Real estate funds are under scrutiny for a lack of liquidity in some vehicles – yet are also hailed as “flavour of the year”. To counter structural problems, portfolios need to reflect a changing world, Alex Rolandi is told.

Retail properties were once seen as a defensive asset. Five to ten years ago, a standard diversified real estate strategy could have had as much as 50% invested in this corner of the property asset class, followed by offices. But the retail and office sub-sectors face challenges.

Retail’s problem is well known: plummeting demand and an oversupply of properties run parallel to the growth in online shopping. For Tom Walker, fund manager and co-head of Schroders’ global real estate securities team, this factor could be at work in the recent turmoil in the real estate funds market – namely the suspension in trading of the M&G Property Fund.

“The headlines would lead you to believe the funds are suspended because of Brexit. Although there is an element of truth there, when I look at the underlying assets, the bedrock of the portfolio is retail, and then offices, because that’s always been how diversified portfolios have been built, but the world has moved on,” he tells Funds Europe. “A lot of real estate exposures are still set up for a world that doesn’t reflect that change.”

Direct property funds – those that own the real assets and not securities that gain real estate exposure – will have to rethink their allocations in order to generate strong returns, the fund manager says. But it’s difficult to shift bricks and mortar in a day. In the case of M&G, the fund could not keep up with sustained outflows from investors and was consequently gated.

A “structural vulnerability risk” exists in the real estate funds sector, according to the European Securities and Markets Authority. Many funds offer daily liquidity while the assets they invest in are not liquid. The International Advisory Board for Fund Selection also raised concerns recently regarding daily liquidity, especially in real estate funds.

As board member Andrew Clare highlighted, most people know they can’t wake up in the morning and sell their house by midday.

“But investors expect to have daily liquidity in their property portfolio – that is, the option to complete commercial property transactions in a day,” Professor Clare said after a board meeting in Madrid earlier this year. “To have daily liquidity in property funds is just nonsensical. Of all the asset classes, it’s probably the biggest mismatch between product and underlying asset there is.”

M&G Real Estate predominantly manages direct property funds. Peter Riley, its head of capital solutions, says these strategies are designed to provide investors with what they need.

“Our funds, in general, are open-ended, so essentially investors vote with their feet,” he adds. “If they’re not happy with the performance, or the way in which a fund is managed, then ultimately investors will walk away. Assets need to be evaluated whether they are robust and have a long-term role, or whether they need to be rethought.”

Flavour of the year

Real estate and infrastructure are flavour of the year, according to Francisco Da Cunha, real estate tax leader at Deloitte Luxembourg and chair of a Luxembourg funds industry real estate working group, and many funds are re-addressing strategies to adapt to the “ups and downs” in sectors like retail and office sub-sectors.

“Little by little, firms are letting go of multi-sector strategies – but this also depends on geography,” Da Cunha says. “One way to avoid issues is for firms to plan ahead in the fund incorporation phase as regards any perceived financial or political sensibilities with the sector and strategy they are planning to invest in, so as to tailor their commitments and investments accordingly.”

Instead of investing directly in real estate, the Schroder Global Cities Real Estate Income strategy – which allocates about 5% of its portfolio to retail – buys shares in listed companies.

Over the past five years, it has generated cumulative returns to the tune of over 50%, at the time of writing. “It’s very different to bricks and mortar,” says Walker, who runs the strategy alongside colleague Hugo Machin. “But nothing’s perfect – we can give the same exposure in a liquid vehicle, but you will have slightly more volatility – as opposed to the volatility of not getting your money out.”

In the UK, there has been a hesitancy to invest in listed real estate. Real estate investment trust (Reit) legislation did not come into effect until 2007, just before the financial crisis began.

Countries like the US, Australia and the Netherlands have had Reits for decades and the average consumer has investments in them, according to Walker.

“Here [in the UK] you just don’t have that history, but as these crises with daily-dealt funds go on, with ongoing suspensions, or the FCA [Financial Conduct Authority] saying various things, it opens people’s eyes to the issues of one type of investment and the benefits of another,” he says.

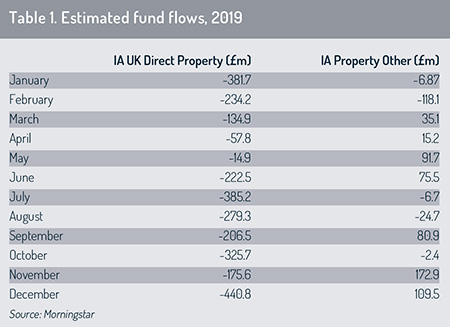

Data from Morningstar shows investors are shunning direct property. The IA Direct Property sector suffered outflows every month last year. In December, over £440 million (€519 million) was withdrawn from the sector, while returns averaged in the red. The IA Property Other sector, which includes funds like Schroder Global Cities Real Estate, finished the year with two consecutive months of inflows (see Table 1).

Interest is being driven towards funds investing in listed real estate, rather than those investing directly.

Interest is being driven towards funds investing in listed real estate, rather than those investing directly.

Aberdeen Standard Investments’ (ASI) European Real Estate Share strategy – which has seen cumulative returns of around 70% over the past five years – also invests primarily in Reits rather than direct property and has seen more interest in the fund. “One thing that has supported this are the issues faced by direct property funds – specifically in the UK – where they have had a very high concentration in retail assets like shopping centres or retail parks. It makes vehicles like ours much more attractive,” says Sanjeet Mangat, investment director and fund manager of the fund.

According to Mangat, being underweight in the retail sector has significantly contributed to the fund’s overall performance.

Back at Schroders, Tom Walker says the inherent risks that come with investing in retail are no greater than in the office or industrial sectors if the investment is city-focused. “If you’re investing outside of a major city, your chances of success are less.”

Regional industrial and office assets outside of growing, innovative cities will end up suffering the same fate as retail over the next five or ten years, he maintains. He doesn’t write retail off completely, however. “There is still a need for retail assets in cities. If you look at any of the retailers today, they will always keep a physical store,” he says. Nonetheless, footfall is important.

“We’re happy to invest in retail in a city, but we’ve got to know millions of people walk past it, which means the retailer will always want to be there. This is where data analysis comes in.

“We’re happy to invest in retail in a city, but we’ve got to know millions of people walk past it, which means the retailer will always want to be there. This is where data analysis comes in.

Looking at foot-flow and transport volumes going through specific locations is key to underwriting the value of any real estate.”

What people need

The Schroder Global Cities Real Estate Income fund invests in what makes cities tick, according to Walker. He compares the strategy to a microcosm of society. “Yes, we’re a real estate fund, but we’re investing in things people need when they’re living in a city.”

And not all cities are alike. Walker was in China before Christmas, meeting with management teams and viewing assets, before the coronavirus outbreak. “The scale of cities like Shanghai and Shenzhen is incredible – it’s inspirational,” he says. “Just the scale of what’s going on – the numbers of people, the businesses, how well the cities are run. In some equity indices, China is counted as an emerging market, but there is nothing emerging about Shenzhen or Shanghai – they are far more advanced than most of the cities we all live in.”

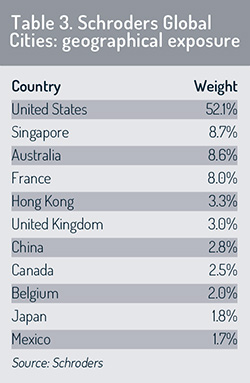

Exposure to China was just 2.8%, with the country ranking eighth globally. US exposure, in first place, was much higher at 52% (see Table 3).

Some of the best-returning cities in the Schroders fund include Shanghai, Los Angeles, Boston, San Francisco, Beijing and Paris. Tailor-made databases are used to rank the strongest around the globe, effectively, and which companies have the highest exposure in those cities. After that, it is a case of looking at details like transportation and resilience.

Some of the best-returning cities in the Schroders fund include Shanghai, Los Angeles, Boston, San Francisco, Beijing and Paris. Tailor-made databases are used to rank the strongest around the globe, effectively, and which companies have the highest exposure in those cities. After that, it is a case of looking at details like transportation and resilience.

London may be strong in Europe, but if you compare it to other places, such as San Francisco, it’s not as good as you might hope, Walker says.

Looking at the fund’s index, it’s a battle between US coastal cities and the big cities in Asia. The growth outlook in Europe is slower, with ageing demographics playing a large part in this.

Asia is only going to get bigger. “In five or ten years’ time, Asia is going to be higher than it is today. Will Asia grow at the expense of Europe or the US? We don’t know yet, but my gut feeling is that it’ll be Europe – that seems to be what the data is saying, we just need to see it play out a bit longer.”

Upsides can be found in niche sub-sectors, where low building supply is complemented by high demand. Self-storage, student accommodation, data centres, apartments and logistics are particularly favourable. These sorts of niche exposures can potentially weather the political risk posed by issues such as Brexit, regardless of what happens, according to ASI’s Mangat.

The ASI European Real Estate Share fund struggled in 2016 as UK stocks weakened following the vote to leave the EU. But a lot of companies that initially suffered have performed much better since. “Names like Segro in the industrial space, Assure in healthcare and Unite in the student housing sector,” says Mangat.

“Things like student accommodation are always going to be needed. They don’t face the same types of structural challenges we see in the retail space.”

As cities worldwide continue to grow, there will always be a need for certain types of building. By 2050, the UN estimates that more than 60% of the world’s burgeoning population will live in urban spaces. “Urbanisation is relentless,” says Walker. “The numbers for growth are off the charts. It’s a very old trend, but it’s also very nascent in terms of the future impact it will have on real estate valuation around the world. And it’s going to continue for many decades, as will the trends that come with it, such as data creation and ageing demographics.”

Keeping up with the times is key for survival. As liquidity becomes more of an issue, cash convertibility is also crucial. According to Mangat, about 95% of the ASI European Real Estate Share fund can be liquidated in a week. “Direct property funds might want to consider having more of a liquidity buffer,” she says. “Rather than having 10% cash, maybe those funds want to invest 10% into a fund that invests in listed real estate, then you’d have a Reit buffer, because what are you earning on cash these days?”

© 2020 funds europe