Hong Kong government’s move to standardise land premium rates has potential to boost much-needed housing supply

- The new formula to calculate land premiums can speed up the land-conversion use process, which can go a long way in boosting housing supply

- It took an average of seven months previously to reach a final agreement using conventionally calculated land premiums

Hong Kong’s land supply shortage and housing crisis has been the bane of the city’s prosperity for decades. Its residents cry for affordable homes whilst many restlessly wait in line for an average of six years to be granted public housing. The city has been battling this crisis since the handover in 1997.

And while private land owners are faced with the duty to fulfil the city’s demands to provide homes in quantity and quality, the conventionally calculated land premiums would often take an average of seven months to reach a final agreement.

Thus, to alleviate this burden, in 2020, the Hong Kong Institute of Surveyors proposed that the government apply standard rates to assess land premium for lease modification and land exchange. The approach aims to enhance the efficiency in processing land-development applications and to encourage better use of idle land, thus increasing the potential of land and housing supply.

The two-year pilot scheme of charging land premiums at standard rates has proved successful in the redevelopment of industrial buildings.

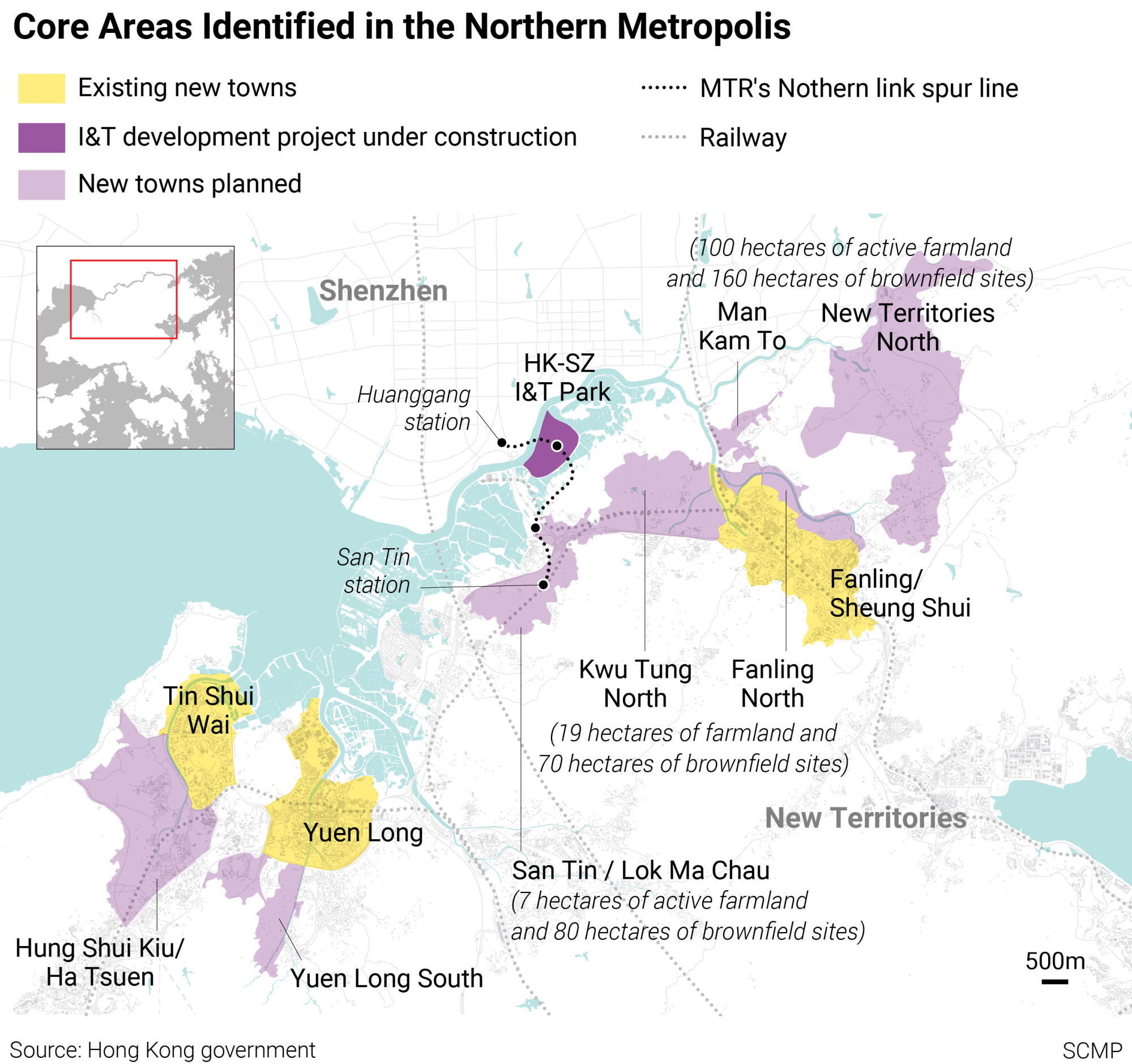

At the same time, the addition of the new development areas (NDAs) in the New Territories has seen developers increase their land holdings and convert agricultural land to residential use.

As of mid-April 2022, applicants of nine eligible lease modifications opted for standard rates under the pilot scheme, data from the Lands Department shows. Of these, seven have agreed land premiums with the Lands Department. The remaining two cases are under processing.

In the three years before the launch of the pilot scheme, on average only about three to four lease modification cases for redeveloping industrial buildings had premiums agreed per year.

Land premiums have been conventionally calculated as the difference between the “after value” and the “before value”. Where applicable, deductions for the construction cost of community facilities, such as public transport interchange, are also allowed, to expedite construction of relevant infrastructure.

Under the new approach, depending on the original use of the land and whether it will be developed into residential or non-residential use, the land premium is assessed as the difference between the two uses on the basis of certain standard rates.

For instance, the standard rate of agricultural land (before value) in NDAs for residential and non-residential use is fixed at HK$372 (US$47.40) per square foot. The standard rate for residential and non-residential land use (after value) in Kwu Tung North is HK$5,574 per square foot and HK$3,252 per square foot, respectively, while the rates in Fanling North are HK$5,110 per square foot and HK$2,787 per square foot, respectively.

Considering the “before value” and “after value” set of figures as a whole, the difference makes it more attractive for land owners to apply for lease modification and land exchange via the standard rates mechanism.

The development of Kwu Tung North and Fanling North has the potential to unlock a total of 60,000 housing units, similar to 60,000 in Hung Shui Kiu. The NDAs in the New Territories look set to receive the first intake of residents by 2024.

Subsidised housing will also cover at least half of these developments to fulfil the needs of those waiting in line. Kwu Tung North and Fanling North will have 50 per cent, while Hung Shui Kiu will have 60 per cent allocated for subsidised housing.

The policy of charging land premiums through a pre-formulated standard rates mechanism can provide greater certainty and transparency around the premium. This can help encourage more applications for lease modification, while accelerating the progress of land use conversion for more housing supplies.

Currently, the standard rate policy is only applicable to the Kwu Tung North, Fanling North and Hung Shui Kiu/Ha Tsuen NDAs.

Given the similarities, if the policy can be extended to include the other planned NDAs such as San Tin/Lok Ma Chau and Yuen Long South, it is believed that the future development process will be expedited significantly.

So far, the development of the northern New Territories has been slow and subject to delay, partly caused by frequent disagreements between the government and private developers over land values for agricultural and other uses.

To this end, I am happy to see that the Development Bureau has extended the charging of land premiums at standard rates scheme to NDAs in the New Territories, which has resulted in clearer and more realistic land premiums.

After the transparency of the relevant procedures is enhanced, the negotiation process and the time needed are expected to be greatly reduced, which will be conducive to accelerating the progress of land development and enhancing the supply of local residential housing.

Andrew Chan is managing director and head of valuation and advisory services for Greater China at Cushman & Wakefield

.jpg?itok=9hHL9gVw&v=1656404021)