Third party motor insurance is compulsory in India. The practice of renewing car insurance policy is pretty commonplace among thousands of car-owners in India. Although, many people in India are under the misconception that car insurance renewal is a money making tactic of insurance companies, there are many avenues available to save money if one chooses to go online. Online renewals further provide car-owners with a number of benefits. This post aims at assisting those who are looking to renew their existing car insurance policy and to ensure that they get the best deal at a much-reduced price.

Ways to reduce car insurance renewal cost

There are many windows available when it comes to save on the expense of renewing a motor insurance plan. Let us start our discussion with 5 major ways.

Comparison

This is one of the key ways of saving money while renewing car insurance policy in India. People those who never compare various quotes and are content with the renewal quote that their exiting car insurers offer may lose out on a great chance to reduce the expense. One of the major reasons why these people turn their faces away from comparison is the task of visiting a myriad of insurance portals and comparing costs manually.

However, to ease out the entire process many a quality insurance comparison portals has come into existence. The best among these portals like GIBL also help people compare, buy and renew policies from a single interface as well. Car-owners should make the most of this unique facility and check out advantageous car renewal plans so that they can compare , find the best and make a renewal and save money in the process.

Zero in on vital features

While comparing a myriad of car renewal schemes, car owners invariably come across a plethora of features on offer by insurers. Since the requirement varies from one car-owner to another, it is prudent for motor insurance renewal seekers to narrow down on features they they need and opt out those costly plans with extensive features that are not relevant for them. This ploy can save them a good amount of money.

No-claim bonus

Car-owners with valid insurance policies are eligible for concession at the time of renewing their policies if they don’t make any claim during the policy year. The concession is known as no claim bonus or NCB and it keeps increasing as the policyholder’s claim-free year also increases.

Higher deductible

At the time of car policy renewal, current policyholders are entitled to opt for a voluntary deduction.As per the norm, policyholders are supposed to pay this voluntary deduction amount at the time of claim settlement. If one chooses to pay higher amount one will have to pay less on premium , hence one can save on car policy renewal.

Advance Renewal

Most car insurers tend to raise the price of renewal on or some days before the stipulated renewal date. A lot of car-owners faced a sudden hike on the day of renewal , simply because insurers are well-aware of the fact that car-owners have no option but to grab them by paying more. Hence, it is prudent to start looking for a car renewal policy at least two months in advance. A week or two can be spent on searching, finding, comparing and selecting the best motor insurance renewal plan so that the renewal policy can be acquired at least 45 days before the lapse of current policy. Even if insurers raised the renewal rates at the time of renewing car policy it won’t be a matter as the policy has already been renewed at a reasonable price.

An early renewal will not take any value away from an existing car policy

All insurance companies offer vehicle insurance renewals at least 45 days prior to the expiry of the current policy. Even if a car-owner has his or her motor insurance policy renewed well before the expiry of the existing policy, the new policy will come into effect only when the former one ceases to exist. This means the money that car-owners paid for premium earlier will not be lost.

Let us assume, a person by the name of Mr. Nikhil Kumar, a Mumbaikar, purchased a stylish Hyundai Santro car a year back. His policy is about to expire on 30th September, 2015. In a bid to find and compare available renewal policies for his car, Mr. Kumar visited the portal of GIBL and furnished his and his car’s details. His car details are, a 5 seater Hyundai Santro , AT, petrol with a cubic capacity of 1086. Mr. Kumar made a claim in the first policy year and he opted out for voluntary deduction.

Upon furnishing all the information Mr. Kumar got hold of 15 car renewal policies to compare with. When he started to compare policies on the basis of beneficial features, he found only 3 policies offer all those facilities that he was looking for. Here is a table of top 3 car insurance renewal plans.

|

Parameters> Insurer |

Premium |

Lodging Claims

|

Free Pickup Car

|

Cashless Settlement

|

Towing Reimbursement

|

Bi-Fuel Coverage |

|

IFFCO-TOKIO |

Rs. 9,157 |

YES |

YES |

YES |

YES |

YES |

|

Tata AIG |

Rs. 15,333 |

YES |

YES |

YES |

YES |

YES |

|

Futture Generali |

Rs. 15,333 |

YES |

YES |

YES |

YES |

YES |

It is clearly understandable from the top 3 vehicle insurance renewal plan that the policy offered by IFFCO-TOKIO is the best among the lot. It comes with all the features that other two plans also provide but the plan costs a hoping Rs. 6176 (Rs. 15333 – Rs. 9157) less than two other polices.

How could Mr. Kumar save even more?

Mr Kumar has to pay Rs. 9,157 if he wants to grab the IFFCO-TOKIO car renewal plan. However, j he could have saved even more had he opted for a voluntary deduction and if he had not made a claim in the previous year. Let’s se how much he could have saved if he had not made any claim.

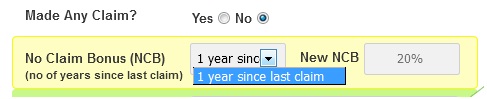

No claim bonus

Let’s see how much Mr. Kumar would have managed to save had he not made any claim and received a no claim discount.

The portal of GIBL comes with an option for calculating NCB or no claim bonus. There is a separate section where car-owners need to mention whether they have made any claim or not. Since Mr. Kumar made a claim, he had to check the ‘Yes’ box.

Had he refrained from making a claim, he could have gained 20% discount on premium rate.

Source: GIBL.IN

Here is a table of car insurance renewal policies, assuming Mr. Kumar did not make any claim in the first policy year.

|

Parameter Insurer |

Premium |

Lodging Claims

|

Free Pickup Car

|

Cashless Settlement

|

Towing Reimbursement

|

Bi-Fuel Coverage |

|

IFFCO-TOKIO |

Rs. 7,712 |

YES |

YES |

YES |

YES |

YES |

|

Tata AIG |

Rs. 12,711 |

YES |

YES |

YES |

YES |

YES |

|

Futture Generali |

Rs. 12,711 |

YES |

YES |

YES |

YES |

YES |

Source: GIBL.IN

There is not much of a difference as far as the insurers are concerned. All the top 3 polices are again in the leading positions. However, the noticeable difference lies in the premium amount. Since, we assumed Mr. Kumar did not make any claim and he is eligible for 20% NCB, the revised premium rates are quite lower than the previous amount.

In this situation Mr. Kumar had to pay just Rs. 7,712 if he chose to go for IFFCO-TOKIO car renewal plan. Originally, the amount was Rs. 9,157. Hence, Mr. Kumar could have saved another Rs. 1445 (Rs. 9,157 – Rs. 7,712).

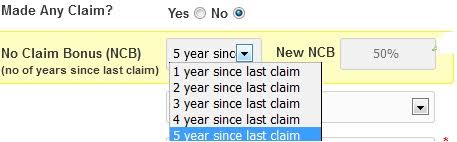

Mr. Kumar would have received a much bigger discount if his car was 4-5 years old and if he hadn’t not made any claim for all these 4-5 years in a row. There is a maximum of 50% discount on premium available for not making claims for 5 consecutive years.

Source: GIBL.IN

Had Mr. Kumar bought his car in 2010 and made no claim since then, he would have received a 50% discount on premium. The revised premium rates in that case would be;

|

Parameter Insurer |

Premium |

Lodging Claims

|

Free Pickup Car

|

Cashless Settlement

|

Towing Reimbursement

|

Bi-Fuel Coverage |

|

Tata AIG |

Rs. 6,092 |

YES |

YES |

YES |

YES |

YES |

|

Futture Generali |

Rs. 6,092 |

YES |

YES |

YES |

YES |

YES |

Source: GIBL.IN

In this revised table of car insurance renewal policy only 2 plans available with all beneficial features. Both these policies come with much-reduced premium amount. For 1 year of NCB, the premium for these two plans were Rs. 12,711. But for 5 years of NCB, the premium amount has come down to Rs. 6,092 which is less than half of the previous amount .

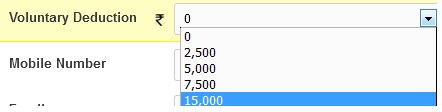

Voluntary deduction

Initially, while looking for a car insurance renewal plan, Mr. Kumar didn’t opt for any voluntary deduction. Had he done this, he could have saved more on premium as well. Here is a table of car insurance renewal policies, having opted for Rs. 5000 as voluntary deduction. All the premiums are calculated considering a claim is being made in the previous year.

|

Parameter Insurer |

Premium |

Lodging Claims

|

Free Pickup Car

|

Cashless Settlement

|

Towing Reimbursement

|

Bi-Fuel Coverage |

|

Tata AIG |

Rs. 13,623 |

YES |

YES |

YES |

YES |

YES |

|

Futture Generali |

Rs. 13,623 |

YES |

YES |

YES |

YES |

YES |

Source: GIBL.IN

In our previous comparison with a claim being made and no voluntary deduction, the premium amount of the above two insurers was Rs. 15,333. After opting for Rs. 5000 voluntary deductions the premium for same insurers is reduced to Rs. 13,623. This simply means, had Mr. Kumar opted for Rs. 5000 as a voluntary deduction he could have saved Rs. 1710(Rs. 15333 – Rs. 13623).

Depending on one’s affordability one can opt for as much as Rs. 15,000 as a voluntary deduction with a view to minimize even more.

Source: GIBL.IN

Hence, it is a proven fact that factors like NCB and Voluntary Deduction do influence premium rate of car renewal policies. Mr. Kumar did the right thing by resorting to an insurance comparison portal and weighing various parameters to compare various car renewal plans. However, he missed out on additional discounts because he did make a claim and he did not choose to pay for voluntary deduction.

If you have a car in India, you cannot escape paying for renewals every year. However, if you consider these money-saving ways and implement them to good effect you can surely save a significant amount of money effortlessly.