By Eric Klieber

Created in 1935, in the depths of the Great Depression, Social Security (officially the Old Age, Survivors and Disability Insurance System) was initially motivated primarily by a desire to provide economic relief for those deemed unable to work due to old age and thus unable to benefit from the new Unemployment Insurance program or from New Deal programs providing jobs for the unemployed, such as the Works Progress Administration and Civilian Conservation Corps. In the words of President Franklin Delano Roosevelt, in his statement upon signing the Social Security Act, it was meant to give some measure of protection to the average citizen and to his family against poverty-ridden old age.[1] Nevertheless, its designers chose not to create a program targeted specifically toward those in demonstrable financial need. Rather, they created a social insurance program covering a broad spectrum of the population and financed by a dedicated tax levied on the wages of all covered workers. Workers with higher wages receive higher benefits at retirement measured in absolute dollars, but workers with lower wages receive higher benefits relative to the taxes they pay. Thus, there is an individual equity, or savings, element to the system as well as a social adequacy, or need-based, element.

Since its creation, Social Security has evolved and grown into one of the most successful large-scale programs of the federal government. It is not the intent of this essay to chronicle the development of the system over time, but to examine the system as it exists today and its prospects for the future.

A Brief Description of Social Security Taxes and Benefits

The following description is limited to provisions referred to later in this article.[2] Those familiar with the Social Security tax and benefit formulas can skip to the next section.

Social Security has three sources of income. Its primary source is the tax on workers’ earnings. The current Social Security payroll tax rate is 12.4%, applied to wages and income from self-employment (together called “covered earnings”), up to a maximum amount: the contribution and benefit base, often referred to as the maximum taxable wage base. The contribution and benefit base is $147,000 in 2022. For employed workers, the tax is split equally between employee and employer, while the self-employed pay the entire tax. The contribution and benefit base is adjusted each year in proportion to changes in the national average wage. The contribution and benefit base is also the maximum amount of earnings included in the Social Security benefit formulas.

Income to Social Security accumulates in two trust funds—one for old age and survivor benefits, and one for disability benefits. Trust fund assets are invested in special-issue government bonds whose interest rate is set at the average rate on all outstanding regular government bonds at time of issue with at least four years remaining to maturity. Interest on these bonds comprises the second source of income.

Finally, a portion of the Social Security benefits paid to some beneficiaries is subject to federal income tax, and the additional revenue from this tax is shared between the Social Security and Medicare trust funds. In calendar year 2020, the payroll tax accounted for 89.6% of income to the system, interest income 6.8%, and the tax on benefits 3.6%.

Determining a retired worker’s monthly benefit level begins with calculating an adjusted career-average earnings, using the same definition of covered earnings as for taxes. Each worker’s covered earnings before age 60 is adjusted by the ratio of the national average wage in the earlier of the second year before benefit commencement or the year the worker turns age 60 divided by the national average wage in the year earned. There is no adjustment to earnings at age 60 or later. For workers whose benefits commence at age 62 or later, indexed earnings for the 35 highest years, including, if necessary, years with zero earnings, are averaged and divided by 12; the resulting amount is called the “average indexed monthly earnings” (AIME). For workers disabled before age 62, the number of years used in the AIME is the number of years from the calendar year of attainment of age 22 to the calendar year of disablement less a number of years which varies from 0, for those disabled before age 27, to 5, for those disabled after age 46.

The fundamental amount on which most Social Security benefits are based is the “primary insurance amount” (PIA). The PIA is calculated by multiplying 90% times the AIME up to the first bend point in the formula, 32% times the portion of the AIME that falls between the first and second bend points, and 15% times the AIME over the second bend point. The bend points, where the percent factors in the formula change, are dollar amounts indexed over time by the same national average wage index used to adjust the contribution and benefit base and workers’ earnings. The 2022 bend points are $1,024 and $6,172. Indexing workers’ earnings and the bend points in the benefit formula based on changes in the national average wage index helps ensure that initial Social Security benefits keep pace with increases in the wages of those still working.

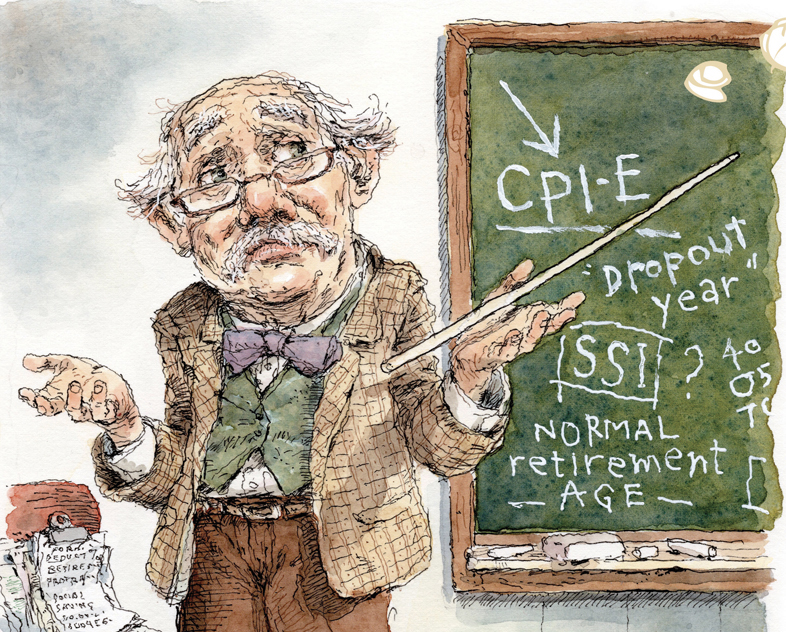

The PIA is indexed by an annual cost-of-living adjustment (COLA) beginning with December of the year the worker attains age 62. The COLA depends on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which is calculated by the Bureau of Labor Statistics (BLS). This indexing continues after benefit commencement to maintain the buying power of Social Security benefits during retirement. For workers whose benefits begin at the normal retirement age (NRA), and for workers who are totally and permanently disabled before that age, the monthly benefit equals the PIA increased by any COLA. Benefits are reduced if a non-disabled worker commences benefits before the NRA and are increased if the worker commences benefits after the NRA, but only up to age 70. The NRA is 67 for workers born in 1960 or later, that is, those who attain age 62, the earliest eligibility age for old age benefits, in 2022 or later.

The program also provides auxiliary benefits for spouses and other dependents of a worker based on the worker’s earnings history. If there is a significant difference in the earnings histories of the two members of a married couple, the lower-paid (or non-working) spouse receives a benefit based on 50% of the higher-paid spouse’s PIA unless the lower-paid spouse can receive a higher benefit based on his or her own earnings history. If the higher-paid spouse dies first, the surviving spouse’s benefit is based on 100% of the deceased spouse’s PIA. Note that, because spouses might have different early or late retirement factors applied when determining their benefits, the benefit received by the lower-paid spouse might not be exactly 50% or 100% of the higher-paid spouse’s benefit. Social Security also pays benefits to other family members in certain circumstances, including former spouses, dependent children, and parents, but the great majority of auxiliary benefits are paid to spouses and surviving spouses.

Challenges Facing Social Security

In 1983, the Social Security trust funds faced imminent insolvency, assets having fallen to 14% of annual expenses at the beginning of that year.[3] To remedy this situation, Congress passed the Social Security Amendments of 1983, which, through a combination of tax increases and benefit reductions, staved off insolvency through the entire 75-year valuation period, through 2057, based on the trustee’s intermediate, or best estimate, assumptions regarding future demographic and economic trends.[4] Since the 1983 Amendments, Congress has enacted no changes to the program with significant cost implications. In particular, all provisions described in the previous section are unchanged since 1983.

The 2021 Trustees Report projects, again based on the intermediate assumptions, that the trust funds will be depleted in 2034, 23 years earlier than projected in 1983, due to experience during the intervening period less favorable to system finances than projected by the assumptions, particularly on the economic side.[5] This is not a sudden development, as all Trustees Reports for several decades have projected trust fund depletion well before 2057, the exact year of depletion varying mostly within the 2030s.[6] As in 1983, some combination of tax increases and benefit reductions is necessary to enable the system to continue paying all promised benefits beyond 2034. Congress should not wait until insolvency is imminent. Adopting changes in the near future rather than waiting until the last minute reduces the magnitude of the required changes and allows for a more gradual phase-in of those changes. This is Social Security’s first challenge.

For the past several decades, poverty rates among those age 65 and over have been comparable to, and in recent years slightly below, rates among those age 18 to 64.[7] In broad terms, the retired population has averted poverty with the same degree of success as the working population. Although Social Security is not specifically an anti-poverty program, it has made an important contribution to this success. About a quarter of Social Security beneficiaries receive over 90% of their income from Social Security.[8]

The Social Security Amendments of 1972 included two provisions directed specifically toward alleviating poverty in the retired population. It created the special minimum PIA to provide adequate benefits to long-term low wage earners. Initially set at $170 per month for workers with at least 30 years of covered employment, pro-rated for workers with fewer than 30 years of covered employment, the amount has grown by the CPI adjustment to $950.80 in 2021. Since the bend points used to calculate the regular PIA are adjusted by the national average wage index, which historically has increased more rapidly than the CPI, the special minimum PIA has affected an ever smaller percentage of Social Security beneficiaries over time. In 2019, only about 32,100 out of over 64 million Social Security beneficiaries were receiving benefits determined by the special minimum PIA.[10]

The 1972 law also created the Supplemental Security Income (SSI) program, funded by general revenue rather than the dedicated payroll tax, which provides additional income for persons who are age 65 or over, disabled, or blind and who meet eligibility requirements based on income and resources.[11] The maximum resources allowed to qualify for an SSI benefit have not been updated since 1989: $2,000 for a single person or $3,000 for a couple, excluding a primary residence, an automobile valued up to $4,500, household goods valued up to $2,000 and a life insurance policy with a face value not exceeding $1,500. As a result of these limits on resources and limits on income that vary by state, only about 4% of Social Security beneficiaries receive SSI benefits.[12] Only a third of SSI recipients receive Social Security benefits.

While Social Security as currently structured has played an important role in ensuring the risk of living in poverty does not increase when a worker retires, a ny further reduction in poverty in the retired population requires a more focused approach. Finding the best approach to reducing poverty among beneficiaries is Social Security’s second challenge.

The current structure of Social Security auxiliary benefits favors married couples with one primary wage earner. A single worker pays a certain amount in taxes and receives a certain amount in benefits. In a couple whose members earn comparable wages, each member pays taxes and receives benefits on the same basis as the single worker. But in a one-earner couple, the working member pays the same taxes as the single worker but the couple receives, in addition to the benefits of the working member, spouse and surviving spouse benefits for the non-working member, while paying little or no additional taxes. At a time when the one-earner couple was idealized, this inequity seemed justified, but it is clearly outdated in a society where no single family structure can be considered the norm.

Society today features not only greater diversity in family structure, but also greater diversity in career paths for individual workers. Gone are the days when it was common for a worker to spend most or all of his or her career working in the same trade or for the same company. According a survey by BLS, the average worker born in the period 1957 to 1964 held 12.4 jobs between ages 18 and 54.[13] Changing jobs often entails periods of unemployment. Also, it has become increasingly common for a worker to drop out of the labor force temporarily for career-related education or to care for children or parents. Thus, Social Security’s third challenge is adjusting its benefit structure to meet the needs of a society with a greater diversity of both family structure and career patterns.

The following three sections discuss each of these challenges in greater depth.

Avoiding Insolvency

Since its inception, the ratio of workers contributing into the system to beneficiaries drawing payments from the system has been declining.[14] During the period from 1975 to 2005, when all members of the baby boom generation were in their prime working years, the ratio stabilized temporarily at 3.3 to 3.4 workers per beneficiary. Since then, lower fertility among women following the baby boom has reduced the supply of new workers while greater life expectancy at retirement has increased the beneficiary population, causing the ratio to decline to 2.7 workers per beneficiary in 2020. The trustees project continued decline to 2.1 by 2095.

The ongoing decline in the ratio of workers to beneficiaries was anticipated at the time of the 1983 amendments. In response, Congress adopted a schedule of tax rates rising rapidly to the current 12.4% rate, effective in 1990. This rate was much higher than required to finance benefit payments during the next two decades, leading to a large accumulation of assets in the trust funds. The intent was to avoid a much larger tax increase that would otherwise have been required when the baby boom generation began retiring around 2010. Trust fund assets have continued to increase, reaching slightly more than $2.9 trillion at the end of 2020. However, the trustees anticipate that trust fund assets will begin declining in 2021 until totally depleted in 2034.[15]

It was always anticipated that further tax increases and/or benefit reductions would be required to keep the system solvent for the indefinite future. However, the time for those changes has come sooner than was expected in 1983. Here is a suite of five proposed changes, four of which are drawn from comprehensive proposals already in the public domain:

- A bill introduced in 2014 by Rep. John Larson, the current chair of the Social Security Subcommittee of the House Ways and Means Committee, increases the payroll tax rate by 0.1% per year over the period 2027 to 2046, until it reaches 14.4%.[16] Under the trustees intermediate long-range assumptions, real wages after adjustment for inflation are expected to increase by 1.15% per year.[17] This proposed tax increase would reduce the rate of increase in net pay after the payroll tax to just over 1.0% during the 20-year tax increase period. This, I believe, is a small price for workers to pay to ensure they will receive their promised benefits in retirement.

- The contribution and benefit base was originally set so that taxable earnings represented about 90% of all covered earnings. Over the years, greater disparity of earnings between low- and high-paid workers has caused this percentage to slip. In 1977, the wage base was increased by legislation to restore the 90% taxable ratio. The percentage has slipped again and in recent years has fluctuated around 83%.[18] A proposal by the 2005 Social Security Advisory Board increases the contribution and benefit base over the period from 2022 to 2031 so that at the end of that period the taxable percentage returns to the 90% level, thereby restoring the intended allocation of funding between low- and high-paid workers.[19]

- About 25% of the employees of state and local governments, representing about 4% of the labor force, are not covered by Social Security.[20] This is the largest block of uncovered workers. The 2010 National Commission on Fiscal Responsibility and Reform, among others, has proposed covering all newly hired state and local government employees.[21] Given that these employees are covered by Medicare, excluding them from Social Security no longer makes sense. Including them would improve system finances since additional tax revenue would come immediately, but additional benefit payments over time.

- The Social Security NRA was initially set at age 65. Life expectancy at age 65 in 1940, the first year benefits were paid, was 12.7 years for men and 14.7 years for women.[22] When the 1983 amendments raised the NRA in steps to 67, life expectancy at age 65 had increased to 15.1 years for men and 18.9 years for women. In 2022, the figures are 19.1 years for men and 21.7 year for women, and by 2095 they are expected to reach 23.2 years for men and 25.3 years for women, in both cases more than 10 years more than in 1940. Greater longevity increases the total lifetime benefits received by the average worker without any change in the benefit formulas. Raising the NRA has an offsetting effect by reducing the monthly amount of benefits at any given benefit commencement age. A proposal by retired Rep. Reid Ribble increases the NRA by two months per year after 2022 until it reaches 69 in 2034 and then by one month every other year thereafter.[23] Under this proposal, the NRA would reach age 71 and six months by 2095, offsetting 6½ years of the projected increase in life expectancy.

- A principal objection to raising the NRA is that it unfairly reduces the benefits of workers in physically demanding jobs who are unable to continue working to more advanced ages. To meet this objection, I propose creating an occupational disability benefit for workers not totally disabled under the Social Security definition but unable due to disability to continue in their usual occupations. Social Security currently has a less stringent definition of disability for older workers but still requires they demonstrate an inability to perform any job they are reasonably qualified for. The occupational disability benefit would equal the benefit for non-disabled workers before the 1983 amendments, but not higher than the current disability benefit; that is, the full PIA would be payable at age 65 and over and a reduced benefit as early as age 62. Thus, such workers would be held harmless against all increases to the NRA beyond age 65.[24]

The Office of the Chief Actuary of the Social Security Administration (OCACT) maintains a section on its website that shows the impact on Social Security’s finances of various proposed changes to the system’s tax and benefit formulas made over the past several decades by members of Congress, advisory boards and commissions and policy think tanks. At present, cost estimates are based on the valuation model used for the financial projections in the 2021 Trustees Report using trustees’ intermediate set of assumptions.[25]

OCACT has performed its analysis on the first four proposals described above. Individually, these proposals eliminate 43%, 22%, 4% and 36% of the 75-year actuarial deficit, respectively. Summing these percentages yields 105%. However, working together the four proposals eliminate a higher percentage than this sum. In the individual calculations, the additional taxes from increasing the taxable wage base, raising the NRA, and including newly hired government employees are collected at the current tax rate. If the tax rate is increased as well, the additional taxes in all cases would be greater, thus increasing the percentage of the deficit eliminated. OCACT has not performed an analysis of the occupational disability benefit. Whether the margin provided by the first four proposals is sufficient to absorb the cost of the occupational disability benefit I do not know, but if not I believe only minor adjustments would be required to achieve solvency.

Reducing Poverty Among Beneficiaries

Most recent comprehensive Social Security reform proposals include a provision for updating the special minimum PIA, typically to between 100% and 125% of the federal poverty level for a worker with at least 30 years of coverage, with proportionately lower benefits for workers with fewer years of coverage. Such provisions increase benefits of workers with the lowest AIMEs beyond the amounts provided under the regular PIA formula. While provisions of this nature would certainly reduce poverty among Social Security beneficiaries, they would provide insufficient benefits for workers with long periods of unemployment while overpaying workers with significant sources of non-wage income. The Social Security benefit structure is designed to meet a worker’s presumed need during retirement based on the worker’s covered earnings while working, rather than the worker’s actual need based on the worker’s financial situation during retirement.

On June 16, 2021, the Supplemental Security Income Restoration Act was introduced in the U.S. Senate.[26] The major provisions of the bill would modify the SSI program as follows, assuming a Jan. 1, 2022 effective date:

- Increase the maximum monthly benefit for a single person to 100%, and for a married couple to 200%, of the federal poverty level, increases of roughly 35% and 80%, respectively;

- Increase the monthly income allowance before reducing benefits from $65 to $415 for earned income and from $20 to $128 for general income;

- Exclude from the income allowance in-kind support, such as rent-free housing provided by a relative or friend;

- Raise the limit on allowed resources from $2,000 to $10,000 for a single person and from $3,000 to $20,000 for a married couple;

- Index the income and resource allowances after 2022 by the consumer price index for the elderly (CPI-E).

SSI, as modified by this or similar legislation, would reduce poverty among Social Security beneficiaries by paying benefits specifically to those whose income in retirement falls short of the federal poverty level. Thus, an updated SSI would target anti-poverty benefits more efficiently than Social Security. Social Security improves the lives of over 65 million beneficiaries, but no single program can be expected to meet every retiree need. As a social insurance program, it is not the job of Social Security to lift out of poverty people who have lived at or near the poverty level for most of their lives. The goal of reducing poverty among Social Security beneficiaries can and should be left to an updated SSI program.

Meeting the Needs of a Diverse Society

President Roosevelt’s observation, in his signing statement, that we can never insure 100% of the population against 100% of the hazards and vicissitudes of life remains true today. If anything, the greater diversity of society today puts this ideal even further out of reach. As the discussion on reducing poverty reveals, it is important to distinguish those social problems that can be readily addressed within the structure of the Social Security, or without unduly modifying that structure, from those problems best addressed by other programs.

The PIA formula provides higher benefits relative to covered earnings, and hence taxes paid, for low-paid workers than for high-paid workers. The ratio of monthly benefits commencing at age 65 in 2022 to career average covered earnings ranges from 68.0% for workers whose earnings average 25% of the national average wage to 24.1% for workers whose earnings have always equaled or exceeded the taxable wage base.[27] This disparity is essential for Social Security to fulfill one of its primary purposes: providing a floor level of income for all covered workers. When coupled with an updated SSI program, the PIA formula can also play a key role in reducing poverty among beneficiaries.

Workers who become totally and permanently disabled under the Social Security definition before reaching the NRA receive an unreduced benefit. There is a much greater insurance element in this benefit than the old age benefit, as far fewer workers receive disability benefits, and those who do become disabled, particularly at early ages, can receive substantially greater lifetime benefits while paying taxes for a shorter period. A special provision for disabled workers is necessary to ensure the floor level of income standard extends to them as well. Given the changed family circumstances consequent to a worker disability, current law dependent benefits should be retained for disabled workers as well. The same applies to benefits for dependents of deceased workers.

Parents who leave the labor force to care for children, mostly women, have lower lifetime earnings and, in consequence, lower Social Security benefits.[28] Other programs, such as The Child Tax Credit, can provide needed assistance during the period of care. While features of Social Security such as the progressive benefit formula partially compensate for lower earnings, there is widespread support for Social Security to do more to support in retirement parents who care for children during their working years. One way to accomplish this is to reduce the number of years included when calculating the AIME. For this purpose, we define a “dropout year” as one of the following: a year in which a child is born that is followed by a zero-earnings year; a year in which a child turns 14 preceded by a zero-earnings year; or any intervening zero-earnings year. Only one parent can claim a dropout year in any given year, and no parent can claim more than 12. The number of years included in the AIME calculation, 35 for non-disabled workers, is then reduced by the number of dropout years. Thus, reduced earnings years due to child care do not drag down the AIME, leaving benefits comparable to those of similarly situated workers who never take on child care responsibilities.

As noted above, Social Security’s current benefit structure favors single-earner couples through its spouse and surviving spouse benefits. The ostensible motivation is also to support child care: spouse and surviving spouse benefits were seen as compensation for wives who forgo a career to raise children while their husbands work to support the family. Child care dropout years would provide an alternate way to support parents who leave the labor force only temporarily to care for children. But there remains a small group of married people with limited labor force participation and no child care responsibilities. There seems no reason to continue the non-working spouse benefits for these people. Couples that can support themselves on one primary income during the working years can be expected to do likewise in retirement. Thus, I propose providing the aged spouse and surviving spouse benefits only to people with more than the otherwise maximum allowed 12 child care dropout years. In combination, these provisions would accommodate both parents who take short breaks from work for child care and those who make longer term commitments, while eliminating unnecessary subsidies for those who never take on child care responsibilities.

When the 1983 amendments raised the NRA from 65 to 67, the number of years included in the AIME remained unchanged, even though workers were expected to work longer on average. Many proposals to raise the NRA further increase the number years included in the AIME, often to 38 or 40 years. However, even with careers extending to older ages and allowance for non-work periods devoted to child care, a host of factors support leaving the number of AIME calculation years unchanged: increasing need for post-graduate education before starting a career and for mid-career “up-skilling”; non-work periods devoted to parent care; and more periods of unemployment incidental to more frequent job changes. Addressing each factor individually would needlessly complicate an already complex benefit structure. Leaving the number of AIME calculation years unchanged at 35 allows workers flexibility to step out of the labor force when competing needs arise without affecting their Social Security benefits.

Another proposal for introducing greater equity into the system is earnings sharing, under which the covered earnings of a married couple are summed and divided equally between the spouses for purposes of computing the AIME and PIA.[29] This proposal is based on the paradigm that in marriage, economic resources should be shared equally regardless of their source. However, the progressive benefit formula, under which benefits are higher relative to AIME at the lower end of the AIME spectrum, makes this scheme less appealing. The AIME of a single worker who attains age 65 in 2022 and whose covered earnings have always exactly equaled the taxable wage base is $10,437, yielding a PIA of $3,209. If those earnings are shared equally with a non-working spouse, each would have an AIME of $5,219, yielding a PIA of $2,264 for each, or $4,528 combined, about 41 percent higher than the single worker while both spouses are alive.

OCACT has not performed an analysis of any of the provisions suggested above. A less generous child care dropout year provision, limited to children under age six with a maximum of six dropout years per parent, increases the long-term deficit by only 1%.[30] The cost of providing the more generous dropout year provision would be offset by savings from eliminating spouse and surviving spouse benefits for the small number of spouses with limited work labor force participation and no child care responsibilities.

Conclusion

From a program designed initially to help older Americans weather the Great Depression, Social Security has evolved into a program that workers have come to rely on to provide vital income when they can no longer work due to old age or disability. The program has not changed significantly in nearly 40 years, and not surprisingly faces challenges brought on by changes in the social, demographic and economic environment over that period. The good news is that these challenges can be met and overcome with only a few changes that preserve the basic structure of the program. These changes include, principally, a tax increase that applies uniformly to all covered workers, a tax increase that applies only to high-paid workers, a benefit decrease that excludes workers unable to continue working due to disability, and a realignment of provisions that support parents who take time off from work to care for their children that targets benefits more precisely to this group while also accommodating a broader array of parenting arrangements.

Eric KlIEber, MAAA, retired as a consulting actuary at Buck Consultants.

References

[1] https://www.ssa.gov/history/fdrsignstate.html

[2] https://www.ssa.gov/news/press/factsheets/HowAreSocialSecurity.htm , https://www.ssa.gov/OACT/COLA/Benefits.html

[3] https://www.ssa.gov/oact/TR/2021/VI_A_cyoper_hist.html#293711

[4] https://www.ssa.gov/history/1983amend.html

[5] https://www.ssa.gov/oact/TR/2021/II_A_highlights.html

[6] https://www.ssa.gov/oact/TR/2021/VI_B_LRact_bal.html#103557

[7] https://www.census.gov/content/dam/Census/library/visualizations/2019/demo/p60-266/Figure11.pdf

[8] https://www.ssa.gov/policy/docs/ssb/v77n2/v77n2p1.html

[9] https://www.ssa.gov/cgi-bin/smt.cgi

[10] https://www.ssa.gov/policy/docs/program-explainers/special-minimum.html

[11] https://www.ssa.gov/ssi/text-understanding-ssi.htm

[12] https://www.ssa.gov/policy/docs/chartbooks/fast_facts/2021/fast_facts21.html#page24

[13] https://www.bls.gov/news.release/pdf/nlsoy.pdf

[14] https://www.ssa.gov/oact/TR/2021/IV_B_LRest.html#493869

[15] https://www.ssa.gov/oact/TR/2021/VI_A_cyoper_hist.html#293711 https://www.ssa.gov/oact/TR/2021/IV_B_LRest.html#473953

[16] https://www.ssa.gov/oact/solvency/provisions/charts/chart_run236.html

[17] https://www.ssa.gov/oact/TR/2021/V_B_econ.html#292722

[18] https://www.ssa.gov/policy/docs/policybriefs/pb2011-02.html

[19] https://www.ssa.gov/oact/solvency/provisions/charts/chart_run285.html

[20] https://www.ssa.gov/oact/solvency/FiscalCommission_20101201.pdf

[21] https://www.ssa.gov/oact/solvency/provisions/charts/chart_run425.html

[22] https://www.ssa.gov/oact/NOTES/ran2/an2021-2.pdf

[23] https://www.ssa.gov/oact/solvency/provisions/charts/chart_run272.html

[24] https://www.nasi.org/research/social-security/strengthening-social-security-for-workers-in-physically-demanding-occupations

[25] https://www.ssa.gov/oact/solvency/provisions/index.html

[26] https://www.brown.senate.gov/newsroom/press/release/social-security-program-update

[27] https://www.ssa.gov/oact/NOTES/ran9/an2021-9.pdf

[28] https://crr.bc.edu/briefs/how-much-does-social-security-offset-the-motherhood-penalty

[29] https://www.ssa.gov/policy/docs/ssb/v69n1/v69n1p1.html

[30] https://www.ssa.gov/oact/solvency/provisions/charts/chart_run417.html