Will the Stock Market Crash in 2023?

13 Min Read | Feb 1, 2024

2022 sure was a roller coaster for the economy, right? Worries about inflation, rising interest rates, and a bunch of chaotic global events sparked wave after wave of volatility to the stock market.

All the fear and uncertainty led to whispers about the next potential stock market crash—the first since the start of the coronavirus pandemic back in 2020. But here’s the thing: We’re in the middle of 2023 and a crash still hasn’t happened.

So, here are the golden questions: Can the market continue to correct itself? Or is the crash still looming on the horizon? Let’s take a look at some major factors (with a cool, level head) to better understand where the market is going.

Is the Stock Marketing Crashing?

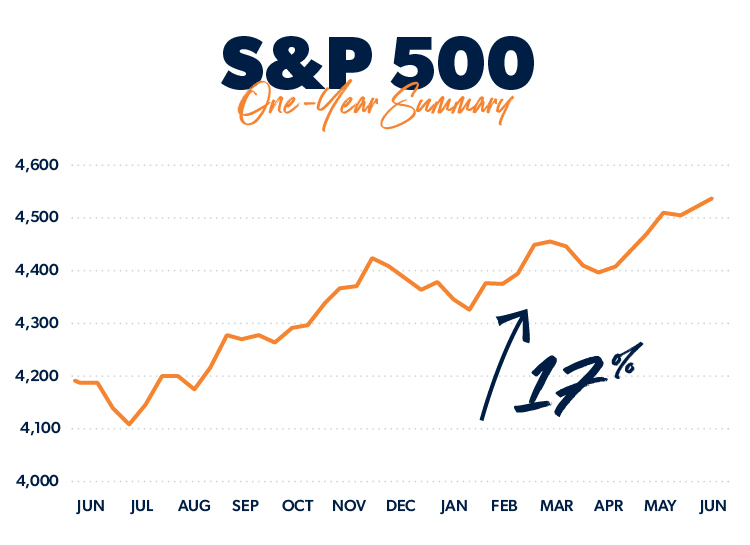

No, as of right now, the market isn’t crashing. So, take a deep breath—the sky isn’t falling (at least, not yet). In fact, on July 17, the S&P 500 was up over 17% since the beginning of the year.1 Nice! So even though the market hasn’t rebounded quite as strongly as some experts would like, it’s been a pretty tame and stable year so far.

But there are still a few reasons to stay cautious for the second half of 2023—we’ll go over those in a minute. But first, let’s review what exactly a stock market crash is, what causes it, and how panic can send the market into a tailspin.

What is a stock market crash?

A stock market crash is a sudden, big drop in the value of stocks that’s caused by investors selling their shares quickly. That drives down the value of stocks for all the other shareholders, who also start selling their shares to try to cut their losses.

What causes the stock market to crash?

A stock market crash is caused by two big things: A dramatic drop in stock prices and a boatload of panic. (You know, like Gotham City at the end of every Batman movie).

How can you track a stock market crash?

To help us visualize how well the stock market is (or isn’t) doing, we look at indexes like the Dow Jones Industrial Average (DJIA), the S&P 500 and the Nasdaq. If you look at a historical graph of one of these indexes, you can see why we use the term crash. It’s like watching a plane take a nose dive.

So, if investors think the market is headed for harder times, they’ll probably sell their stock to get out with as much money as they can before the value drops. That’s why panic plays just as big of a role in causing a stock market crash as the actual economic issues that led to it.

How does panic selling affect the stock market?

Let’s walk through an example from the coronavirus pandemic that shows just how powerful panic is. As news of the virus spread, grocery and convenience stores across the world sold out of toilet paper in a matter of days. Was there really a toilet paper shortage?

Well, yes and no. There wasn’t a shortage before people started panicking. But when people lost their minds and started stocking up on toilet paper, their actions created a shortage. They literally willed a toilet paper shortage into existence.

The same kind of panic can trigger a stock market crash. Once investors see other investors selling off their stock, they get pretty nervous. Then stock values start to dip, and more investors sell their shares. Next thing you know, everyone is dumping their stocks, and the market is in a full-fledged crash. Look out below!

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Our point here is this: While much of a stock’s value is based on fact, like the bottom-line of the of the company behind the stock, perception and prediction of the future are also huge factors. No wonder it feels like such a roller coaster ride!

Will the Stock Market Crash in 2023?

Listen, no one can perfectly predict what the stock market is going to do. All we can do is look at the things that’ll influence the market and your investments throughout the rest of the year. Let’s get into some specifics and look at where we are now.

Inflation’s high, but it’s cooling down.

Yep—that pesky inflation is still hanging around, and it’s one of the biggest issues gripping the economy, especially at the gas pump or grocery store. But here’s the good news: Inflation is starting to fall.

Currently, the inflation rate is around 3% (as of June 30), which is much better than the rate of over 9% we hit last year.2 But don’t take that victory lap just yet. The Federal Reserve (aka the Fed) likes to keep inflation hovering around 2%, so that’s when they’ll likely ease up on hiking interest rates.

Interest rates could keep going up.

To combat inflation, the Fed started raising interest rates back in 2022. Currently, the target interest rate is set between 5% and 5.25% (it was 0% at the beginning of 2022).3 While policymakers voted to skip another rate hike back in June, they haven’t ruled out a few more increases this year.4

The Fed raises interest rates to discourage people (and businesses) from excessive borrowing and spending. This can help control market stability and encourage people to actually, you know, save their money.

But rate hikes come with heavy risks. People who keep using credit may find themselves trapped under a ton of high-interest debt. Yikes! And if rate hikes slow the economy too much, it could send us into a recession. It’s quite a balancing act.

There’s still no recession (for now).

Some experts believed we were on a one-way road toward recessionville (the happiest town on Earth . . . not!) sometime during the first half of 2023.5 But so far this year, the economy has held its own and stayed pretty stable.

We’re not out of the woods yet, but a soft landing (an economic slowdown that avoids a recession) actually seems possible now.6

The tech industry continues to rally the S&P 500.

The news is filled with stories about the latest technological advances. You know, the rise of artificial intelligence and all those other fancy gadgets and gizmos aplenty. As it turns out, the tech industry has done a ton of work holding up the economy.

Is this a good or a bad thing? Well, it's a bit complicated—so stick with us here. When the stock market depends on a few large-cap tech companies—businesses worth over $10 billion in market capitalization (a company’s value that’s traded on the stock market—think Apple, Google, and Microsoft) that’s called a narrow market. And it can make investors nervous.

Think about it this way: Without the top seven large-cap companies, the S&P 500 would be down 0.8% since the beginning of the year (as of May 2023), instead of the market’s decent recovery we mentioned earlier.7

Now, while booming industries (like tech, biotech and e-commerce) can provide confidence for some investors, others might lose faith in the broader market’s ability to support itself. And that lack of investor confidence can lead to panic.

4 Things to Do With Your Investments if the Stock Market Crashes

Let’s say you’re on Baby Step 4 and you’re investing 15% of your income into your 401(k). You’re probably feeling pretty good about it, right? But what if you wake up one morning and see the news the world’s been dreading: The stock market’s crashing! Here’s what to do next:

1. Refuse to panic.

Like we said before, panic can make the crash just as bad as the actual economic issues we’re facing. Don’t fall for it. Dealing with the unknown creates uncertainty, and uncertainty left unchecked can become fear.

So, take a deep breath and choose to stay clear-minded and think positively. It’s the best way to make logical choices about your personal finances and retirement investments during a challenging time.

2. If you’re invested, stay invested.

But the stock market’s tumbling! It’s time to sell, right? Nope. Not even close. Turn off the news and try to keep on keeping on (unless you need to pause for a while because you lost your income). Remember, when you take your money out of the market, you’re basically locking in and guaranteeing that loss.

Here’s the deal: Smart investors keep a long-term perspective. They don’t stress about how their investments have performed in the past few weeks or what they’ll do in the next couple of months. Nope!

They’re more concerned about what’ll happen five, 10 or even 20 years from now. And that helps them stay cool when everyone else is panicking like it’s Y2K all over again. Remember, the market has always bounced back. So don’t try to time the market. Focus on time in the market.

3. Talk to your investment professional.

When there are big shifts in the market, schedule a call with your investment professional. You need specific advice for your situation—your age, your funds, the types of retirement accounts you have, and which Baby Step you’re on.

Ask your pro if you need to make any changes because of the crash. Don’t be afraid to share what’s on your mind. If you’re married, make sure your spouse is on the call too. Make a plan for how you’ll move forward together.

And by the way, if you’ve been playing the investment game without a pro in your corner—don’t. Connect with an investment professional in your area.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

4. Think about buying the dip.

History shows the stock market doesn’t stay down forever—it recovers time and time again. In fact, in all but one time in the past 100 years, every instance of market decline has been followed by a remarkable recovery the year after.

Think about it: The stock market almost always experiences significant gains after a period of decline. So what does that mean for you when the market’s down? It’s a fire sale, baby!

If you’re on Baby Step 7 and have extra money to invest, now might be a great time to “buy the dip” by buying more mutual funds at lower prices. But keep in mind, it’s always a smart idea to discuss investment strategies with your pro first. They’ll help you make sure it’s a good time to pick up more mutual funds.

Remember, jumping off the roller coaster hurts (like, a lot).

If you’re checking your 401(k) balance every morning and watching the gloom-and-doom news segments on the economy every night, then yeah . . . you might be freaking out a little bit. But let’s turn off Fox News and CNN for a minute. Take a deep breath, step back, and look at the bigger picture.

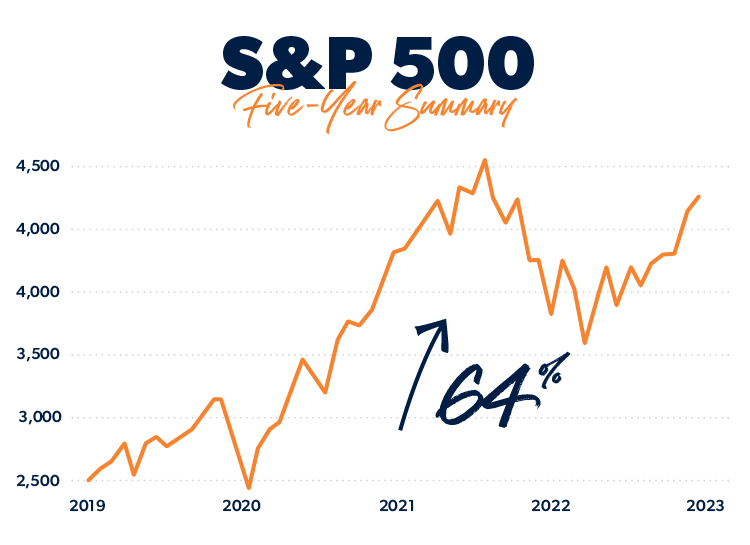

Savvy investors see that over the past 12 months (from June 2022 to June 2023), the S&P 500 is up over 17%. And if you pull back even further, you’ll see the stock market is still up almost 64% from where it was five years ago.8 Sixty-four percent!

Here's the lesson: When it comes to investing, keeping a proper perspective is the key. The only folks who get hurt on a roller coaster are the ones who jump off before the ride is over—so don’t jump off!

Previous Stock Market Crashes: Examples From History

Throughout history, the market has gone through a lot of extreme ups and downs. When we look back, we’re reminded that, yes, a market crash is a very difficult thing to go through, but it’s something we can and will overcome.

- The Great Depression, 1929: Over the course of a few days, the DJIA dropped nearly 25%. It took a little over a decade for the economy to get back to predepression levels. It was the industry from World War II that helped get things back up and running.

- The stock market crash, 1987: The market lost 22.6% of its value in one day known as Black Monday. But within two years, it had recovered everything it had lost.

- September 11, 2001: Terrorist attacks in our country caused a major hit on the market, but it corrected itself super quick. Just one month later, the stock market had returned to September 10 levels and kept going up throughout the end of 2001.

- The Great Recession, 2008: The DJIA lost more than 50% of its value in a really short time. But after a couple of years, the market was stronger than ever before—we were basically in a bull market (a period of strong economic growth) from 2009 to just before the coronavirus crash.

- The coronavirus crash, 2020: In March of 2020, the COVID-19 pandemic triggered the most rapid global crash in financial history. Still, the stock market recovered ground pretty quick, and the year closed with record highs. In fact, economists are now saying the recession from the coronavirus crash was the shortest on record—only lasting two months.9

So, keep your head up. Chances are, you’ve already lived through at least two major crashes and recessions. It’s part of the rhythm of life!

What to Do at Home During a Stock Market Crash

If the market does crash again in 2023 and we find ourselves in a true recession, remind yourself that you lived through tough economic times just a few years ago. Focus on what you can control: your attitude, your outlook and your actions. Here are two huge things you can do at home to help ease economic lows:

1. Cut back on everything.

If you lose your job in the middle of an economic downturn, that means it’s time to cut out all unnecessary spending of any type.

Cancel your gym membership and avoid going on an online shopping spree! Meal plan to save money. Use up the food you have in your pantry and freezer before you even think about eating out at a restaurant.

Focus on funding the Four Walls before spending money on anything else:

- Food

- Utilities

- Shelter

- Transportation

2. Follow the proven plan.

Rain or shine, the Baby Steps don’t change. It’s the proven plan for managing your money, and it works. You need to understand which step you’re on and then work the plan.

If you’ve lost your income, focus on piling up as much cash as you can. You can pause paying extra toward debt right now. As much as that stinks, don’t worry—it’s not forever. When the tough time passes—and it will—then you can start back up and pay extra on your debt.

If your income is stable, keep right on working the Baby Steps like you were and don’t pause your debt snowball. Stay on the plan!

Stay Calm During a Stock Market Crash

You’ve got to choose to be patient and think long term here. No matter what the rest of 2023 has in store, remind yourself of the things you know to be true. You care about your family, your dreams and your future—so make your investment decisions with those things in mind. You’ll do a much better job of that if you stay positive and focus on the factors you can control.

Next Steps

- When you understand how the stock market works, you won’t be taken by surprise or gripped by fear every time the S&P 500 or Nasdaq dips. Check out our article that offers a complete rundown of the stock market.

- Take the R:IQ retirement assessment and get a better understanding of where you are today and how much money to save each month for the retirement you want.

- Before you make any drastic changes to your retirement portfolio, talk with your pro or find one in your area through the SmartVestor program.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.