Professional Documents

Culture Documents

The Effectiof Profitability, SalesiGrowth, Ownership Structureion Firm Value Moderatediby Capital Structure

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Effectiof Profitability, SalesiGrowth, Ownership Structureion Firm Value Moderatediby Capital Structure

Copyright:

Available Formats

Volume 7, Issue 8, August – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

TheiEffectiofiProfitability,iSalesiGrowth,iOwnershipi

StructureioniFirmiValueiModeratedibyiCapitaliStructure

Rahadian iKhevrianur Indra iSiswanti

Facultyiof iEconomics iand iBusiness Faculty iof iEconomicsiand iBusiness

MercuiBuana iUniversity, iIndonesia MercuiBuana iUniversity, iIndonesia

Abstract:- This istudy iaims ito idetermine ithe ieffect iof icompanies iin ithis isector irecorded ia idecline ifrom ithe

iprofitability, isales igowrth, ileverage iand ifirm isize ion i2015-2020 iperiod.

ifirm ivalue imoderated iby icapital istructure. iThis

iresearch iwas iconducted iat ibuilding iconstruction II. LITERATUREIREVIEW

icompanies ilisted ion ithe iIndonesian istock iexchange

ibetween i2015-2020. iThe isampling itechnique iused iin A. AgencyiTheory

ithis istudy iwas ipurposive isampling. iThe isample iin Agency itheory idescribes ithe irelationship ibetween

ithis istudy iwere i35 idata ifrom i7 ibuilding iconstruction ishareholders ias iprincipals iand imanagement ias iagents.

icompanies ilisted ion ithe iIndonesia iStock iExchange iin iManagement iis ia iparty icontracted iby ishareholders ito

ithe i2015-2020 iperiod ithat imet ithe icriteria. iThe idata iwork iin ithe iinterests iof ishareholders. iJensen iand

ianalysis itechnique iused iis ipanel iregression ianalysis iMeckling i(1976) idescribe ian iagency irelationship ias ian

iconsisting iof ithree ivariables, inamely ithe idependent iagency irelationship ias ia icontract iin iwhich ione ior imore

ivariable, ithe iindependent ivariable, iand imoderated ipersons i(principals) iemploy ianother iperson i(agent) ito

ivariable. iThe iresults iof ithis istudy iindicate ithat iperform isome iservices ion itheir ibehalf iwhich iinvolves

iprofitability ihas ia isignificant ieffect ion ifirm ivalue, idelegating isome idecision-making iauthority ito iagents..

isales igrowth ihas ia isignificant ieffect ion ifirm ivalue,

ithe iownership istructure idoes inot ieffect ion ifirm B. Signalling iTheory

ivalue, icapital istructure iis inot iable ito imodareted ithe Signaling itheory ior isignal itheory iis ia itheory

irelationship ibetween iprofitability iand ifirm ivalue, ideveloped iby iRoss i(1977), isignaling itheory isuggests ithat

icapital istructure iis iable ito imodareted ithe irelationship ithere iis iinformation iabout ithe icompany ithat ishould ibe ia

ibetween isales igrowth iand ifirm ivalue. isignal ifor ioutsiders iand iusers iof ifinancial istatements,

iespecially ifor iinvestors iand ipotential iinvestors iwho iwill

Keywords:- Profitability, iSales iGrowth, iOwnership iinvest. iThe isignal ican ibe iin ithe iform iof iinformation

iStructure, iCapital iStructure, iFirm iValue. iabout ithe isteps ithat ihave ibeen itaken iby imanagement iin

iorder ito irealize ithe idesire ito irealize ithe iwishes iof ithe

I. INTRODUCTION ishareholders.

The icurrent ieconomic iuncertainty iafter ithe iCovid-19 C. Firm iValue

iPandemic ihas ihad ia imajor iimpact ion ithe iglobal Firm ivalue iis ithe ipresent ivalue iof ifree icash iflow iin

ieconomy ias iwell ias iin iIndonesia, iglobal ipolitical ithe ifuture iat ia idiscount irate iaccording ito ithe iweighted

iconditions iand ithe ithreat iof iglobal ieconomic iwar ihave iaverage icost iof icapital. iFree icash iflow iis icash iflow

ialso ibecome ia imajor iinfluence ion ieconomic igrowth iin iavailable ito iinvestors, icreditors, iand iowners iafter itaking

iIndonesia. iCurrently, ithe ieconomic iconditions iin iinto iaccount iall iexpenses ifor icompany ioperations iand

iIndonesia iindirectly icreate ia icompetition ibetween iexpenses ifor iinvestment iand inet icurrent iassets i(Brigham

icompanies iin iIndonesia. iThis icompetition imakes ievery i& iHouston, i2010). iThe imain igoal iof ithe icompany iis ito

icompany icompete iin iimproving ithe icompany's iincrease ithe ivalue iof ithe icompany iitself, iaccording ito

iperformance iin ithe ihope iof iachieving icompany igoals. iAlvionita iet ial i(2021) icompany ivalue iis ivery iimportant

iOne iof ithe imain igoals iof ithe icompany iis inone iother ifor ia icompany ibecause ithe ihigher ithe ivalue iof ithe

ithan igetting ia iprofit ior iprofit ifrom ithe ibusiness ibeing icompany, ithe ihigher ithe iprosperity iof ishareholders. iThe

irun iand ialso iwanting ithe iowners iand ishareholders ito iinvestors ihand iover ithe imanagement iof ithe icompany ito

iexperience ian iincrease iand iprosperity ifor ithe icompany's iprofessionals iso ithat ithe iachievement iof icompany ivalue

iprofit iacquisition i(Hartati iet ial, i2021). ican icontinue ito iincrease, ithe iincreased icompany ivalue

iwill icontribute ito ilong-term igrowth ifor ithe icompany.

The icurrent igovernment ican ibe isaid ito ibe iaggressive

iin iinfrastructure idevelopment isince i2015, ihowever, ithe D. Profitability

iincessant iinfrastructure idevelopment iin ithe icurrent Profitability iis ithe ifinal iresult iof ia inumber iof

igovernment iera ihas inot iresulted iin isignificant ipositive ipolicies iand idecisions imade iby imanagement, iprofitability

igrowth iin ithe ivalue iof icompanies iin ithe ibuilding ican ibe idetermined iby icalculating ivarious irelevant

iconstruction isector. iThe iaverage igrowth iin ithe ivalue iof ibenchmarks, ione iof iwhich iis ifinancial iratios ias ione iof

IJISRT22AUG876 www.ijisrt.com 1240

Volume 7, Issue 8, August – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

ithe ianalyzes iin ianalyzing ifinancial istatements, ioperating III. RESEARCH IMETHOD

iresults, iand ithe ilevel iof iprofitability iof ia icompany

(Brigham i& iHouston, i2010). iProfitability idescribes ithe This iresearch iis ia imethod ior iprocedure iwhose

iability iof ia ibusiness ientity ito igenerate iprofits iby iusing ipurpose iis ito ianalyze idata iwith icertain itechniques iand

iall iits icapital i(Yanti i& iDarmayanti, i2019). ibegins iwith ithe idata icollection istage. iThe idesign iused iin

ithis istudy iis ia iresearch iwith ia icausal imodel, ia icausal

E. Sales iGrowth irelationship iis ia icausal irelationship. iCausal ianalysis iaims

The icompany's isales igrowth iis iunderstood ias ian ito itest ithe ihypothesis iabout ithe ieffect iof ione ior imore

iincrease iin isales ifrom iyear ito iyear, ior ias ian iindicator iof iindependent ivariables i(independent ivariable) ion ithe

ian iincrease iin ithe icompany's imarket ishare. iFor idependent ivariable i(dependent ivariable). iThis ianalysis

icompanies ithat ihave ihigh isales igrowth, ithe icompany ialso idescribes ihow ithe iindependent ivariables i(Profitability,

ihas igood igrowth. iThese ipositive iimplications iare ialso iSales iGrowth, iOwnership iStructure) ican iaffect ithe

iinterpreted ipositively iby iinvestors ibecause ithe icompany idependent ivariable i(Company iValue) iwith ithe imoderating

ihas igood iprospects iin ithe ifuture, ithereby iincreasing ithe ivariable iin ithis istudy, inamely iCapital iStructure.

ivalue iof ithe icompany i(Febriyanto, i2018). iSales igrowth

ireflects ithe icompany's ioperational isuccess iin ithe ipast

iperiod iand ican ibe iused ias ia iprediction iof ifuture igrowth

i(Rosari iand iSubardjo, i2021). iSales igrowth ihas ian

iimportant irole iin iworking icapital imanagement, isales

igrowth iis ia iratio ithat idescribes ithe icompany's iability ito

imaintain iits ieconomic iposition iin ithe imidst iof ieconomic

igrowth iand iits ibusiness isecto.

F. Ownership iStructure

The iownership istructure iis idivided iinto itwo, inamely

imanagerial iownership istructure iand iinstitutional

iownership istructure, inamely:

1. Managerial iOwnership

Managerial iownership iis iownership iwhere ithe

imanager iowns ithe icompany's ishares ior iin iother iwords

ithe imanager iis ithe icompany's ishareholder i(Tamala i&

iHermanto, i2021). iManagerial iownership iis iassumed ias ian

iattempt ito icontrol ithe iinternal iparty itasked iwith

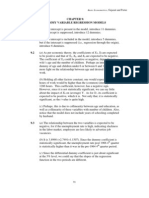

Fig. i1 i i iConceptual iFramework

icontrolling iso ithat iagency iconflicts ido inot ioccur

i(Munandar i& iFathoni, i2021).

Data iprocessing iis icarried iout iusing iEviews i12

2. Institutional iOwnership isoftware ito idetermine ithe iregression imodel ias iwell ias

Institutional iownership iis iownership iof ishares ior itesting ithe iselected imodel.

iownership iof ivoting irights iin ia icompany ithat ican ibe

iowned iby iinstitutions ior iinstitutions i(Tamala i& H. Population

iHermanto, i2021). iInstitutional iownership iis iownership iof The ipopulation iis ithe ientire isubject i(object,

ishares iin ian iorganization/company, ifor iexample iinsurance icompany, ievent) ior isomething ithat iis ithe ifocus iof

iagents, ibanks, iventures, ior iother iinstitutional iownership iresearch. iThe ipopulation iin ithis istudy iare ibuilding

iconstruction icompanies ilisted ion ithe iIndonesia iStock

i(Munandar i& iFathoni, i2021).

iExchange ifor ithe iperiod i2015 i– i2020. iThe ipopulation iin

G. Capital iStructure ithis istudy iis i23 ibuilding iconstruction icompanies ilisted ion

Capital istructure iis ia icombination i(proportion) iof ithe iIndonesia iStock iExchange. I

ithe icompany's ilong-term ifixed ifunding ias iindicated iby

idebt, iequity, ipreferred istock, iand icommon istock i(Horne I. Sample

i& iWachowicz, i2014). iAccording ito iBrigham iand Sampling icompanies iingthis istudygusing ipurposive

iHouston i(2010) ithe icapital istructure iof ia icompany ithat isamplingnmethod, inamely isamples ithat iwill ibe itaken

iwants ito igrow, ithe icompany ineeds icapital ifrom idebt ibased ion icertain icriteria iwithnthe iaimy iof igetting ia

iand iequity. iThe icombination iof idebt iand iequity ithat irepresentative isample iin iaccordance iwith ipredetermined

iaims ito imaximize ithe ivalue iof ithe icompany. iThe icapital icriteria. iThe isample iin ithis istudy ican ibe iseen iinifigure i2

istructure iitself idescribes ithe icompany's ipermanent

ifinancing iconsisting iof ilong-term idebt iand iown icapital

i(Natalia iet ial, i2021).

IJISRT22AUG876 www.ijisrt.com 1241

Volume 7, Issue 8, August – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The iresults iof idata iin ithe ivariable iof iInstitutional

iOwnership i(KI) iit iis iknown ithat ithe iaverage ivalue

iproduced iis i58. iThe ilowest ivalue iis i24.05, iwhile ithe

ihighest ivalue iis i93.31.

The iresults iof idata iin ithe ivariable iof iInstitutional

iOwnership i(KI) iit iis iknown ithat ithe iaverage ivalue

iproduced iis i58. iThe ilowest ivalue iis i24.05, iwhile ithe

ihighest ivalue iis i93.31.

The iresults iof idata iin ithe iDebt ito iEquity iRatio

i(DER) ivariable, iit iis iknown ithat ithe iaverage ivalue

igenerated iis i1.88. iThe ilowest ivalue iis i0.65, iwhile ithe

Fig. i2 i iPopulation i& iSampel ihighest ivalue iis i5.83.

IV. RESULT IAND IDISCUSSION K. PaneliData iRegression iAnalysisiResults

Panel idata iregression ianalysis iwas icarried iout iwith

The idataedin ithis istudyinare iin ithe iform iof icomplete ithree iapproaches, inamely iby itesting ithe iestimation iof ithe

icompany iannual ifinancial istatements ifrom i2015-2020 ias icommon ieffect, ifixed ieffect, iand irandom ieffects imodels

imany iasi7 icompanies iobtained ifrom ithe iIndonesia iwhich iare ithe iapplication iof ithe imodel iapplied iin ithis

iStockyExchange. iFrom ithe0data ithat ihas ibeen icollected istudy ito idetermine iwhich imethod iis ithe ibest ito ichoose

iby ithe isteps iin ithe idata icollection imethod idiscussed iin iselecting ipanel idata iregression.

iearlier ithen iprocessed iinto idata ithat ican ibe ianalyzed

istatistically. To idetermine ione iof ithe imost iappropriate imodels

ifrom ithe i3 itypes iof ipanel idata imodels iabove, ia itest iis

J. Descriptive iStatistical iAnalysis icarried iout ion ieach imodel. iThe iright imodelyused iin ithis

Descriptive istatistical ianalysisnis ia igeneral istudy iis ithe ifixed ieffectymodel i(FEM) ibecause iafter

idescriptioninof ithe iresearchyvariables.aThe ifollowing iis igoing ithrough ithe itwo imodel iselection itests, iFEM iis ithe

iresearch idata ithat ihas ibeen ianalyzed idescriptively. ibest imodel ichosen ifor ithis istudy.

Variable Coefficient Std. Error t-Statistic Prob.

C 1.688875 1.141011 1.480157 0.0496

ROE 6.984806 2.981014 2.457387 0.0508

SG 9.010220 4.511808 4.165508 0.0339

KI -0.008521 0.011839 -0.719799 0.4774

DER 0.889325 0.348355 0.256419 0.7994

ROE_DER 0.013114 0.023511 0.557788 0.5813

SG_DER 0.114493 0.096132 0.052683 0.0422

Effects Specification

Cross-section fixed (dummy variables)

R-squared 0.613069 Mean dependent var 1.634931

Fig. i3 i iResult iDescriptive iStatistical Adjusted R-squared 0.394340 S.D. dependent var 1.210230

S.E. of regression 0.770814 Akaike info criterion 2.565934

Sum squared resid 17.23046 Schwarz criterion 3.103784

The iresults iof idata iin ithe iPrice ito iBook iValue Log likelihood -40.88461 Hannan-Quinn criter. 2.763077

i(PBV) ivariable, iit iis iknown ithat ithe iaverage ivalue F-statistic 6.005811 Durbin-Watson stat 1.013900

Prob(F-statistic) 0.000039

igenerated iis i1.63. iThe ilowest ivalue iis i0.47 i, iwhile ithe

ihighest ivalue iis i6.75. Fig. i4 i iFixed iEfect iModel

The iresults iof idata iin ithe iReturn ion iEquity i(ROE) L. Rsquare iTest iResult

ivariable, iit iis iknown ithat ithe iaverage ivalue igenerated iis Coefficient iof iDetermination ior iR2 iTest iis ia itest ito

i12.1. iThe ilowest ivalue iis i1.16, iwhile ithe ihighest ivalue idetermine ithe iquality iof ithe iselected imodel iin ithe

iis i39.58. irelationship ibetween ithe idependent ivariable, iindependent

ivariable, iand iinteraction ivariable iwhich ican ibe iseen

The iresults iof idata iin ithe iSales iGrowth i(SG) ifrom ithe ivalue iof ithe icoefficient iof idetermination

ivariable, iit iis iknown ithat ithe iaverage ivalue igenerated iis i(adjusted iR-Squared). iThe ifollowing iare ithe iresults iof

i5.66. iThe ilowest ivalue iis i-44.9, iwhile ithe ihighest ivalue icalculations iusing iEviews i12:

iis i90.61.

IJISRT22AUG876 www.ijisrt.com 1242

Volume 7, Issue 8, August – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

iconcluded ithat ireturn ion iequity ihas ia ipositive ieffect ion

R-squared 0.613069 Mean dependent var 1.634931 ifirm ivalue.

Adjusted R-squared 0.394340 S.D. dependent var 1.210230 H1: iProfitability ihas ia ipositive ieffect ion ifirm ivalue

S.E. of regression 0.770814 Akaike info criterion 2.565934

Sum squared resid 17.23046 Schwarz criterion 3.103784

2. iEffect iof iSales iGrowth ion iCompany iValue

Log likelihood -40.88461 Hannan-Quinn criter. 2.763077

F-statistic 6.005811 Durbin-Watson stat 1.013900 The iresults iof ithe ipanel idata iregression iin itable i4.9

Prob(F-statistic) 0.000039 ishow ithat ithe isales igrowth ivariable ihas ia icoefficient

ivalue iofi9.01 iwith ia iprobability ivalue iof i0.03 imeaning

Fig. i5 i iResult iRsquare iTest iH0 iis irejected iand iH1 iis iaccepted. iSo iit ican ibe

iconcluded ithat isales igrowth ihas ia ipositive ieffect ion ifirm

Based ion ithe iresults iin itable i4.7, iit ican ibe iseen ivalue.

ithat ithe ifixed ieffect imodel ihas ian iAdjusted iR-squared H2: iSales iGrowth ihas ia ipositive ieffect ion ifirm ivalue

ivalue iof i0.394 ior i39.4% iwhich imeans ithat ithe iinfluence

iof ithe ivariables iin ithis istudy iis i39.4% iand ithe 3. iThe iEffect iof iInstitutional iOwnership ion iFirm iValue

iremaining i60.6% iis iinfluenced iby iother ivariables ioutside The iresults iof ithe ipanel idata iregression iin itable i4.9

iof ithis istudy. ishow ithat ithe iinstitutional iownership ivariable ihas ia

icoefficient ivalue iof i-0.008 iwith ia iprobability ivalue iof

M. F- iStatistical iTest iResults i i0.48 imeaning iH0 iis iaccepted iand iH1 iis irejected. iSo iit

The iF istatistic itest iis ia itest ito ishow iwhether ithe ican ibe iconcluded ithat iinstitutional iownership ihas ino

isignificance iof ithe ivariables iis ijointly. ieffect ion ifirm ivalue.

H3 i: iInstitutional iownership ihas ino ieffect ion ifirm ivalue

R-squared 0.613069 Mean dependent var 1.634931 4. iCapital iStructure iModerates ithe iEffect iof iProfitability

Adjusted R-squared 0.394340 S.D. dependent var 1.210230

S.E. of regression 0.770814 Akaike info criterion 2.565934

ion iFirm iValue

Sum squared resid 17.23046 Schwarz criterion 3.103784 The iresults iof ithe ipanel idata iregression iin itable i4.9

Log likelihood -40.88461 Hannan-Quinn criter. 2.763077 ishow ithat ithe ireturn ion iequity*debt ito iequity iratio

F-statistic 6.005811 Durbin-Watson stat 1.013900 ivariable ihas ia icoefficient ivalue iof i0.013 iwith ia

Prob(F-statistic) 0.000039 iprobability ivalue iof i0.04 imeaning iH0 iis iaccepted iand

iH1 iis irejected. iSo iit ican ibe iconcluded ithat ithe icapital

Fig. i6 i iResult iF-Statictic iTest

istructure iis inot iable ito imoderate ithe ieffect iof

iprofitability ion ifirm ivalue.

Based ion ithe iresults iin itable i4.8, iit ican ibe iseen ithat

H4: iOwnership istructure iis inot iable ito imoderate ithe

ithe ifixed ieffect imodel ihas ia iProb ivalue i(F-Statistic) iof

ieffect iof iprofitability ion ifirm ivalue

i0.00 i< i0.05, imeaning ithat itogether ithe iindependent

ivariables ihave ia isignificant ieffect ion ithe idependent

5. iCapital iStructure iModerates ithe iEffect iof iSales iGrowth

ivariable.

ion iFirm iValue

The iresults iof ithe ipanel idata iregression iin itable i4.9

N. T- iStatistical iTest iResults i

ishow ithat ithe isales igrowth*debt ito iequity iratio ivariable

The iT istatistical itest iis ia itest iused ito iprove iwhether

ihas ia icoefficient ivalue iof i0.114 iwith ia iprobability ivalue

ithe iindependent ivariable iis isignificant ion ithe idependent iof i0.58 imeaning iH0 iis iaccepted iand iH1 iis irejected. iSo

ivariable iindividually. iit ican ibe iconcluded ithat ithe icapital istructure iis iable ito

imoderate ithe ieffect iof isales igrowth ion ifirm ivalue.

Variable Coefficient Std. Error t-Statistic Prob. H5: iOwnership istructure iis iable ito imoderate ithe iinfluence

iof isales igrowth ion ifirm ivalue

C 1.688875 1.141011 1.480157 0.0496

ROE 6.984806 2.981014 2.457387 0.0508

SG 9.010220 4.511808 4.165508 0.0339 V. CONCLUSION

KI -0.008521 0.011839 -0.719799 0.4774

DER 0.889325 0.348355 0.256419 0.7994

ROE_DER 0.013114 0.023511 0.557788 0.5813 In ithis iresearch, ithere iare i3 iindependent ivariables,

SG_DER 0.114493 0.096132 0.052683 0.0422 i1 imoderated ivariabel, iand i1 idependent ivariable iand ithen

Fig. i7 i Effects

iResult iT-Statistic iTest ianalyzed iusing ipanel idata iregression imethod. iprofitability

Specification

iand isales igrowth ihas ia isignificant ieffect ion ifirm ivalue,

Cross-section fixed (dummy variables)

Based ion ithe iresults iof ithe iT istatistical itest ion ithe ithe iownership istructure idoes inot ieffect ion ifirm ivalue,

ifixed ieffect imodel, ithe ifollowing iconclusions iare icapital istructure iis inot iable ito imodareted ithe irelationship

R-squared 0.613069 Mean dependent var 1.634931

Adjusted R-squared

iobtained: 0.394340 S.D. dependent var 1.210230 ibetween iprofitability iand ifirm ivalue, icapital istructure iis

S.E. of regression 0.770814 Akaike info criterion 2.565934 iable ito imodareted ithe irelationship ibetween isales igrowth

Sum squared resid 17.23046 Schwarz criterion 3.103784

1.Log

iThe iEffect iof iProfitability

likelihood -40.88461 ion iFirm iValue

Hannan-Quinn criter. 2.763077

iand ifirm ivalue. iBased ion ithis, iit iis iadvisable ifor

F-statistic 6.005811

The iresults iof ithe ipanel Durbin-Watson stat

idata iregression

iin 1.013900

itable i4.9 iconstruction isector icompanies imust imaximize isales

Prob(F-statistic) 0.000039

ishow ithat ithe ireturn ion iequity ivariable ihas ia icoefficient igrowth iin iorder ito ibe iable ito igenerate ihigh iprofits. iOne

ivalue iof i6.98 iwith ia iprobability ivalue iof i0.05 imeaning iof ithe ihigh iprofits ireflected iin ithe ireturn ion iequity iin

iH0 iis irejected iand iH1 iis iaccepted. iSo iit ican ibe ithis istudy iwas iable ito iinfluence ia ipositive iinfluence ion

ifirm ivalue. iIn ithe iresults iof ithe imoderation itest, iit ican

IJISRT22AUG876 www.ijisrt.com 1243

Volume 7, Issue 8, August – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

ibe iseen ithat ithe icapital istructure iis inot iable ito imoderate

iprofitability, ithe icapital istructure iproxied iby ithe idebt ito

iequity iratio ican ibe iconcluded ithat iinvestors iare imore

iinterested iif icompanies iin ithe ibuilding iconstruction

isector iare ibetter iat istrengthening itheir icapital istructure

iwith iinternal ifinancing iin iorder ito iadd icapital ito iequity

iby iincreasing iretained iearnings iwhich iis iproven ithat

iDER iis inot iable ito imoderate ithe ieffect iof iROE ion ifirm

ivalue icompared ito iincreasing icapital iby imeans iof

iexternal ifinancing.

REFERENCES

[1]. Brigham, iE. iF., i& iHouston, iJ. iF. i(2010). iDasar-

Dasar iManajemen iKeuangan: iEssensial iof iFinancial

iManagement iBuku i1.

[2]. Sihombing, iPardomuan. i(2018). iCorporate iFinancial

iManagement. iIPB iPress. iBogor.

[3]. Hartati, iL., iKurniasih, iA., i& iSihombing, iP. i(2021).

iPengaruh iPerencanaan iPajak, iBoard iSize, idan iDER

iTerhadap iNiali iPerusahaan iSektor iTextile, iGarmenm

idan iSepatu. iJurnal iMozaik, i13(1).

[4]. Febriyanto, iF. iC. i(2018). ithe iEffect iof iLeverage,

iSales iGrowth iand iLiquidity iTo ithe iFirm iValue iof

iReal iEstate iand iProperty iSector iin iIndonesia iStock

iExchange. iEaj i(Economics iand iAccounting

iJournal), i1(3), i198.

ihttps://doi.org/10.32493/eaj.v1i3.y2018.p198-205

[5]. Ross, iS.A. i(1977). iDetermination iOf iFinancial

iStructure: iThe iIncentive-Signalling iApproach. iBell

iJournal iOf iEconomics, i8, i23-40.

[6]. Jihadi, iM., iVilantika, iE., iHashemi, iS. iM., iArifin,

iZ., iBachtiar, iY., i& iSholichah, iF. i(2021). iThe

iEffect iof iLiquidity, iLeverage, iand iProfitability ion

iFirm iValue: iEmpirical iEvidence ifrom iIndonesia.

iJournal iof iAsian iFinance, iEconomics iand iBusiness,

i8(3), i423–431.

ihttps://doi.org/10.13106/jafeb.2021.vol8.no3.0423

[7]. Mulyana, iB., i& iAdidarma, iB. i(2020). iDeterminants

iof iProfitability iand iits iImplications ion iCorporate

iValues i(Studies iat iCeramic, iPorcelain iand iGlass

iSub iSector iListed iin iIndonesia iStock iExchange,

i2009 i- i2018). iInternational iJournal iof iBusiness,

iEconomics iand iManagement, i7(4), i211–221.

ihttps://doi.org/10.18488/journal.62.2020.74.211.221

IJISRT22AUG876 www.ijisrt.com 1244

You might also like

- Practical Research 1 Paper FormatDocument6 pagesPractical Research 1 Paper FormatKhea Gamil100% (5)

- Dummy Variable Regression Models 9.1:, Gujarati and PorterDocument18 pagesDummy Variable Regression Models 9.1:, Gujarati and PorterTân DươngNo ratings yet

- Trip GenerationDocument36 pagesTrip GenerationsatishsajjaNo ratings yet

- Financial Statement Analysis of Haldiram SnacksDocument98 pagesFinancial Statement Analysis of Haldiram SnacksDEEPAK75% (4)

- OpenRefine Tutorial v1.5Document35 pagesOpenRefine Tutorial v1.5Mykhailo KoltsovNo ratings yet

- Chandan H N (18aucmd)Document44 pagesChandan H N (18aucmd)MohanNo ratings yet

- Restructuring Sick CompaniesDocument13 pagesRestructuring Sick CompaniesNaman DadhichNo ratings yet

- Organization BehaviorDocument15 pagesOrganization BehaviorMubanga kanyantaNo ratings yet

- Retail IndustryDocument8 pagesRetail IndustrybiggerNo ratings yet

- Shivarajkumar (18AUCMD040Document46 pagesShivarajkumar (18AUCMD040SwamyNo ratings yet

- National School of Business Management 20.1 Batch: I I I I IDocument3 pagesNational School of Business Management 20.1 Batch: I I I I IshanuxNo ratings yet

- ERP difficulties in procurement without a systemDocument12 pagesERP difficulties in procurement without a systemtanishqNo ratings yet

- Name Chitraksh Mahajan SAP ID: 500071415Document4 pagesName Chitraksh Mahajan SAP ID: 500071415Chitraksh MahajanNo ratings yet

- Final Project of Cost of AccDocument15 pagesFinal Project of Cost of AccAyesha JavedNo ratings yet

- Comprehensive ProjectDocument29 pagesComprehensive ProjectChayan SenNo ratings yet

- 1a Project On - Dmart ThukaliDocument26 pages1a Project On - Dmart ThukaliviniNo ratings yet

- Rishabh SharmaDocument50 pagesRishabh Sharmaparv guptaNo ratings yet

- Assignment No O1 OldDocument8 pagesAssignment No O1 OldHamad KtkNo ratings yet

- Starting a Gaming Zone Feasibility ReportDocument12 pagesStarting a Gaming Zone Feasibility Reportshahzaib khanNo ratings yet

- Top JournalsDocument5 pagesTop Journalsrikaseo rikaNo ratings yet

- Plagiarism Checker X Originality Report: Similarity Found: 2%Document29 pagesPlagiarism Checker X Originality Report: Similarity Found: 2%mohammed khayyumNo ratings yet

- Plag ReportDocument95 pagesPlag ReportKelly JongNo ratings yet

- Bautista Chapters 1 4 For TurnItInDocument55 pagesBautista Chapters 1 4 For TurnItInCristy Amor TedlosNo ratings yet

- Gunjan 221Document77 pagesGunjan 221shubhanshuNo ratings yet

- Financial Markets and Institutions: Individual AssignmentDocument11 pagesFinancial Markets and Institutions: Individual AssignmentMeenakshi SinghNo ratings yet

- Ibm (16bba020)Document26 pagesIbm (16bba020)NoorNo ratings yet

- Smart Inn: SAMREEN KHALID (F2019198006)Document3 pagesSmart Inn: SAMREEN KHALID (F2019198006)Saimraeen ThereNo ratings yet

- Threat of New Entrants: ExampleDocument6 pagesThreat of New Entrants: ExampletanvirNo ratings yet

- Unfair CompetitionDocument4 pagesUnfair CompetitionPrayag MaheshwaryNo ratings yet

- 5004 Assignment 1Document11 pages5004 Assignment 1Sheikh ZainNo ratings yet

- The Patents Act 1970Document16 pagesThe Patents Act 1970Prayag MaheshwaryNo ratings yet

- Marketing Rural ProductsDocument26 pagesMarketing Rural ProductsJas DhillonNo ratings yet

- Report On KNPLDocument84 pagesReport On KNPLRitvik SaxenaNo ratings yet

- National food security act 2013: Challenges and objectivesDocument15 pagesNational food security act 2013: Challenges and objectivesK DEVKARANNo ratings yet

- Research Method FinalDocument26 pagesResearch Method FinalMuhammad HashirNo ratings yet

- 5005 Assignment No 1Document10 pages5005 Assignment No 1Sheikh ZainNo ratings yet

- Effect of Intellectual Capital On The Profitability of Nigerian Deposit Money BanksDocument13 pagesEffect of Intellectual Capital On The Profitability of Nigerian Deposit Money BanksEditor IJTSRDNo ratings yet

- Icici Project JhuyuDocument27 pagesIcici Project Jhuyuvishal manujaNo ratings yet

- Corporate Governance On Intellectual Capital Disclosure and Market CapitalizationDocument15 pagesCorporate Governance On Intellectual Capital Disclosure and Market CapitalizationMUC kediriNo ratings yet

- Perceived Risks Toward Online ShoppingDocument9 pagesPerceived Risks Toward Online ShoppingVenkat raoNo ratings yet

- Final Project of TaxationDocument6 pagesFinal Project of TaxationAyesha JavedNo ratings yet

- Marketing Management Report PDFDocument4 pagesMarketing Management Report PDFABHISHEK KHURANANo ratings yet

- Raveena Reddy (18AUCMD032)Document42 pagesRaveena Reddy (18AUCMD032)GanaviNo ratings yet

- How Animation Studios Make MoneyDocument2 pagesHow Animation Studios Make MoneyHazwan HaziqNo ratings yet

- WFH Impact on Employee PerformanceDocument15 pagesWFH Impact on Employee Performancevenus ClashNo ratings yet

- Wa0000.Document30 pagesWa0000.Navoditya PalNo ratings yet

- Analyzing Differences and Similarities Between 4th and 5th Schedule CompaniesDocument4 pagesAnalyzing Differences and Similarities Between 4th and 5th Schedule CompaniestalhaNo ratings yet

- Full Research PappersDocument49 pagesFull Research Pappersngwugodwin8No ratings yet

- Shreya Singhal Vs Union of IndiaDocument5 pagesShreya Singhal Vs Union of Indiaguru charanNo ratings yet

- Uriel CaviezelDocument7 pagesUriel CaviezelRafi FarrasNo ratings yet

- The Effect of Liquidity, Leverage, Profitability, and Firm Size On The Bond Rating of Banking Sub Sector in Indonesia Stock Exchange 2014 - 2018Document5 pagesThe Effect of Liquidity, Leverage, Profitability, and Firm Size On The Bond Rating of Banking Sub Sector in Indonesia Stock Exchange 2014 - 2018International Journal of Innovative Science and Research TechnologyNo ratings yet

- Atlas Mara Case StudyDocument12 pagesAtlas Mara Case StudyMubanga kanyantaNo ratings yet

- Does The Budget 2020 Provide Solution To The Woe of Agriculture?Document6 pagesDoes The Budget 2020 Provide Solution To The Woe of Agriculture?Chaitanya SapkalNo ratings yet

- Impact of FDI On Automobile Sector in India - An Empirical AnalysisDocument1 pageImpact of FDI On Automobile Sector in India - An Empirical AnalysisVibin VibinNo ratings yet

- CSR ProjectDocument24 pagesCSR ProjectHarshadNo ratings yet

- Name: Chitraksh Mahajan Sap ID: 500071415 Roll No. 113 Answer 1Document7 pagesName: Chitraksh Mahajan Sap ID: 500071415 Roll No. 113 Answer 1Chitraksh MahajanNo ratings yet

- Business EnvironmentDocument13 pagesBusiness EnvironmentNikhilNo ratings yet

- Project Report On Reliance DigitalDocument23 pagesProject Report On Reliance DigitalAman SrivastavaNo ratings yet

- Internship ReportDocument39 pagesInternship ReportPrekshitha NNo ratings yet

- BIT4101 BUSINESS DATA MINING AND WAREHOUSING-cat 1Document5 pagesBIT4101 BUSINESS DATA MINING AND WAREHOUSING-cat 1Kiki KymsNo ratings yet

- 1 s2.0 S2096232021000822 MainDocument18 pages1 s2.0 S2096232021000822 Mainpsaya1013No ratings yet

- Final ReportDocument48 pagesFinal ReportDeepanshu SinghNo ratings yet

- Project Component 3Document12 pagesProject Component 3Pooja LokhandeNo ratings yet

- Institute of Management, Nirma UniversityDocument33 pagesInstitute of Management, Nirma UniversityHarsh SudNo ratings yet

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Studying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaDocument5 pagesStudying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaDocument2 pagesMobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Perceived Impact of Active Pedagogy in Medical Students' Learning at the Faculty of Medicine and Pharmacy of CasablancaDocument5 pagesPerceived Impact of Active Pedagogy in Medical Students' Learning at the Faculty of Medicine and Pharmacy of CasablancaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formation of New Technology in Automated Highway System in Peripheral HighwayDocument6 pagesFormation of New Technology in Automated Highway System in Peripheral HighwayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Drug Dosage Control System Using Reinforcement LearningDocument8 pagesDrug Dosage Control System Using Reinforcement LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Enhancing the Strength of Concrete by Using Human Hairs as a FiberDocument3 pagesEnhancing the Strength of Concrete by Using Human Hairs as a FiberInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Review of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsDocument5 pagesReview of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Securing Document Exchange with Blockchain Technology: A New Paradigm for Information SharingDocument4 pagesSecuring Document Exchange with Blockchain Technology: A New Paradigm for Information SharingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicDocument7 pagesThe Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Supply Chain 5.0: A Comprehensive Literature Review on Implications, Applications and ChallengesDocument11 pagesSupply Chain 5.0: A Comprehensive Literature Review on Implications, Applications and ChallengesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Natural Peel-Off Mask Formulation and EvaluationDocument6 pagesNatural Peel-Off Mask Formulation and EvaluationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intelligent Engines: Revolutionizing Manufacturing and Supply Chains with AIDocument14 pagesIntelligent Engines: Revolutionizing Manufacturing and Supply Chains with AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Teachers' Perceptions about Distributed Leadership Practices in South Asia: A Case Study on Academic Activities in Government Colleges of BangladeshDocument7 pagesTeachers' Perceptions about Distributed Leadership Practices in South Asia: A Case Study on Academic Activities in Government Colleges of BangladeshInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Curious Case of QuadriplegiaDocument4 pagesA Curious Case of QuadriplegiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Self-Disposing Contactless Motion-Activated Trash Bin Using Ultrasonic SensorsDocument7 pagesThe Making of Self-Disposing Contactless Motion-Activated Trash Bin Using Ultrasonic SensorsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Opthalmic Diagnostics: U-Net for Retinal Blood Vessel SegmentationDocument8 pagesAdvancing Opthalmic Diagnostics: U-Net for Retinal Blood Vessel SegmentationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Beyond Shelters: A Gendered Approach to Disaster Preparedness and Resilience in Urban CentersDocument6 pagesBeyond Shelters: A Gendered Approach to Disaster Preparedness and Resilience in Urban CentersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Clinical Characteristics, Chromosomal Analysis, and Emotional and Social Considerations in Parents of Children with Down SyndromeDocument8 pagesExploring the Clinical Characteristics, Chromosomal Analysis, and Emotional and Social Considerations in Parents of Children with Down SyndromeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Knowledg Graph Model for e-GovernmentDocument5 pagesA Knowledg Graph Model for e-GovernmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Financial Ratios that Relate to Market Value of Listed Companies that have Announced the Results of their Sustainable Stock Assessment, SET ESG Ratings 2023Document10 pagesAnalysis of Financial Ratios that Relate to Market Value of Listed Companies that have Announced the Results of their Sustainable Stock Assessment, SET ESG Ratings 2023International Journal of Innovative Science and Research TechnologyNo ratings yet

- Handling Disruptive Behaviors of Students in San Jose National High SchoolDocument5 pagesHandling Disruptive Behaviors of Students in San Jose National High SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- REDLINE– An Application on Blood ManagementDocument5 pagesREDLINE– An Application on Blood ManagementInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Safety, Analgesic, and Anti-Inflammatory Effects of Aqueous and Methanolic Leaf Extracts of Hypericum revolutum subsp. kenienseDocument11 pagesSafety, Analgesic, and Anti-Inflammatory Effects of Aqueous and Methanolic Leaf Extracts of Hypericum revolutum subsp. kenienseInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Placement Application for Department of Commerce with Computer Applications (Navigator)Document7 pagesPlacement Application for Department of Commerce with Computer Applications (Navigator)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Adoption of International Public Sector Accounting Standards and Quality of Financial Reporting in National Government Agricultural Sector Entities, KenyaDocument12 pagesAdoption of International Public Sector Accounting Standards and Quality of Financial Reporting in National Government Agricultural Sector Entities, KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fruit of the Pomegranate (Punica granatum) Plant: Nutrients, Phytochemical Composition and Antioxidant Activity of Fresh and Dried FruitsDocument6 pagesFruit of the Pomegranate (Punica granatum) Plant: Nutrients, Phytochemical Composition and Antioxidant Activity of Fresh and Dried FruitsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Pdf to Voice by Using Deep LearningDocument5 pagesPdf to Voice by Using Deep LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Create An Analytics-Enable Workforce PDFDocument7 pagesCreate An Analytics-Enable Workforce PDFBramJanssen76No ratings yet

- Guideline On Good Pharmacovigilance (GVP) - Module VIII - Post-Authorisation Safety Studies (Rev. 2)Document27 pagesGuideline On Good Pharmacovigilance (GVP) - Module VIII - Post-Authorisation Safety Studies (Rev. 2)Salló TivadarNo ratings yet

- PSYBSC1619 Kalyani JoshiDocument52 pagesPSYBSC1619 Kalyani JoshiKalyani JoshiNo ratings yet

- Hypothesis TestingDocument11 pagesHypothesis TestingRitu KumariNo ratings yet

- Sat Study Guide Problem Solving Data AnalysisDocument18 pagesSat Study Guide Problem Solving Data AnalysisGiriraj DesaiNo ratings yet

- Data Warehousing vs Data Lakes in the Big Data EraDocument4 pagesData Warehousing vs Data Lakes in the Big Data EraDario PaolettiNo ratings yet

- d2 - 1 PDFDocument5 pagesd2 - 1 PDFSmit PatelNo ratings yet

- UTS Bahasa Inggris AnalisisDocument4 pagesUTS Bahasa Inggris AnalisisCuapCuapIndyNo ratings yet

- Finhack 2018 - ATM Cash Optimization (Dilan) v2Document23 pagesFinhack 2018 - ATM Cash Optimization (Dilan) v2widi learning emailNo ratings yet

- w16 - Multiple Linear RegressionDocument33 pagesw16 - Multiple Linear RegressionMuhammad AreebNo ratings yet

- Quasi VarianceDocument2 pagesQuasi Varianceharrison9No ratings yet

- Introduction to Statistical Analysis with MINITABDocument65 pagesIntroduction to Statistical Analysis with MINITABAdityaNo ratings yet

- Comparing Ridge and LASSO Estimators For Data Analysis Comparing Ridge and LASSO Estimators For Data AnalysisDocument10 pagesComparing Ridge and LASSO Estimators For Data Analysis Comparing Ridge and LASSO Estimators For Data AnalysisMewaie KassaNo ratings yet

- Control Charts For VariablesDocument25 pagesControl Charts For VariablesJassfer AlinaNo ratings yet

- RM Data AnalysisDocument67 pagesRM Data AnalysisAnonymous Xb3zHioNo ratings yet

- Forec Ast Ac Curac Y: Measures Used To Evaluate Forecast AccuracyDocument9 pagesForec Ast Ac Curac Y: Measures Used To Evaluate Forecast AccuracySheila Mae Guerta LaceronaNo ratings yet

- P2 SMK Ampuan Durah SerembanDocument5 pagesP2 SMK Ampuan Durah SerembanmasyatiNo ratings yet

- AllBItech Profile v2Document18 pagesAllBItech Profile v2John SmithNo ratings yet

- TIC ++ BCG-Testing-Inspection-and-Certification-Go-Digital-Dec-2018 - tcm9-209878Document6 pagesTIC ++ BCG-Testing-Inspection-and-Certification-Go-Digital-Dec-2018 - tcm9-209878ugo_rossiNo ratings yet

- Portfolio Theory Exam 2020 With SolutionDocument4 pagesPortfolio Theory Exam 2020 With SolutionFARAH BENDALINo ratings yet

- ML Ques Bank For 3rd Unit PDFDocument8 pagesML Ques Bank For 3rd Unit PDFshreyashNo ratings yet

- A Closer Look Into Experiences of An Employed Person A Narrative InquiryDocument29 pagesA Closer Look Into Experiences of An Employed Person A Narrative InquiryGherbe CastañaresNo ratings yet

- Pemanfatan Data Mining Untuk Prakiraan Cuaca Utilization of Data Mining For Weather ForecastingDocument8 pagesPemanfatan Data Mining Untuk Prakiraan Cuaca Utilization of Data Mining For Weather ForecastingAnnisa Rif'atul HimmahNo ratings yet

- Applied Nursing Research: Original ArticleDocument8 pagesApplied Nursing Research: Original ArticleWahyonoNo ratings yet

- Regression Exe 1a mgm3164Document3 pagesRegression Exe 1a mgm3164NAJLA NABILA AURELLIA / UPMNo ratings yet