Banking Tech Awards 2023 Finalist: Madiston

Madiston, has been selected as a finalist in the Best Digital Solution Provider – LendTech category in the Banking Tech Awards 2023.

Madiston

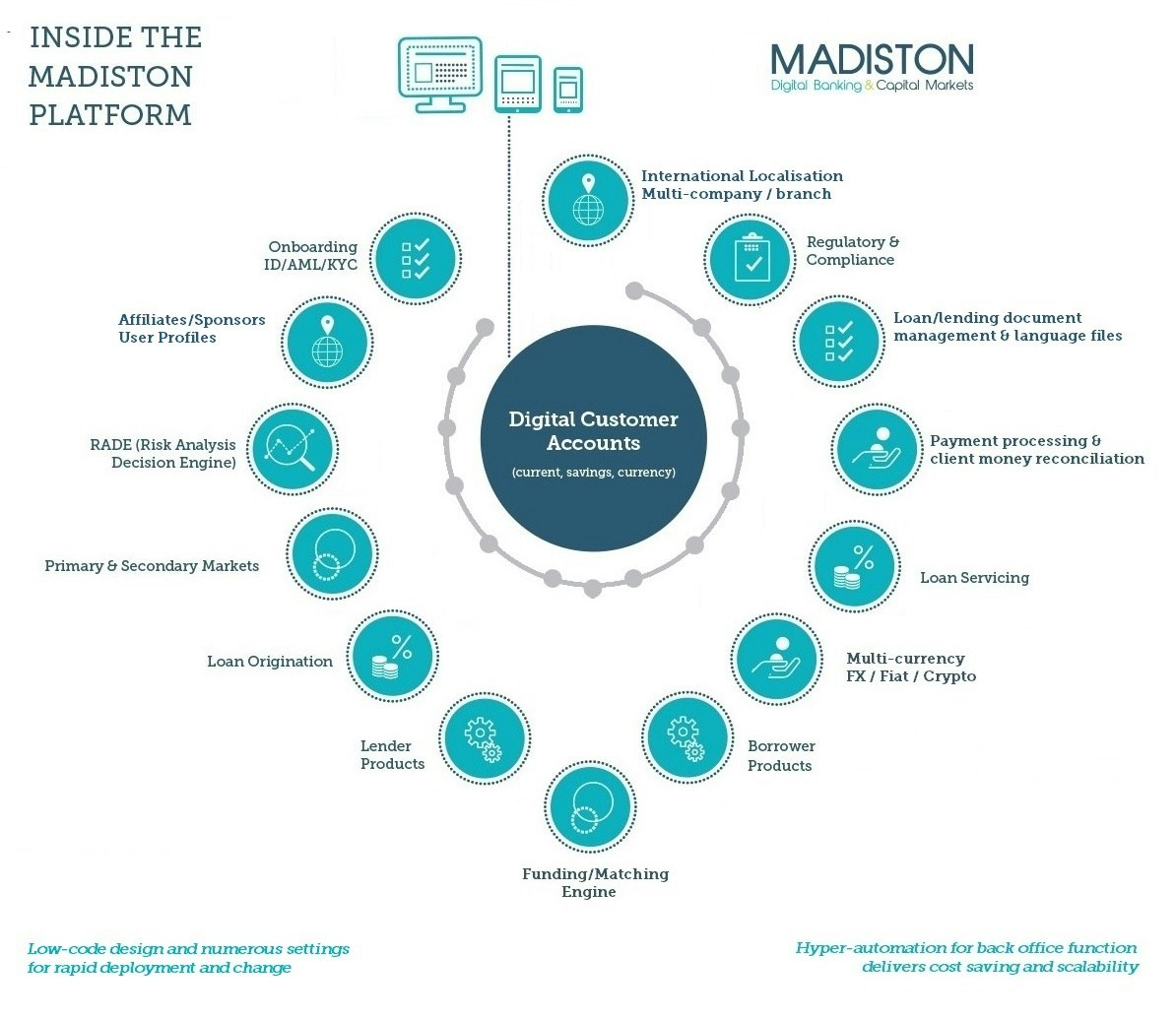

The Madiston Lending Platform provides a marketplace and "engine" for digital lending systems. It covers the entire borrowing, lending/investment process from onboarding, all loan servicing including credit decisioning and payment processing, through to maturity, whatever the type of loan, security or participant.

It is a global product with multi-currency, multi-lingual capability with independent units able to be managed centrally or locally. For example, one client operates in three countries, managed locally by only four operatives, each with different currencies, regulation, lending and borrowing products. The Madiston Lending Platform enables them to operate separately, collate data, provide reports in each country’s currency and allows them to bring Group level management information together for overall control.

Low-code, with thousands of configurable settings, and a level of automation that goes beyond competition thanks to its monitoring and trigger points, it is compliant with current UK FCA regulation and configurable to rules elsewhere. Madiston’s extensive profiling technology ensures appropriate routing through the system, appropriate testing, messaging, products and processing, to ensure all users of the system are processed according to compliance regulations.

About Madiston

As a low-code, holistic lending platform with thousands of configurable settings, individual borrowing and lending models can be built with ease and speed, enabling simple or complex systems. These settings define various elements including the customer journey based on profiles, lender/borrower products, automated processing, reconciliations, reporting etc.

For UK and global markets, it includes payments, Open Banking, multi-currency, multi-lingual, multi-country/company/location, with a hyper-automated back office and is compliant with current UK FCA regulations.

Original design objectives for the Platform were threefold…

- increase speed to market for clients (by reducing the need for writing new code)

- keep clients’ costs to a minimum to launch (add function as its needed)

- reduce clients’ operating costs, so profitability is expedited even in low-margin models.

Processes were automated wherever possible, event-driven monitoring programmes introduced, which trigger processes automatically when action is needed - so the system is "active", not passive. Fewer people needed - requiring less office space - so profitability is more easily achieved.

Functionality

• Onboarding – ID/AML/KYC

• User Profiles/Sponsors/Affiliates (based on profile) – routing, navigation, processing

• RADE (Risk Analysis Decision Engine) including third party ID tools, Credit Reference Agency interface

• Markets - Primary/Secondary

• Marketing – SEO, incentive/loyalty, affiliate schemes

• Loan origination – including personalised quotation

• Lender products (based on profile) – Balance sheet, P2P, Institutional, Retail, HNWI, Sophisticated Investor, IFISA

• Market - Automated Funding/Matching engine, Auctions

• Borrower products (based on profile) - Consumer loans, Business loans, Asset backed loans (property, bridging, buy to let), POS/Embedded Finance/BNPL, Employee loans

• Loan servicing - client communications, dashboard, loan reconfigurations, debt holidays, arrears/default, debt collections interface

• Payment processing – User Accounts, Client Money Account, Site Account, deposits, withdrawals, repayments, allocations, ACH, upload/download (UK) bank files

• Regulatory compliance – banking standards, messaging, routing, processing, client asset/money reconciliations, reporting, audit trails

• Loan/lending document management, language files

• International localisation - automated routes based on location, multi-company, multi-currency/lingual, consolidation currency, local banking/payment systems, local regulation

Technology/relevant processes:

Open Source

Runs within Joomla! open-source Content Management System (CMS). Database is MySQL. This technology is mainstream enabling secure deployment of the software within an easily own-branded website. Joomla! has 10,000+ extensions providing most general website facilities required.

Low Code

Back-office settings enable thousands of configurations for digital lending models without further coding.

Security

Secure Sockets Layer, anti-hacker system, registration validation, links to third party verification tools, encryption.

Access

Run completely online so users can be anywhere in the world. Cloud, via a hosting facility, offered as Software-As-A-Service (SAAS), Platform-As-A-Service (PAAS) or as a market participant on an own branded or generalised marketplace, or run on in-house servers.

Testing/Migration Tools

Unique testing facilities including timeline manipulation for testing loans over their lifecycle. Data migration tools for clients with existing loan books.

External interfaces/API

For third party access including fraud databases, Credit Reference Agencies, Open Banking, individual bank access, ID verification tools, etc.

What makes it unique or standout?

Automation Above and Beyond…

…which means the Platform carries the heaviest workload for client lending firms. We have been told this level of automation is beyond anything available elsewhere by those researching the LendTech market. Examples include:

• for consumer lending, automation of the mandated cooling-off borrower loan rejection process, highly complex for P2P lending, meaning the potential reversal of many hundreds of transactions.

• the provision for lenders of multiple lending portfolios with multiple parameters based automated loan matching, the sale or transfer of entire loan portfolios, institutional batch loan upload to secondary market, and many high volume handling and archiving facilities.

• perhaps uniquely, because of our language files approach, any text appearing on web pages, both front and back office, and in automated emails, may be changed easily by the administration users and/or implemented in alternative languages.

Holistic System

The Platform contains all the elements needed to run a Digital Lending firm. There is no need, for example, to buy-in functions like risk decision engines or payment processors, which dilute already tight margins.

Global multi-company system

Clients, the Carilend Group, run their separate lending operations in Barbados, Jamaica and Trinidad & Tobago using Madiston’s Lending Platform. This is all achieved on a single instance of Madiston’s lending technology with different currencies, different banking arrangements, different processes, all managed separately but operating within one platform. Each country offers different lending products too, from institutional lending (local banks and financial institutions), peer to peer lending, Buy Now Pay Later loans (local merchants) to salary deducted loans (Barbados Government) - all available within the system. The Madiston platform enables different business models to co-exist within the overall system with operations centralised or run as completely individual units.

Minimum Viable Product to assist regulatory authorisations

In this fast-moving industry, many new firms with innovative ideas must first obtain the confidence of the regulator, the FCA in the UK, to achieve their permission to trade. The best way to achieve that is by demonstrating a minimum viable product (MVP), to show how compliance will be achieved. The platform, with its configurable settings and compliant processing, can deliver an MVP for a new lending model quickly and at low cost.

Built in growth ability

The Platform was designed so new lending systems could be launched within three months. With many years’ experience in financial sector technology, we understand what clients need at the outset is often different from needs 6 or 12 months later. The platform enables changes to be made quickly and cheaply, without the necessity to re-write code, and new products can be configured as and when required.

Regulatory understanding

Madiston has been through the application process with the FCA successfully, so, as a provider, we have real regulatory experience to offer alongside our lending platform.

Ongoing Innovation

Madiston continues to innovate and, whilst not yet running in live environments, functionality exists in key areas including Open Banking A2A and R4P payments, crypto currencies, FX, digital banking front end presentation, direct loan exchange, P2P funded property Equity Release borrowing and lending product.

Business level use cases and examples from Carilend:

Extract from press release in August 2022 when Carilend launched in Trinidad & Tobago on Madiston’s Lending Platform:

“It is the hyper-automation that has helped Carilend to expand because they have been able to keep their operational costs low and achieve early profitability. With the minimum of staff, they have managed some US$50 million loans, and many of those were peer to peer loans which each have hundreds of micro-transactions to process.”

Direct quote from Mark Young, CEO, Carilend:

“Madiston have provided the digital lending technology on which the whole Carilend Group operates, from customer onboarding through loan servicing. It is a robust and highly flexible platform which has enabled us to keep our operational costs down, add new products as we grew and expand geographically.

Madiston’s customer service is frankly second to none. As we take our digital lending service into our third country, Trinidad & Tobago, launching the Instaloan in partnership with Massy Finance, we continue to use the reliable and innovative Madiston technology as our platform.

One of the key factors, working with respected financial firms like VM Group in Jamaica and Massy Finance in Trinidad & Tobago, is all parties want to ensure high standards of compliance and management control. The Madiston platform provides the rails on which all processing takes place, ensuring consistency of approach and adherence to quality standards.”

Specific examples:

Salary Deducted Loans (SDL)

The Platform enables Salary Deducted Loans where all parties could benefit. Individual employees were able to approach their employer to request payment is made from their salary, saving them interest on their loan and perhaps even gaining access to a loan which previously would have been declined due to their credit scores. SDL became a mainstream method of lending in Barbados, minimising risk for the lender, minimising cost for the borrower and helping employers to attract and retain key staff. One of the major employers using the system is the Government of Barbados.

Institutional and Retail Lending

The Platform extended its profiling features, broadening the opportunity for different lending Funds to be used so multiple institutional allocations could be managed as separate Funds but work alongside the retail investors as required.

Point-of-Sale/Buy Now Pay Later

Madiston’s API enabled local tech hardware company, Promotech’s customers access to the Carilend platform and took them, step-by-step through the onboarding, ID verification, KYC, AML, credit referencing, affordability checks and decisioning, all within minutes. Madiston’s technology meant the borrowers followed all Carilend’s compliance steps ensuring responsible lending at speed.

Future commitments

A recent commitment to a further 4-year licence for the Platform validates the quality of the software and Madiston as a service provider. The client wishes to explore innovative new functionality within the Platform and continue to expand geographically.