TV and radio media owners diversify to balance out ad slump, finds Ofcom

The fortunes of UK TV and radio broadcasters have remained stable in the last year despite continued general declines in the ad market, according to Ofcom data.

UK TV and radio adapted to ad market slump with diversification

The Ofcom Communications Market Report, which also features an interactive report that can be used to track different fields of data, contexualised the reach and performance of media channels.

TV made up for a 4% decline in net ad revenue with TV shopping and sponsorship offerings. Meanwhile, an 11% decline in local advertising in radio was overturned by a 5% increase in national executions, a 7% increase in sponsorship and 18% growth from other sources such as on-air competitions.

Broadly, there hasn't been a material change in internet take-up or smartphone ownership (stable at 87% and 79% respectively).

However, superfast broadband lines increased by 17% and the volume of data used on fixed and mobile connections both grew by around a quarter, mostly fuelled by video.

The report also took a look at the consumption of, and challenges facing, TV and radio.

TV

Total revenue for the commercial broadcasters in the UK in 2018 stayed at £11.3bn – but the way revenue is generated has significantly changed.

Increases in pay TV and revenue from other sources (eg TV shopping and sponsorship) made up for a 4% decline in net advertising revenue.

In the last year, Channel 4 unveiled a shoppable VOD format and ITV upped brand partnerships (Love Island-style) and strived to be 'more than TV'.

The ad spend decrease had slowed between 2016 and 2017 from 7.5% to 4%... although this may be attributed to the 2018 Fifa World Cup, half of which aired on ITV with ads.

Average weekly reach for TV was 88.5% in 2018, down from 90.2% the previous year. The average number of minutes that people in the UK spent watching fell by 11 minutes to 3 hours 12 minutes each day.

The fall was steepest in younger segments.

16-24-year-olds spent an average of 1 hour 25 minutes each day watching live TV in 2018, 15 minutes less than in 2017. 25-34s watched for 2 hours 2 minutes, 18 minutes less than in 2018.

Average viewing of public service broadcasters is in slim, steady decline.

The likes of TV body Thinkbox are trying to get small and medium-sized entreprises into TV advertising, tempting them with the new slew of local targeting options addressable TV in particular has to offer.

Thinkbox has further data on which advertisers put in the most investment into TV in 2018, and Amazon surprisingly took the top spot.

Radio and Audio

Similar to TV, commercial radio revenues were flat year on year in 2018, coming in at £572m.

An 11% decline in local advertising was offset by a 5% increase in national advertising, a 7% increase in sponsorship. The most interesting outlier here was an 18% growth in another relevant turnover (such as revenue from on-air competitions).

There is further diversification afoot.

Bauer Media launched new radio channels, propped up by special partners like Disney, Chris Evans took the top spot on ad-free Virgin Radio (sponsored by Sky), and Global even made a concerted push into the out of home advertising market.

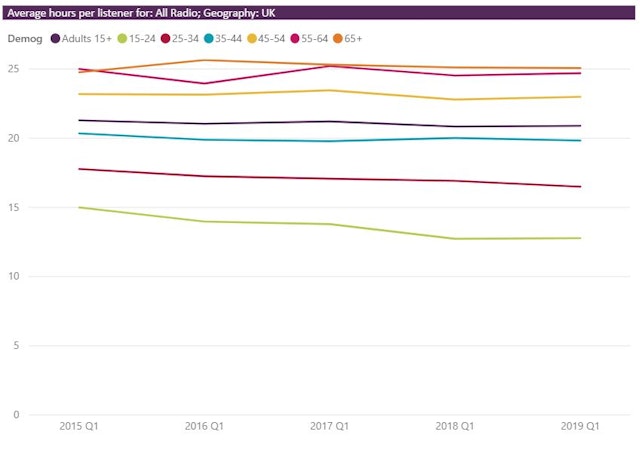

Overall reach for radio remained high (89.4%), and the time spent listening has remained the same year on year. Each radio listener spent 20 hours 54 minutes listening to radio in an average week. This is significantly less for younger people.

Listening habits remain stable generally.

Earlier today, a report from Global outlined that advertisers are increasingly going to put money into digital audio this year.

Of 215 manager-level media and ad agency figures between March and April 2019, 75% said they would up podcast ad spend, and 85% digital audio ad spend.

Smart speakers and smarter in-car interfaces provide additional opportunities for new inventory and creative executions from the advertising perspective.