For over a year, we have been discussing the acceleration of digital banking activity that resulted from the closing of physical facilities in response to the pandemic. As consumers and businesses flocked to digital channels, traditional financial institutions responded by deploying new technologies, products and services to improve customer experiences.

Many financial institutions doubled down on digital transformation initiatives to try to keep pace with fintech and big tech firms that quickly became the darlings of Wall Street. Larger financial institutions as well as these non-traditional firms are stealing the lion’s share of market cap growth in the financial services industry and are breaking records for venture capital investment. According to McKinsey’s Global Banking Annual Review, this is causing a significant divergence between the industry’s top performers and performance laggards.

What McKinsey finds is that the banking industry is splitting into haves and have-nots around the response to market changes, the resiliency of existing business models, and the determination to become future-ready. While some factors, such as geography, customer base, and scale may be difficult to modify quickly, alternative business models can make a measurable positive impact on future results if implemented quickly.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Current Revenues Do Not Guarantee Future Success

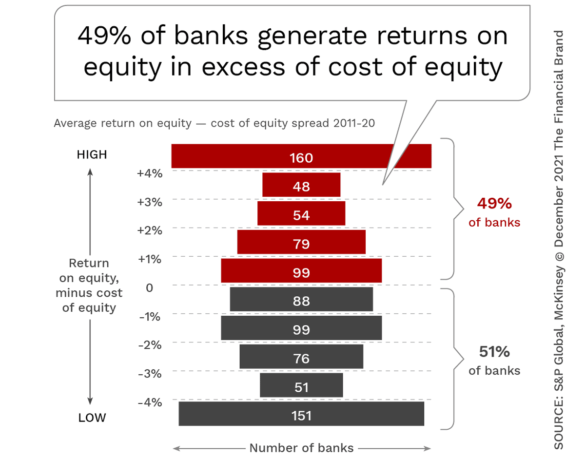

The majority of financial institutions appear to be doing well financially, especially in context of what has occurred globally related to the pandemic. That said, only half of the banks currently cover their cost of equity. According to McKinsey, 51% of banks operate with an ROE below cost of equity (COE), and 17% are below COE by more than four percentage points.

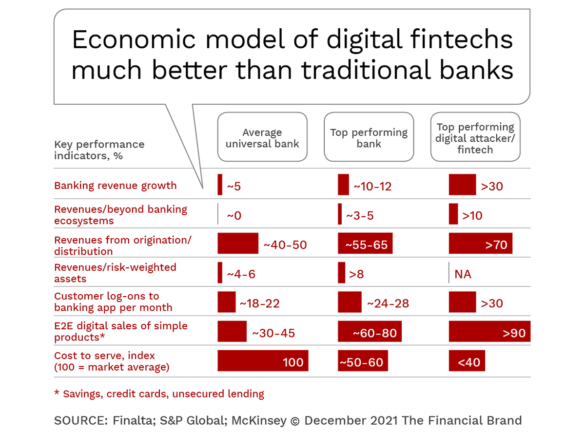

Barring another major economic setback, performance of most banks may be satisfactory, but will significantly lag other industries. More concerning should be the reality that many banks still cling to old-school business models that are more capital-intensive and have lower revenue opportunity. This is in contrast to fintech firms and other digital players that are much better situated for financial success going forward.

Many Banks are Like Taxis Operating in an Uber World

The global ride-sharing application, Uber, was founded in 2009 and quickly disrupted modern transportation as we knew it. At one point, Uber grew to become the highest-valued private startup company in the world, leveraging modern technology and focusing on a vastly improved customer experience. Though the road has often been bumpy, Uber remains an excellent example of how an old-school business model can be reimagined.

Banking is facing a similar dilemma that cabbies had a decade ago – how to compete with a solution that is positioned significantly better in a marketplace that values improved experiences and mobile-first innovation? Similarly, there is a need to act quickly, since much of the opportunity after an industry crisis occurs in the first few years after disruption, with less opportunity thereafter. “The coming five years or so will mark the beginning of a new era in global banking, in which the industry will move from a decade of convergent resilience (2011–20) to a period of divergent growth (2022–27),” states McKinsey.

Being a Taxi in an Uber World:

Legacy banks will continue to struggle if they are unable (or unwilling) to provide the level of integrated digital experiences customers have become accustomed to in other industries.

In the ride-sharing industry, the offerings of cab companies became commoditized, while the emergence of Uber made customer expectations skyrocket. This is occurring in the banking industry as well, with interest rates remaining low and differentiation within the traditional banking industry lacking. At the same time, fintech and financial offerings of big tech firms are focusing on offering innovative, fee-based services that are challenging traditional banks’ business models.

Read More:

- 6 Digital Banking Transformation Trends

- Executing What’s Possible With Digital Banking Transformation

- The 6-Step Survival Guide to Digital Banking Transformation

Sources of Bank Performance Divergence

As the industry has seen with digital banking transformation, it is impossible to change every component of a legacy banking organization overnight. Some factors can be modified, while others may be beyond the control of many organizations, So, what should organizations focus on today to improve shareholder (and customer) value in the immediate future?

McKinsey analyzed more than 150 financial institutions globally—including banks, specialist firms, and fintechs—and found four sources of performance divergence. The first three are more difficult for most financial institutions to modify. The fourth (covered in the next section) is where legacy banks can make positive change the most … and the fastest. While having a larger potential impact, these are the three toughest areas to address.

1. Geography. Location is the biggest factor in the potential for price to book value deviation. It is expected that the power of geography will increase in the immediate future, with banks in emerging markets benefiting from an oversized share of global banking revenue. Obviously more organizations can’t pick up roots and move internationally, but the potential to generate business in growing regional markets is made more possible with an expanded digital footprint.

2. Scale. Larger banks benefit from cost efficiencies that are propelled by the ability to invest in modern technologies. McKinsey also expects digital scale to deliver network effects of mass platforms offering improved payments, lending and other applications.

3. Segments. A financial institution’s ability to serve the most profitable and fastest-growing segments also impacts performance. Unfortunately, many legacy banking organizations have an oversized share of low- and middle-income households that are also in the older age segments that are often more costly to serve. The good news is that some of these same organizations have performed well with small businesses (a higher growth segment).

Build a Future-Proof Business Model … Now

The fourth source of performance divergence that can be impacted the most (and the fastest) is changing existing business models. The challenge is that changing existing business models requires full leadership endorsement and commitment. In interviews over the past 24 months for the Banking Transformed podcast, the challenge mentioned most by banking, fintech and big tech leaders has been the inability for legacy leadership to embrace change, take risks and disrupt legacy business models.

The best performing banks, fintech firms and other specialized financial services providers are capital-light, with a commitment to modern technology, innovation, and exceptional customer service that is easily scalable and agile. In many instances, these challenger organizations are generating higher returns and valuation multiples than most traditional banks of any size in any country.

The BIG Question:

What components of the challenger bank business model can be replicated quickly, with returns that can future-proof legacy banks?

First and foremost, customers no longer want products and services. They want experiences that are embedded in their everyday life. While the relationship may still have the foundation of a deposit account, savings plan, borrowing functionality, investments and rapid credit, these services will be integrated seamlessly. They will also be supplemented and complimented with non-financial services that may provide new revenue opportunities.

As opposed to selling products, successful financial institutions will build experiences that drive digital engagement the customer values. Examples from fintech providers include the one-click PayPal payment option embedded across retail platforms or the automated savings and investment tools provided by Acorns. In both instances, customer acquisition is achieved by providing digital experiences that exceed expectations. In the future, customers will also expect proactive AI-driven recommendations on how to meet financial objectives.

Secondly, financial institutions will be better positioned to succeed if they can reduce the cost to serve and increase value-added fees. This includes the refinement of internal back-office processes, the reduction of physical infrastructure, the deployment of insight-driven models to drive engagement, and the ability to generate fees from new sources within and outside the existing business. We already are seeing firms like La Caixa in Spain, Emirates NBD in the UAE and Sber in Russia build segment-based non-financial services ecosystem that are generating significant revenues.

Harsh Reality:

In some markets, fintechs are already serving 30% of customers and generating 3% to 5% of banking revenues.

– Mckinsey

Finally, legacy banks need to significantly increase the scale and pace of innovation. As opposed to building large innovations that are deployed annually (at best), future-ready financial institutions need to put innovation at the epicenter of the organization. As I found in my visit to Shenzhen, China in early 2020, WeBank launches close to 1,000 updates per month and takes only about ten days to go from ideation to implementation. This is facilitated on parallel cloud platforms where testing can be done on a real database of customers in real-time.

Digital Migration is Far From Over

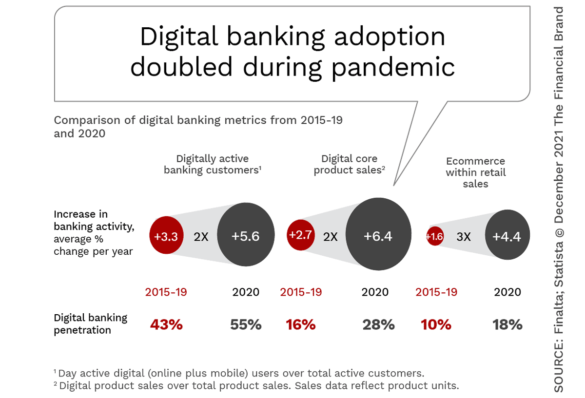

The most lasting impacts of the pandemic on the banking industry was the immediate shift of transactions to digital channels, the reduction in cash usage, the increase in savings, the move to a remote (and hybrid) work environment and the increased emphasis on the environment, equality, and diversity. While digital banking had been increasing before the pandemic, the surge in growth escalated exponentially over the past 18-24 months.

In most developed markets, digital banking use surpassed physical interactions at a branch before the pandemic. This shift in channel use became more significant as digital laggards were forced to digital channels and as financial institutions improved their digital offerings … often out of necessity. According to McKinsey, “COVID-19 has also reinforced the digital trend in payments and retail commerce across payment types, demographics, and geographies.”

In the United States, the share of consumers using two or more digital payments methods jumped from 45% in 2019 to 58% in 2020. Many governments and businesses also found ways to replace cash usage with digital options that were safer and more accepted.

As we move forward, the key to success will be to continue the current digital transformation process. In a future-proof business model, the customer, not the product, must be the focus. As outlined in the report by McKinsey, the next few years are crucial for any bank with aspirations to succeed in the future. “Not only is there simply no value to waiting, but also history shows a pattern in which institutions that take bold steps toward growth in the first years after a crisis generally hold on to those gains for the longer term.”

The coming years will require the speed and focus that was there at the beginning of the crisis.