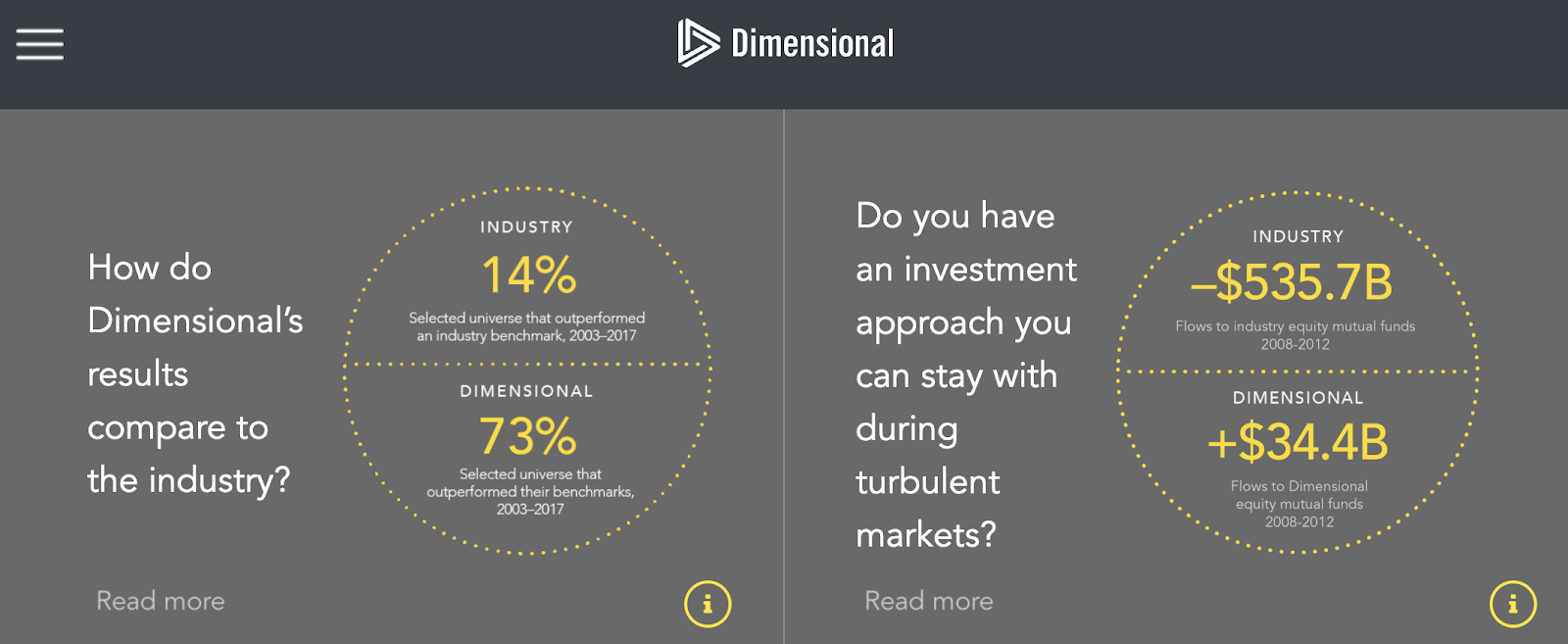

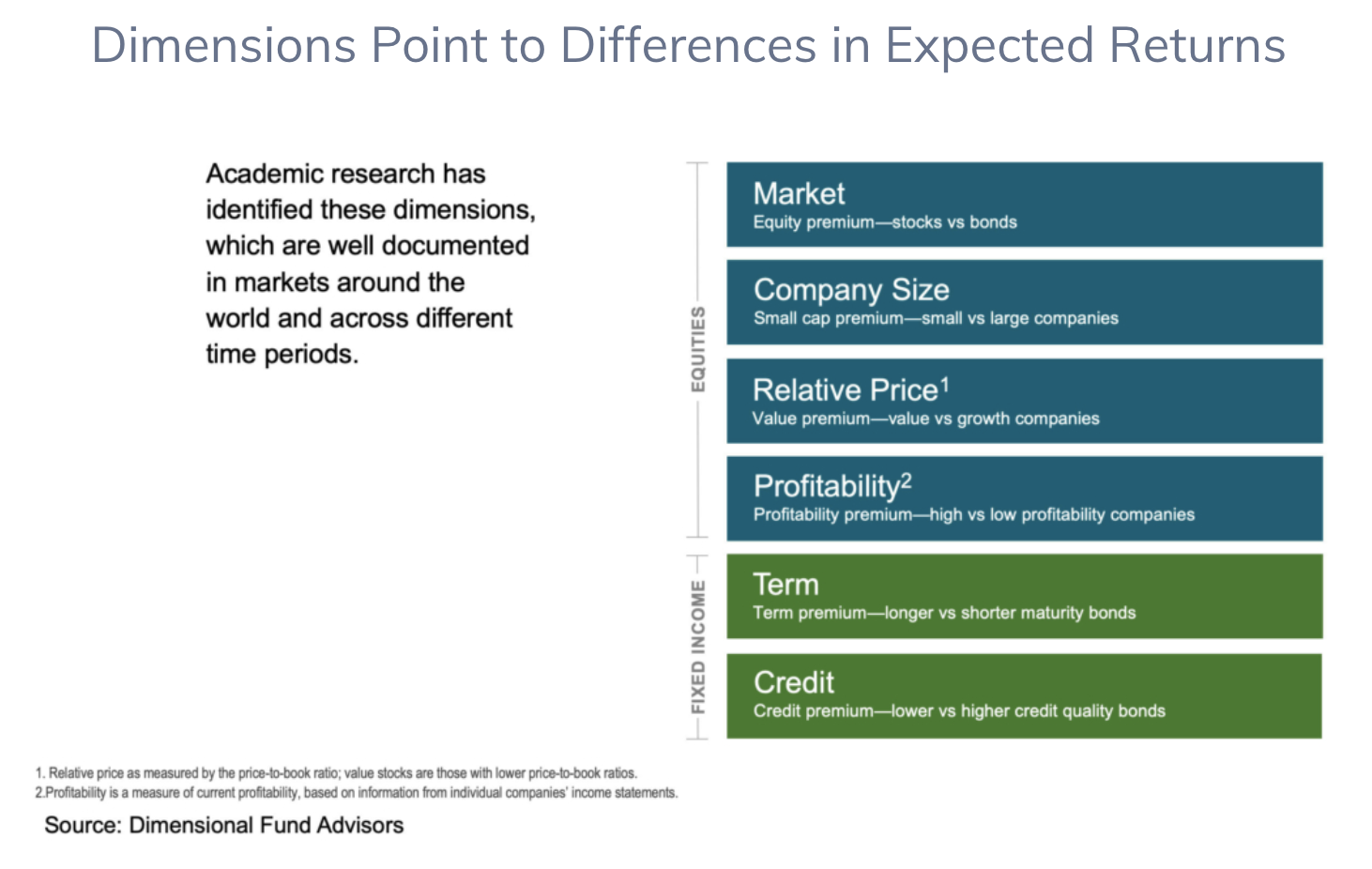

Dimensional Fund Advisors has a pretty solid history that you can easily read about if you Google them, but what I like to highlight is that their selection criteria is such that only persistent and pervasive factors (dimensions) over time that are cost-effective to capture will be selected.

You can read more about their investment philosophy and history here.

However, it isn’t easy to gain access to Dimensional Fund Advisors (DFA) funds here in Singapore. Most of your insurance agents (or “financial consultants” / “wealth consultants”) and relationship managers in most banks will not be able to get them for you. But one platform you can now get access through would be MoneyOwl.

How can I invest?

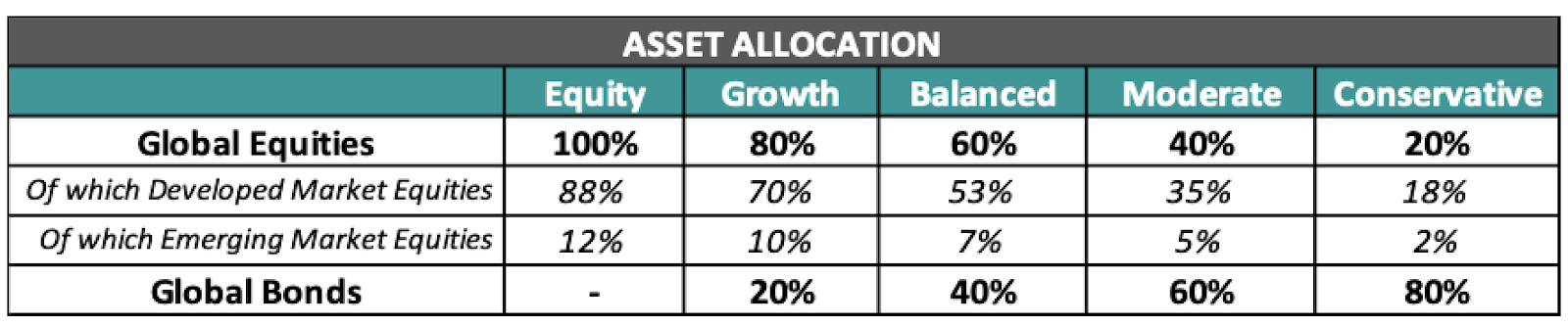

MoneyOwl now offers 5 portfolios, chosen as globally diversified funds which match market returns (historically ahead of inflation) but are low in cost (average of 0.4% per annum) with annual management fees. You can take their online assessment to find out which portfolio the system recommends for you, based on your inputs.

To add on, if you’re unsure about your results and wish to explore another portfolio that you deem as more suitable, MoneyOwl offers human advisory services for you at just a phone call away.

What’s the minimum to start investing?

You can start from as low as $50 per month for regular savings plans (yes, that’s lower than most of the other RSPs I’ve been championing all these years!), or a one-off investment with a minimum of $100.

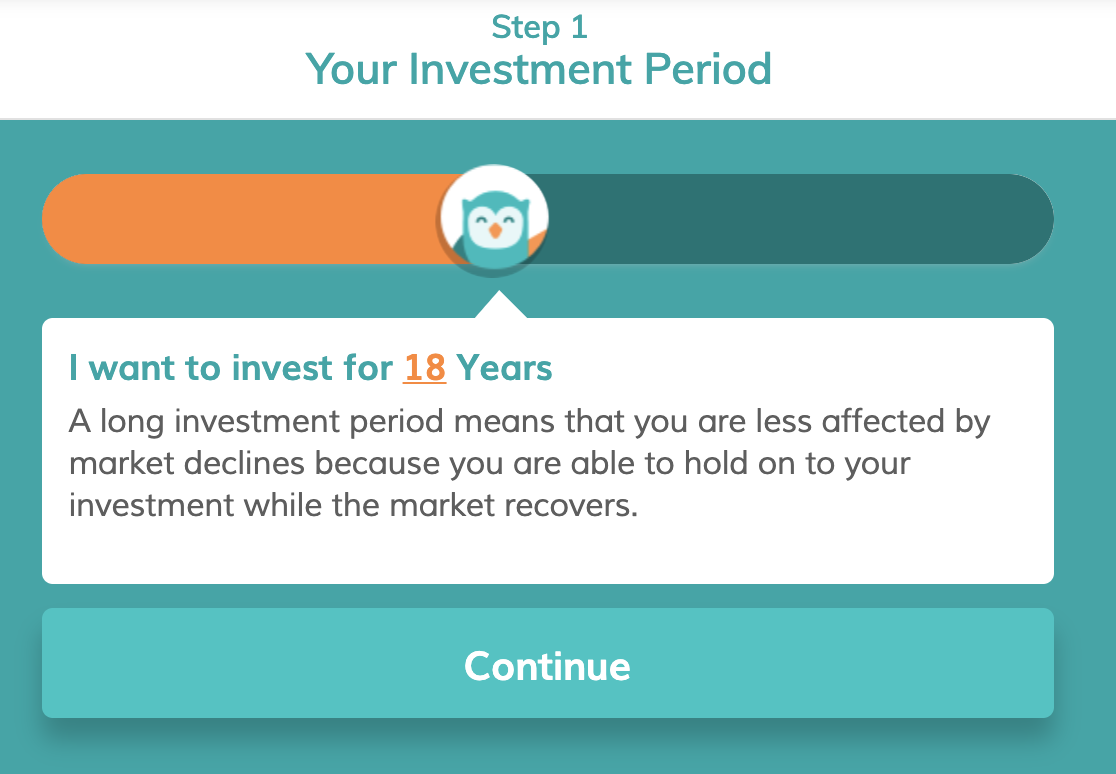

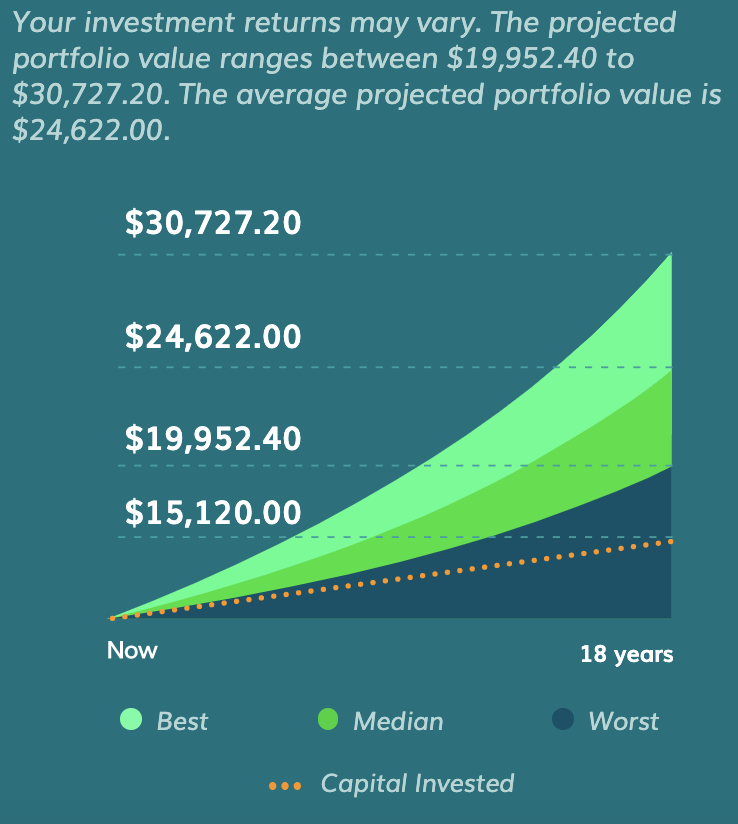

I’m actually quite keen to explore creating a portfolio for my 5-month-old son in this manner for its returns and educational value, and ran a simulation on his behalf:

I explored putting in $70 a month, which I presume will be the equivalent of his pocket money.

Unlike investing with other financial advisers, there is no upfront sales charge and no annual trailer fees. Trailer fees (the portion of funds’ annual management fees that are paid to distributors) can make up to half of a fund’s total expenses, so it’s important to look out for this being as low as possible, or ideally even zero.

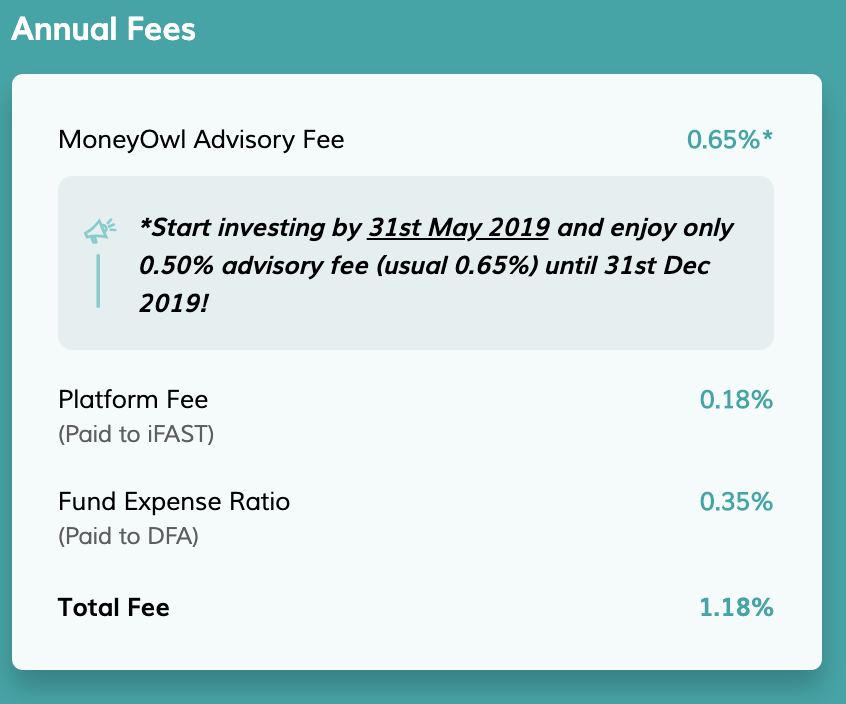

The total costs involved work out to be about 1.2% p.a., which is less than half of what an investor might otherwise pay if investing in an actively-managed fund. These cost savings will compound significantly and make a big difference to your portfolio value over time! To recap on this concept, read this piece I wrote previously on the need to keep your investment fees low.

Aside from the 0.32% – 0.38% fund expenses, the total costs will also include a 0.65% advisory (wrap) fee and a 0.18% third-party custodian and platform fee. All costs are on a per annum basis. You can view the impact of these costs on your returns on MoneyOwl, where the projected returns are presented net of all fees.

Is this for me?

If you’ve been disillusioned with unit trusts and have been looking for cheaper methods, this is your answer as the fees work out to be almost half of what you could otherwise pay.

However, this is not the cheapest method. If you want to keep the costs at its absolute lowest, then the best way would be to DIY your own investments as an alternative. You can do this by:

- Registering with an international brokerage (eg. IB or Charles Schwab)

- Opening a multi-currency account (eg. DBS Multiplier or MCA)

- Manage your own foreign currency fluctuation risks and exchanges

- Purchase globally diversified and low-cost ETFs (eg. IWDA, VWRD, EIMI)

- Manage your own portfolio and regular investments

IB is the most popular among Singaporean investors. If you’ve more than USD 100,000 to invest, then you don’t have to pay their USD 10 monthly charge. Otherwise, be prepared to fork out USD 120 in fees each year to maintain your portfolio.

The problem is, not everyone is savvy or disciplined enough to execute a DIY portfolio. While I continuously write to educate and teach readers about how to invest better, the truth is, not everyone might be willing to do so either. Perhaps you don’t have time to learn. Perhaps you’re unable to overcome your own self-doubt. Or maybe you fear it too much because investing is so new to you.

I’ve been able to teach most of you how to start investing in Singapore stocks and funds, but the problem is, overseas investments warrant a different playing field. There’s stuff like forex fluctuations, 30% withholding tax, custodian fees every month, etc to think about. Yet, we all know that investing in Singapore alone may not be enough in the long-run because Singapore has already gone past its hyper-growth stage.

This is why I believe there will always be a need for financial advisors to handhold and guide you through your investments, ensuring that you at least remain invested in the markets so you do not lose the value of your capital to inflation.

But I’m not a fan of unit trusts because I don’t like the (higher) costs, especially when results aren’t guaranteed. Since the only factor, you can have 100% control over in investing is cost, then you’ll want to make sure that’s the lowest you can get.

So if you don’t want unit trusts for the same reason, but aren’t keen to DIY your investments outside of Singapore either, then MoneyOwl’s latest investment offerings might just be your cup of tea.

*** Sponsored Message ***

From now till 31st May 2019, enjoy a reduced advisory fee of only 0.50% p.a. until 31st December 2019 when you invest with MoneyOwl. Find out more here!

You can also attend MoneyOwl’s Investment Symposium to learn more about the keys to successful investing, as well as meet the folks behind Dimensional Fund Advisors and ask them about their investment philosophy or selection criteria for their investment solutions – one formerly only limited to institutional investors, but now you can get access too through MoneyOwl!

Date: 25 May 2019

Time: 9am – 12.30pm

Price: Free!

For more event details and to register, click here.

Limited seats only, first come first served.

1 comment

This comment has been removed by a blog administrator.

Comments are closed.