The saga of Elon v.s. the Twitter board is the most captivating business technology news item of this period. It has everything:

- Compelling global story.

- Strong characters.

- Drama.

- History.

- Chess-like moves with key players showing they are at least 5 steps ahead of everyone.

- An extremely public hostile takeover.

In the past weeks, I grew a deeper appreciation of the challenges faced by Twitter in terms of:

- The product.

- The company and its leadership.

- Its investors, users and stakeholders.

I also tried to understand why this is an important venture for Elon to spend so much time, investment consideration and effort.

Product Purpose

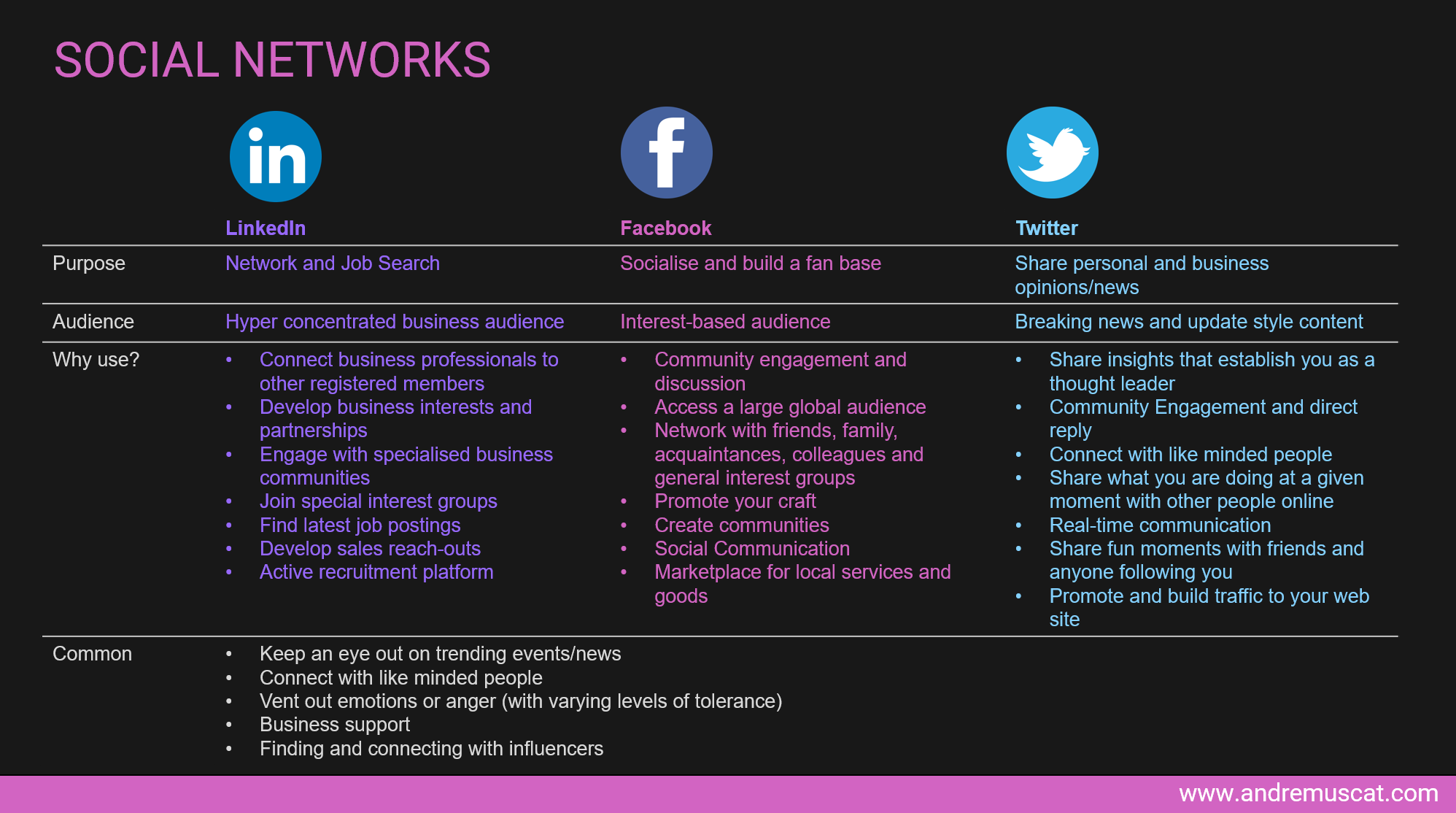

At the outset, the purpose of Twitter is rather generic:

"Twitter is a social media site, and its primary purpose is to connect people and allow people to share their thoughts with a big audience."

This generalistic purpose seems to be a strength and weakness. It is a strength as you can link to or start any conversation with anyone on the platform. By being flexible, Twitter fails to identify its core theme of value or primary area of interest (e.g. LinkedIn = Business Networking & Job Search v.s. Twitter = Anything).

"when you join you get a blank screen, not a bunch of stuff from your friends, and you have to put a lot of work into mining and crafting to get to a feed and an audience that’s valuable"........"I used to describe twitter as like a blank spreadsheet - you can build anything, but what?", Ben Evans

This generality makes it difficult to build for, curate content, improve experiences and drive higher value.

To help achieve better engagement, Twitter developed a sophisticated API layer designed to allow developers to build new solutions and product experiences for audience engagement. Some of this results in:

- Desired outcomes of higher user engagement and new solutions published by independent developers.

- A bucket-load of undesired outcomes, including disjointed branding/consumption experiences, spam etc. (more on this later).

Product and Value of Twitter

In a super article by Stratechery titled "Back to the Future of Twitter" I learned a lot more about the value that Twitter holds within its grasp. Key highlights include:

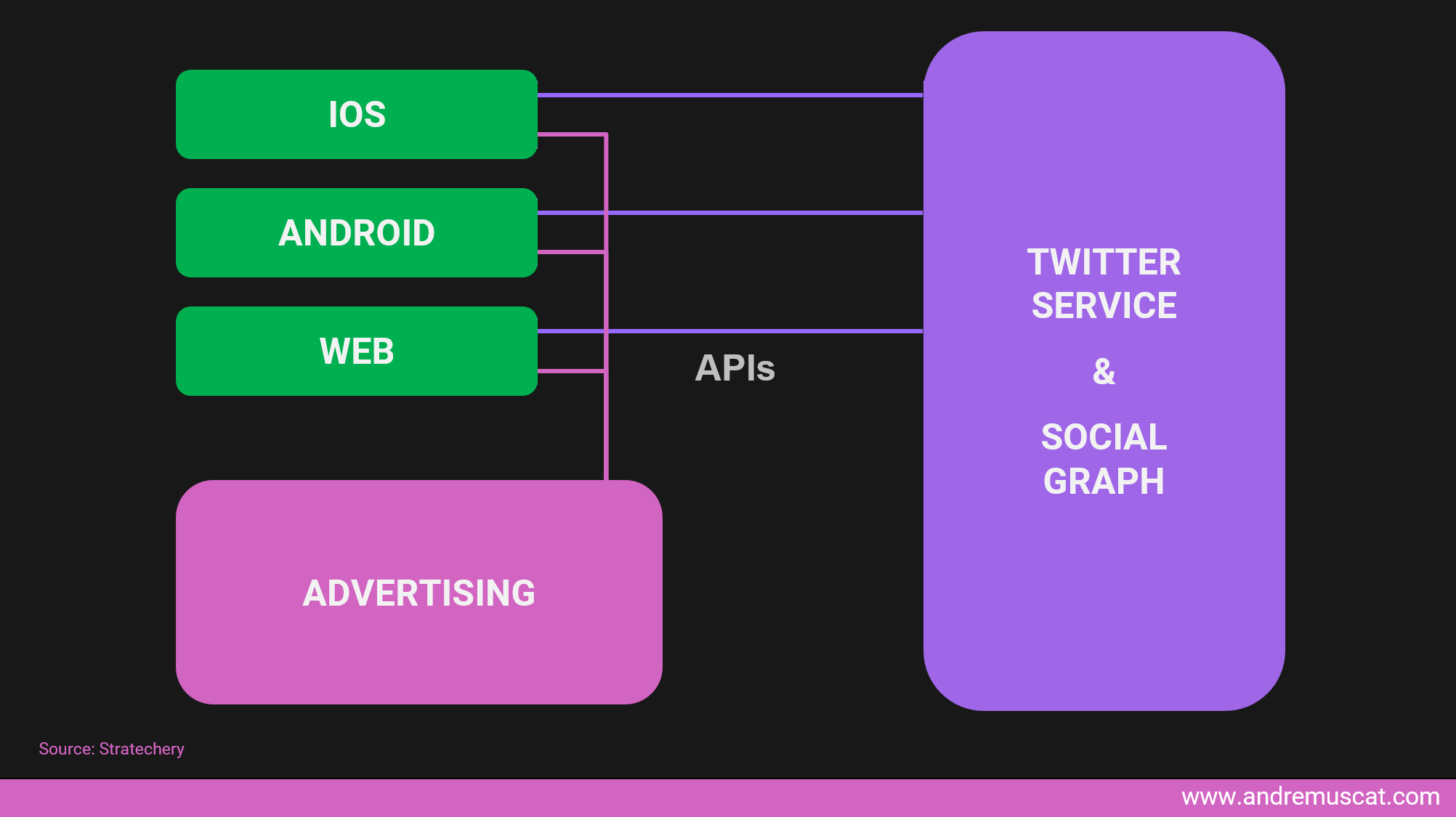

"Twitter is actually a host of microservices, including a user service (for listing a user’s timeline), a graph service (for tracking your network), a posting service (for posting new tweets), a profile service (for user profiles), a timeline service (for presenting your timeline), etc.; the architecture to tie all of these together and operate at scale all around the world is suitably complex.", Stratechery.

The article highlighted how the only end-user facing components are those you get in iOS, Android and Web Apps. All of the rest are driven through APIs and social graph services. These end-user facing components (the green boxes below) are distinct to the intelligence and value of the Twitter Service and Social Graph Capability.

"What is valuable is that social graph: while Facebook understands who you know, Twitter, more than any other company, understands what its users are interested in.", Stratechery.

The opportunity of impact by the Twitter social graph over its competition is hidden within its potential to drive a higher cultural impact than any of its competitors. I imagine this readily available technology is most likely what Elon is after.

"Most people don’t get their news off of Twitter; the places they get their news, though, are driven by Twitter", Stratechery.

I highly recommend you read this article as it posits an interesting fresh technical view of the internal value within Twitter, and positions several great options on how to better deploy and use capital, structure for growth and deliver great shareholder value.

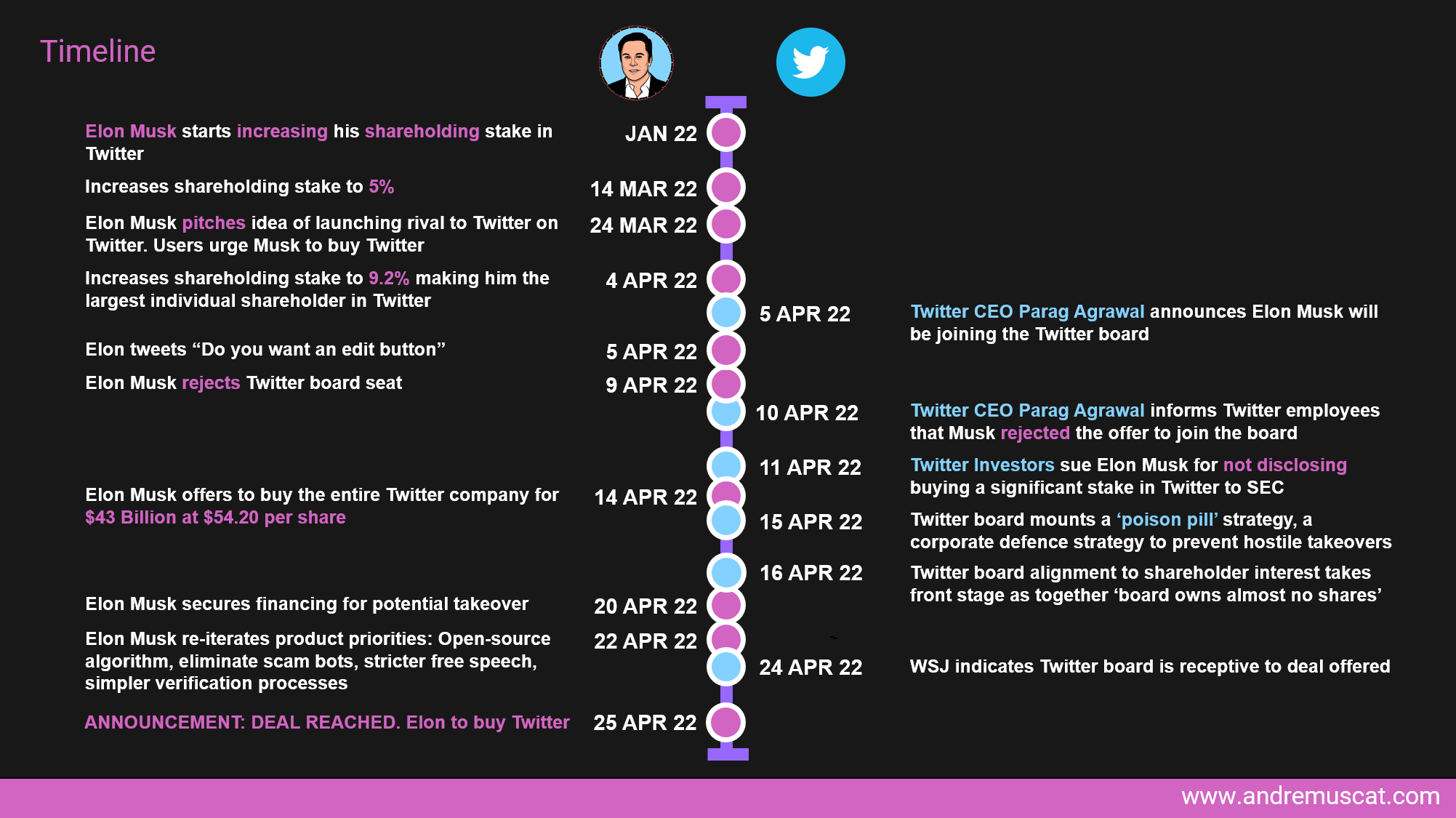

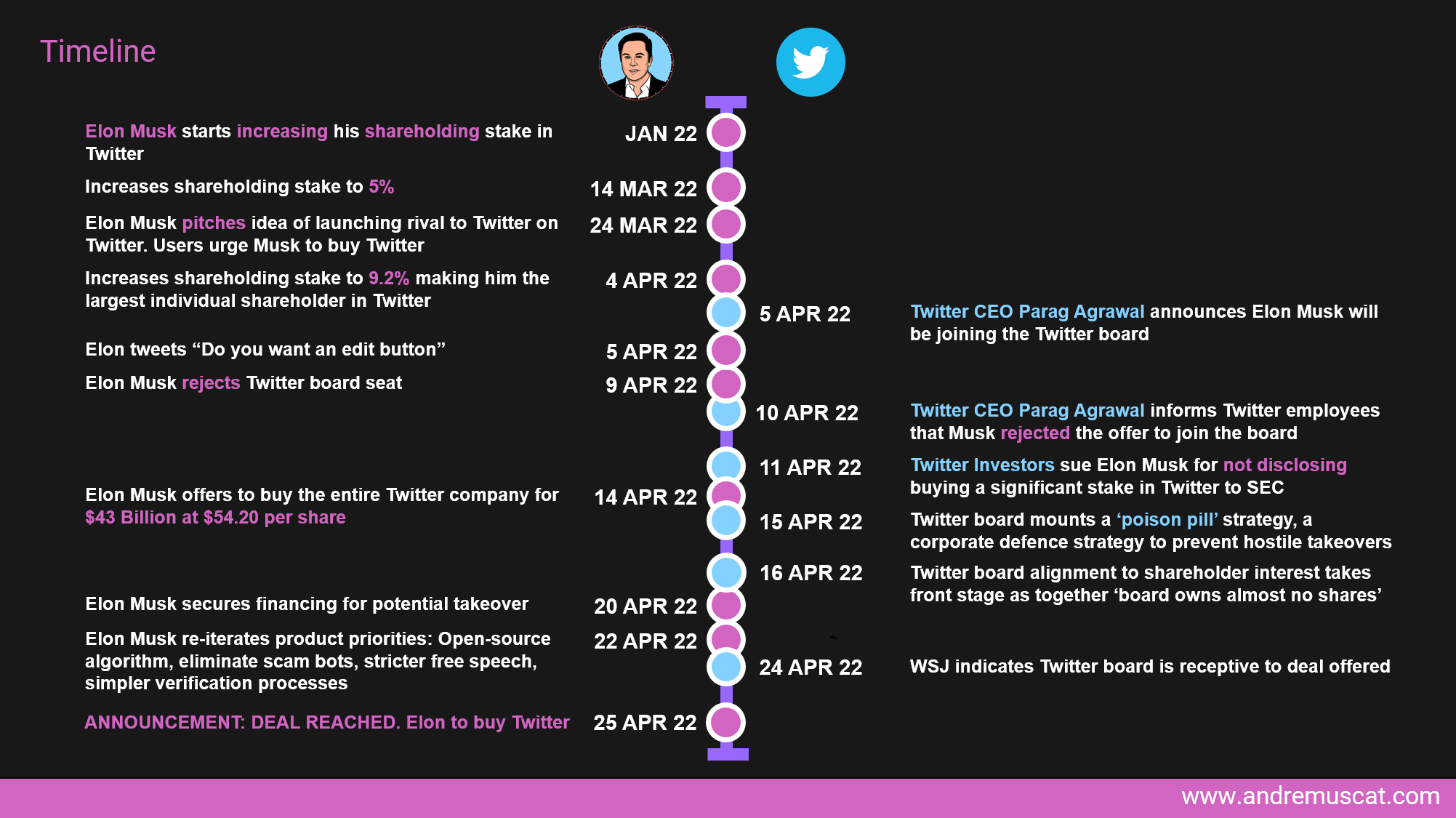

Key Timeline/Emerging Themes

As the events of 2022, Elon and Twitter unfolded, the following sub-topics frequently emerged:

- Product issues - e.g. Edit button, Uncontrolled bots & spam ecosystem, near-flat stock price/sideways moving stock price etc.),

- Twitter's ability to support free speech in an era of increasing speech regulation and other "indoctrinating concepts".

- Transparency in the application of policies that trigger de-monetisation and de-platforming actions.

- Twitter board composition, measures-of-success and incentives.

- The fiduciary duty of the Twitter board to drive higher shareholder value, protect and not tank the public shareholder price in an age where competitors are generating higher value for their shareholders.

- The suitability of the current Twitter board to drive an effective operation in line with expectations that other similar companies are already delivering.

- The alignment of the current Twitter board incentives to shareholder incentives.

- The increasing customer sentiment demanding increased platform capabilities, transparency and security.

- The Investor sentiment seeking an increased ROI for their stock investment.

Let's explore some of these.

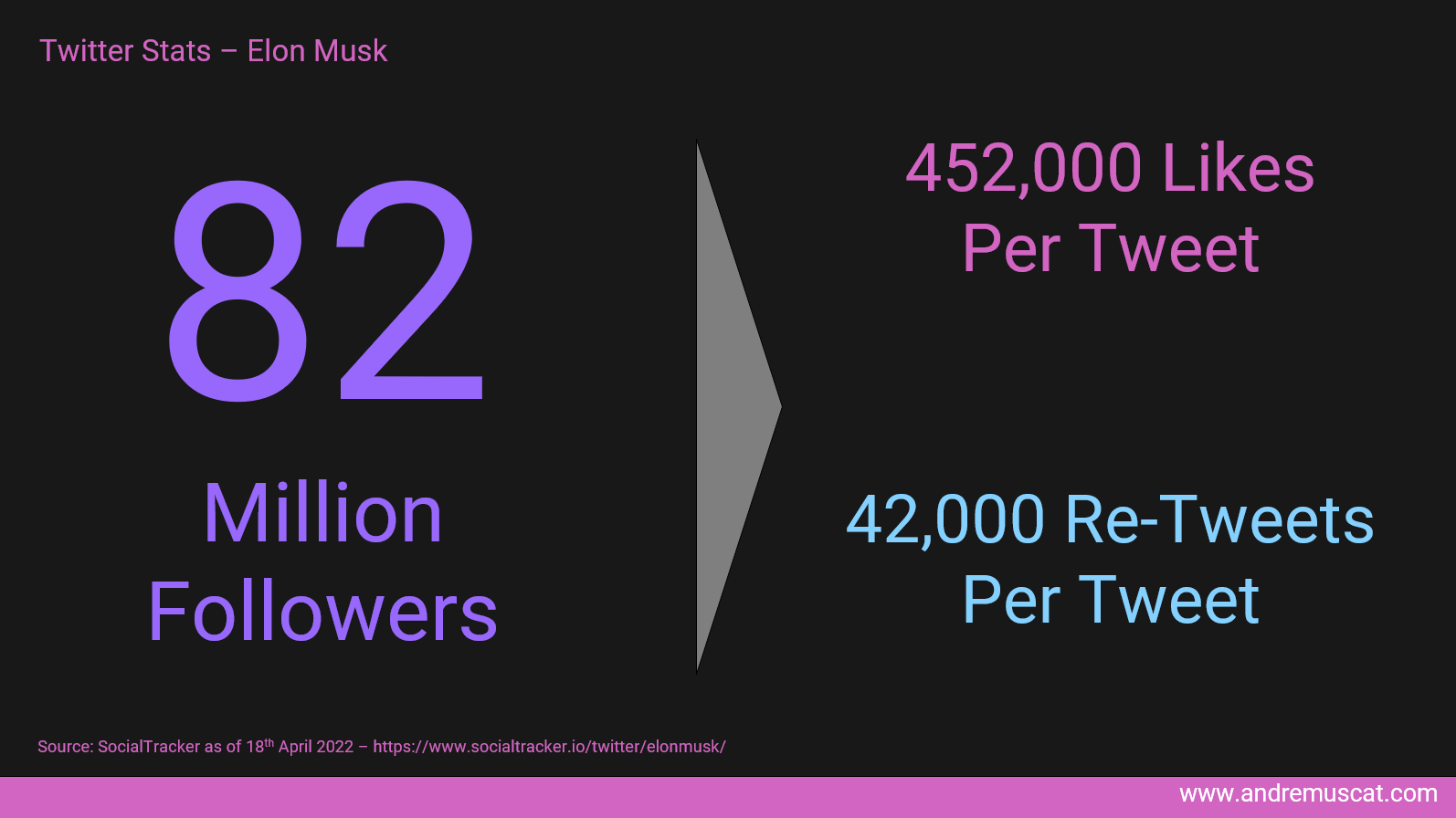

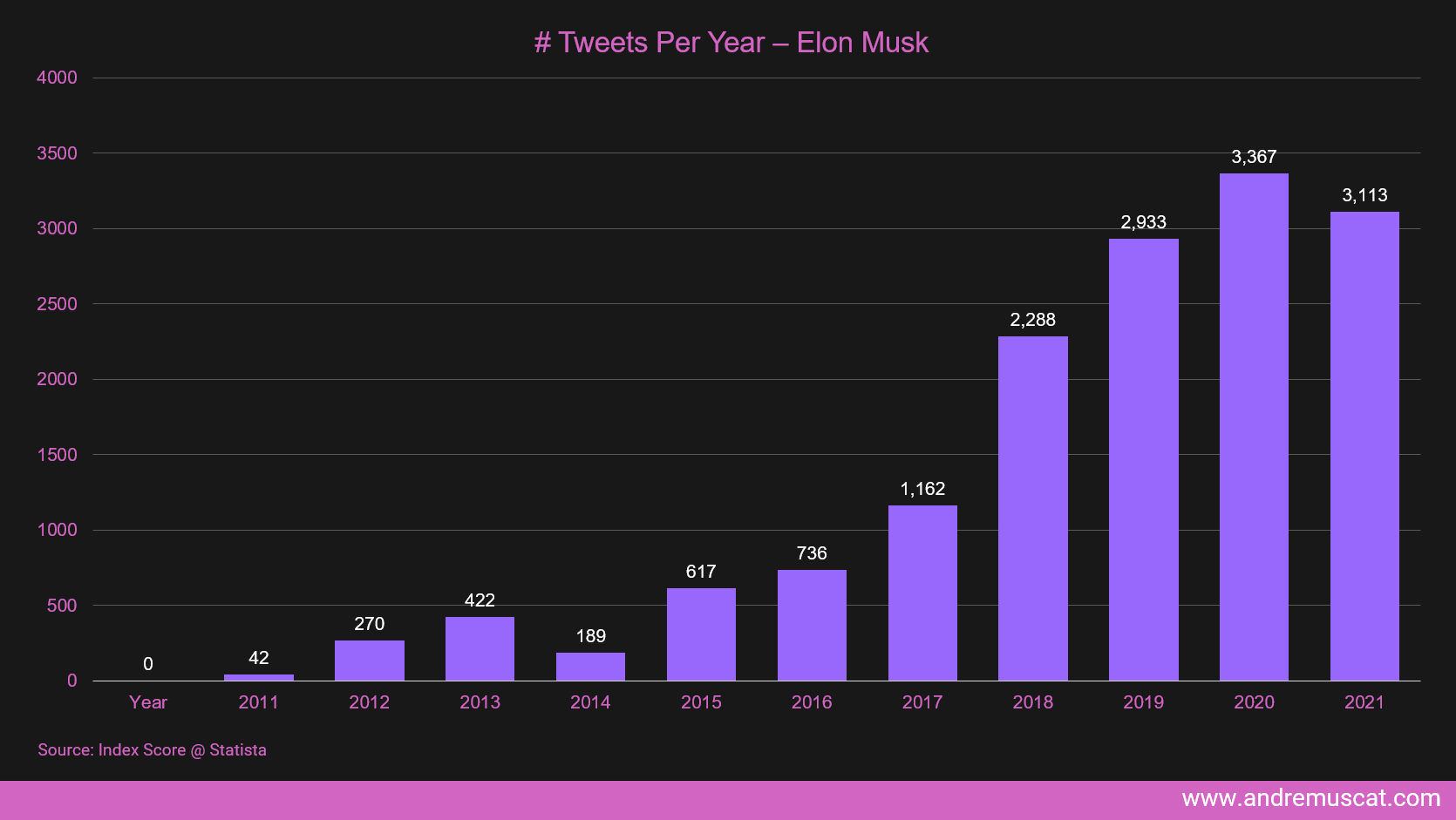

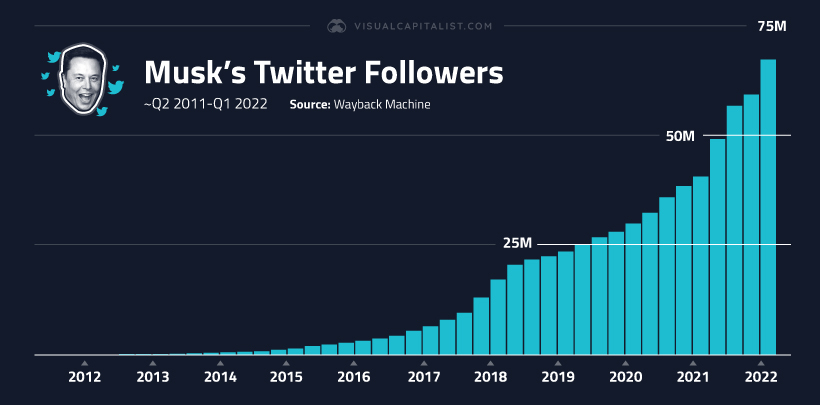

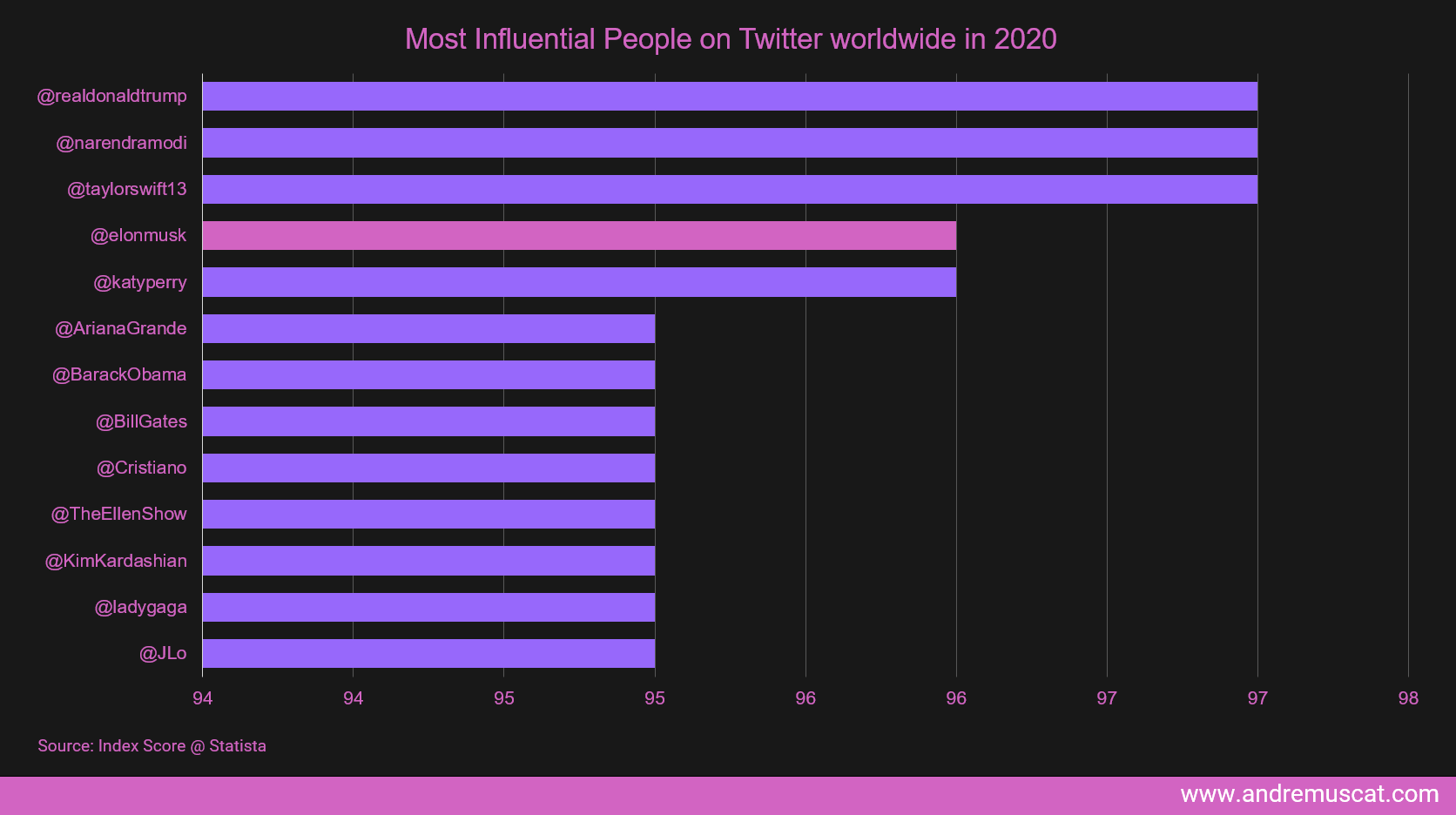

Elon Musk - A heavyweight user of Twitter!

Elon Musk is well known for his fame and online Twitter presence, providing followers with a unique opportunity to catch an unfiltered look into his eccentric mind.

- Elon is well established and capable of deploying capital and transformation teams to build uncompromising high-efficiency production environments at scale for global deployment.

- With over 77 million followers, people care about what he likes, has to say and share.

- He tweets often and candidly across various topics, with some days hitting 30+ tweets.

- His tweets are far-reaching, often making the headlines as they trigger widespread political debates, stock price movements (particularly to Tesla and cryptocurrency markets, e.g. Dogecoin and Bitcoin) and fun memes.

- With a net worth of 270 billion, he is the current richest person globally.

- In 2021, he was also named Time magazine Person of the Year.

- He has been publicly critical of Twitter's management team and how the company has been led and operated.

- He referenced how influencers and celebrities preferred to use other platforms, thereby pulling users elsewhere.

- Elon insists that this is not an act of "greed" and "economic gain". He emphasises that his recent actions have been driven by his purpose of being a "free speech absolutist".

You’re an idiot

— Elon Musk (@elonmusk) December 15, 2017

My Twitter is pretty much complete nonsense at this point

— Elon Musk (@elonmusk) April 19, 2019

Tesla stock price is too high imo

— Elon Musk (@elonmusk) May 1, 2020

You can now buy a Tesla with Bitcoin

— Elon Musk (@elonmusk) March 24, 2021

With an increasing tone of frustration on how social and communication policies are being deployed and enforced...

The coronavirus panic is dumb

— Elon Musk (@elonmusk) March 6, 2020

FREE AMERICA NOW

— Elon Musk (@elonmusk) April 29, 2020

Pronouns suck

— Elon Musk (@elonmusk) July 25, 2020

to active participation, ensuring people's voices can continually be heard

Starlink service is now active in Ukraine. More terminals en route.

— Elon Musk (@elonmusk) February 26, 2022

To public "pre-flight" engagement before action....

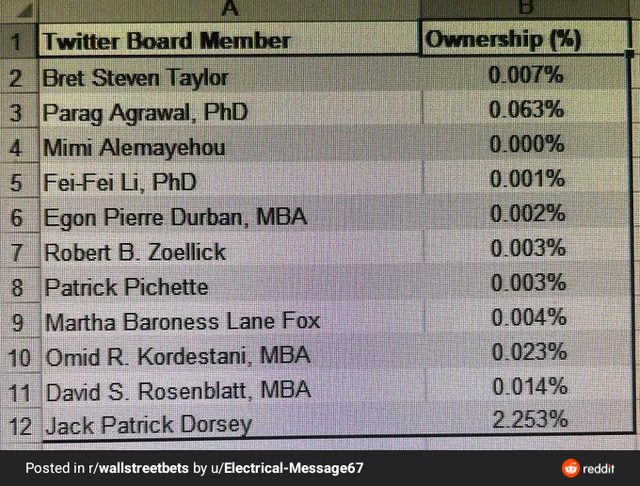

Twitter Board (Compensations, Shareholder Alignment & Sentiment)

The below tweet from Gary Black (Managing Partner, The Future Fund LLC) gave a lot of anecdotal insight into the arguments used to describe the decision making influences of the board:

- Company success metrics as measured quarterly by the market (more on this below)

- Stock Shareholding

- Compensations by the company of around $250 - $300K annually for a part-time job.

Let me point out something obvious: If @elonmusk takes $TWTR private, the TWTR board members don’t have jobs any more, which pays them $250K-$300K per year for what is a nice part-time job. That could explain a lot. pic.twitter.com/vLgpEZpapA

— Gary Black (@garyblack00) April 17, 2022

I did not go deep into the individual components of the Twitter board as I wanted to remain focused on the outcomes / macro topics being analysed instead of focusing on who is leading today.

The key items I noted are:

- Former founder Jack Dorsey insists on reporting he left Twitter of his own will.

- With the departure of Dorsey (who holds 2.253%), the stock ownership between the remaining board members rounds up to almost no shares (compared to the total stock available).

- There is a hidden battle on who owns most stock (with Vanguard group upping their holdings to have 10.3% shareholding).

- The annual compensation of this board is up there with the top compensations, globally.

- Some articles also noted Jack Dorsey referring to the board as “consistently the dysfunction of the company” (Forbes)

it’s consistently been the dysfunction of the company

— jack⚡️ (@jack) April 17, 2022

If look into the history of Twitter board, it’s intriguing as I was a witness on its early beginnings, mired in plots and coups, and particularly amongst Twitter’s founding members. I wish if it could be made into a Hollywood thriller one day.

— Χαλιδ Σωέϊδ (@iHadrami_) April 17, 2022

This last comment made me think. It depends on the drivers of the board and what the board is protecting against.

While I refuse to believe that a board of this calibre would make intentionally destructive decisions to destroy value, I can easily see them take pre-cautionary actions that greatly impacts their longevity in their company position due to some decision that would impact a key KPI that the investor community values.

At the outset, I can appreciate why Elon would use this argument to create massive social pressure on the suitability of the board to drive shareholder value. However, given that Elon himself clearly stated that the company needs to be taken private to transform it, he also knows that no one can apply the necessary changes without tanking the stock price.

"Since making my investment (bringing the stock price up to 9.2%) I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company," Musk said in a letter to Twitter Chairman Bret Taylor, seen by Reuters.

I firmly believe the board is between a rock and a hard place. On one side, they want to create product-led decisions at speed, while on the other, they cannot accelerate more than much as they are also bound to protect the sock price. Elon is correct, and the board knows it. The work needed to achieve radical change cannot be done while the company is public. There would be too much noise and distraction.

Let's discover more about this.

Stock price

Using HTTP://finance.google.com set to a MAX period to analyse stock price trends over time, we can chart Twitter performance over approx 10 years.

From this chart, we can see that throughout the spread of 10 years spread, the stock price of Twitter has predominantly oscillated around the 45 USD mark. This means that, brutally said, this stock has remained relatively FLAT throughout these 10 years.

For the avoidance of doubt, yes, there were periods of spikes and throughs. Still, suppose you compare the growth pattern to other similar social platforms (e.g. Facebook) that enable people to connect and share experiences. In that case, you will notice an entirely different growth path (up and to the right).

The people who will lose from this transaction are those who bought their shares at $54.21. The rest will experience a smaller ROI than initially planned (but not experience monetary loss).

This means that from a shareholder performance standpoint, long-term investors have not seen little ROI on their shares. This puts in question the ability of the Twitter leadership to effectively create new incremental value that drives interest and growth engagement.

Just on this, the offer of Elon to purchase Twitter stock at a fixed price of 54.20 USD per share in cash does not seem to shabby.

However, one can argue that this may not be enough, as the board/leadership of Twitter may have internal insight and judgement that makes them believe this company is in for an upswing in short to medium term.

If I were a Twitter investor, I would expect Twitter to demonstrate it is listening to the market and positioning itself for long term growth. Let's look at other KPIs of the company to determine if it is posted to return to the $70 high mark or higher any time soon?

Let's go deeper....

Shareholder Sentiment

Shareholder Sentiment is generally (and oversimplified) related to the performance of the stock price throughout the duration of the holding of that stock.

From above, we have already established how this stock is relatively "flat". I separately analyse the stock price and stock holding by Elon aspects in more depth:

This means that for a Shareholder to have "hope" that the stock price will increase to give them a better return is based on their belief or prayers that:

- Something fundamental changes in the company is operated that gives them an unfair advantage over their competition.

- Twitter ships new or highly upgraded products with new value the market is willing to pay for and buy.

- Other partnerships/investor-level moves.

Let's analyse some of these health indicators.

Revenue per head

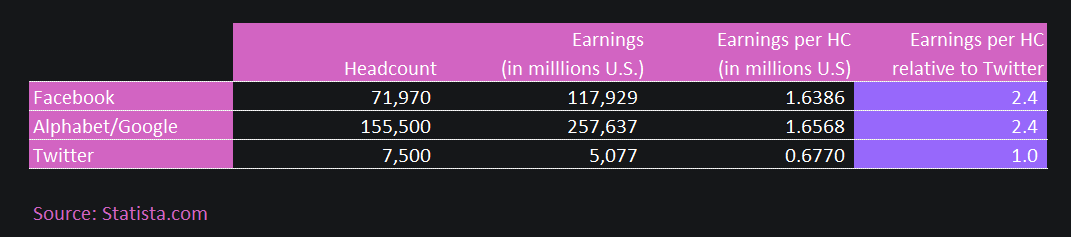

Revenue per head is a popular KPI used to measure and compare businesses' performance within the same industry. Otherwise said, this KPI is used to get a sense of its resource usage efficiency relative to the overall revenue generated. It is a simple calculation that divides the total revenue generated by the total headcount a company carried in that year.

From this simple tabulation, one can see that the revenue per employee of Twitter is 0.7 million USD per headcount employed. This may sound great until you start comparing it to that of other similar companies (tech giants) operating in the same space. Both Facebook and Google (notorious for running highly efficient companies) carry a 1.6 million USD revenue per headcount KPI.

Through simple proportion, we can see that both Google/Alphabet and Facebook drive higher returns for each employee by a factor of 2.4. That is a huge performance gap.

The resulting questions towards Twitter from this include:

- Are you carrying more personnel than required to operate effectively in that space?

- Are your current processes driving people to have too many meetings?

- Are you losing efficiencies due to high employee churn rates and third-party fees?

- Are you driving development operations effectively or losing cycles to manual processes?

To an investor or outside eye, this may indicate that the Twitter board and leadership are not giving enough focus on the effective running of the company.

But again, let's go even deeper...

Engagement/number of monthly active users

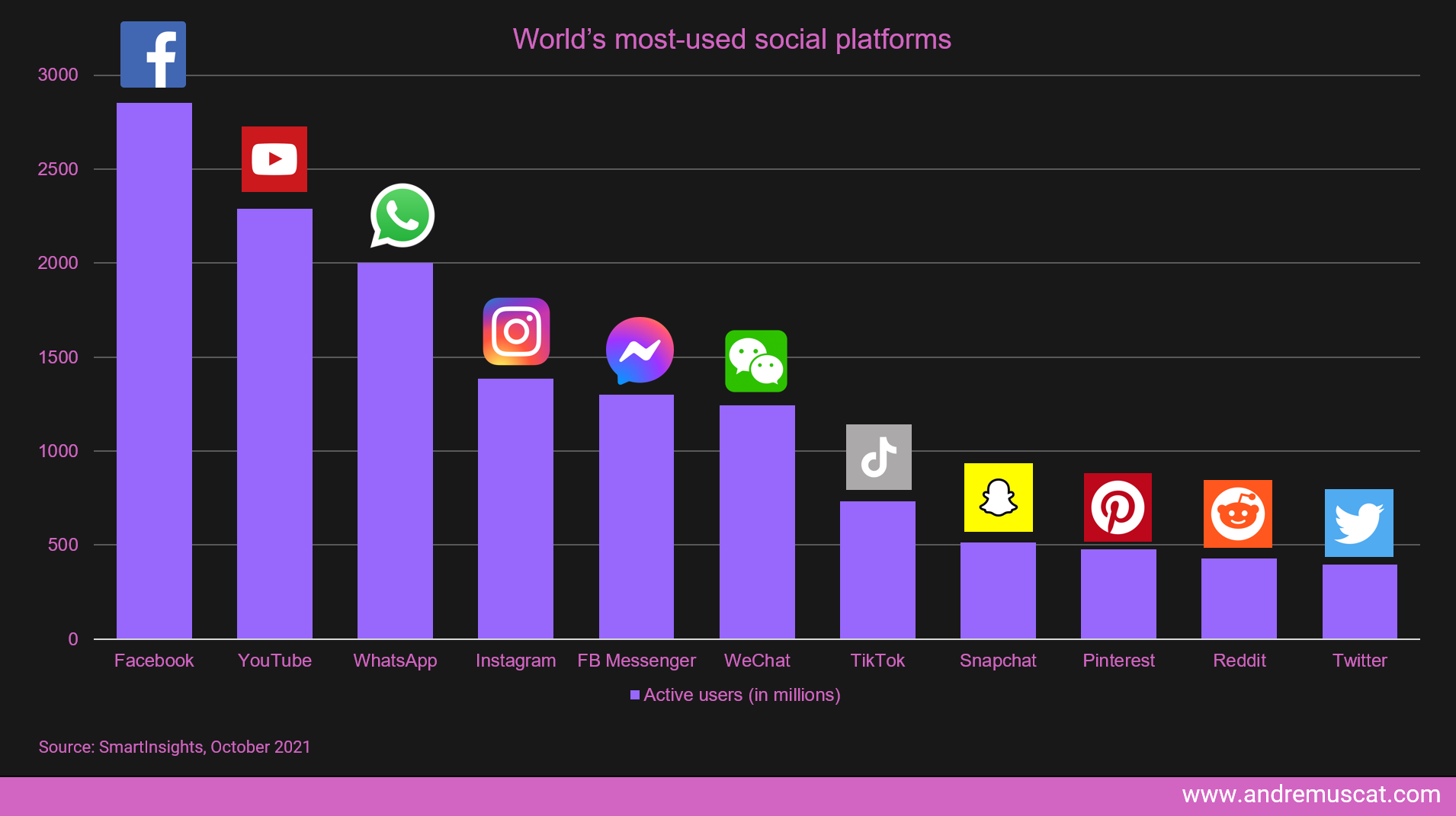

The most popular social networks are ranked AND JUDGED based on the number of monthly active users.

This Key KPI is what I also believe Twitter measures its success messaging around, e.g. engagement per day, posts per day etc. These KPIs are significantly impacted by who/what and how frequently activity/actions or tweets are done on the platform per period (day/week/month etc.).

Looking at the active daily users across social platforms using data from SmartInsights research in 2021, you can see that Twitter is already positioned as the least used social platform.

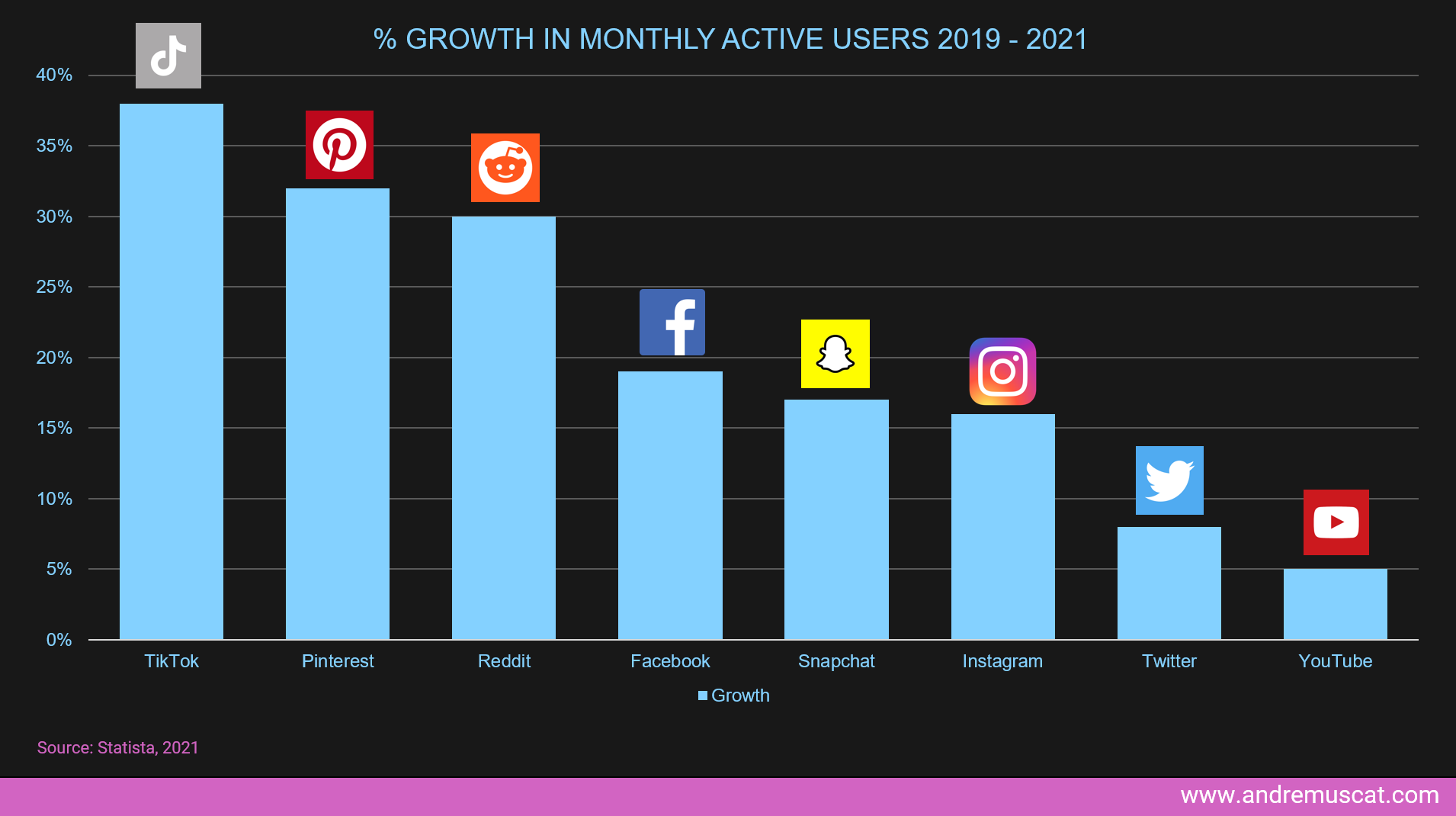

However, let's not stop there, let's look at whether this number is growing and at what rate.

Again Twitter is losing ground to emerging platforms like TikTok, Reddit, Pinterest etc.

This is incredibly sensitive for Twitter leadership, as both their performance and stock value are directly correlated and judged by this KPI.

Their incentive is to drive behaviours that positively impact this KPI BIG TIME!

This matters a lot because Elon is stating he HAS TO TAKE THIS PRIVATE to fix the Twitter market value challenge.

BOTS and SPAM

People use social platforms for various reasons, including:

- To learn about products

- To know how to do something

- To learn about a hobby, interest or industry

- To catch up with emerging trends

- To entertain

- Other

As they use this platform, they get reactions from other Twitter users and hope for a high-quality information signal that helps them achieve their desired outcomes.

However, things are not so simple. In 2021, Twitter publicly released an API to help developers develop solutions to enhance the value and usage of the platform through automation.

Bots are software solutions designed to interact with humans. They can automatically tweet messages, re-tweet messages of choice, like posts, follow accounts, unfollow accounts or drive other interactions.

This created a new capability for people to create new value built on the platform:

While productivity, customer service experiences and user engagement were enhanced, there was a side effect to this - the rise of agenda-driven bots (political, social etc.) and Spammers. Bots were built and deployed with ease to collect and use data to drive their developer's purpose. Using an example, you can create a bot that posts an automated reply or direct message when someone mentions your competitor.

This means that the sophistication of bots grew to a level they could be used to:

- Create a denial of service on a user

- Kick-off users from the platform

- Spreading misinformation

- Spreading specific agendas (e.g. https://www.ier.org.uk/news/gender-pay-gap-twitter-bot-causes-embarrassment-on-iwd/)

For you, this means the signal quality of posts you are presented in your feed is significantly undermined by the messaging agenda of organisations with the time, resources and interest to build bots that help them manipulate narratives and contexts to the detriment of the original post may have had.

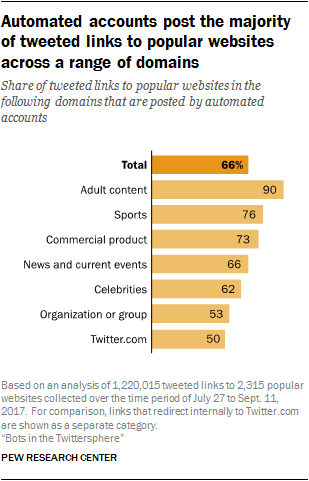

In an article by Pew Research, titled "Bots in the Twittersphere", they estimated that TWO-THIRDS of tweeted links to popular websites were done through automated accounts - not human beings!.

This is HUUUUGE!. And being so huge, you can easily use data and intelligence methods to detect and stop such behaviours! So why did Twitter not stop this yet?

I believe that this was not done because, as I indicated in the earlier section, the board measures success in terms of active monthly users no matter if that interaction or behaviour is coming from:

- A social user

- A bot designed to react to events and keywords

- A spamming exercise.

This bot and spam problem, in particular, are incredibly significant considerations in this discussion, as it touches on several aspects, including;

- Customer perception of the platform (does the company have a plan to push)

- Customers reliance on the platform to get the information they seek for the purpose they seek

- Platform ability to fight back active propaganda

- Noise in the signal of information

- Customer satisfaction as information is not relevant to the value they are seeking to get out of the platform

- etc.

I believe that fixing this issue will drop the monthly engagement number, putting the board under tremendous pressure in an environment where:

- Their success is measured by the success of the stock price.

- The stock price is driven by customer perception of users actively using the platform.

- An action that requires an aggressive reaction that will drop the same metric that makes them successful as measured by the KPIs they are rewarded by.

This being the number 1 annoyance to users (after the edit button) is what is driving their highest activity. Why would Twitter WANT to solve that problem?. This means the investment KPI driver of success is directly AGAINST the board's interest to FIX the issue. It is not that they cannot fix it. Based on this, I can see a conflicting situation where their ability to fix a customer issue directly impacts their ability to be seen as successful in an increasingly emerging competitive social market). I can also see that fixing the issue makes them less attractive to businesses to build solutions on their platform. It is a nightmare situation!

Product and Environment Issues

Customers and users of Twitter have been quite vocal about their unhappiness with the Twitter solution:

- Lack of transparency in "content regulation" and "de-platforming."

- The poisoning and weakening of the signal within the Twitter feed resulted from propaganda, woke-driven messaging and other extreme controls deemed to over-restrict the right to express and discuss.

- Infiltration of politics and agendas driving bias within the feed algorithm

- Too long to get simple features like "Edit" where other companies have had them for so long

The top requests seem to circle the same topics consistently Elon is citing as his drivers for this takeover:

- Open-source the feed algorithm - and openly and progressively eliminate any sense of bias in the signal.

- Eliminate all bots - let users drive the signal quality and not automation.

- Restore free speech.

- Develop the core purpose of the product and make it great!

- Eliminate extra employees who do not directly contribute to the platform's core purpose.

- Take an official posture to leave politics outside of the workplace (as Netflix and Coinbase did)

- Suggestion to make Dogecoin (DOGE) a payment option for the Twitter Blue service

Shrink to Grow

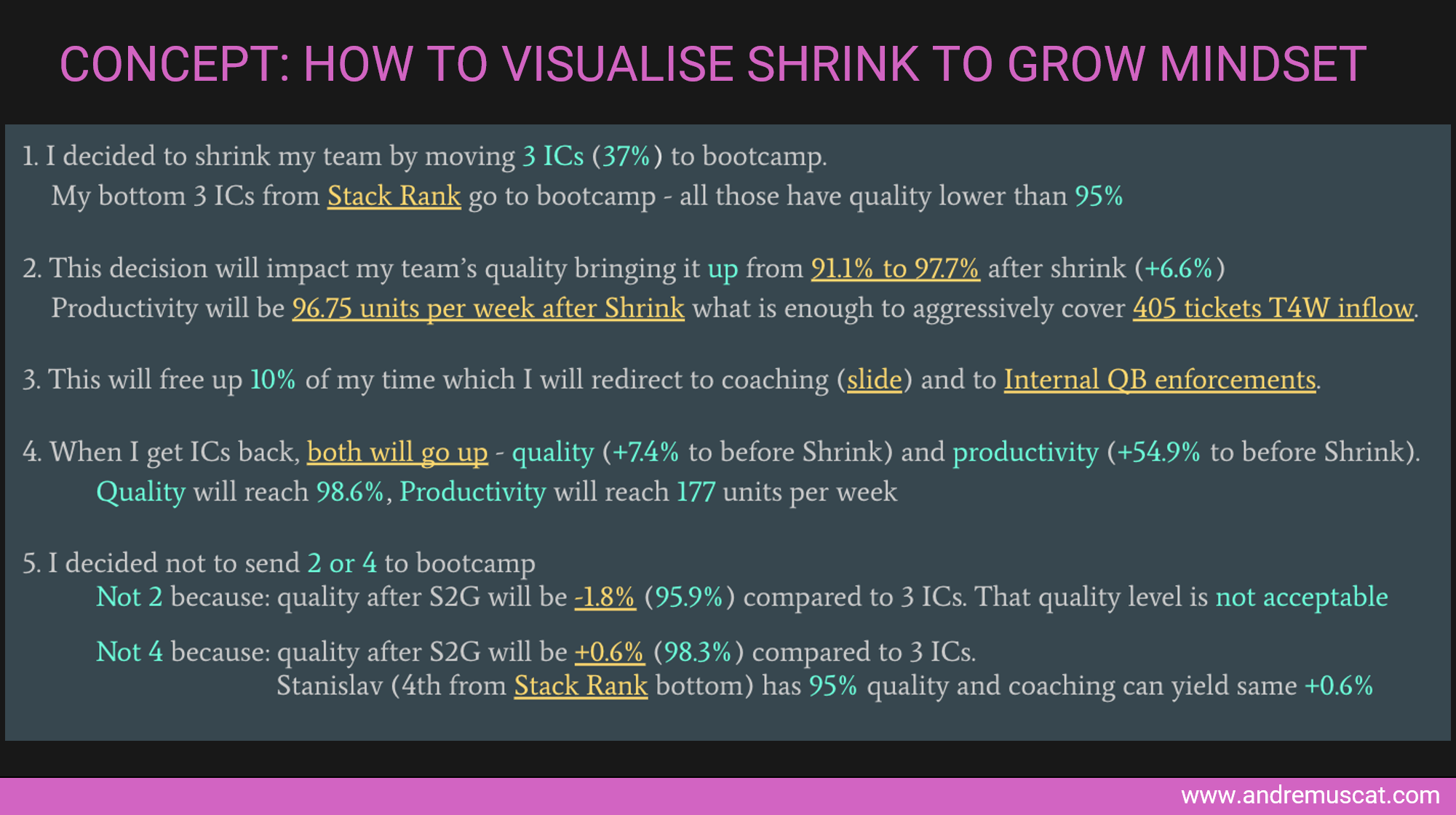

I learned a fundamental lesson named "Shrink to Grow" in my career. It was brutal and yet highly needed. The "Shrink to Grow" a strategy is a transformational approach that is built on intentionally taking drastic actions to trim down operations, branches, subsidiaries, and staff to:

- Re-focus the product propositions

- Re-focus the business on core-value propositions

- Re-baseline profitability

- Establish a long-term sustainable journey

Shrink to grow is a move that carries massive risk and change. It is also a blunt instrument that, if applied well, can enable a company to refocus and achieve accelerated growth thereafter successfully.

While it can take us out of context, I found this slide helps frame a portion of the mindset behind a Shrink to grow operation:

NOTE: While in the above example, the manager is making the recommendation, in the Twitter case, the cut size is determined top-down, where managers are given a target shrinkage to achieve over a period of time. These shrinkages will manifest in:

- Higher use of automation to shorten concept-to-go-live and elimination of manual operations

- Job cuts

From our analysis of the Twitter KPIs, I fail to see how the present Twitter board can address the main issues within the business without a "Shrink-to-Grow" mindset:

- Unfocused product purpose

- Stock Price

- Revenue Per Head

- Engagement/number of monthly active users

- Out of control activity by bots and spam

- Company environment issues

While it is not a given that Elon will manage to take over Twitter, there is one thing that is sure on my mind; Twitter is in for a considerable transformation one way or another.

You cannot fix the bot/spam problem without shrinking that active monthly user engagement KPI. You cannot keep a healthy stock price without that KPI.

I believe Elon is right when he says the only way to fix Twitter and make it a thriving, growing company again is by taking it private. By doing so, he is openly stating his plan to apply the "shrink to grow" model that brings in an immediate shrink in profitability/incoming revenue balanced out by the transformation needed to lower the cost of operation aggressively. This can only be fathomed by highly sustainable investors with a long-term view - something that I am sure you will agree traditional stock investors are not :).

If Elon takes it private, the following are near-sure things in my mind."

- More mature and extreme visioned company leadership

- Better product management and the introduction of radical policies designed to push advancement through product-led growth approaches.

- Expansion of factory-like processes and mentality (heavy automation and highly-aggressive continuous improvement focused initiatives)

- Minimum of 50% cut in staff effectively eliminating bad practices/legacy cultures processes in short to medium term. Unfortunately, with this, there will be a lot of "good" practices that will die with the "bad".

Otherwise said, if Elon takes it private, a model will be prepared for Twitter, and the company and employees will get on an accelerated journey to get "In Model". Just like the GigaFactories are model-driven, Elon and the team will drive a "model-driven" approach to Twitter too.

Do not mistake this with "product-led" business, although it will be positioned as such. A model-driven business is built on a formula. This means there is a pre-established formula, and if you fit the formula, great, and if not, you are out. This formula focuses intensely on measured productivity, obsessive improvement to productivity metrics, and automation wherever possible (to levels people cannot naturally fathom). This means:

- The product teams will be focused on increasing the value of the product to customers (GREAT) while

- The operational teams will be manically deployed to eliminate costs wherever possible (to crazy levels).

If Elon is not the one to take it private, then we can rest assured that a key competitor will emerge to kill Twitter (backed by Elon) now that we have shown and seen that Twitter systematically failed to thrive over the past 10 years!

Board options from here

I fail to see the current Twitter board having the knowledge or appetite to apply a radical Shrink to Grow model. You can see they are trying to delay the inevitable by deploying the "poison pill" strategy whose sole purpose is to delay hostile takeovers.

The most conflicting thing about this is that we all secretly want Elon to manage this takeover to see what happens and how things will change. What we fail to appreciate is the virtual "carnage" that will occur in an operation of this size.

Current options on what the Twitter board can do without setting themselves up for failure are either:

- Demonstrate that they can achieve desired shareholder and customer value IN THE SHORT TERM through technological innovations and approaches that were not publicly shared yet (new transformative products/capabilities or ways of operating Twitter itself).

- Accept the Elon offer as-is.

- Shop around, and put Twitter out to the highest offer.

- Negotiate a deal with Elon, present a plan that is superior to his offer - or get out of the way.

- Let the shareholders vote (my preferred)

Taking Twitter private at $54.20 should be up to shareholders, not the board

— Elon Musk (@elonmusk) April 14, 2022

No matter the outcome, the current board and leadership, are toast one way or another. My heart does reach out to the current CEO, who had to face the toughest of opponents in his first months of tenure without any chance to apply the changes he was most probably after. I am sure that whatever he was going to do, it would not be as aggressive Elon is planning :).

The Genius of Elon's moves in this operation

I never lived a hostile takeover of a public company, and got to learn a lot on this from Elon's "chess-master" moves:

- He acquired a significant 9.2% of shareholding he managed to get the attention of shareholders and potential shareholders considering investing in Twitter.

- He brought global acknowledgement on how badly the company is being run compared to similar companies in the same space. This sets a great deal of pressure on the effectiveness of the current approach of the board

- He set the final price at which he is interested to transact per share (preventing a stock run-off/rally)

- He got public acknowledgement on what is majorly wrong with the product experience and honed in on the Customer Sentiment AND Shareholder Sentiment.

- He set a purchase price that is a reasonable price for the vast majority of the current shareholders.

- He confirmed via an SEC filing on April 20th that he has the finance to acquire the company

This means that he has now built a compelling case for the board of Twitter to sell, and the shareholders to have a compelling reason on why the board should sell.

This means that the board can only delay a sale by much. Their options are mainly around:

- Showing the world IN A VERY SHORT TIME that their current management approach will transform the outcomes of the company. Given the ten-year history, this is very hard to expect anything to change to the required levels that will make the stock price jump to anywhere close the offering of Musk (or beyond)

- Showing that they have a better plan

- Shop around for better buyers to ensure they get the best deal from the acquirer for the shareholders.

This means that if they refuse, they will be faced with the question of whether the delay or refusal was in line with their fiduciary duty to protect and operate in the interest of the shareholder.

WHERE DOES THIS LEAVE US???

A Twitter under Elon will be a massively different Twitter. As a consumer, I think this is great. I am fascinated by the possibility of a future with less woken agendas, exaggerated censorship boards etc. I fully appreciate the last sentence is an incredible horns nest :) so I will stop there. However, we can easily predict the new Twitter will

- Be better run.

- Be a more open "free speech" platform with better limits on the insane censorship we saw of late.

- Be ambitious to innovate and improve the product.

- Be manically focused on attracting users with better publishing and debate capabilities.

Twitter is going to change fundamentally. The only remaining question is how by whom, and by when. I can only dream of the new lessons I will learn in the coming weeks' thanks to these tech giant moves.

Meaningful moves since the original publishing of this article:

20-Apr-2022 - Elon secures financing

Based on an SEC filing posted on April 20th 2022, Elon is saying he has secured USD 46.5 billion in financing to acquire Twitter. This funding seems to be composed of:

- 25.5 billion in debt and loan agreements with Morgan Stanley and “other financial institutions” (unnamed)

- “Equity Financing” commitments by Elon himself are expected to be approximately in the range of 21 billion

NOTE: While this means that Elon has confirmed that he now has the financial position to acquire, the Twitter Board is most likely “shopping around” for alternative buyers. Should a serious alternative buyer emerge, Elon may still need to negotiate that position.

24-Apr-2022 - WSJ indicates the Twitter board is receptive to deal offered.

On Sunday 24th April The Wall Street Journal (WSJ) reported that the board and bid side are meeting to discuss the takeover bid. You do not meet on Sunday unless it is super urgent/important.

At this rate, it being speculated that the Twitter sale could be finalized by the end of April 2022.

25-Apr-2022 - Announcement

Deal reached

Twitter accepted Elon Musk’s bid to take over the company, giving him control over the social media network.

Concluding thoughts

We live in interesting times, where a potentially hostile takeover is lived from the front-row seat thanks to the same platform that is under scrutiny: Near-instant News, Social communications and Social media.

We have so much to learn from this!