If you want to score the largest possible early-stage valuation, what should your startup focus on? New data makes it clear that the seed and Series A markets are hardly equal when it comes to what venture capitalists are willing to pay for one category of startup over another.

Don’t worry, the answer here is not just “build an AI startup,” even if that does appear to be pretty solid advice for avoiding a down round.

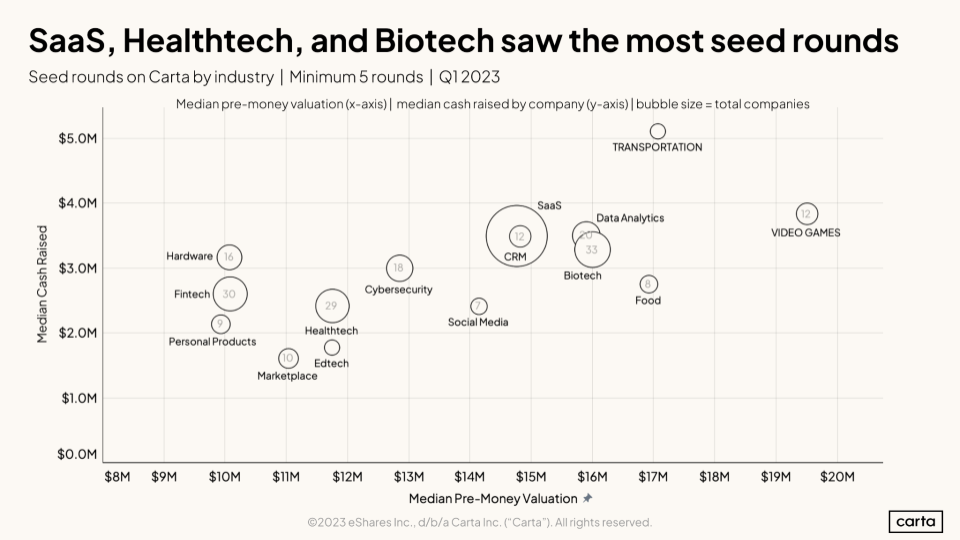

Data shared by Carta when we interviewed the company’s CEO on the Equity podcast earlier this week provides a simple and clear stratification of early-stage valuations and fundraising sizing. Let’s start with seed data:

This chart tracks median cash raised by startup category in the first quarter — only those with at least five rounds in the Carta dataset — along the vertical axis and median pre-money valuation for the same rounds along the horizontal axis. The bubbles are categories, with larger circles given to groups of startups that saw more total deals.

The data indicates that — and this honestly blew our minds — video game-focused startups were in pole position for richest median seed round valuations (pre-money) in the first quarter. Transportation came in second, followed by food, biotech, data analytics, and then CRM and SaaS.

Frankly, we figured that SaaS would be higher up in the pecking order due to the durability of recurring revenues in a down market; we doubly didn’t think that video game-focused startups would be on top, let alone ahead of SaaS. After all, video game companies have historically been a venture category that investors have shunned thanks to the episodic nature of game releases and, therefore, revenues. This proves what we know, expecting more conservative bets to fare better in a more conservative market.

Seeing edtech and fintech down toward the lower end of median pre-money seed valuations for Q1 2023 rounds, however, did not surprise. Fintech has taken a battering in the venture downturn, with companies trading on the public markets enduring a nigh-shocking devaluation from highs set back in 2021. That sort of valuation compression will always trickle backward into the venture market over time. Edtech is a similar story.

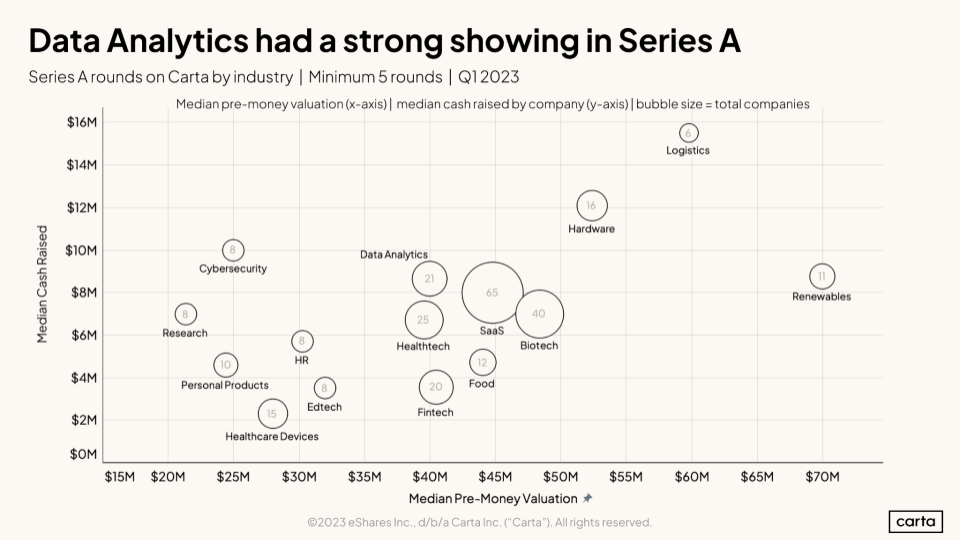

Now, onto the Series A market, charted in the same manner and pulled from the same dataset (rounds that Carta helped facilitate) and timeframe (Q1 2023):

Our first takeaway is that in the current market, cybersecurity startups are having a tough go of it, at least from a valuation perspective. This is somewhat ironic given that TechCrunch+ recently noted that a number of public cybersecurity companies are doing very well, making depressed venture interest in the category a puzzler; perhaps valuations are low due to limited venture interest?

Regardless, in the lead this time around are renewables-focused startups, logistics-focused startups, early-stage companies building hardware, then biotech, SaaS, food, and then a nearly three-way tie between fintech, health tech and data analytics startups.

Once again, the categories of startups that are seeing the richest pre-money valuations are not what we might have predicted. Sure, climate tech is hot today because the planet is as well, but that is a tasty Series A valuation median for renewable tech — and far better than we expected.

There are caveats to this data worth considering: Each of the leading categories in raw pre-money valuation terms are small groupings; categories with more rounds tend toward the middle of both dollars raised and the prices paid for the equity in question. If the categories that are surprise winners had more rounds, perhaps they, too, would have moderated somewhat in valuation terms.

And this is just a single quarter’s data, meaning that if we recut the same chart for Q2 2023 (and we will), we could get a different set of results.

Still, if you want the best chance to raise a median-ish round at a median-ish price for startups generally and fish in the most active pond, build a SaaS startup. Just don’t be afraid to argue for a higher valuation if you are in a hot category that, despite limited deal volume, we now know VCs are willing to pay up for.

Comment