FHFA clarifies: $17k+ lump sum payments were never intended

Mortgage forbearance is suddenly a huge topic for U.S. homeowners.

This little-used term is now a big deal for millions of mortgage borrowers who have missed one or more monthly payments.

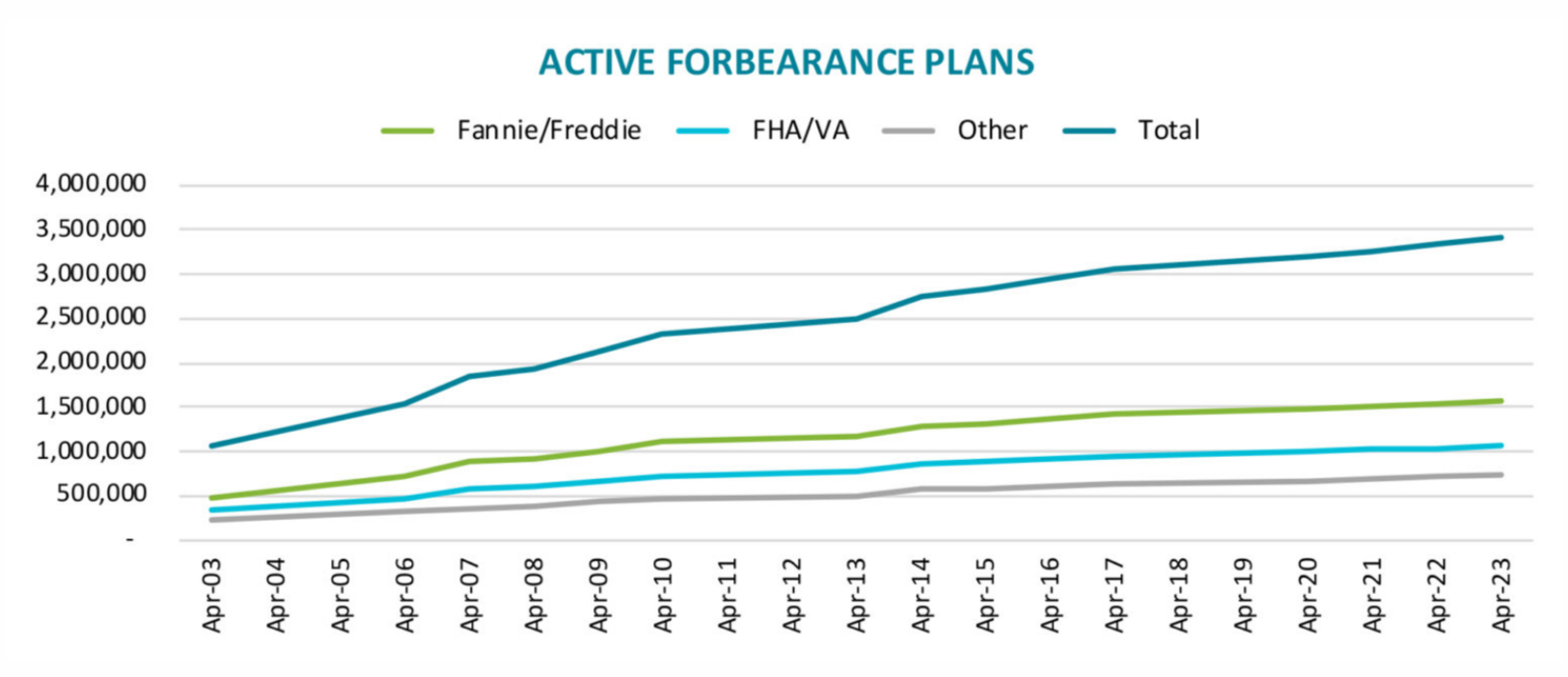

More than 3.5 million mortgage borrowers had asked for forbearance as of late April, according to the Mortgage Bankers Association.

And yet, there’s still some uncertainty as to how the forbearance process actually works.

Will homeowners owe a lump sum of back payments at year 30 — about $17,000 on a $300,000 loan?

The Federal Housing Finance Agency (FHFA) took steps to address the confusion this week, by clarifying how forbearance repayment plans will work for homeowners.

You won’t have to repay all the missed payments at once

Remember, forbearance does not mean mortgage debt is reduced. All money owed to the lender is still owed. What’s changed is the repayment schedule.

“Forbearance doesn’t mean your payments are forgiven or erased,” explains the Consumer Financial Protection Bureau. “You are still required to repay any missed or reduced payments in the future.”

There are several ways to repay the lender once forbearance ends.

- Payment Plans. You repay the lender by making larger monthly payments once forbearance ends

- Loan modifications. The lender changes the loan terms. Maybe the interest rate can be reduced, the loan term extended, or both. You could reduce your monthly payments altogether while still paying back the forbearance sum

- Lump-sum repayments. You can, if you elect, repay the entire missed amount as a lump sum once the COVID forbearance period is over

Many homeowners feared they would owe up to 12 months’ worth of payments at the end of their loan term. That means, at year 30 of a 30-year fixed $300,000 loan, you would need to come up with nearly $17,000, or lose your home.

A lump sum repayment might be required under “normal” circumstances. But it’s hardly a feasible solution for borrowers who have been laid off or put on reduced pay due to COVID-19.

Thankfully, borrowers won’t be asked to make a lump sum repayment for their coronavirus forbearance, said FHFA on Monday, April 27. At least, not borrowers who have conventional loans backed by Fannie Mae and Freddie Mac.

“If you are a homeowner seeking forbearance and Freddie Mac [or Fannie Mae] owns your loan, you are never required to make up missed payments in a lump sum.”

“Simply put,” said Freddie Mac CEO David Brickman in April, “if you are a homeowner seeking forbearance and Freddie Mac owns your loan, you are never required to make up missed payments in a lump sum.”

This is good news for borrowers. It means they’ll have access to alternative repayment plans — whether they accept larger monthly payments after COVID-19 is over, or restructure their loan to incorporate the missed amount and keep payments low.

- Not sure who owns your loan? Ask your servicer, or use Fannie Mae’s lookup tool and Freddie Mac’s lookup tool

On the downside, FHFA’s announcement didn’t clarity how those alternative repayment plans will work. If there is a standard process, FHFA hasn’t made a clear announcement about it yet.

So for now, borrowers still need to work with their loan servicers one-on-one to come up with a repayment plan that will make sense for their unique situation.

>> Related: How to request mortgage forbearance under the coronavirus CARES Act

No clarity on forbearance plans for government loans, yet

The FHFA announcement only applies to mortgage loans owned by Freddie Mac and Fannie Mae. As of yet, there’s no clear statement about what will happen to government-backed loans in forbearance; including loans backed by FHA, VA, and USDA.

Image: Black Knight

FHFA Director Mark Calabria did “encourage all mortgage lenders to adopt a similar approach” with regard to forbearance. But your options depend on the type of loan you have and who owns it.

For now, homeowners with government-backed and privately-owned mortgages should follow general best practices when requesting coronavirus loan forbearance:

- FHA, VA, and USDA loan holders are guaranteed the right to mortgage forbearance under the CARES Act, for 180 days, plus a 180-day extension if necessary (up to one year)

- If you’re worried you won’t be able to make payments, contact your mortgage servicer as soon as possible to talk about options (you can find your servicer’s contact info on your mortgage statements)

- Make sure you discuss repayment plans BEFORE you agree to loan forbearance

- When you come to an agreement about how the missed payments will be repaid, get it in writing

>> Related: Coronavirus relief programs for homeowners, renters, and the unemployed

What ONE thing must borrowers do to get lender help?

To get mortgage forbearance, you must call your loan servicer. The number can be found on your payment statement or online.

You can ask for as much as 180 days (six months) of forbearance. Once you have a forbearance plan you can ask the lender for a 180-day extension.

The sooner you call, the better.

- Explain why a payment will be late or missed

- Have documents to support your claim

- Ask for help

- Document your call and who you spoke with

What kind of forbearance help can you get?

There are a couple different ways to structure forbearance plans.

- Interest-only. The lender lowers monthly costs by accepting interest-only payments for a given period, say six months

- Skip your payments. The lender allows the borrower to skip payments altogether for several months

Remember, during the time your loan is on forbearance, the lender cannot charge any late fees or start forbearance proceedings. And your credit score won’t be affected by missed payments.

What does mortgage forbearance mean?

A mortgage is a contract between a lender and a borrower. The lender agrees to provide funding, and the borrower promises to repay the debt with interest. Forbearance happens when a lender decides not to enforce that contract.

Typically, if a borrower misses mortgage payment(s), there are serious repercussions. These include late fees and — in extreme cases — foreclosure.

But lenders understand that homeowners sometimes undergo temporary hardship. That’s where forbearance comes in.

Forbearance is a solution for borrowers who can’t make mortgage payments for a short time — usually because of financial events like a lost job or large medical bills.

In today’s world, COVID-19 falls under the category of “temporary hardship” for millions of homeowners.

Under a forbearance plan, the homeowner is relieved of mortgage payments for a set number of months.

Current CARES Act rules state that most homeowners can get forbearance for up to one year (180 days, with a possible extension of 180 days if necessary).

During that time, the lender cannot enforce late fees or start a foreclosure against the homeowners.

In addition, the CARES Act mandates that forbearance plans during coronavirus can’t affect a homeowner’s credit. So you’re protected from those “late or missing” payments counting against your score.

The COVID-19 pandemic and mortgage forbearance

Until the coronavirus came along, the housing market was doing remarkably well.

In February, according to ATTOM Data Solutions, there were only 48,004 foreclosure filings nationwide (defined as default notices, scheduled auctions or bank repossessions ).

This was “the lowest number of total foreclosure filings recorded, since [ATTOM] began tracking in April 2005.”

With more than 25 million people suddenly on the unemployment lines, you might expect a massive increase in foreclosure numbers.

But that hasn’t happened yet — and it may not happen — because of the forbearance process.

By making it a rule that anyone with a conventional or government-backed mortgage could request forbearance, Congress effectively protected almost all U.S. homeowners from foreclosure due to COVID-19.

Of course, those forbearance plans will only carry homeowners so far.

Once America starts going back to work, mortgage lenders will expect repayment from borrowers. And those who can’t repay the missed amounts could still face foreclosure once COVID-19 is over.

That’s why FHFA’s announcement is important. Forbearance repayment plans that do not require a lump sum will be much more feasible for borrowers coming out of COVID economic turmoil.

Homeowners will be at far less risk of foreclosure if they can restructure their payment plans, staggering out the forbearance repayment rather than having to hand it over all at once.

Why does a lender offer forbearance?

Mortgage investors are looking for a steady income stream.

Charging late fees and threatening foreclosure do not help a borrower with temporary financial problems. And foreclosure is something lenders want to avoid. Foreclosures can mean big lender costs and maybe more scrutiny by regulators.

A better option is to help the borrower get through a tough period caused by a lost job, medical emergency, or damage from a natural disaster such as a hurricane, fire, flood, or earthquake.

That’s why forbearance exists in the first place.

Thanks to the Coronavirus Aid, Relief, and Economic Security Act (CARES), borrowers affected economically by coronavirus now have easy access to forbearance.

The CARES Act “prohibits lenders and servicers from beginning a judicial or non-judicial foreclosure against you, or from finalizing a foreclosure judgment or sale, during this period of time” according to the Consumer Financial Protection Bureau (CFPB).

What to consider before requesting COVID mortgage forbearance

If Lender Jones says Borrower Smith can reduce or skip monthly payments for several months that will mean big cash savings to Smith. That’s a huge advantage for the borrower.

However, forbearance solves some problems but not all.

- A payment plan that requires bigger monthly payments may sound good now, but may not be good in the future. If a borrower is having trouble with payments today, then bigger payments in a few months may cause a buyer to re-default. This is a particular worry today with so many people suddenly out-of-work.

- According to the VA, “any option to resolve missed payments begins with your ability to make regular monthly mortgage payments” in the future. So your decision about forbearance repayment plans should consider what your employment will look like post-COVID-19

- Forbearance may help with mortgage principal and interest, however, borrowers have separate obligations to pay property taxes, property insurance, and HOA fees

The bottom line: Forbearance is much, much better than a foreclosure. It’s a tool that may help borrowers get past tough times.

However, there are still risks that come with mortgage forbearance — especially when it comes to repaying your loan after the forbearance period ends.

For details and specifics, speak with your lender as soon as late or missed payments seem likely. Make sure you fully understand what you’re getting into before signing on for loan forbearance.

Time to make a move? Let us find the right mortgage for you