Professional Documents

Culture Documents

Analysis of Digital Product For Multipurpose Financing Through The Mobile Banking System As A Digital Transformation Effort in Bank X

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Digital Product For Multipurpose Financing Through The Mobile Banking System As A Digital Transformation Effort in Bank X

Copyright:

Available Formats

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Analysis Of Digital Product For Multipurpose

Financing through the Mobile Banking System as a

Digital Transformation Effort in Bank X

Rosalyn Febriyani Inaku Tukhas Sihlul Imaroh

Master of Management Program, Mercu Buana University Master of Management Program, Mercu Buana University

Jakarta, Indonesia Jakarta, Indonesia

Abstract:- Banks need to provide digital financing services I. INTRODUCTION

without place and time restriction to improve effectiveness,

efficiency and create faster, more comfortably and better The development of information technology in the digital

continuity of service to customers. Bank X which operates era has brought changes in the management and operations of

in Indonesia seeks to improve the performance of online the Bank. One of the other phenomena that has emerged in the

financing services in order to improve overall financing era of digital financial transformation is financial technology

performance. This study aims to determine the (fintech). The background for the emergence of fintech is when

effectiveness of the mobile banking model of online there is a problem in society that cannot be served by general

financing service compared to traditional manual models; banking because of strict regulations from the regulator and the

to find out the constraint factors experienced after the limitations of bank branches to serve the community in certain

launch of online financing products; to find out solutions areas. With the existence of fintech, it has created various

to solve online product financing constraints. The research financial service opportunities by adopting digital transaction

method which used is descriptive qualitative research. This banking, convenient to use, paperless and user-friendly that

study uses primary data and secondary data as well as provides added value in meeting customer satisfaction.

improvement methods using the Six Sigma DMAIC According to the 2019 Islamic Finance National Committee,

(Define-Measure-Analyze-Improve-Control) method. The Indonesian people who are not familiar with bank transactions

results showed that the number of successful online as much as 76% of the population, if only 2/3 of them already

partner financing applications disbursed was 11.15% of have a mobile phone, then they can recognize financial

the total submissions. The effectiveness of online transactions by accessing fintech applications. According to

multipurpose financing product can acquire new regular Indonesia Financial Authority, fintech growth experienced a

manual financing by 65%. There are 6 factors that give a high increase, especially in the type of digital financing,

high impact on the low disbursement of online reaching 249 trillion rupiah until August 2021 or increase of

multipurpose financing product including: bad reputation 60% compared to December 2020.

of collectability, service failed (system constraints), name

data does not match the civil registration data, and

approval limit is below Rp 10.000.000, does not meet risk

acceptance criteria, customer debt burden ratio more than

50%. Solutions to solve problems include expanding

market segments, improving the IDEB system, developing

product feature changes by relaxing the bank's risk

acceptance criteria from DBR to DSR, increasing the

financing period and limit to more than IDR 50,000,000, Table 1: Financial Technology Lending

developing automation recommendations to other Source : Indonesia Financial Authority (2021)

financing options with a small limit such as a paylater in

mobile banking if the customer gets the minimum Digital technology that used by fintech has driven positive

financing limit. and negative changes for individual customers and for banks.

In the digital transformation business process, it makes easy for

Keywords:- Six Sigma. Digital Banking, Digital Financing, customers to order products, deliver goods, make payments or

Digital Transformation. transactions for various things easily and efficiently from

fintech applications. This effect continues to the price of the

product which will be cheaper, this is because the marketing

and administrative processes can be minimized. With this shift

in activity towards digital, Banks that are still running

traditional business processes will be abandoned by their

customers. Therefore, the presence of digital transformation is

a must for Bank X to improve digital-based services that create

efficiency, cost saving, and able to encourage innovation and

IJISRT22JUL545 www.ijisrt.com 742

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

to provide speed in service, in line with the Bank's Vision and Innovations in the operation of digital financing

Mission to become the top 10 Global Islamic Bank in the world. application services have been able to shorten the operational

service time of the financing process in 15 minutes to 1 day as

Bank X is a sharia banking financial services company long as the results of data verification held by the Bank are

whose business entities that carry out their operational complete and appropriate. If there are incomplete and other

activities based on sharia principles (based on Qur’an and technical problems, the customer can reapply from the

Hadist). Financing is an activity of a Sharia Bank in distributing beginning at a different time or submit a complaint to the Bank

funds to parties other than the Bank based on Sharia principles. X Call service for disbursement.

The distribution of funds in the form of financing is based on

the trust given by the owner to the users of the funds. The Based on the monitoring observation of online

recipient of the financing has the trust of the financier, so that multipurpose financing since the trial run started from 16

the recipient of the financing is obliged to return the financing September 2021 to 7 February 2022, there have been problems

that has been received in accordance with the agreed period in that encountered, as presented in the following table based on

the financing contract. Bank X has several financing programs data obtained on 7 February 2022:

which include: Mudharabah, Musyarakah, Murabahah and Bai'

Salam financing.

With this financing, it is hoped that it will encourage the

community to be able to create businesses and to develop them.

Recently, Bank X financing has begun to be intensively

disseminated to build the community's economy or also to meet

the needs of the community. One of them is Civil Servants

(PNS) or Candidates for Civil Servants (CPNS), in Indonesia Table 2 Financial Technology Lending

there are not a few people who work as PNS/CPNS. There are Source : Data Bank X (2021)

also many civil servants who need a lot of funds to meet all

their needs, such as multipurpose financing, education costs,

home renovations, and other needs. So that it encourages to do

financing to the Bank. The financing provided by the Bank to

customers almost entirely requires collateral in the form of

principal guarantees or additional guarantees to cover if one

day the debtor cannot pay its obligations to pay off debts in

accordance with the agreement.

One of the financings at Bank X that has been transformed

into a digital process is online multipurpose financing that does

not require collateral. This financing is a new financing service

from Bank X, with a multipurpose purpose, the process of

which is full digital financing (processed end-to-end through

Fig. 1: Number of Online Multipurpose Financing

digital solutions) through Bank X's mobile banking, starting

Application in Bank X

from customer submissions to financing disbursement (process

Source : Data Processed (2022)

less than 15 minutes). The online multipurpose service, which

was just launched on 1 November 1 2021, provides a financing

Based on the above data, it can be seen disbursed

limit from Rp. 10,000,000 to Rp. 50,000,000, currently it is still

financing applications is very low and rejected financing

intended for the special segment of payroll customers, namely

applications is very high. Therefore, it is necessary to conduct

for civil servants that their institution has collaborated with the

research on the evaluation of digital financing products at Bank

payroll system with Bank X. This multipurpose digital

X, especially Multipurpose Online financing through mobile

financing product can be accessed anytime and anywhere by

banking as an effort of digital transformation to improve

using the “Bank X Mobile” which is Bank X mobile banking

financing performance at Bank X by considering the

application.

constraints/problems that occur in its financing services.

This Online Multipurpose Financing product has

One method of process improvement that is often used is

advantages over competing products from other Banks, namely

Six Sigma method. The application of the six sigma method has

that customers can apply for this financing from Bank X

proven to be very suitable for the needs of the service industry

Mobile from anywhere without coming to the branch, no need

(Sharma & Chowhan, 2013). There have been many studies on

to complete and send personal files, without collateral, safe

the successfule implementation of Six Sigma in the financial

according to sharia, and the financing process takes no more

sector. Based on the description above, researchers are

than 15 minutes.

interested in using the six sigma method in improving online

multipurpose digital financing products as an effort of

transform digital banking at Bank X.

IJISRT22JUL545 www.ijisrt.com 743

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

II. LITERATURE REVIEW Welcoming the era of Bank 4.0, Islamic banking digital

banking products and services that can be offered to customers

Theory of Sharia Financing Product are in the form of Automated Teller Machines (ATM),

The definition of financing is funding provided by a party electronic data capture (EDC) machines, electronic banking

to another party, to support planned investments, either by products, in the form of mobile banking, internet banking,

themselves or by institutions. The difference between the term Cash Management System (CMS) , Officeless Financial

financing and credit is if the term financing is used for Islamic Services (Laku Pandai), and e-money. Digital banking

banks, while credit is for conventional banks. In addition, what services and products continue to be developed by optimizing

distinguishes between financing and credit is that Islamic the use of customer data in order to serve customers more

banks are based on the principle of profit sharing or “ujroh” on quickly, easily, and according to customer experience, and can

financing, while for conventional banks, it is based on the be completely and independently carried out by customers,

principle of interest profit. According to Indonesia Law No. 7 taking into account security aspects.

of 1992 concerning banking as amended to Indonesia Law No.

10 of 1998 concerning Banking in Article 1 number (12): Basic Concept of Six Sigma

Six sigma is a method for improving business processes

"Financing based on sharia principles is the provision of that aims to find and reduce the causes of failures and errors,

debt or claims equivalent to it based on an agreement between to increase productivity, to meet customer needs effectively,

the Bank and other parties that require the party to be financed and to get a better return on investment in terms of production

after a certain period of time with compensation or profit and service (Evans & Lindsay, 2007)

sharing".

According to Chase (2011), Six sigma uses DMAIC

Financing in Islamic banks contains various elements methodology (Define, Measure, Analyze, Improve, Control).

that stick together, namely:

1. Trust Define

2. Term The define stage is the first operational step in the Six

3. Risk Sigma quality improvement program (Gaspersz, 2002). This

stage is carried out to determine critical things that are

Online Financing is a type of financing that can be considered by consumers.

submitted online through a mobile application, without the

need to meet face-to-face. This method provides convenience Measure

and speed in the financing application process. Online The measure stage is the second operational step that

financing is growing very fast in Indonesia. The convenience aims to evaluate and understand the current condition of the

and speed of process are the main attraction. Financing process or performance. At this stage, data collection and

applications, which have been known to be long and processing is carried out before improvement is carried out.

complicated, can now be done quickly, easily, online and

without face to face. Analyze

The third stage is analyze, which is the stage of

Digital Transformation determining the cause and effect of a problem and

According to Danuri (2019), Digital transformation is a understanding the existence of source of variation from the

change way of handling by using information technology to data obtained at the measure stage (Montgomery and Woodall,

gain efficiency and effectiveness. 2008). In addition, a fishbone diagram is also made to

determine the causal relationship of a problem. Fishbone

Application of Digital Banking in Islamic Banking diagrams are very useful in quality improvement because of

One of the challenges of Indonesian Islamic Banking is their ability to visualize the root of the problem simply as

Information Technology (IT). Things that need to be shown in Figure 2.1.

anticipated when using digital and automation technology, are

the increasing efficiency of product production and marketing,

changes in the composition of human resources and aspects of

customer protection.

Conceptually, according to Cisco Consulting Services

(2014), the concept of Bank 4.0 was formed in the era of the

internet of everything where its form can be applied with the

existence of digital banks, mobile banking, digital branches,

intercloud, omni-channel analysis and "Market Of One"

Customer Centricity. In the development of digital banking,

each era has a focus on improving customer experience that

combines human resources, processes, data and other

supporting parts into a more personal digital banking concept,

according to each customer's needs. Fig. 2: Cause and Effect Diagram (Fish Bone Diagram)

Source : Heizer & Render (2015)

IJISRT22JUL545 www.ijisrt.com 744

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Improve In this study the define stages can be seen in the

This stage is an operational step which is the stage of following figure.

drafting improvement proposals to be later implemented in the

Bank. There are many improvements used to improve the

process seen from several factors, namely humans, methods,

environment, and measurement.

Control

This stage is the last operational step in the six sigma

method in which the process of monitoring the performance of

the process that will come after undergoing improvements is

carried out.

III. RESEARCH METHODOLOGY

The research approach used descriptive qualitative

research using case study methods that focus on historical,

descriptive and action analysis. Historical research is obtained

by collecting, examining and evaluating the process of Fig. 4: Improvement Charter

Multipurpose Online financing application. While descriptive Source : Researcher Data (2022)

research aims to determine the root cause of rejected

financing. Furthermore, with action research, it is hoped that Measure stage

the causes can be known and overcome so that the rejected At the Measure stage, it is necessary to define problems

financing can be minimized. as a reference in making improvements. Determination of the

problem is done by means of a workshop with the core team.

Several approaches were used for primary and secondary

data collection, namely by conducting direct observations and Based on the percentage of the total number of problems,

interviews with the project management team that became the customer collectibility problems, service failures, and the

object of research, including the Digital Asset Project Manager suitability of customer demographic data are the top three

who also acted as a subject matter expert in this study. problems faced in the online multipurpose digital financing

Meanwhile, secondary data was obtained from internal data of process. For more details, the problem data as presented in the

Bank X as well as literature studies from various publications following Tables and Figures.

and journals related to this research.

IV. DISCUSSION

This study uses Six Sigma methodology based on

DMAIC stages with an explanation of each stage as follows:

Define stage

The online multipurpose financing product was launched

in August 2021. The effectiveness of both regular and online

multipurpose financing in the period August 2021 to February

2022 is shown in the following figure.

The Effectivity of Multipurpose Financing Product in

Bank X

(August 2021 - February 2022)

35% Table 3 Case of Rejected Financing Application

Source : Data processed (2022)

65%

Regular Financing Online Multipurpose Financing

Fig. 3: The Effectivity of Multipurpose Financing Product in

Bank X

Source : Data Bank X (2022)

IJISRT22JUL545 www.ijisrt.com 745

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Pareto Diagram The high rate of failure to disburse online multipurpose

Rejected Financing Problem financing can be caused by the following problems:

30.00% • Bad collectibility problems due to unpaid installments and

27.42%

poor financing history in other finances.

25.00% • Service fail problem was caused by OJK IDEB SLIK

21.76%

20.81% (Financial Information Service System of Debtor

20.00% Information operated by Indonesia Financial Authority)

15.15%

was having problems and the financing system needed

15.00% improvement.

• Customer data problem that does not match with civil

9.38%

10.00%

registry office data that because the customer does not

5.49% update the data.

5.00%

• Approval limit problem of less than RP. 10.000.000 due to

marketing analysis data that is not optimal.

0.00%

Bad Collectibility Customer's Debt Service Fail Customer Approval Customer Data • Customer capability does not meet Risk Acceptance

Burden Ratio

(DBR) more than

capability does

not meet Risk

financing limit does not

less than Rp accordance with

Criteria (RAC). It is caused that criteria is intended for a

50% Acceptance 10.000.000 civil registry limited segment, namely payroll of civil servant officer in

Criteria (RAC) office

the first stage with a limited amount and a limited tenor

Fig. 5: Pareto Diagram of Rejected Financing Problem • Problems of Debt Burden Ratio (DBR) of more than 50%

Source : Researcher Data (2022) due to strict and less flexible risk acceptance criteria.

Analyze Stage Improve Stages

In the analyze stage, a causal analysis is carried out In the improve stage, researchers and team members

regarding the problems that arise and resulting in a low level determine solutions to fix problems (defects) of online

of liquid financing. The cause-and-effect analysis used in this multipurpose financing that occur through dashboard

study is a fish bone diagram. Cause-and-effect analysis data monitoring, brainstorming with business units, risk units,

were obtained from the results of discussions through Focus operation financing units, digital banking operations units and

Group Discussions (FGD), the results of researcher group of information technology strategy and development.

observations, and interviews with the Group Head. The cause operation financing units, digital banking operations units and

and effect diagram of the rejected financing problem can be group of information technology strategy and development.

seen in Figure 4.6.

From the results of the brainstorming, the action plan or

solution determined by the researcher and the team as shown

in Table IV.

Control Stage

During research, solutions and improvement initiatives

are still in the process of implementation and development.

Therefore, the results of improving the online multipurpose

financing system through mobile banking can only be

monitored through the results of user acceptance test (UAT)

for several development initiatives. From the results of the

UAT, it was concluded that the developed system could run

well in accordance with the established design.

In implementing of this improvement proposal, it is

necessary to update the standardization of policy procedures

and product manuals. The purpose of updating standard

procedure policy is to serve as a guide for the Bank in the

implementation and business processes of online multipurpose

financing in accordance with current conditions.

Fig. 6: Fish Bone Diagram of Rejected Financing Problem

Source : Researcher Data (2022) Changes in procedural policies that support the

improvement of the online multipurpose financing system can

be seen in the following table.

IJISRT22JUL545 www.ijisrt.com 746

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Rejected Financing

Solution Initiatives Follow Up

Problem

SDLC (Software

- Improve the number of Development Life

Expanding segment to Bank X Cycle)

application for online

employees 1. Forum Group

multipurpose financing

Discussion with Project

Team

2. Establish CR,

Bad Collectibility Business Requirement

3. Technology

- Expanding market Develop multipurpose financing top Development

segments up for existing customer 4. SIT

5. UAT

6. RCB

7. PTR

8. Live

SDLC (Software

- Improve IDEB System Improvement of IDEB System

Development Life

Cycle)

1. Forum Group

- Partnership with API Discussion with Project

(Automation Protocol Team

Interface) to access IDEB 2. Establish CR,

Service Fail Business Requirement

in order to avoid Select reliable IDEB vendor that

dependency to Financial has successful rate 90% 3. Technology

Infomation Service System Development

from Indonesia Financial 4. SIT

Authority (OJK SLIK) 5. UAT

6. RCB

7. PTR

8. Live

the customer is notified to

update the data to the Bank

via mobile Banking and

branches via push

notification and whatsapp

blast as well as develop a Enhancement of online SDLC (Software

Customer Data does not Development Life

service where customers multipurpose financing with

accordance with civil registry Cycle)

can update their NPWP updating Tax ID dan ID number in

office 1. Forum Group

(tax ID) or NIK (identity mobile banking

number) data when applying Discussion with Project

for financing via mobile Team

banking and the data will be 2. Establish CR,

updated to the Bank's main Business Requirement Table 5 Change Of Procedure

data 3. Technology Source : Researcher Data (2022)

- Risk Acceptance Criteria Development

relaxation 4. SIT

- Notification of other 5. UAT V. CONCLUSION AND RECOMMENDATION

digital financing 6. RCB

Development of a Decision Engine

recommendation such as 7. PTR

Approval financing limit less to provide the right financing This study describes how to analyze online multipurpose

paylater or other digital 8. Live

than Rp 10.000.000 options if customer can't apply for

product

online multipurpose financing digital financing products through mobile banking to improve

- Extending the choice of digital financing performance through the DMAIC-based Six

online multipurpose

financing period Sigma process improvement method. Bank X's financing

- Risk Acceptance Criteria target from online multipurpose financing contributions is to

Multipurpose Financing Top Up

relaxation acquire regular financing of up to 80% in order to support go

- Expanding new market

segment beside civil

green banking (paperless application), save the service level

Develop centralized payroll system

servant that payroll agreement period and provide a great opportunity to compete

registered in Bank X SDLC (Software with other online financing in the financing market in

- Develop additional Development Life

system that can verify Indonesia.

Increase feature and financing time Cycle)

performance allowance 1. Forum Group

Customer capability does not period

income for customer from Discussion with Project

meet Risk Acceptance

civil servant

At the time of product launch until February 2022, the

Criteria (RAC) Team

- Develop additional 2. Establish CR, number of successful online multipurpose financing

system that can verify all Business Requirement applications was disbursed as much as 65% of the total

customer segment payroll 3. Technology

system in Bank X Development

submissions. This indicates that the effectiveness of online

- Add financing limit to be 4. SIT multipurpose financing can acquire regular financing of 65%

more than Rp 50.000.000 5. UAT

dan add time period of

from the target of 80%.

6. RCB

online multipurpose 7. PTR

financing 8. Live The constraint factors that encountered after the launch

Change DBR to DSR (Debt

Service Ratio) in which of online multipurpose financing products were the high

Customer's Debt Burden Develop the change of DBR to be

Ratio (DBR) more than 50%

total installment only

DSR (50%)

number of rejected financing applications caused by 6 factors

calculated in Bank X with

percentage > 50%

including: bad customer collectibility, service fail (system

constraints), personal data does not match with civil registry

Table 4 Solution And Initiatives office, approval limit was below Rp. 10,000,000, customer

Source : Researcher Data (2022)

IJISRT22JUL545 www.ijisrt.com 747

Volume 7, Issue 7, July – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

capabiity does not meet the risk acceptance criteria, and the REFERENCES

customer's debt burden ratio is more than 50%.

[1]. AGUSTINUS, B. S., IMAROH, T. S., 2021. Waste

Solutions to solve the problems on online multipurpose Minimization Efforts Towards Green Logistic at PT

financing product include the following: expanding market Nardevchem Kemindo. EJBMR, 6(4).

segments to increase collectibility; improve the existing IDEB [2]. https://www.ejbmr.org/index.php/ejbmr/article/view/99

system and in parallel to expedite the assignment of IDEB 2

system services with other external parties so that Bank X does [3]. DANURI, M., 2019. Perkembangan Dan Transformasi

not has dependence on OJK SLIK; the customer is notified to Teknologi Digital. INFOKAM, 5(2), 116-123. DOI

update the data to the Bank via mobile Banking and branches https://doi.org/10.53845/infokam.v15i2.178

via push notification and whatsapp blast as well as develop a [4]. EVANS, J. R., LINDSAY, W, M., 2014. An Introduction

service where customers can update their NPWP (tax ID) or to Six Sigma and Process Improvement. Jakarta :

NIK (identity number) data when applying for financing via Salemba Empat

mobile banking and the data will be updated to the Bank's main [5]. GASPERZ, V., 2002. PEDOMAN IMPLEMENTASI

data; developing changes in product features by relaxing the PROGRAM SIX SIGMA TERINTEGRASI DENGAN ISO 9001 :

Bank's risk acceptance criteria from Debt Burden Ratio (DBR) 2000 MBNQA DAN HCCP. JAKARTA : GRAMEDIA

to Debt Service Ratio (DSR); increasing the financing period PUSTAKA

and limit so that digital financing can be more than IDR [6]. HEIZER, J., RENDER, B., 2015. MANAJEMEN OPERASI,

50,000,000; developing automation recommendations to other SUSTAINBILITY AND SUPPLY CHAIN MANAGEMENT. EDISI

financing options with a small limit such as a paylater in 11. JAKARTA : SALEMBA EMPAT

mobile banking if the customer gets a financing limit below [7]. JACOBS, F. R. & CHASE, R., 2011. Operations and

the minimum limit (under Rp. 10,000,000); solution initiatives Supply Chain Management. (13th ed.) Boston,

to expand to other market segments such as employee of state- [8]. MA: McGraw-Hill Irwin.

own-company, hospital employees, private employees; [9]. KING, B., 2018. Bank 4.0. Perbankan di Mana Saja dan

initiatives to develop additional systems that can verify all Kapan Saja, Tidak Perlu di Bank. Penerbit Mahaka

payroll employee benefits and income with Bank X; make [10]. MONTGOMERY, D. C., & WOODALL, W. H., 2008.

changes to the relaxation of customer risk acceptance criteria, An overview of six sigma. International Statistical

which originally used the Debt Burden Ratio installment Review, 76(3), 329–346. https://doi.org/10.1111/j.1751-

calculation method to become the Debt Service Ratio 5823.2008.00061.x

installment calculation method for the solution of rejected [11]. SHARMA, A., CHOWHAN, S, S., 2013. Concept of Six

financing because the customer's installments were already Sigma and its Application in Banking. Indian Journal of

more than 50% of their income. Applied Research, 3 (7), 433-435.

The researcher's suggestion for the management of Bank

X is to recommend that the results of this research be

submitted as a strategic initiative to be realized in order to

increase the volume of financing and particularly for the online

multipurpose financing customer base and generally for active

users of mobile banking.

For further research, the researcher recommends to

continue the research on the results of monitoring at the

"control" stage of online multipurpose financing product after

improvement with the DMAIC-based six sigma method so that

rejected financing applications can decrease significantly

compared to before improvement period.

IJISRT22JUL545 www.ijisrt.com 748

You might also like

- The Changing Face of BankingDocument12 pagesThe Changing Face of BankingAsish Dash100% (1)

- PRJ p450Document23 pagesPRJ p450Kavya MudhirajNo ratings yet

- How Digital Banking Has Brought Innovative Products and Services To IndiaDocument4 pagesHow Digital Banking Has Brought Innovative Products and Services To IndiaHardik MistryNo ratings yet

- How Digital Lending Platforms Are Providing Impetus To The EconomyDocument10 pagesHow Digital Lending Platforms Are Providing Impetus To The EconomycoolNo ratings yet

- Digital LendingDocument9 pagesDigital LendingArpit JainNo ratings yet

- Digital Transformation: The Case of South Indian BankDocument24 pagesDigital Transformation: The Case of South Indian BankSabbir RahmanNo ratings yet

- Digital Revolution Transforms Indian BankingDocument9 pagesDigital Revolution Transforms Indian BankingHARSH MALPANINo ratings yet

- Journal Innovation Knowledge: Digital-Only Banking Experience: Insights From Gen Y and Gen ZDocument10 pagesJournal Innovation Knowledge: Digital-Only Banking Experience: Insights From Gen Y and Gen Zninhtieuthat251No ratings yet

- SustainabilityDocument16 pagesSustainabilityAnhar Januar MalikNo ratings yet

- Digital Transformation and Strategy in The Banking Sector: Evaluating The Acceptance Rate of E-ServicesDocument14 pagesDigital Transformation and Strategy in The Banking Sector: Evaluating The Acceptance Rate of E-ServicesVáclav NěmecNo ratings yet

- An Article On Digital Innovations in BanksDocument4 pagesAn Article On Digital Innovations in BanksKadar mohideen ANo ratings yet

- Fintech Ecosystem Fintech Start-Ups FintechDocument2 pagesFintech Ecosystem Fintech Start-Ups FintechTimNo ratings yet

- Fintech Services For Banks in KP - in Order of PriorityDocument3 pagesFintech Services For Banks in KP - in Order of PriorityHassan Sarfraz AliNo ratings yet

- Digitalization in Banking SectorDocument7 pagesDigitalization in Banking SectorEditor IJTSRDNo ratings yet

- Mentorship Report On Digitization in BankingDocument46 pagesMentorship Report On Digitization in BankingravneetNo ratings yet

- Fin Tech 1 To 30Document428 pagesFin Tech 1 To 30Harshil MehtaNo ratings yet

- Maurenthia Jeinely Mandey, Sri Murni, Arrazi Hasan Jan - Januari 2023Document8 pagesMaurenthia Jeinely Mandey, Sri Murni, Arrazi Hasan Jan - Januari 2023Mayang SandyNo ratings yet

- Rural Financial Inclusions Through Digital Banking Services in IndiaDocument4 pagesRural Financial Inclusions Through Digital Banking Services in IndiaShishir GuptaNo ratings yet

- Peer 2 Peer Lending (India) Report: Compiled byDocument24 pagesPeer 2 Peer Lending (India) Report: Compiled byPulkit SharmaNo ratings yet

- The Effect of Bank Performance Factors On The Bank's Profitability in Indonesia BanksDocument5 pagesThe Effect of Bank Performance Factors On The Bank's Profitability in Indonesia BanksLISTRI HERLINANo ratings yet

- Business Model Canvas Strategy to Create Competitive Advantage for Seabank IndonesiaDocument18 pagesBusiness Model Canvas Strategy to Create Competitive Advantage for Seabank IndonesiaAhmad IhsanNo ratings yet

- Research Project (Prateek Gulati)Document82 pagesResearch Project (Prateek Gulati)prateekNo ratings yet

- Fin TechDocument4 pagesFin TechTanmay Shubham PantNo ratings yet

- Challeneges and Issues in Digital BankingDocument4 pagesChalleneges and Issues in Digital BankingHarshikaNo ratings yet

- Contribution of Digital Towards Re-Kyc Bills and UfdDocument59 pagesContribution of Digital Towards Re-Kyc Bills and UfdsachidanandNo ratings yet

- Digital Banking in Rural AreasDocument7 pagesDigital Banking in Rural AreasKartik H ANo ratings yet

- 1 PBDocument16 pages1 PBHandaru Edit SasongkoNo ratings yet

- Fintech 400 PDFDocument410 pagesFintech 400 PDFHarshil MehtaNo ratings yet

- Fin TechDocument7 pagesFin TechHarsh ChaudharyNo ratings yet

- Risks: Digital Banking in Northern India: The Risks On Customer SatisfactionDocument18 pagesRisks: Digital Banking in Northern India: The Risks On Customer SatisfactionKhushi BhartiNo ratings yet

- Financial InclusionDocument6 pagesFinancial InclusionsignNo ratings yet

- Study On Digital Banking Services After Demonetisation With Reference To Kancheepuram DistrictDocument8 pagesStudy On Digital Banking Services After Demonetisation With Reference To Kancheepuram DistrictTJPRC PublicationsNo ratings yet

- PAYMENTSVISIONF4D4Document30 pagesPAYMENTSVISIONF4D4Neelajit ChandraNo ratings yet

- Trust Role in Acceptance of Digital Banking in Indonesia: February 2020Document7 pagesTrust Role in Acceptance of Digital Banking in Indonesia: February 2020Hardik MistryNo ratings yet

- Sustainability 13 11028 v2Document17 pagesSustainability 13 11028 v2Kyle Harvey O. GoholNo ratings yet

- Digital Transformatioin FinanceDocument15 pagesDigital Transformatioin FinancesuhitaNo ratings yet

- Digitalization in Banking SectorDocument3 pagesDigitalization in Banking SectorEditor IJTSRDNo ratings yet

- Summer Internship Report - HDFC Digital BankingDocument32 pagesSummer Internship Report - HDFC Digital BankingMantosh SinghNo ratings yet

- A Strategic Analysis On Digital Banking With Reference To HDFC BankDocument63 pagesA Strategic Analysis On Digital Banking With Reference To HDFC Bankjoju felixNo ratings yet

- BM Notes (Modern Banking)Document28 pagesBM Notes (Modern Banking)Ranvir SinghNo ratings yet

- THE ROLE OF DIGITAL TECHNOLOGIES IN STREAMLINING LOAN SERVICING AND COLLECTION".docx Jyotika BagDocument29 pagesTHE ROLE OF DIGITAL TECHNOLOGIES IN STREAMLINING LOAN SERVICING AND COLLECTION".docx Jyotika BagJyotika BagNo ratings yet

- Impact of Digital Banking on Commercial Bank PerformanceDocument11 pagesImpact of Digital Banking on Commercial Bank PerformanceNaol FramNo ratings yet

- How Has Digital Lending ImpactedDocument11 pagesHow Has Digital Lending ImpactedrofirheinNo ratings yet

- Major Innovations Transforming BankingDocument6 pagesMajor Innovations Transforming BankingKashishNo ratings yet

- JPSP 2022 89Document9 pagesJPSP 2022 89jothi1083No ratings yet

- SEM II Individual Project - E-CommerceDocument20 pagesSEM II Individual Project - E-CommerceAMBER JEWELSNo ratings yet

- Mobile and Online Banking Services in IndiaDocument99 pagesMobile and Online Banking Services in IndiaPrakshi PunmiyaNo ratings yet

- Arm TPDocument15 pagesArm TPSucheta SahaNo ratings yet

- Digital Lending in India Fueled by Growing Urbanization and Formal EmploymentDocument11 pagesDigital Lending in India Fueled by Growing Urbanization and Formal EmploymentSuvhro Deep MondalNo ratings yet

- Omni Fintech, Digital Payments & Banking Revolution in IndiaDocument11 pagesOmni Fintech, Digital Payments & Banking Revolution in IndiavicgreerNo ratings yet

- Mod1 - MBO-14-Banking - Services and InnovationDocument31 pagesMod1 - MBO-14-Banking - Services and InnovationakashvagadiyaNo ratings yet

- Somnath Sardar Research PaperDocument18 pagesSomnath Sardar Research Paperaaquib1110No ratings yet

- A Project Report On Banking 29Document28 pagesA Project Report On Banking 29manojkumaryadav2514No ratings yet

- 44 P732QDocument6 pages44 P732QAniket KolheNo ratings yet

- A Study On Perception of Customers Challenges Towards Digitization in Indian Banks in Prayagraj DistrictDocument7 pagesA Study On Perception of Customers Challenges Towards Digitization in Indian Banks in Prayagraj DistrictEditor IJTSRDNo ratings yet

- Banking and Insurance LawDocument10 pagesBanking and Insurance Lawnishantarya283No ratings yet

- Demystifying Digital Lending PDFDocument44 pagesDemystifying Digital Lending PDFHitesh DhaddhaNo ratings yet

- Fintech Laws and Regulations 2023Document19 pagesFintech Laws and Regulations 2023PREX WEXNo ratings yet

- ANNA UNIV BANKING SERVICESDocument13 pagesANNA UNIV BANKING SERVICESManish BatraNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueDocument2 pagesParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Health Care SystemDocument8 pagesSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Visual Water: An Integration of App and Web to Understand Chemical ElementsDocument5 pagesVisual Water: An Integration of App and Web to Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Air Quality Index Prediction using Bi-LSTMDocument8 pagesAir Quality Index Prediction using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Cities: Boosting Economic Growth through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parkinson’s Detection Using Voice Features and Spiral DrawingsDocument5 pagesParkinson’s Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predict the Heart Attack Possibilities Using Machine LearningDocument2 pagesPredict the Heart Attack Possibilities Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Silver Nanoparticles Infused in Blood in a Stenosed Artery under the Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in a Sten. Art. Under the Eff. of Mag. FieldDocument6 pagesImpact of Silver Nanoparticles Infused in Blood in a Stenosed Artery under the Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in a Sten. Art. Under the Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Compact and Wearable Ventilator System for Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System for Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Implications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewDocument6 pagesImplications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Insights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Oil and Natural Gas Corporation Limited (ONGC) ReportDocument66 pagesOil and Natural Gas Corporation Limited (ONGC) ReportSanket LondheNo ratings yet

- 650i & Loader - A5 - EN - 10.17Document102 pages650i & Loader - A5 - EN - 10.17Centro de Fresado Macrodent ProduccionNo ratings yet

- Opera Cloud User ManualDocument1,018 pagesOpera Cloud User ManualRooban GNo ratings yet

- Summative Assessment 2 ITDocument9 pagesSummative Assessment 2 ITJoana Trinidad100% (1)

- Testing ResumeDocument4 pagesTesting ResumeBaji TulluruNo ratings yet

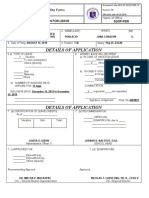

- Details of Application: Quality FormDocument2 pagesDetails of Application: Quality FormjunapoblacioNo ratings yet

- 104 KPI Project ManagementDocument22 pages104 KPI Project ManagementMunguntsetseg GanboldNo ratings yet

- User Manual: Vms For PC Vms para PCDocument24 pagesUser Manual: Vms For PC Vms para PCcesar1948No ratings yet

- Tb0485 PDF EngDocument4 pagesTb0485 PDF EngShashank KrishnaNo ratings yet

- Customer Specific Requirements ChapterDocument5 pagesCustomer Specific Requirements ChapterVijayendran VijayNo ratings yet

- Power BI Imp Questions and AnswersDocument10 pagesPower BI Imp Questions and Answersdiptiroy532019No ratings yet

- SSRN Id4356971Document29 pagesSSRN Id4356971allysamaefaala437No ratings yet

- Learn SEO Online Course for Career in Digital Marketing (40 charactersDocument18 pagesLearn SEO Online Course for Career in Digital Marketing (40 charactersProf.Mustansar Hussain100% (1)

- Branded Mobile Application Adoption and Customer Engagement BehaviorDocument55 pagesBranded Mobile Application Adoption and Customer Engagement BehaviorSasa SanandraNo ratings yet

- Turban eCRMDocument29 pagesTurban eCRMJocelyn MedinaNo ratings yet

- Website: Vce To PDF Converter: Facebook: Twitter:: Csa - Vceplus.Premium - Exam.60QDocument17 pagesWebsite: Vce To PDF Converter: Facebook: Twitter:: Csa - Vceplus.Premium - Exam.60QGabriel GonçalvesNo ratings yet

- PMP Master Quiz - 2013 - Answer Explanations - Ver 1.6Document58 pagesPMP Master Quiz - 2013 - Answer Explanations - Ver 1.6pranjal92pandeyNo ratings yet

- Education: Chartered Accountant - Male, 29Document1 pageEducation: Chartered Accountant - Male, 29Sibesh AgrawalNo ratings yet

- Instructions For BiddersDocument8 pagesInstructions For BiddersS Rao CheepuriNo ratings yet

- ISEM Lecture Note CH1-4Document5 pagesISEM Lecture Note CH1-4JoJo ChanNo ratings yet

- How Blockchain and IoT Are Transforming LogisticsDocument25 pagesHow Blockchain and IoT Are Transforming LogisticsLê Thanh ThôngNo ratings yet

- FPT Training Management System Requirements AnalysisDocument20 pagesFPT Training Management System Requirements AnalysisHuy PGiaNo ratings yet

- Sbi Po & Ibps Po Mains Day - 3 e 169277026799Document32 pagesSbi Po & Ibps Po Mains Day - 3 e 169277026799unknown sharmaNo ratings yet

- SOPDocument3 pagesSOPShreya BonteNo ratings yet

- How Does Snapchat Make MoneyDocument2 pagesHow Does Snapchat Make MoneySheila HernandezNo ratings yet

- Healthcare Marketing Strategy, 10 Actionable Tips (D3) - 24Document24 pagesHealthcare Marketing Strategy, 10 Actionable Tips (D3) - 24Intan Azhari RNo ratings yet

- Improve your writing with free tools better than GrammarlyDocument3 pagesImprove your writing with free tools better than GrammarlySalman AhmedNo ratings yet

- PBI - BhaskarDocument9 pagesPBI - Bhaskarganesh YadavNo ratings yet

- AT 04884 BRO Aspen GDOTDocument6 pagesAT 04884 BRO Aspen GDOTcvolkan1No ratings yet

- Software Requirements Specification: COMSATS University Islamabad, COMSATS Road, Off GT Road, Sahiwal, PakistanDocument10 pagesSoftware Requirements Specification: COMSATS University Islamabad, COMSATS Road, Off GT Road, Sahiwal, PakistanRayyan RaoNo ratings yet