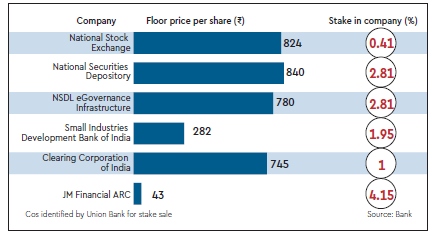

Union Bank of India has put up for sale its stakes in six companies to raise around Rs 700 crore, according to a sale document. The public-sector lender has invited bids for its 0.41% stake in National Stock Exchange (NSE), 2.81% each in National Securities Depository (NSDL) and NSDL eGovernance Infrastructure, 1.95% in Small Industries Development Bank of India (Sidbi), 1% in Clearing Corporation of India (CCIL) and 4.15% in JM Financial ARC.

The last date for sending in bids is October 30.

In a bid document, the bank said it will not accept bids in a price range. “Bids shall be submitted for at least 50% of the quantity of shares of respective company offered for sale by the Bank. The bidder may opt to apply for any or all of the shares offered for sale by the bank,” it said in the document.

In the quarter ended June, Union Bank had raised `194 crore from sales of investments, down 70.3% year-on-year (y-o-y) and 47.3% sequentially.

Earlier this year, Bank of Baroda (BoB), Punjab National Bank (PNB), IDBI Bank, Dena Bank and Canara Bank have carried out sales of their stakes in non-core assets.

Mounting bad loans have taken a toll on public-sector banks’ (PSBs) capital position, leading them to offload their non-core assets. On September 25, the government said PSBs were offered `90,000 crore (of which `80,000 crore was in the form of bonds) in 2017-18 and securities worth another `65,000 crore are to be provided to them in the current fiscal. Any further infusion, if finally approved, ahead of an election year could be done through recapitalisation bonds — which will be the government’s off-budget liabilities — to avoid worsening the fiscal deficit.